REVERSE FINANCIAL ANALYSIS

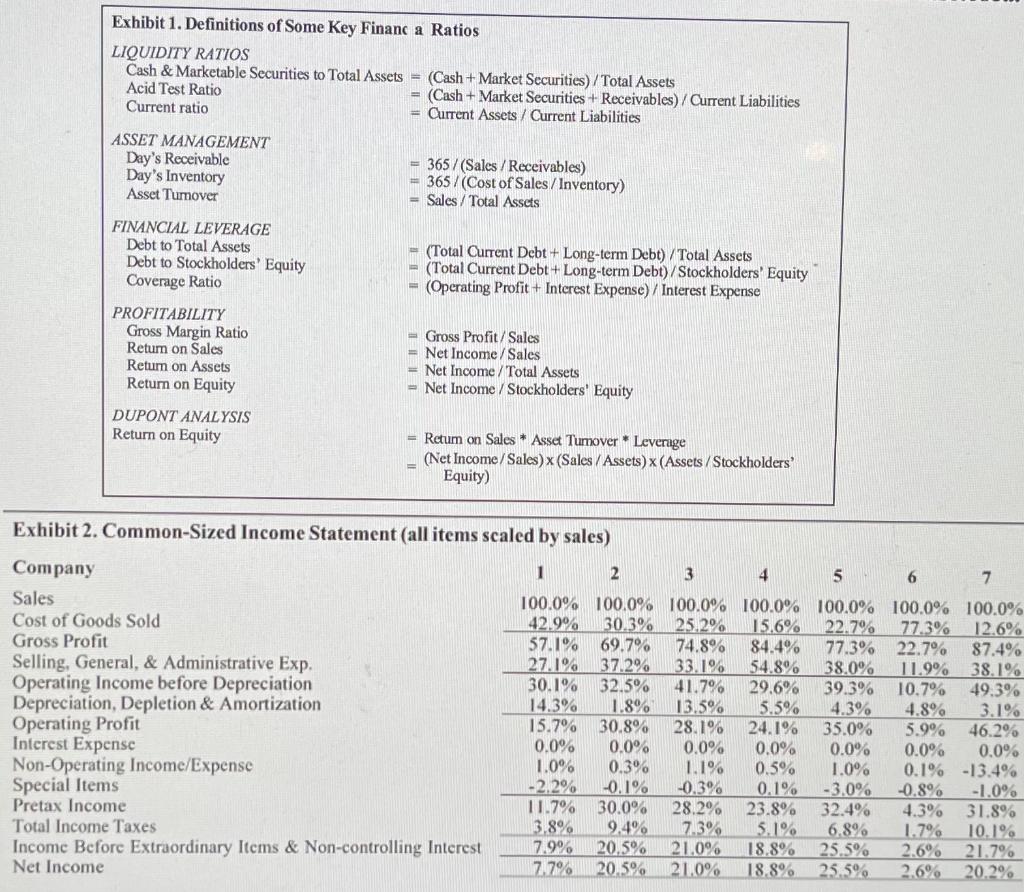

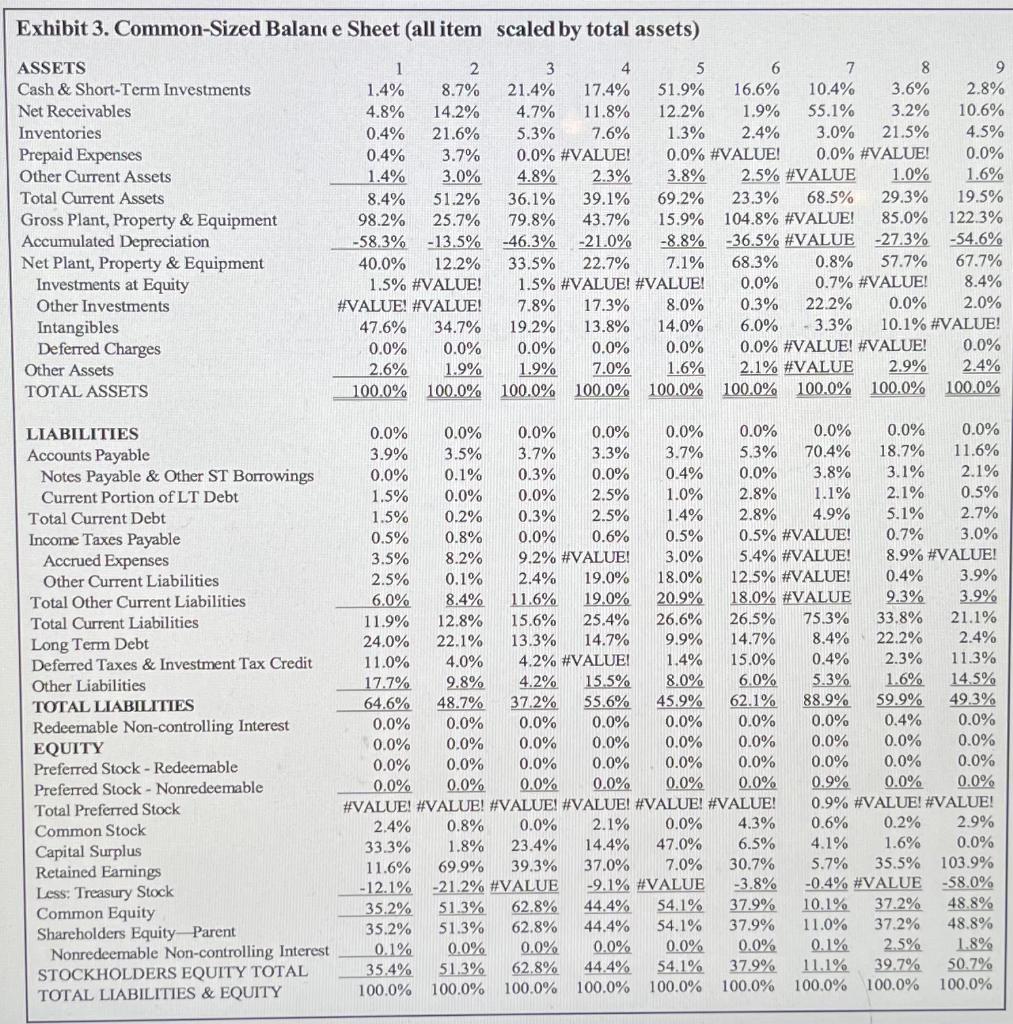

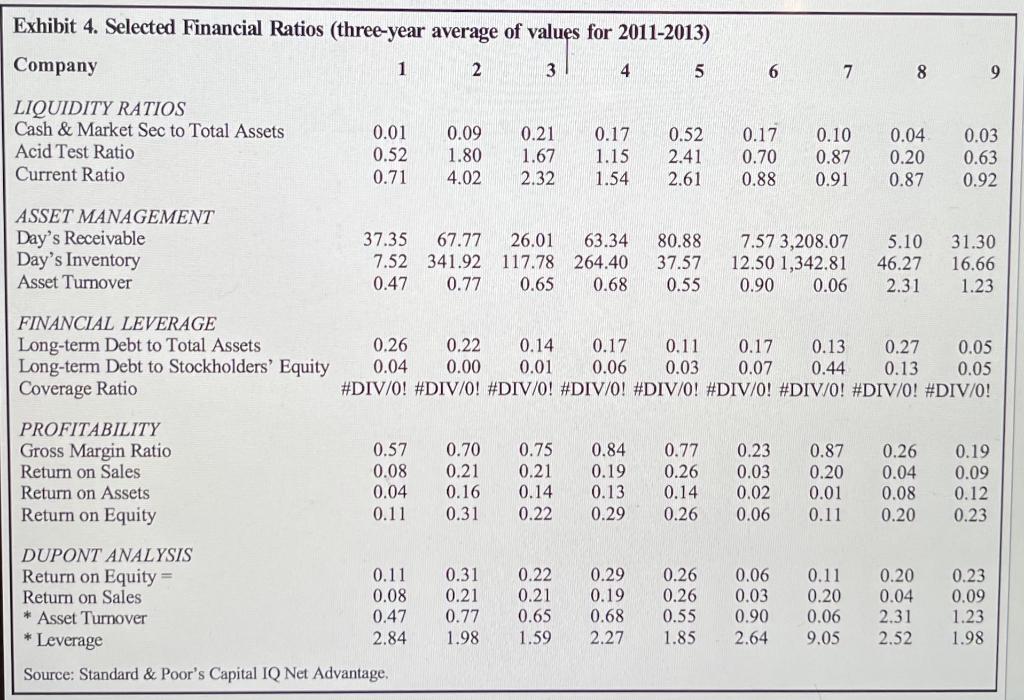

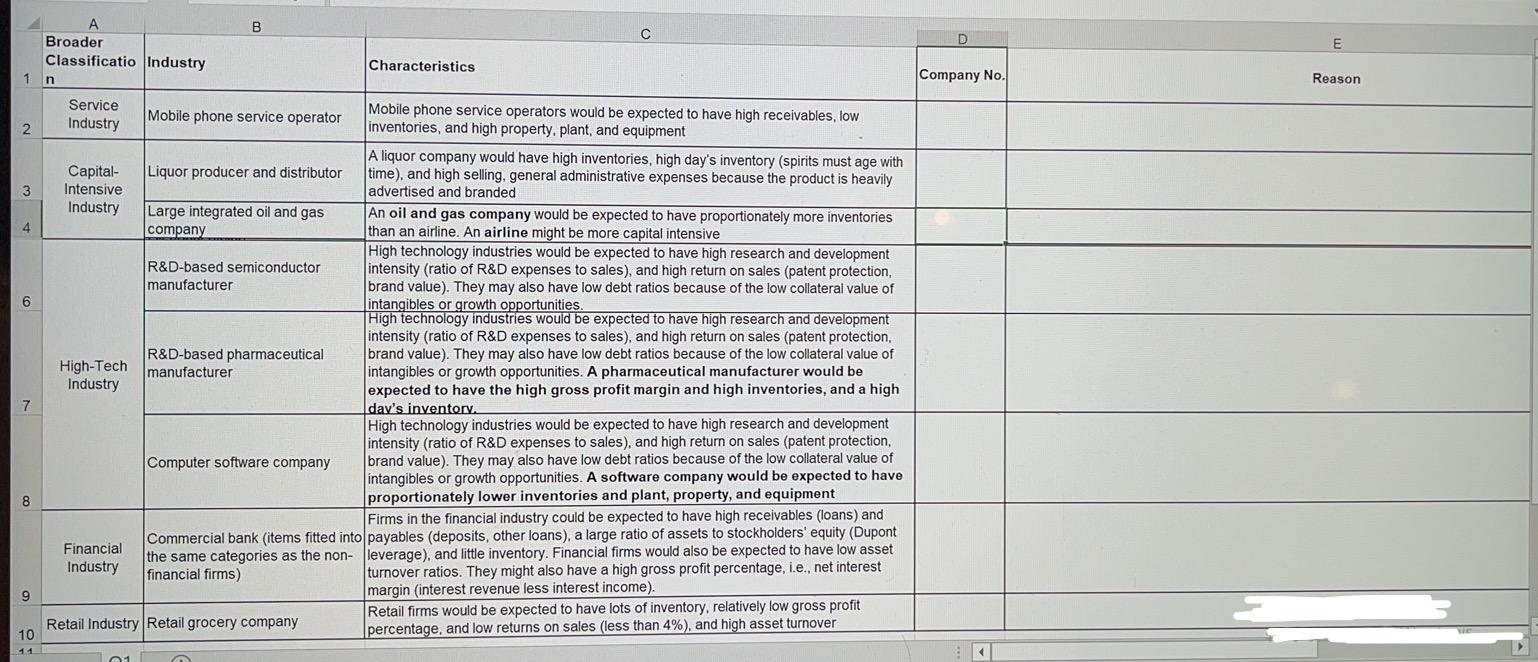

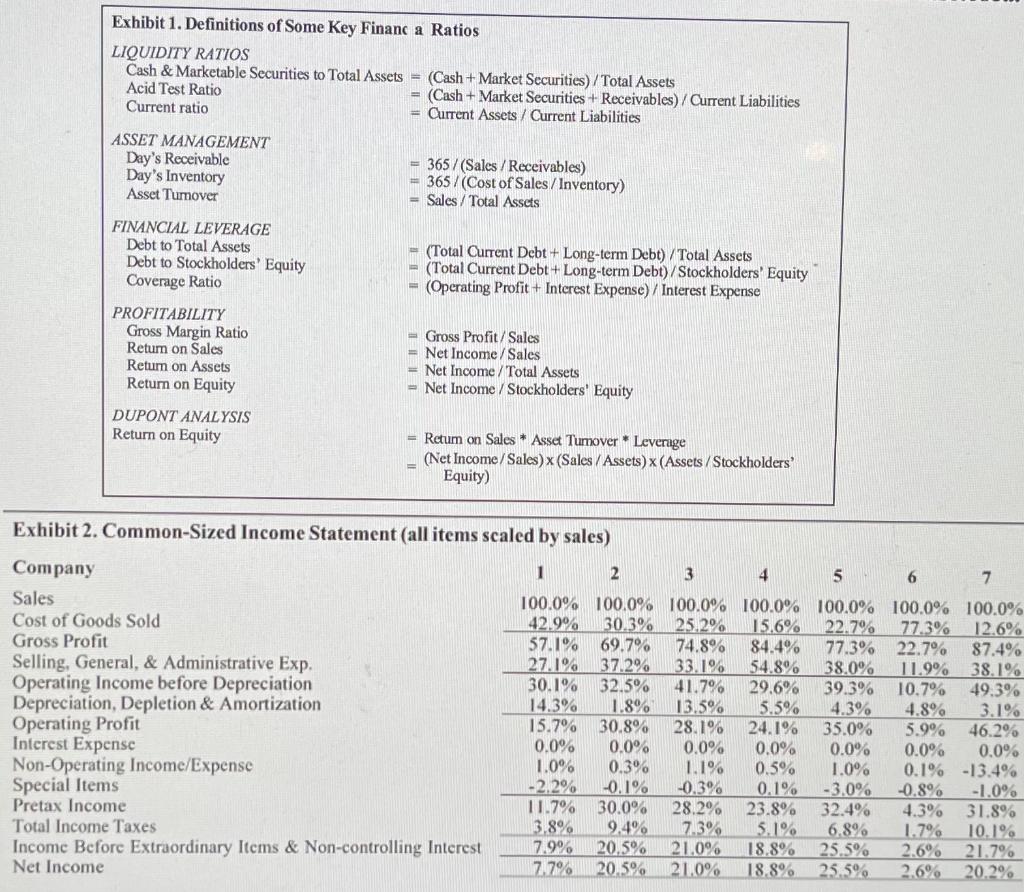

