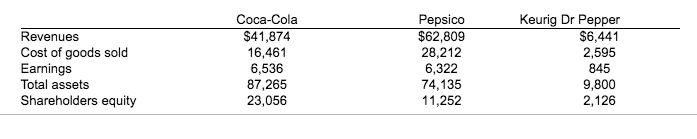

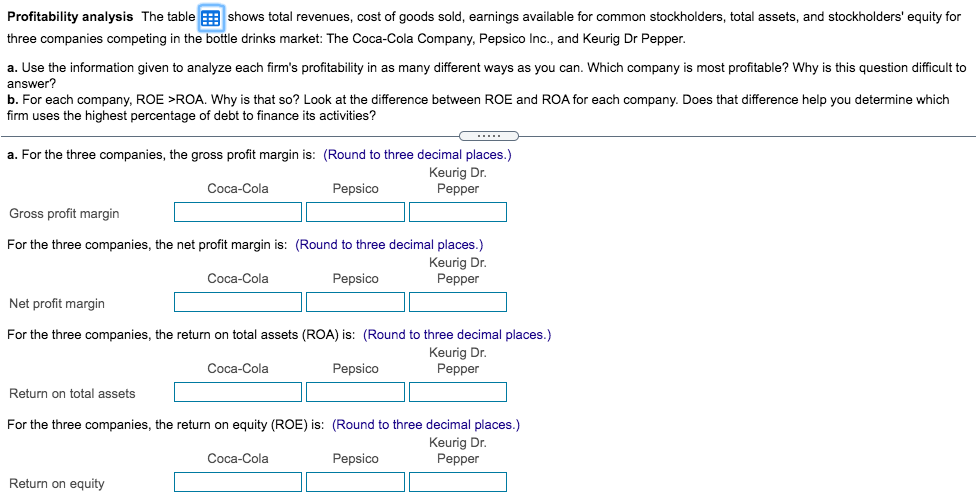

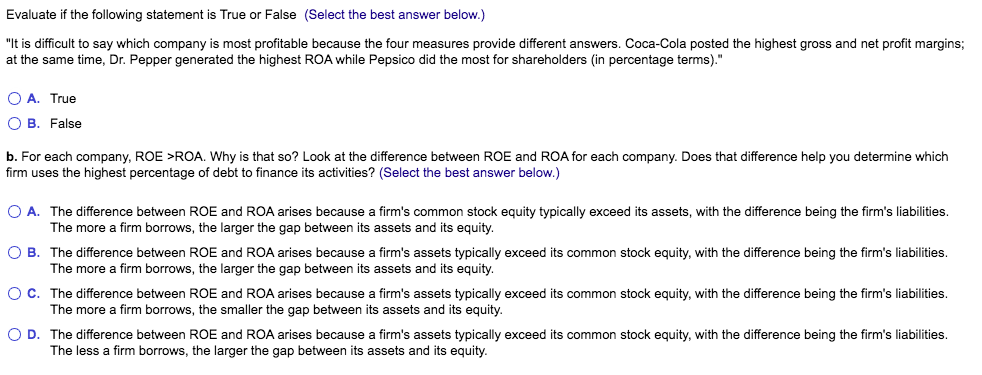

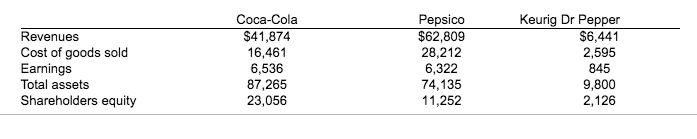

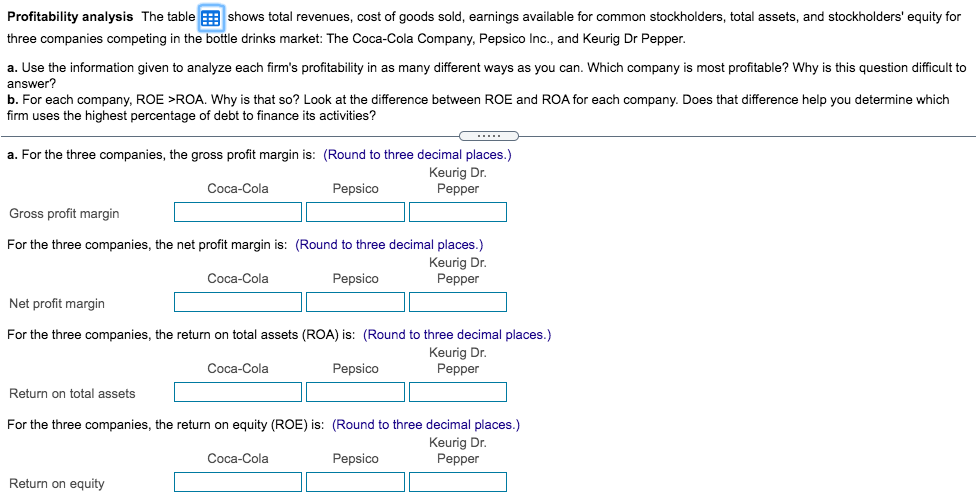

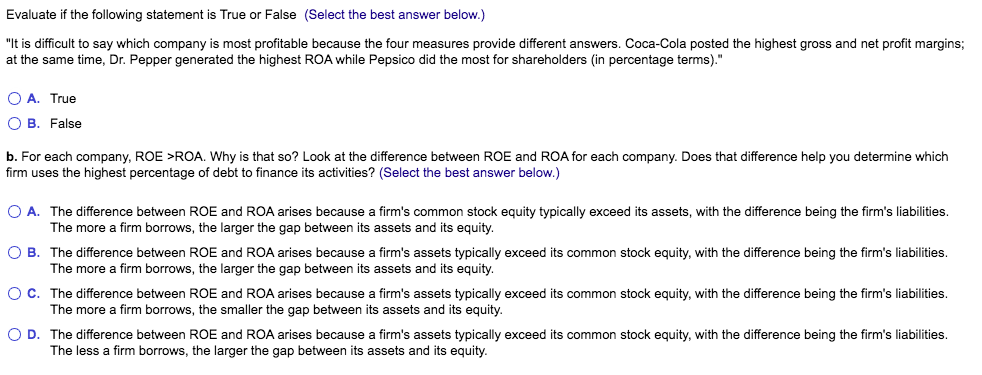

Revenues Cost of goods sold Earnings Total assets Shareholders equity Coca-Cola $41,874 16,461 6,536 87,265 23,056 Pepsico $62,809 28,212 6,322 74,135 11,252 Keurig Dr Pepper $6,441 2,595 845 9,800 2,126 Profitability analysis The table : shows total revenues, cost of goods sold, earnings available for common stockholders, total assets, and stockholders' equity for three companies competing in the bottle drinks market: The Coca-Cola Company, Pepsico Inc., and Keurig Dr Pepper. a. Use the information given to analyze each firm's profitability in as many different ways as you can. Which company is most profitable? Why is this question difficult to answer? b. For each company, ROE >ROA. Why is that so? Look at the difference between ROE and ROA for each company. Does that difference help you determine which firm uses the highest percentage of debt to finance its activities? ..... a. For the three companies, the gross profit margin is: (Round to three decimal places.) Keurig Dr. Coca-Cola Pepsico Pepper Gross profit margin For the three companies, the net profit margin is: (Round to three decimal places.) Keurig Dr. Coca-Cola Pepsico Pepper Net profit margin For the three companies, the return on total assets (ROA) is: (Round to three decimal places.) Keurig Dr. Coca-Cola Pepsico Pepper Return on total assets For the three companies, the return on equity (ROE) is: (Round to three decimal