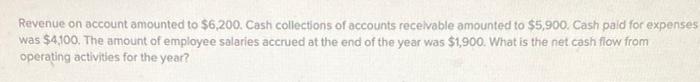

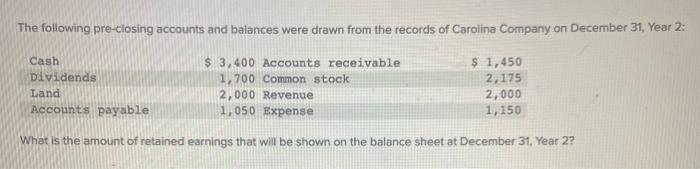

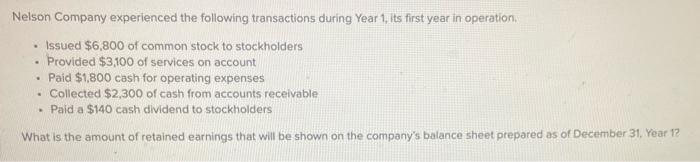

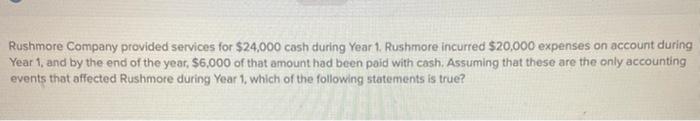

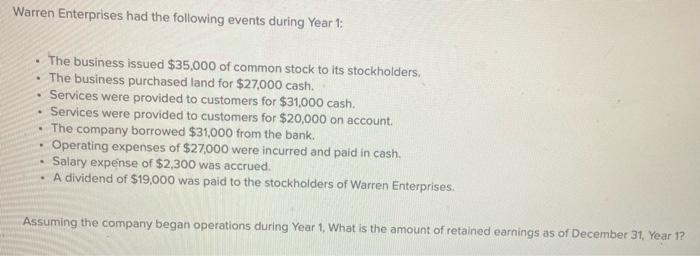

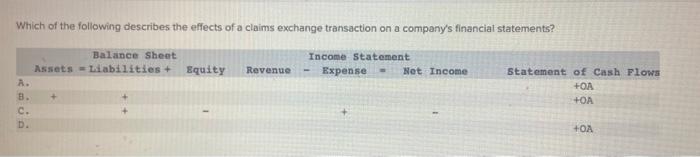

Revenue on account amounted to $6,200. Cash collections of accounts receivable amounted to $5,900. Cash paid for expenses was $4,100. The amount of employee salaries accrued at the end of the year was $1,900. What is the net cash flow from operating activities for the year? The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 2: Cash Dividends Land Accounts payable $ 3,400 Accounts receivable 1,700 Common stock 2,000 Revenue 1,050 Expense $ 1,450 2,175 2,000 1,150 What is the amount of retained earnings that will be shown on the balance sheet at December 31, Year 22 Nelson Company experienced the following transactions during Year 1, its first year in operation Issued $6,800 of common stock to stockholders Provided $3,100 of services on account Paid $1,800 cash for operating expenses Collected $2,300 of cash from accounts receivable Paid a $140 cash dividend to stockholders What is the amount of retained earnings that will be shown on the company's balance sheet prepared as of December 31, Year 12 Rushmore Company provided services for $24,000 cash during Year 1. Rushmore incurred $20,000 expenses on account during Year 1, and by the end of the year, $6,000 of that amount had been paid with cash. Assuming that these are the only accounting events that affected Rushmore during Year 1, which of the following statements is true? Warren Enterprises had the following events during Year 1: The business issued $35,000 of common stock to its stockholders, The business purchased land for $27,000 cash. Services were provided to customers for $31,000 cash. Services were provided to customers for $20,000 on account The company borrowed $31,000 from the bank. Operating expenses of $27,000 were incurred and paid in cash. Salary expense of $2,300 was accrued. A dividend of $19,000 was paid to the stockholders of Warren Enterprises . Assuming the company began operations during Year 1. What is the amount of retained earnings as of December 31, Year 12 Which of the following describes the effects of a claims exchange transaction on a company's financial statements? Balance Sheet Assets Liabilities + Equity Income Statement Revenue - Expense - Net Income Statement of Cash Flows +OA +OA B. C. +OA