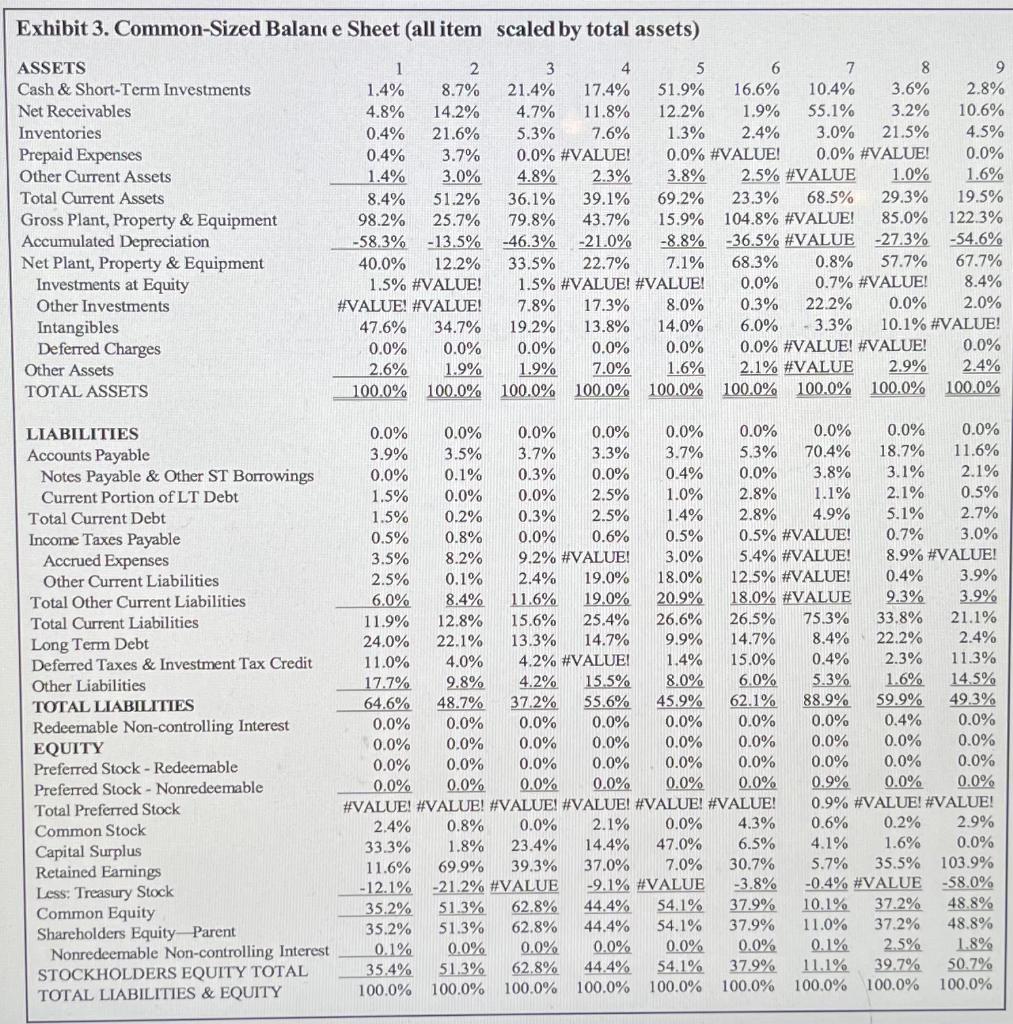

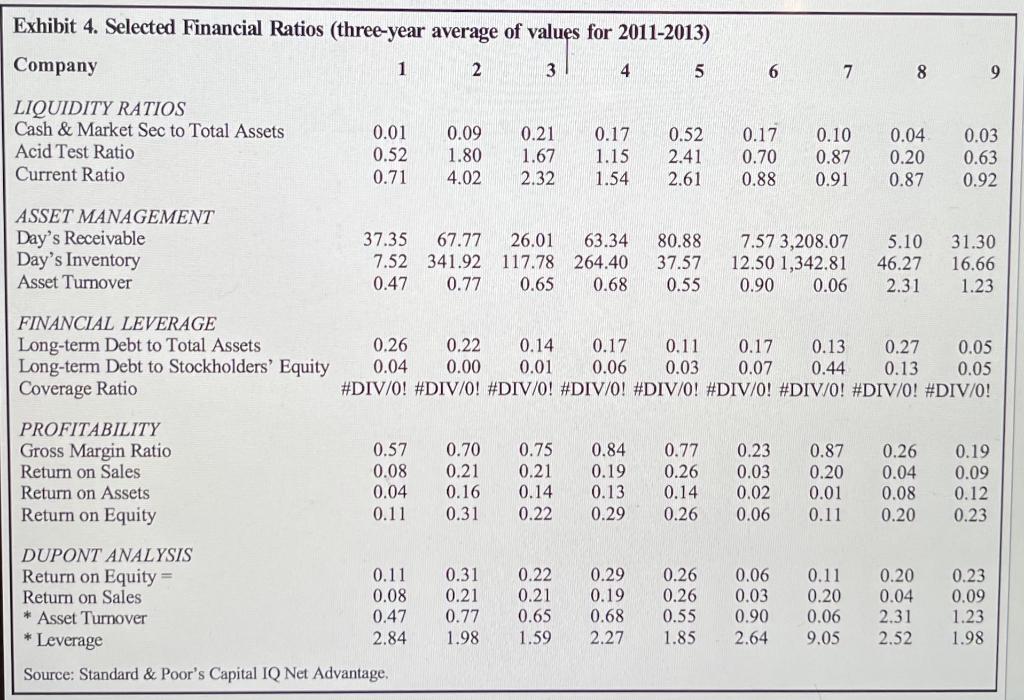

Organizations that operate in the same industry have similar corporate and financial decisions, leading to similar financial characteristics. With some knowledge of the different operating, investing, and financing decisions across industries, financial ratios may be used to identify an industry (see Exhibit 1 for the definition of ratios used).

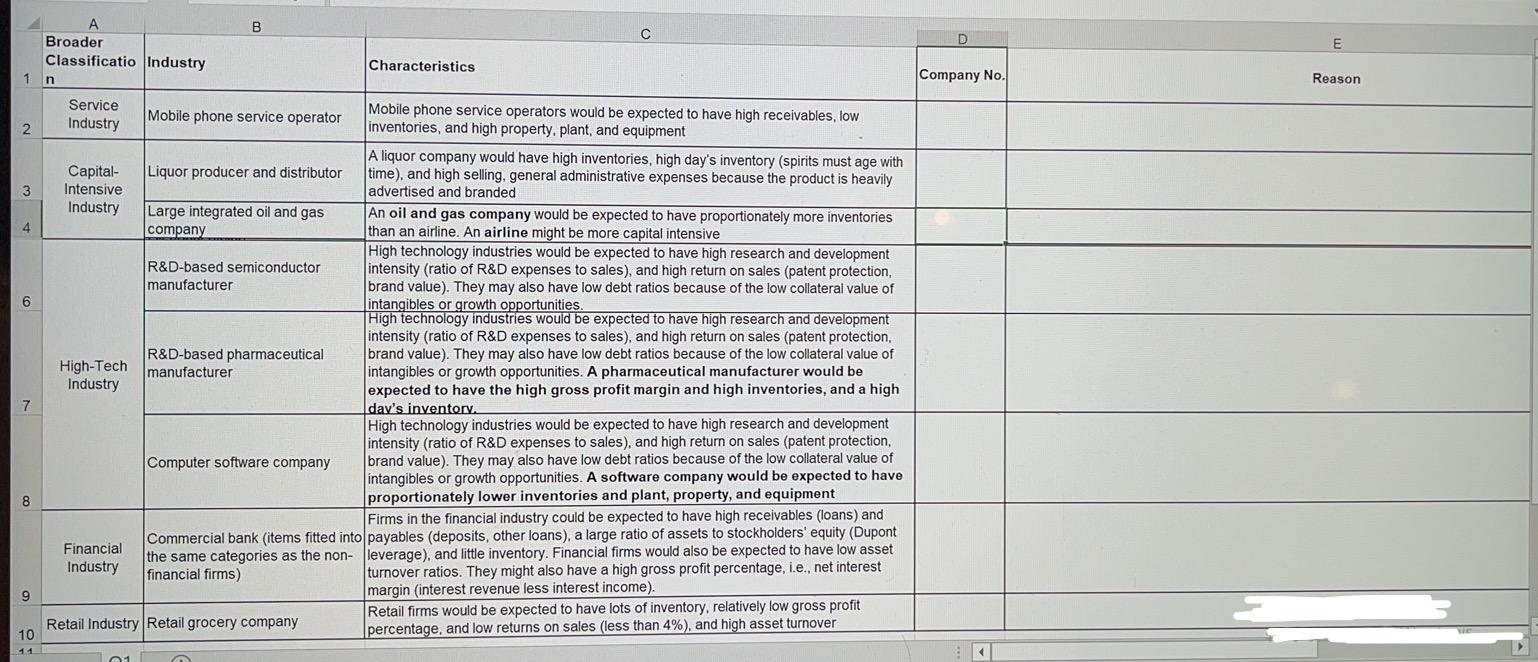

In this problem, using the financial statement data provided in Exhibits 2, 3, and 4, you are required to match the companies with their industry. Use the EXCEL template (Reverse_template.xls) provided to answer the problem. The list of industries is provided below.

