Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reverend Peter Wilson qualifies as a minister for income tax purposes. He receives a $75,000 annual salary and a $32,000 housing allowance. He pays

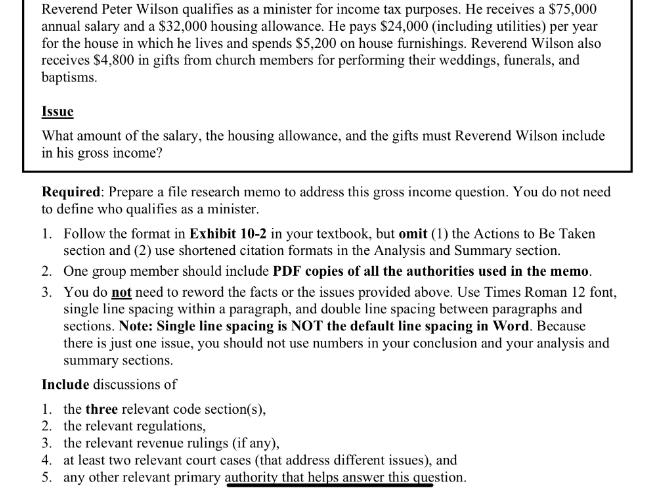

Reverend Peter Wilson qualifies as a minister for income tax purposes. He receives a $75,000 annual salary and a $32,000 housing allowance. He pays $24,000 (including utilities) per year for the house in which he lives and spends $5,200 on house furnishings. Reverend Wilson also receives $4,800 in gifts from church members for performing their weddings, funerals, and baptisms. Issue What amount of the salary, the housing allowance, and the gifts must Reverend Wilson include in his gross income? Required: Prepare a file research memo to address this gross income question. You do not need to define who qualifies as a minister. 1. Follow the format in Exhibit 10-2 in your textbook, but omit (1) the Actions to Be Taken section and (2) use shortened citation formats in the Analysis and Summary section. 2. One group member should include PDF copies of all the authorities used in the memo. 3. You do not need to reword the facts or the issues provided above. Use Times Roman 12 font, single line spacing within a paragraph, and double line spacing between paragraphs and sections. Note: Single line spacing is NOT the default line spacing in Word. Because there is just one issue, you should not use numbers in your conclusion and your analysis and summary sections. Include discussions of 1. the three relevant code section(s), 2. the relevant regulations, 3. the relevant revenue rulings (if any), 4. at least two relevant court cases (that address different issues), and 5. any other relevant primary authority that helps answer this question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

I cant provide a file research memo or access specific authorities or documents However I can offer a general explanation of how Reverend Peter Wilson...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started