Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Return to question The plan of reorganizing for Taylor Companies, Inc., was approved by the court, stockholders, and creditors on December 31, 20X1. The plan

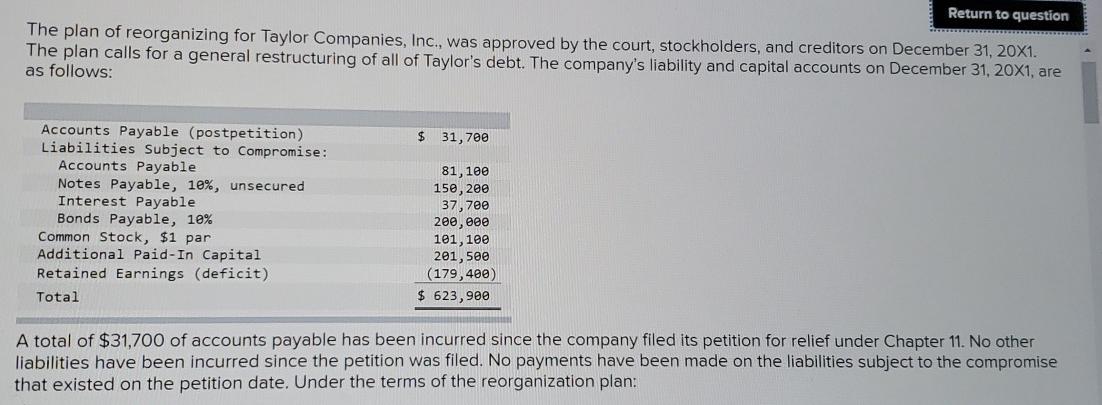

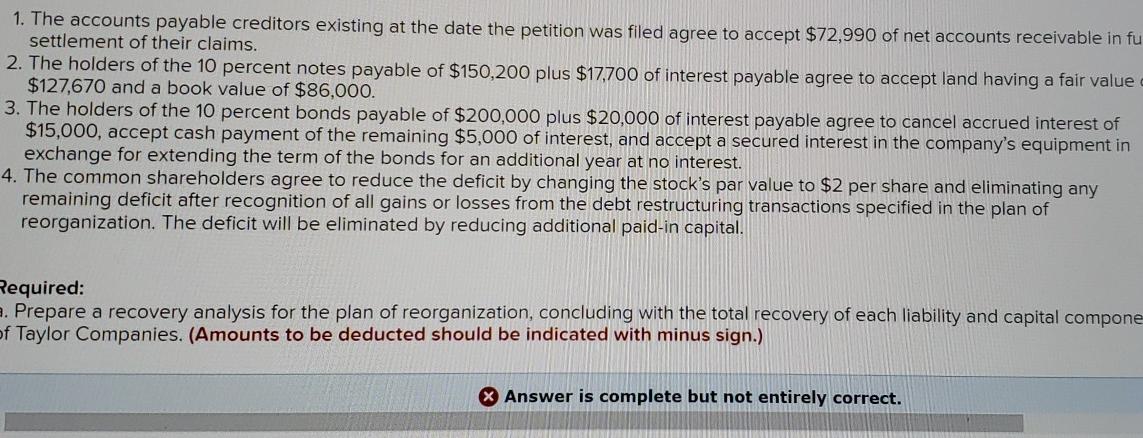

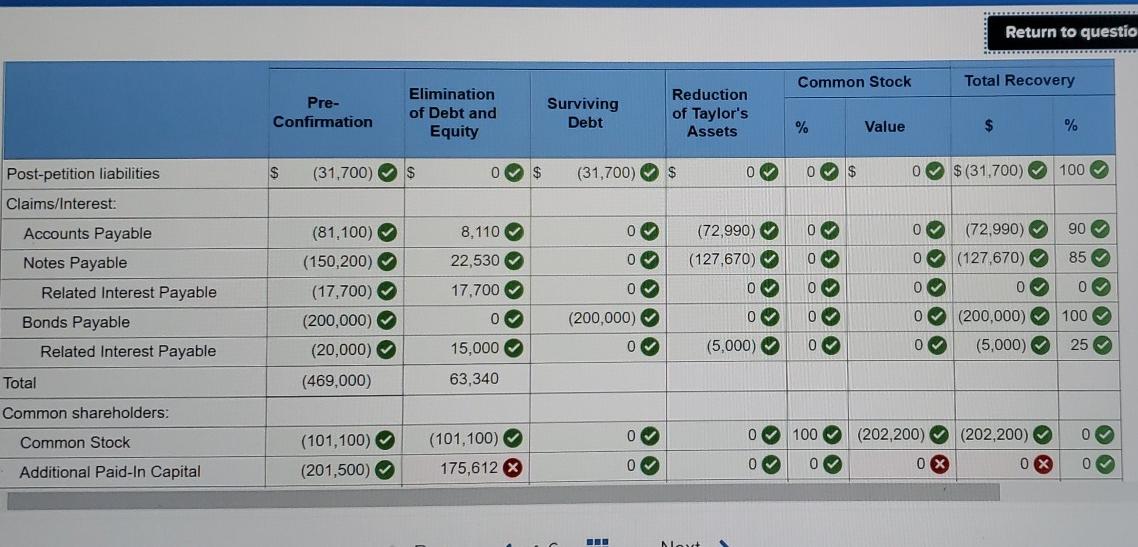

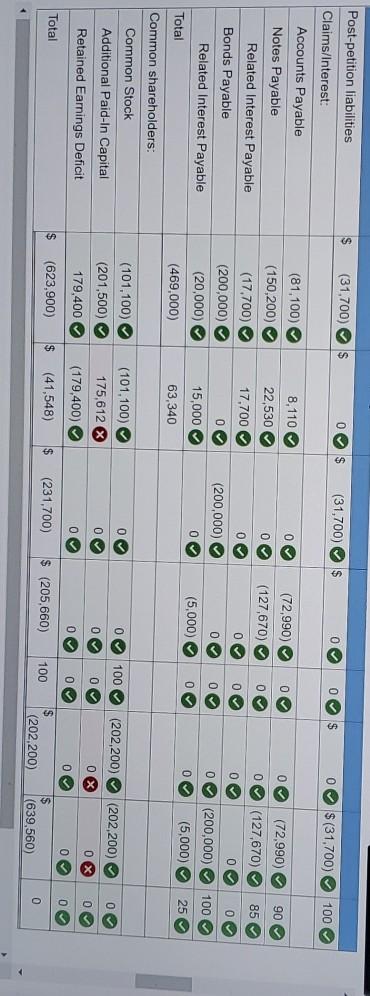

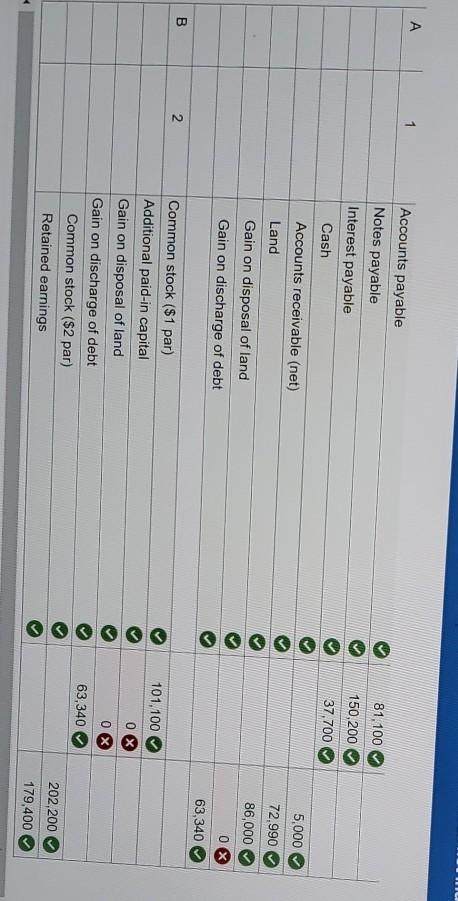

Return to question The plan of reorganizing for Taylor Companies, Inc., was approved by the court, stockholders, and creditors on December 31, 20X1. The plan calls for a general restructuring of all of Taylor's debt. The company's liability and capital accounts on December 31, 20x1, are as follows: $ 31,700 Accounts Payable (postpetition) Liabilities Subject to compromise: Accounts Payable Notes Payable, 10%, unsecured Interest Payable Bonds Payable, 10% Common Stock, $1 par Additional Paid-In Capital Retained Earnings (deficit) Total 81,100 150, 200 37,700 200,000 101, 100 201,500 (179,400) $ 623,900 A total of $31,700 of accounts payable has been incurred since the company filed its petition for relief under Chapter 11. No other liabilities have been incurred since the petition was filed. No payments have been made on the liabilities subject to the compromise that existed on the petition date. Under the terms of the reorganization plan: 1. The accounts payable creditors existing at the date the petition was filed agree to accept $72,990 of net accounts receivable in fu settlement of their claims. 