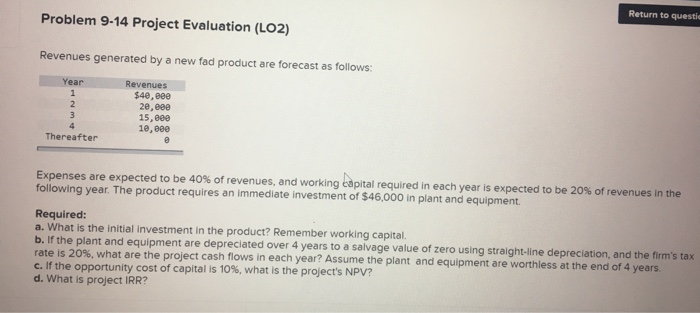

Question: Return to questi Problem 9-14 Project Evaluation (LO2) Revenues generated by a new fad product are forecast as follows: Year Revenues 540, eee 20,000 15,000

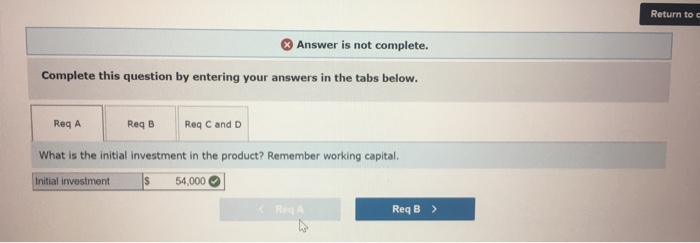

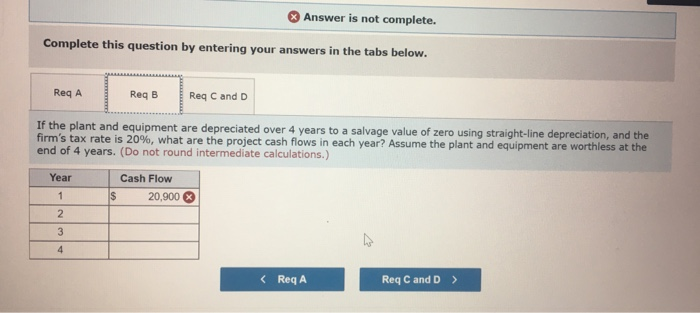

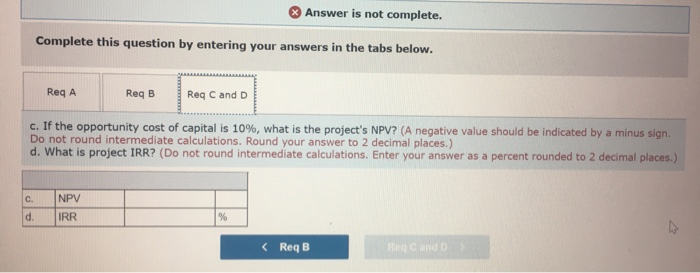

Return to questi Problem 9-14 Project Evaluation (LO2) Revenues generated by a new fad product are forecast as follows: Year Revenues 540, eee 20,000 15,000 10,000 Thereafter Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $46,000 in plant and equipment Required: a. What is the initial investment in the product? Remember working capital. b. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm's tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. c. If the opportunity cost of capital is 10%, what is the project's NPV? d. What is project IRR? Return to Answer is not complete. Complete this question by entering your answers in the tabs below. Req A ReqB Req C and D What is the initial investment in the product? Remember working capital. Initial investment s 54,000 Reg ReqB > Answer is not complete. Complete this question by entering your answers in the tabs below. Req A ReqB Reg C and D If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm's tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. (Do not round intermediate calculations.) Cash Flow $ 20,900 Year 1 2 3 > Answer is not complete. Complete this question by entering your answers in the tabs below. Req A Req B Reg C and D c. If the opportunity cost of capital is 10%, what is the project's NPV? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) d. What is project IRR? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) NPV d. IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts