Question

Return to question Item 11 Item 11 3 points Item Skipped At the beginning of 2019, Metatec Inc. acquired Ellison Technology Corporation for $500 million.

Return to question

Item 11

Item 11 3 points Item Skipped

At the beginning of 2019, Metatec Inc. acquired Ellison Technology Corporation for $500 million. In addition to cash, receivables, and inventory, the following assets and their fair values were also acquired:

| Plant and equipment (depreciable assets) | $ | 140 | million |

| Patent | 30 | million | |

| Goodwill | 120 | million | |

The plant and equipment are depreciated over a 10-year useful life on a straight-line basis. There is no estimated residual value. The patent is estimated to have a 5-year useful life, no residual value, and is amortized using the straight-line method. At the end of 2021, a change in business climate indicated to management that the assets of Ellison might be impaired. The following amounts have been determined:

| Plant and equipment: | |||

| Undiscounted sum of future cash flows | $ | 70 | million |

| Fair value | 50 | million | |

| Patent: | |||

| Undiscounted sum of future cash flows | $ | 19 | million |

| Fair value | 12 | million | |

| Goodwill: | |||

| Fair value of Ellison Technology Corporation | $ | 340 | million |

| Fair value of Ellison's net assets (excluding goodwill) | 290 | million | |

| Book value of Ellison's net assets (including goodwill) | 370 | million* | |

*After first recording any impairment losses on plant and equipment and the patent.

Required:

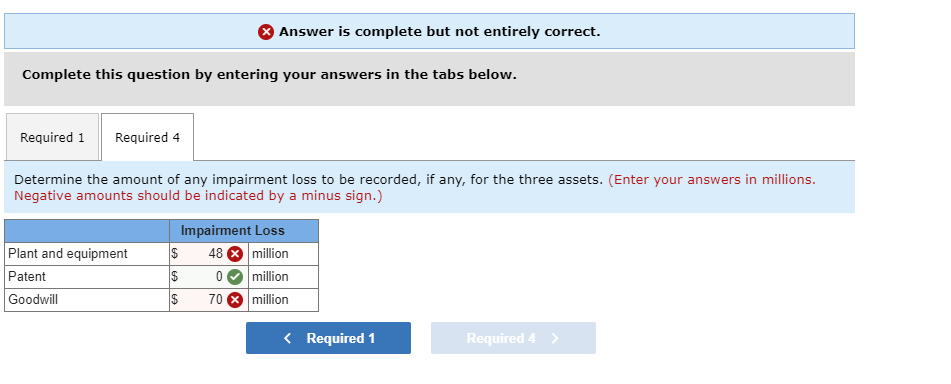

1. Compute the book value of the plant and equipment and patent at the end of 2021. 4. Determine the amount of any impairment loss to be recorded, if any, for the three assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started