Answered step by step

Verified Expert Solution

Question

1 Approved Answer

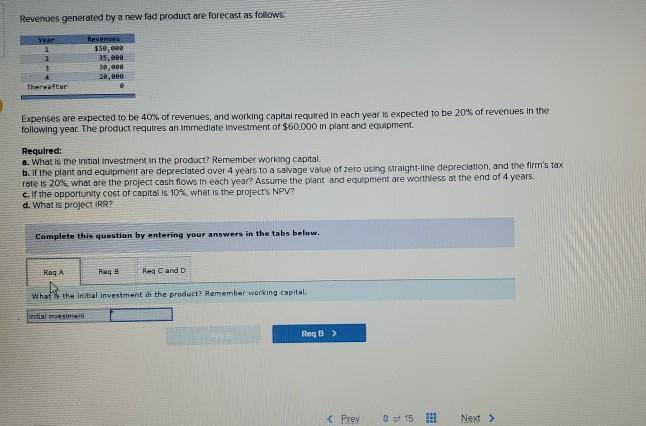

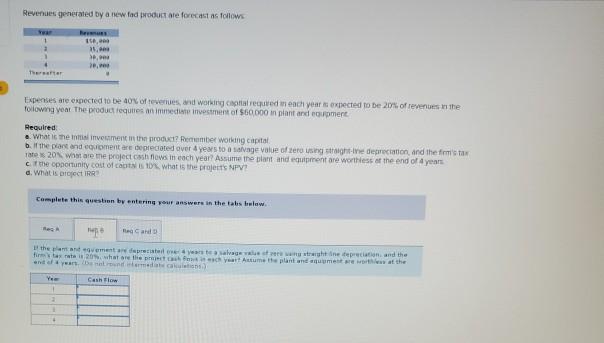

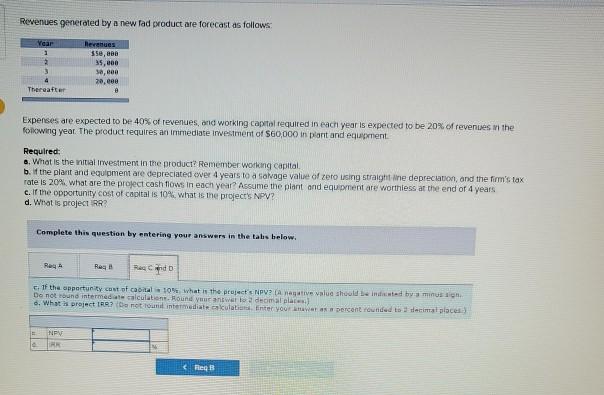

Revenues generated by a new fad product are forecast as follows Year 1 2 1 Revenue sse, 35. 30,00 22, Bee Thereafter Expenses are expected

Revenues generated by a new fad product are forecast as follows Year 1 2 1 Revenue sse, 35. 30,00 22, Bee Thereafter Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $60.000 in plant and equipment Required: a. What is the initial investment in the product? Remember working capital b. the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm's tax Tote is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years c. If the opportunity cost of capital is 10% what is the project's NPV? d. What is project IRR? Complete this question by entering your answers in the tabs below. Reg A Ruge RC and D What the initial investment in the product Remember working capital Req> Revenues generated by a new tod product are forecast as follow 1 * 1, 2. . . Theater Expenses are expected to be of revenues, and working required each year expected to be 20% of revenues in the following year the product requires an immediate investment of $60.000 in plant and emert Required What is the movement in the product? Remember working capital bit the plant and comentare deprecated over 4 years to a salvage value of zero using right ne depreciation and the first 20% wat are me project cash flows in each year? Assume the plant and equipment are worthless of the end of 4 years che opportunity cost of cats is what is the projects NPV! d. What is tot IRR Complete this question by entering your answers in the tabs buluw Can the devements depreciatie van wat steht in depreciation and the firmarta 20 what are the yeart Astume the plant and met at the and of years and med Cash Flow + Revenues generated by a new fad product are forecast as follows Year 1 2 3 Revenues sse, 35,000 30,00 20.000 Thereafter Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $60,000 in plant and equipment Required: 8. What is the nitial investment in the product? Remember working capital b. if the plant and equipment are depreciated ever 4 years to a savage value of zero using straight line depreciation, and the firm's tax rate is 20% what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years c. Ir the opportunity cost of capital is 10% what is the project's NPV? d. What is project RR? Complete this question by entering your answers in the tabs below. Rey Rega Red 51f the opportunity cost of capital 10% what is the project's NPV? (Anagative value should be inted by a mis Do not round intermediate calculation. Hound your answer to a doma alate) .. What is project ? ( Doni intermediate akulation Inter your wars percent rounded to decimal places NPV RE FB

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started