The list of industries is as below:

Liquor producer and distributor

Discount airline

Commercial bank (items fitted into the same categories as the non-financial firms)

Computer software company

Large integrated oil and gas company

Mobile phone service operator

R&D-based pharmaceutical manufacturer

Retail grocery company

R&D-based semiconductor manufacturer

The template provided to you has 5 columns. The first column is the broader classification of industries such as Retail, Financial, High-Tech etc. The second column is the same list of industries as provided above. The third column describes the financial characteristics of these industries. These characteristics should help you in matching the companies to the industries. You are free to do some additional research, if required, on the specific industry to understand its financial characteristics.

You need to fill columns 4 (Company No.) and column 5 (Reason). The reason should clearly articulate why did you match a specific company to a specific industry, focussing on the ratios and other data provided to you.

NOTE: #DIV/0! or #VALUE! in the exhibits indicates that the item was not disclosed.

D E 1 Company No. Reason 3 4 6 A B Broader Classificatio Industry Characteristics n Service Mobile phone service operator Mobile phone service operators would be expected to have high receivables, low Industry inventories, and high property, plant, and equipment A liquor company would have high inventories, high day's inventory (spirits must age with Capital- Liquor producer and distributor time), and high selling, general administrative expenses because the product is heavily Intensive advertised and branded Industry Large integrated oil and gas An oil and gas company would be expected to have proportionately more inventories company than an airline. An airline might be more capital intensive High technology industries would be expected to have high research and development R&D-based semiconductor intensity (ratio of R&D expenses to sales), and high return on sales (patent protection, manufacturer brand value). They may also have low debt ratios because of the low collateral value of intangibles or growth opportunities. High technology industries would be expected to have high research and development intensity (ratio of R&D expenses to sales), and high return on sales (patent protection, R&D-based pharmaceutical brand value). They may also have low debt ratios because of the low collateral value of High-Tech manufacturer intangibles or growth opportunities. A pharmaceutical manufacturer would be Industry expected to have the high gross profit margin and high inventories, and a high day's inventory. High technology industries would be expected to have high research and development intensity (ratio of R&D expenses to sales), and high return on sales (patent protection, Computer software company brand value). They also have low debt ratios because of the low collateral value of intangibles or growth opportunities. A software company would be expected to have proportionately lower inventories and plant, property, and equipment Firms in the financial industry could be expected to have high receivables (loans) and Commercial bank (items fitted into payables (deposits, other loans), a large ratio of assets to stockholders' equity (Dupont Financial the same categories as the non- leverage), and little inventory. Financial firms would also be expected to have low asset Industry financial firms) turnover ratios. They might also have a high gross profit percentage, i.e., net interest margin (interest revenue less interest income). Retail firms would be expected to have lots of inventory, relatively low gross profit Retail Industry Retail grocery company percentage, and low returns on sales (less than 4%), and high asset turnover 7 9 10 11 Exhibit 1. Definitions of Some Key Financ a Ratios LIQUIDITY RATIOS Cash & Marketable Securities to Total Assets = (Cash+ Market Securities)/Total Assets Acid Test Ratio (Cash + Market Securities + Receivables) / Current Liabilities Current ratio Current Assets / Current Liabilities ASSET MANAGEMENT Day's Receivable Day's Inventory Asset Tumover = 365/(Sales / Receivables) = 365/(Cost of Sales / Inventory) = Sales/ Total Assets = (Total Current Debt + Long-term Debt) /Total Assets = (Total Current Debt + Long-term Debt) /Stockholders' Equity (Operating Profit + Interest Expense) / Interest Expense FINANCIAL LEVERAGE Debt to Total Assets Debt to Stockholders' Equity Coverage Ratio PROFITABILITY Gross Margin Ratio Return on Sales Return on Assets Return on Equity = Gross Profit/Sales = Net Income/Sales = Net Income / Total Assets - Net Income / Stockholders' Equity DUPONT ANALYSIS Return on Equity = Retum on Sales * Asset Tumover Leverage (Net Income/Sales) x (Sales / Assets) (Assets/Stockholders' Equity) Exhibit 2. Common-Sized Income Statement (all items scaled by sales) 