Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Return to question Jack and Liz live in a community-property state and their vacation home is community property. This year they transferred the vacation

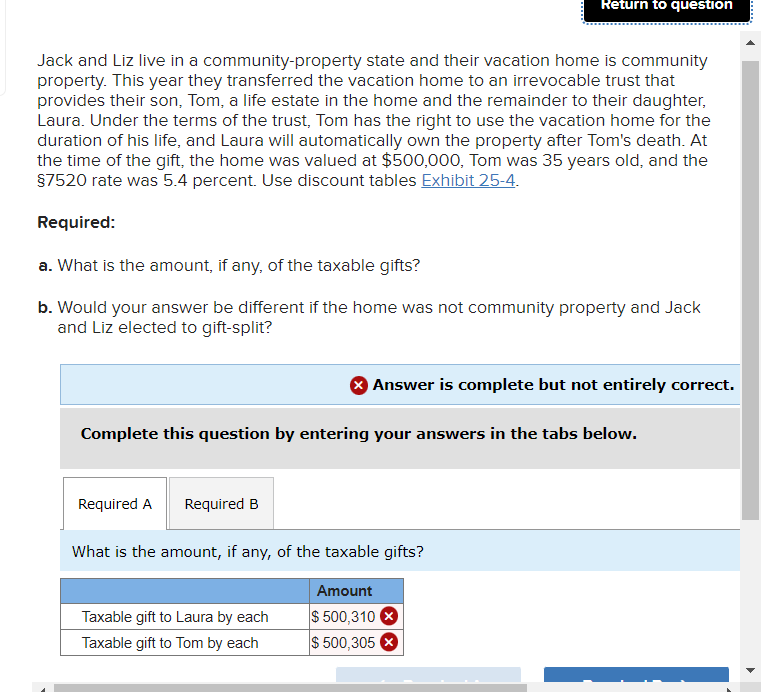

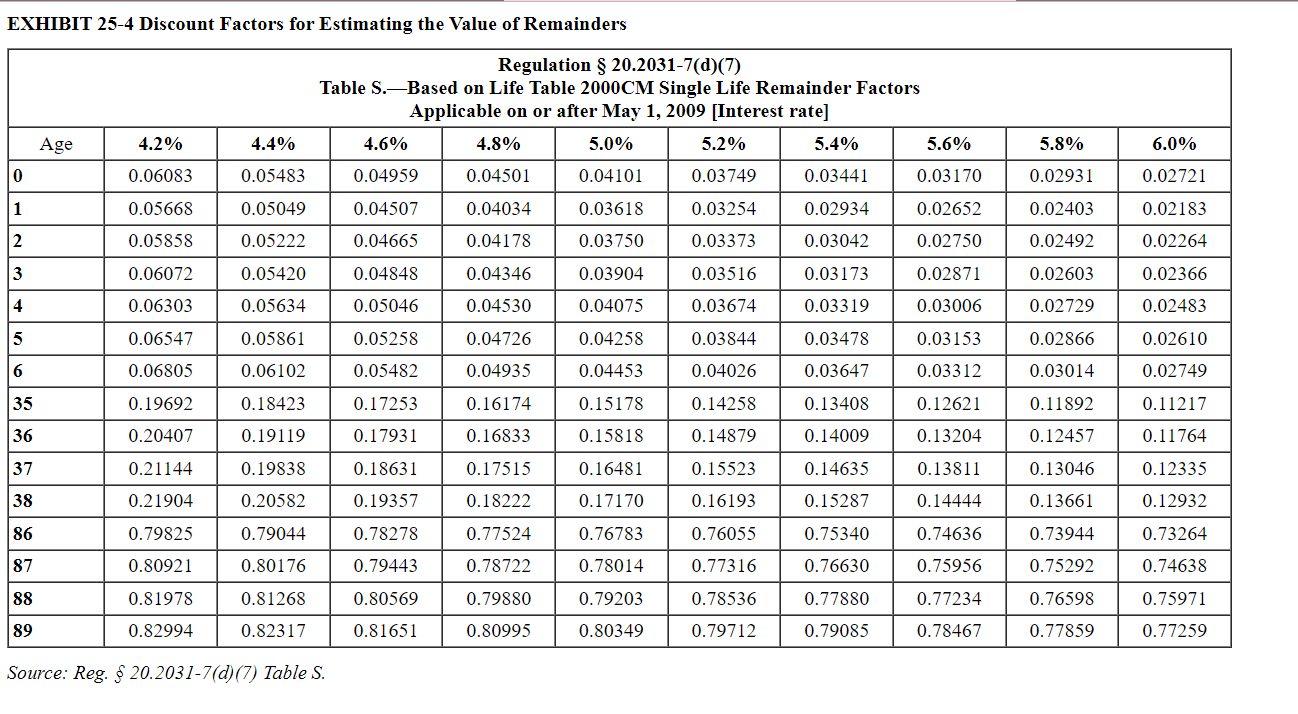

Return to question Jack and Liz live in a community-property state and their vacation home is community property. This year they transferred the vacation home to an irrevocable trust that provides their son, Tom, a life estate in the home and the remainder to their daughter, Laura. Under the terms of the trust, Tom has the right to use the vacation home for the duration of his life, and Laura will automatically own the property after Tom's death. At the time of the gift, the home was valued at $500,000, Tom was 35 years old, and the $7520 rate was 5.4 percent. Use discount tables Exhibit 25-4. Required: a. What is the amount, if any, of the taxable gifts? b. Would your answer be different if the home was not community property and Jack and Liz elected to gift-split? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B What is the amount, if any, of the taxable gifts? Amount Taxable gift to Laura by each $ 500,310 Taxable gift to Tom by each $ 500,305 x EXHIBIT 25-4 Discount Factors for Estimating the Value of Remainders Regulation 20.2031-7(d)(7) Table S. Based on Life Table 2000CM Single Life Remainder Factors Applicable