Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reuther leases second-hand cars. He started business on 1 January 2018 and has decided to depreciate the cars on a straight line basis at

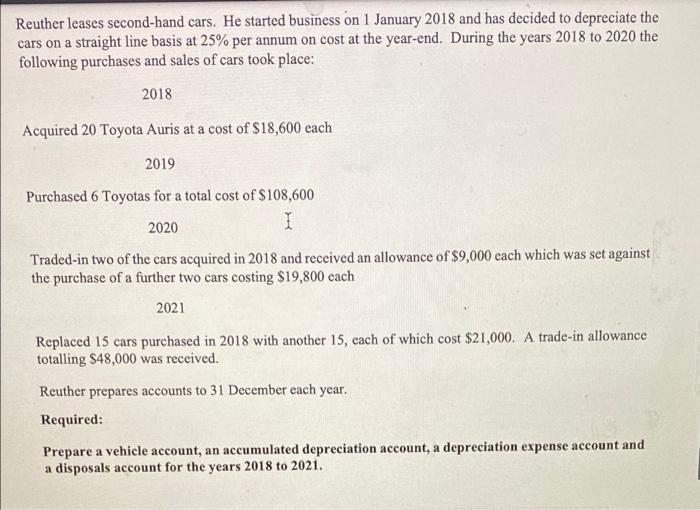

Reuther leases second-hand cars. He started business on 1 January 2018 and has decided to depreciate the cars on a straight line basis at 25% per annum on cost at the year-end. During the years 2018 to 2020 the following purchases and sales of cars took place: 2018 Acquired 20 Toyota Auris at a cost of $18,600 each 2019 Purchased 6 Toyotas for a total cost of $108,600 2020 Traded-in two of the cars acquired in 2018 and received an allowance of $9,000 cach which was set against the purchase of a further two cars costing $19,800 cach 2021 Replaced 15 cars purchased in 2018 with another 15, cach of which cost $21,000. A trade-in allowance totalling $48,000 was received. Reuther prepares accounts to 31 December each year. Required: Prepare a vehicle account, an accumulated depreciation account, a depreciation expense account and a disposals account for the ars 2018 to 2021.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Vehicle Account For the year 2018 2021 Date Particulars Amount Date Particulars Amount 2020 By Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started