32.5% Company Sales Cost of Goods Sold Gross Profit Selling, General, & Administrative Exp. Operating Income before Depreciation Depreciation, Depletion & Amortization Operating Profit Interest Expense Non-Operating Incomc/Expense Special Items Pretax Income Total Income Taxes Income Before Extraordinary Items & Non-controlling Interest Net Income 1 2 3 4 5 6 7 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 42.9% 30.3% 25.2% 15.6% 22.7% 77.3% 12.6% 57.1% 69.7% 74.8% 84.4% 77.3% 22.7% 87.4% 27.1% 37.2% 33.1% 54.8% 38.0% 11.9% 38.1% 30.1% 41.7% 29.6% 39.3% 10.7% 49.3% 14.3% 1.8% 113.5% 5.5% 4.3% 4.8% 3.1% 15.7% 30.8% 28.1% 24.1% 35.0% 5.9% 46.2% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 1.0% 0.3% 1.1% 0.5% 1.0% 0.1% -13.4% -2.2% -0.1% -0.3% 0.1% -3.0% -0.8% -1.0% 11.7% 30.0% 28.2% 23.8% 32.4% 4.3% 31.8% 3.8% 9.4% 7,3% 5.1% 6.8% 1.7% 10.1% 7.9% 20.5% 21.0% 18.8% 25.5% 2.6% 21.7% 17.7% 20.5% 21.0% 18.8% 25.5% 2.6% 20.2% Exhibit 3. Common-Sized Balance Sheet (all item scaled by total assets) 4.8% ASSETS Cash & Short-Term Investments Net Receivables Inventories Prepaid Expenses Other Current Assets Total Current Assets Gross Plant, Property & Equipment Accumulated Depreciation Net Plant, Property & Equipment Investments at Equity Other Investments Intangibles Deferred Charges Other Assets TOTAL ASSETS 1 2 3 4 5 6 7 8 9 1.4% 8.7% 21.4% 17.4% 51.9% 16.6% 10.4% 3.6% 2.8% 14.2% 4.7% 11.8% 12.2% 1.9% 55.1% 3.2% 10.6% 0.4% 21.6% 5.3% 7.6% 1.3% 2.4% 3.0% 21.5% 4.5% 0.4% 3.7% 0.0% #VALUE! 0.0% #VALUE! 0.0% #VALUE! 0.0% 1.4% 3.0% 4.8% 2.3% 3.8% 2.5% #VALUE 1.0% 1.6% 8.4% 51.2% 36.1% 39.1% 69.2% 23.3% 68.5% 29.3% 19.5% 98.2% 25.7% 79.8% 43.7% 15.9% 104.8% #VALUE! 85.0% 122.3% -58.3% -13.5% -46.3% -21.0% -8.8% -36.5% #VALUE -27.3% -54.6% 40.0% 12.2% 33.5% 22.7% 7.1% 68.3% 0.8% 57.7% 67.7% 1.5% #VALUE! 1.5% #VALUE! #VALUE! 0.0% 0.7% #VALUE! 8.4% #VALUE! #VALUE! 7.8% 17.3% 8.0% 0.3% 22.2% 0.0% 2.0% 47.6% 34.7% 19.2% 13.8% 14.0% 6.0% 3.3% 10.1% #VALUE! 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% #VALUE! #VALUE! 0.0% 2.6% 1.9% 7.0% 1.6% 2.1% #VALUE 2.9% 2.4% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 1.9% 4.0% LIABILITIES Accounts Payable Notes Payable & Other ST Borrowings Current Portion of LT Debt Total Current Debt Income Taxes Payable Accrued Expenses Other Current Liabilities Total Other Current Liabilities Total Current Liabilities Long Term Debt Deferred Taxes & Investment Tax Credit Other Liabilities TOTAL LIABILITIES Redeemable Non-controlling Interest EQUITY Preferred Stock - Redeemable Preferred Stock - Nonredeemable Total Preferred Stock Common Stock Capital Surplus Retained Earnings Less: Treasury Stock Common Equity Shareholders Equity Parent Nonredeemable Non-controlling Interest STOCKHOLDERS EQUITY TOTAL TOTAL LIABILITIES & EQUITY 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 3.9% 3.5% 3.7% 3.3% 3.7% 5.3% 70.4% 18.7% 11.6% 0.0% 0.1% 0.3% 0.0% 0.4% 0.0% 3.8% 3.1% 2.1% 1.5% 0.0% 0.0% 2.5% 1.0% 2.8% 1.1% 2.1% 0.5% 1.5% 0.2% 0.3% 2.5% 1.4% 2.8% 4.9% 5.1% 2.7% 0.5% 0.8% 0.0% 0.6% 0.5% 0.5% #VALUE! 0.7% 3.0% 3.5% 8.2% 9.2% #VALUE! 3.0% 5.4% #VALUE! 8.9% #VALUE! 2.5% 0.1% 2.4% 19.0% 18.0% 12.5% #VALUE! 0.4% 3.9% 6.0% 8.4% 11.6% 19.0% 20.9% 18.0% #VALUE 9.3% 3.9% 11.9% 12.8% 15.6% 25.4% 26.6% 26.5% 75.3% 33.8% 21.1% 24.0% 22.1% 13.3% 14.7% 9.9% 14.7% 8.4% 22.2% 2.4% 11.0% 4.2% #VALUE! 1.4% 15.0% 0.4% 2.3% 11.3% 17.7% 9.8% 4.2% 15.5% 8.0% 6.0% 5.3% 1.6% 14.5% 64.6% 48.7% 37.2% 55.6% 45.9% 62.1% 88.9% 59.9% 49.3% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.4% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.9% 0.0% 0.0% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! 0.9% #VALUE! #VALUE! 2.4% 0.8% 0.0% 2.1% 0.0% 4.3% 0.6% 0.2% 2.9% 33.3% 1.8% 23.4% 14.4% 47.0% 6.5% 4.1% 1.6% 0.0% 11.6% 69.9% 39.3% 37.0% 7.0% 30.7% 5.7% 35.5% 103.9% - 12.1% -21.2% #VALUE -9.1% #VALUE -3.8% -0.4% #VALUE -58.0% 35.2% 51.3% 62.8% 44.4% 54.1% 37.9% 10.1% 37.2% 48.8% 35.2% 51.3% 62.8% 44.4% 54.1% 37.9% 11.0% 37.2% 48.8% 0.1% 0.0% 0.0% 0.0% 0.0% 0.0% 0.1% 2.5% 1.8% 35.4% 51.3% 62.8% 44.4% 54.1% 37.9% 11.1% 39.7% 50.7% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Exhibit 4. Selected Financial Ratios (three-year average of values for 2011-2013) Company 1 2 3 4 5 6 7 oc 9 LIQUIDITY RATIOS Cash & Market Sec to Total Assets Acid Test Ratio Current Ratio 0.01 0.52 0.71 0.09 1.80 4.02 0.21 1.67 2.32 0.17 1.15 1.54 0.52 2.41 2.61 0.17 0.70 0.88 0.10 0.87 0.91 0.04 0.20 0.87 0.03 0.63 0.92 ASSET MANAGEMENT Day's Receivable Day's Inventory Asset Turnover 5.10 37.35 67.77 26.01 63.34 7.52 341.92 117.78 264.40 0.47 0.77 0.65 0.68 80.88 37.57 0.55 7.57 3,208.07 12.50 1,342.81 0.90 0.06 46.27 2.31 31.30 16.66 1.23 FINANCIAL LEVERAGE Long-term Debt to Total Assets Long-term Debt to Stockholders' Equity Coverage Ratio 0.26 0.22 0.14 0.17 0.11 0.17 0.13 0.27 0.05 0.04 0.00 0.01 0.06 0.03 0.07 0.44 0.13 0.05 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! PROFITABILITY