places.) Keurig Dr. Coca-Cola Pepsico Pepper Return on equity Evaluate if the following statement is True or False (Select the best answer below.) "It is difficult to say which company is most profitable because the four measures provide different answers. Coca-Cola posted the highest gross and net profit margins; at the same time, Dr. Pepper generated the highest ROA while Pepsico did the most for shareholders (in percentage terms)." O A. True OB. False b. For each company, ROE >ROA. Why is that so? Look at the difference between ROE and ROA for each company. Does that difference help you determine which firm uses the highest percentage of debt to finance its activities? (Select the best answer below.) O A. The difference between ROE and ROA arises because a firm's common stock equity typically exceed its assets, with the difference being the firm's liabilities. The more firm borrows, the larger the gap between its assets and its equity. OB. The difference between ROE and ROA arises because a firm's assets typically exceed its common stock equity, with the difference being the firm's liabilities. The more a firm borrows, the larger the gap between its assets and its equity. O C. The difference between ROE and ROA arises because a firm's assets typically exceed its common stock equity, with the difference being the firm's liabilities. The more firm borrows, the smaller the gap between its assets and its equity. OD. The difference between ROE and ROA arises because a firm's assets typically exceed its common stock equity, with the difference being the firm's liabilities. The less a firm borrows, the larger the gap between its assets and its equity