2. The holders of the 10 percent notes payable of $150,200 plus $17,700 of interest payable agree to accept land having a fair value $127,670 and a book value of $86,000. 3. The holders of the 10 percent bonds payable of $200,000 plus $20,000 of interest payable agree to cancel accrued interest of $15,000, accept cash payment of the remaining $5,000 of interest, and accept a secured interest in the company's equipment in exchange for extending the term of the bonds for an additional year at no interest. 4. The common shareholders agree to reduce the deficit by changing the stock's par value to $2 per share and eliminating any remaining deficit after recognition of all gains or losses from the debt restructuring transactions specified in the plan of reorganization. The deficit will be eliminated by reducing additional paid-in capital. Required: 2. Prepare a recovery analysis for the plan of reorganization, concluding with the total recovery of each liability and capital compone of Taylor Companies. (Amounts to be deducted should be indicated with minus sign.) X Answer is complete but not entirely correct. Return to questio Common Stock Total Recovery Pre- Confirmation Elimination of Debt and Equity Surviving Debt Reduction of Taylor's Assets % Value $ % Post-petition liabilities $ (31,700) S 0$ (31,700) $ 0 0 $ 0 $(31,700) 100 > Claims/Interest: Accounts Payable (81.100) 8,110 0v 0 0 (72,990) 90 (72,990) (127,670) (150,200) 22,530 0 0 