Gross Margin Ratio Return on Sales Return on Assets Return on Equity 0.57 0.08 0.04 0.11 0.70 0.21 0.16 0.31 0.75 0.21 0.14 0.22 0.84 0.19 0.13 0.29 0.77 0.26 0.14 0.26 0.23 0.03 0.02 0.06 0.87 0.20 0.01 0.11 0.26 0.04 0.08 0.20 0.19 0.09 0.12 0.23 DUPONT ANALYSIS Return on Equity = 0.11 Return on Sales 0.08 * Asset Turnover 0.47 * Leverage 2.84 Source: Standard & Poor's Capital IQ Net Advantage, 0.31 0.21 0.77 1.98 0.22 0.21 0.65 0.29 0.19 0.68 2.27 0.26 0.26 0.55 1.85 0.06 0.03 0.90 2.64 0.11 0.20 0.06 9.05 0.20 0.04 2.31 2.52 0.23 0.09 1.23 1.98 1.59 D E 1 Company No. Reason 3 4 6 A B Broader Classificatio Industry Characteristics n Service Mobile phone service operator Mobile phone service operators would be expected to have high receivables, low Industry inventories, and high property, plant, and equipment A liquor company would have high inventories, high day's inventory (spirits must age with Capital- Liquor producer and distributor time), and high selling, general administrative expenses because the product is heavily Intensive advertised and branded Industry Large integrated oil and gas An oil and gas company would be expected to have proportionately more inventories company than an airline. An airline might be more capital intensive High technology industries would be expected to have high research and development R&D-based semiconductor intensity (ratio of R&D expenses to sales), and high return on sales (patent protection, manufacturer brand value). They may also have low debt ratios because of the low collateral value of intangibles or growth opportunities. High technology industries would be expected to have high research and development intensity (ratio of R&D expenses to sales), and high return on sales (patent protection, R&D-based pharmaceutical brand value). They may also have low debt ratios because of the low collateral value of High-Tech manufacturer intangibles or growth opportunities. A pharmaceutical manufacturer would be Industry expected to have the high gross profit margin and high inventories, and a high day's inventory. High technology industries would be expected to have high research and development intensity (ratio of R&D expenses to sales), and high return on sales (patent protection, Computer software company brand value). They also have low debt ratios because of the low collateral value of intangibles or growth opportunities. A software company would be expected to have proportionately lower inventories and plant, property, and equipment Firms in the financial industry could be expected to have high receivables (loans) and Commercial bank (items fitted into payables (deposits, other loans), a large ratio of assets to stockholders' equity (Dupont Financial the same categories as the non- leverage), and little inventory. Financial firms would also be expected to have low asset Industry financial firms) turnover ratios. They might also have a high gross profit percentage, i.e., net interest margin (interest revenue less interest income). Retail firms would be expected to have lots of inventory, relatively low gross profit Retail Industry Retail grocery company percentage, and low returns on sales (less than 4%), and high asset turnover 7 9 10 11 Exhibit 1. Definitions of Some Key Financ a Ratios LIQUIDITY RATIOS Cash & Marketable Securities to Total Assets = (Cash+ Market Securities)/Total Assets Acid Test Ratio (Cash + Market Securities + Receivables) / Current Liabilities Current ratio Current Assets / Current Liabilities ASSET MANAGEMENT Day's Receivable Day's Inventory Asset Tumover = 365/(Sales / Receivables) = 365/(Cost of Sales / Inventory) = Sales/ Total Assets = (Total Current Debt + Long-term Debt) /Total Assets = (Total Current Debt + Long-term Debt) /Stockholders' Equity (Operating Profit + Interest Expense) / Interest Expense FINANCIAL LEVERAGE Debt to Total Assets Debt to Stockholders' Equity Coverage Ratio PROFITABILITY Gross Margin Ratio Return on Sales Return on Assets Return on Equity = Gross Profit/Sales = Net Income/Sales = Net Income / Total Assets - Net Income / Stockholders' Equity DUPONT ANALYSIS Return on Equity = Retum on Sales * Asset Tumover Leverage (Net Income/Sales) x (Sales / Assets) (Assets/Stockholders' Equity) Exhibit 2. Common-Sized Income Statement (all items scaled by sales) 32.5% Company Sales Cost of Goods Sold Gross Profit Selling, General, & Administrative Exp. Operating Income before Depreciation Depreciation, Depletion & Amortization Operating Profit Interest Expense Non-Operating Incomc/Expense Special Items Pretax Income Total Income Taxes Income Before Extraordinary Items & Non-controlling Interest Net Income 1 2 3 4 5 6 7 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 42.9% 30.3% 25.2% 15.6% 22.7% 77.3% 12.6% 57.1% 69.7% 74.8% 84.4% 77.3% 22.7% 87.4% 27.1% 37.2% 33.1% 54.8% 38.0% 11.9% 38.1% 30.1% 41.7% 29.6% 39.3% 10.7% 49.3% 14.3% 1.8% 113.5% 