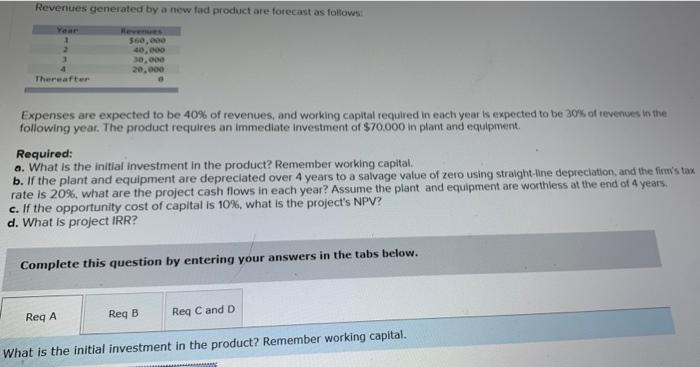

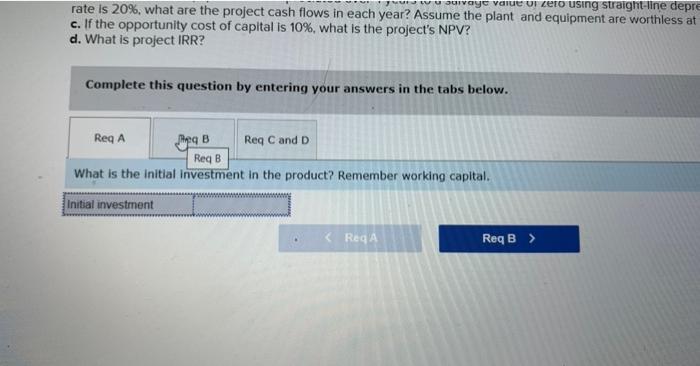

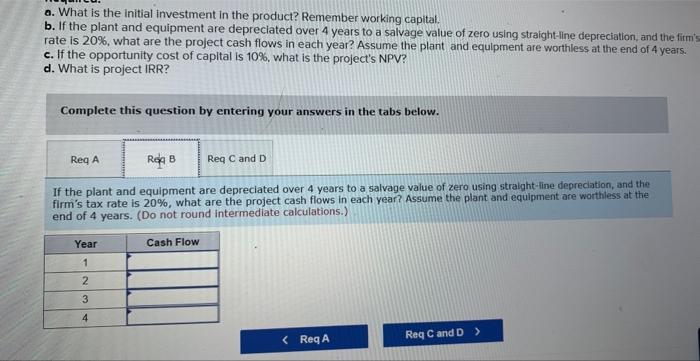

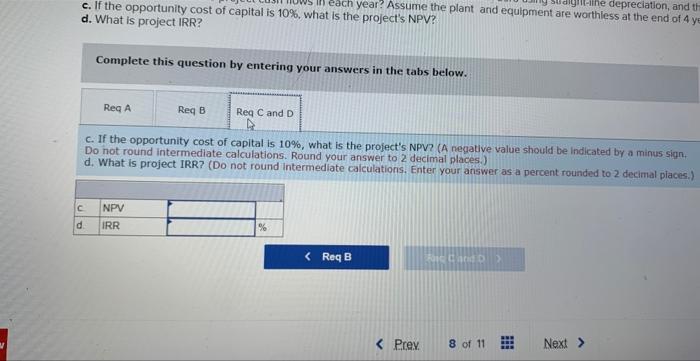

Revenues generated by a new fad product are forecast as follows: Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 30 of of tevenues in the following year. The product requires an immediate investment of $70.000 in plant and equipment. Required: a. What is the initial investment in the product? Remember working capital. b. If the plant and equipment are depreclated over 4 years to a salvage value of zero using straight-line depreciation, and the firmis tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. c. If the opportunity cost of capital is 10%, what is the project's NPV? d. What is project IRR? Complete this question by entering your answers in the tabs below. What is the initial investment in the product? Remember working capital. rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at c. If the opportunity cost of capital is 10%, what is the project's NPV? d. What is project IRR? Complete this question by entering your answers in the tabs below. What is the initial investment in the product? Remember working capltal. a. What is the initial investment in the product? Remember working capital. b. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm rate is 20\%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. c. If the opportunity cost of capltal is 10%, what is the project's NPV? d. What is project IRR? Complete this question by entering your answers in the tabs below. If the plant and equipment are depreciated over 4 years to a salvage value of zero using stralght-line depreciation, and the firm's tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. (Do not round intermediate calculations.) c. If the opportunity cost of capital is 10%, what is the project's NPV? d. What is project IRR? Complete this question by entering your answers in the tabs below. c. If the opportunity cost of capital is 10%, what is the project's NPV? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) d. What is project IRR? (Do not round intermediate calculations, Enter your aniswer as a percent rounded to 2 decimal piaces.)