on or after May 1, 2009 [Interest rate] Age 0 4.2% 0.06083 4.4% 4.6% 4.8% 5.0% 5.2% 5.4% 5.6% 5.8% 6.0% 0.05483 0.04959 0.04501 0.04101 0.03749 0.03441 0.03170 0.02931 0.02721 1 0.05668 0.05049 0.04507 0.04034 0.03618 0.03254 0.02934 0.02652 0.02403 0.02183 2 0.05858 0.05222 0.04665 0.04178 0.03750 0.03373 0.03042 0.02750 0.02492 0.02264 3 0.06072 0.05420 0.04848 0.04346 0.03904 0.03516 0.03173 0.02871 0.02603 0.02366 4 0.06303 0.05634 0.05046 0.04530 0.04075 0.03674 0.03319 0.03006 0.02729 0.02483 5 0.06547 0.05861 0.05258 0.04726 0.04258 0.03844 0.03478 0.03153 0.02866 0.02610 6 0.06805 0.06102 0.05482 0.04935 0.04453 0.04026 0.03647 0.03312 0.03014 0.02749 35 0.19692 0.18423 0.17253 0.16174 0.15178 0.14258 0.13408 0.12621 0.11892 0.11217 36 0.20407 0.19119 0.17931 0.16833 0.15818 0.14879 0.14009 0.13204 0.12457 0.11764 37 0.21144 0.19838 0.18631 0.17515 0.16481 0.15523 0.14635 0.13811 0.13046 0.12335 38 0.21904 0.20582 0.19357 0.18222 0.17170 0.16193 0.15287 0.14444 0.13661 0.12932 86 0.79825 0.79044 0.78278 0.77524 0.76783 0.76055 0.75340 0.74636 0.73944 0.73264 87 0.80921 0.80176 0.79443 0.78722 0.78014 0.77316 0.76630 0.75956 0.75292 0.74638 88 0.81978 0.81268 0.80569 0.79880 0.79203 0.78536 0.77880 0.77234 0.76598 0.75971 89 0.82994 0.82317 0.81651 0.80995 0.80349 0.79712 0.79085 0.78467 0.77859 0.77259 Source: Reg. 20.2031-7(d)(7) Table S.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started