5.5% 4.3% 4.8% 3.1% 15.7% 30.8% 28.1% 24.1% 35.0% 5.9% 46.2% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 1.0% 0.3% 1.1% 0.5% 1.0% 0.1% -13.4% -2.2% -0.1% -0.3% 0.1% -3.0% -0.8% -1.0% 11.7% 30.0% 28.2% 23.8% 32.4% 4.3% 31.8% 3.8% 9.4% 7,3% 5.1% 6.8% 1.7% 10.1% 7.9% 20.5% 21.0% 18.8% 25.5% 2.6% 21.7% 17.7% 20.5% 21.0% 18.8% 25.5% 2.6% 20.2% Exhibit 3. Common-Sized Balance Sheet (all item scaled by total assets) 4.8% ASSETS Cash & Short-Term Investments Net Receivables Inventories Prepaid Expenses Other Current Assets Total Current Assets Gross Plant, Property & Equipment Accumulated Depreciation Net Plant, Property & Equipment Investments at Equity Other Investments Intangibles Deferred Charges Other Assets TOTAL ASSETS 1 2 3 4 5 6 7 8 9 1.4% 8.7% 21.4% 17.4% 51.9% 16.6% 10.4% 3.6% 2.8% 14.2% 4.7% 11.8% 12.2% 1.9% 55.1% 3.2% 10.6% 0.4% 21.6% 5.3% 7.6% 1.3% 2.4% 3.0% 21.5% 4.5% 0.4% 3.7% 0.0% #VALUE! 0.0% #VALUE! 0.0% #VALUE! 0.0% 1.4% 3.0% 4.8% 2.3% 3.8% 2.5% #VALUE 1.0% 1.6% 8.4% 51.2% 36.1% 39.1% 69.2% 23.3% 68.5% 29.3% 19.5% 98.2% 25.7% 79.8% 43.7% 15.9% 104.8% #VALUE! 85.0% 122.3% -58.3% -13.5% -46.3% -21.0% -8.8% -36.5% #VALUE -27.3% -54.6% 40.0% 12.2% 33.5% 22.7% 7.1% 68.3% 0.8% 57.7% 67.7% 1.5% #VALUE! 1.5% #VALUE! #VALUE! 0.0% 0.7% #VALUE! 8.4% #VALUE! #VALUE! 7.8% 17.3% 8.0% 0.3% 22.2% 0.0% 2.0% 47.6% 34.7% 19.2% 13.8% 14.0% 6.0% 3.3% 10.1% #VALUE! 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% #VALUE! #VALUE! 0.0% 2.6% 1.9% 7.0% 1.6% 2.1% #VALUE 2.9% 2.4% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 1.9% 4.0% LIABILITIES Accounts Payable Notes Payable & Other ST Borrowings Current Portion of LT Debt Total Current Debt Income Taxes Payable Accrued Expenses Other Current Liabilities Total Other Current Liabilities Total Current Liabilities Long Term Debt Deferred Taxes & Investment Tax Credit Other Liabilities TOTAL LIABILITIES Redeemable Non-controlling Interest EQUITY Preferred Stock - Redeemable Preferred Stock - Nonredeemable Total Preferred Stock Common Stock Capital Surplus Retained Earnings Less: Treasury Stock Common Equity Shareholders Equity Parent Nonredeemable Non-controlling Interest STOCKHOLDERS EQUITY TOTAL TOTAL LIABILITIES & EQUITY 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 3.9% 3.5% 3.7% 3.3% 3.7% 5.3% 70.4% 18.7% 11.6% 0.0% 0.1% 0.3% 0.0% 0.4% 0.0% 3.8% 3.1% 2.1% 1.5% 0.0% 0.0% 2.5% 1.0% 2.8% 1.1% 2.1% 0.5% 1.5% 0.2% 0.3% 2.5% 1.4% 2.8% 4.9% 5.1% 2.7% 0.5% 0.8% 0.0% 0.6% 0.5% 0.5% #VALUE! 0.7% 3.0% 3.5% 8.2% 9.2% #VALUE! 3.0% 5.4% #VALUE! 8.9% #VALUE! 2.5% 0.1% 2.4% 19.0% 18.0% 12.5% #VALUE! 0.4% 3.9% 6.0% 8.4% 11.6% 19.0% 20.9% 18.0% #VALUE 9.3% 3.9% 11.9% 12.8% 15.6% 25.4% 26.6% 26.5% 75.3% 33.8% 21.1% 24.0% 22.1% 13.3% 14.7% 9.9% 14.7% 8.4% 22.2% 2.4% 11.0% 4.2% #VALUE! 1.4% 15.0% 0.4% 2.3% 11.3% 17.7% 9.8% 4.2% 15.5% 8.0% 6.0% 5.3% 1.6% 14.5% 64.6% 48.7% 37.2% 55.6% 45.9% 62.1% 88.9% 59.9% 49.3% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.4% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.9% 0.0% 0.0% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! 0.9% #VALUE! #VALUE! 2.4% 0.8% 0.0% 2.1% 0.0% 4.3% 0.6% 0.2% 2.9% 33.3% 1.8% 23.4% 14.4% 47.0% 6.5% 4.1% 1.6% 0.0% 11.6% 69.9% 39.3% 37.0% 7.0% 30.7% 5.7% 35.5% 103.9% - 12.1% -21.2% #VALUE -9.1% #VALUE -3.8% -0.4% #VALUE -58.0% 35.2% 51.3% 62.8% 44.4% 54.1% 37.9% 10.1% 37.2% 48.8% 35.2% 51.3% 62.8% 44.4% 54.1% 37.9% 11.0% 37.2% 48.8% 0.1% 0.0% 0.0% 0.0% 0.0% 0.0% 0.1% 2.5% 1.8% 35.4% 51.3% 62.8% 44.4% 54.1% 37.9% 11.1% 39.7% 50.7% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Exhibit 4. Selected Financial Ratios (three-year average of values for 2011-2013) Company 1 2 3 4 5 6 7 oc 9 LIQUIDITY RATIOS Cash & Market Sec to Total Assets Acid Test Ratio Current Ratio 0.01 0.52 0.71 0.09 1.80 4.02 0.21 1.67 2.32 0.17 1.15 1.54 0.52 2.41 2.61 0.17 0.70 0.88 0.10 0.87 0.91 0.04 0.20 0.87 0.03 0.63 0.92 ASSET MANAGEMENT Day's Receivable Day's Inventory Asset Turnover 5.10 37.35 67.77 26.01 63.34 7.52 341.92 117.78 264.40 0.47 0.77 0.65 0.68 80.88 37.57 0.55 7.57 3,208.07 12.50 1,342.81 0.90 0.06 46.27 2.31 31.30 16.66 1.23 FINANCIAL LEVERAGE Long-term Debt to Total Assets Long-term Debt to Stockholders' Equity Coverage Ratio 0.26 0.22 0.14 0.17 0.11 0.17 0.13 0.27 0.05 0.04 0.00 0.01 0.06 0.03 0.07 0.44 0.13 0.05 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! PROFITABILITY Gross Margin Ratio Return on Sales Return on Assets Return on Equity 0.57 0.08 0.04 0.11 0.70 0.21 0.16 0.31 0.75 0.21 0.14 0.22 0.84 0.19 0.13 0.29 0.77 0.26 0.14 0.26 0.23 0.03 0.02 0.06 0.87 0.20 0.01 0.11 0.26 0.04 0.08 0.20 0.19 0.09 0.12 0.23 DUPONT ANALYSIS Return on Equity = 0.11 Return on Sales 0.08 * Asset Turnover 0.47 * Leverage 2.84 Source: Standard & Poor's Capital IQ Net Advantage, 0.31 0.21 0.77 1.98 0.22 0.21 0.65 0.29 0.19 0.68 2.27 0.26 0.26 0.55 1.85 0.06 0.03 0.90 2.64 0.11 0.20 0.06 9.05 0.20 0.04 2.31 2.52 0.23 0.09 1.23 1.98 1.59