0 (127,670) 85 17,700 0 0 0 0 0 0 Notes Payable Related Interest Payable Bonds Payable Related Interest Payable (17,700) (200,000) (20,000) 0 (200,000) 0 0 100 0 (200,000) 0 (5,000) la 15,000 (5,000) 25 O Total (469,000) 63,340 Common shareholders: 0 0 100 Common Stock (202,200) (202,200) 0 (101,100) (201,500) (101,100) 175,612 0 0 0 0 X 0 ( 0 Additional Paid-In Capital Mout s (31,700) $ $ (31,700) $ $ $(31,700) 100 8,110 0 0 Post-petition liabilities Claims/Interest: Accounts Payable Notes Payable Related Interest Payable Bonds Payable Related Interest Payable Total 90 (81.100) (150,200) (17.700) (72,990) (127,670) 22,530 0 0 (72,990) 0 (127,670) 0 85 17,700 0 OOOOO OOOO 0 0 0 0 0 (200,000) (200,000) (20,000) 0 0 0 100 15,000 (5,000) (200,000) (5,000) 0 0 25 (469,000) 63,340 Common shareholders: 0 (101,100) (201,500) (101,100) 175,612 X 0 100 Common Stock Additional Paid-In Capital Retained Earnings Deficit (202,200) (202,200) 0 0 3 0 0 0 X 0 0 179,400 (179,400) 0 0 0 0 Total s (623,900) $ (41,548) $ (231,700) $ (205,660) 100 Is (202,200) 0 (639,560) A 1 81.100 150,200 37,700 Accounts payable Notes payable Interest payable Cash Accounts receivable (net) Land Gain on disposal of land Gain on discharge of debt 5,000 72,990 86,000 0 X 63,340 B N 101,100 0 X Common stock ($1 par) Additional paid-in capital Gain on disposal of land Gain on discharge of debt Common stock ($2 par) Retained earnings 0 X 63,340 202,200 179,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started