Answered step by step

Verified Expert Solution

Question

1 Approved Answer

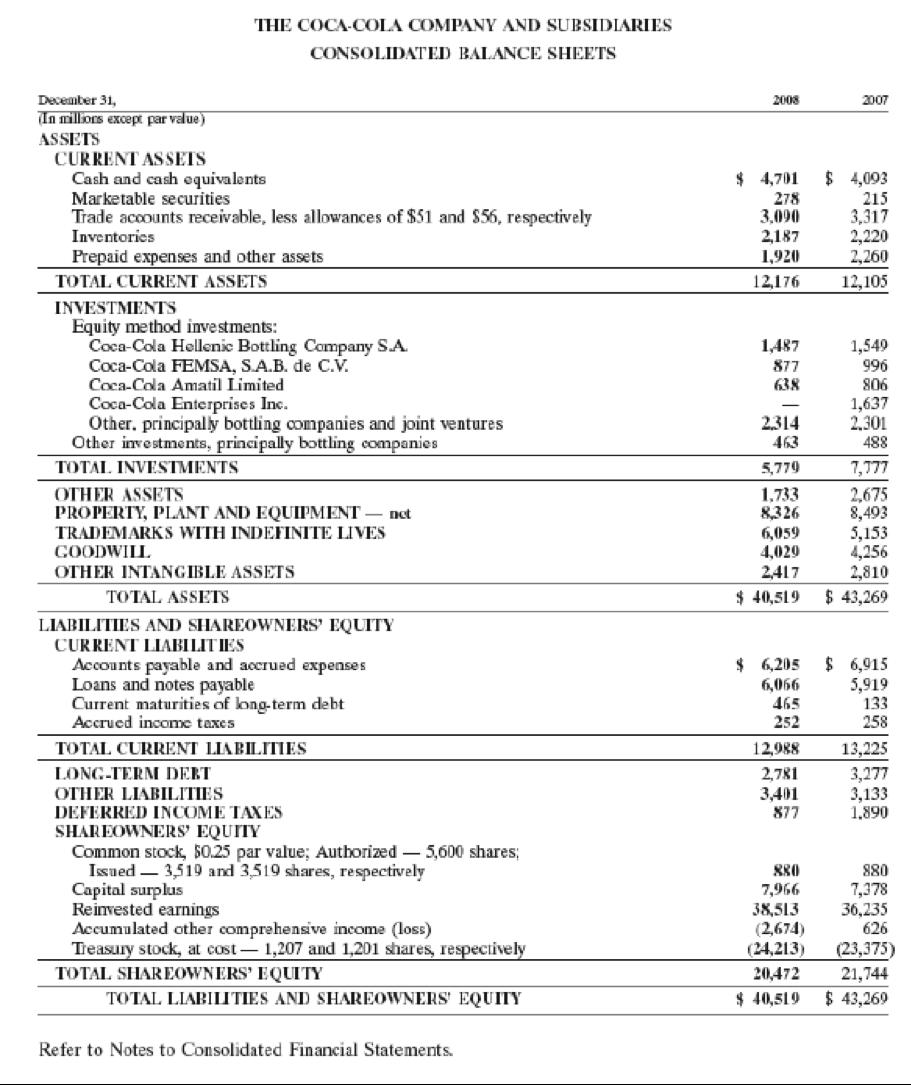

Review Coke Colas financial statements and answer the following questions: What is Cokes percent of current assets to total assets on its December 31, 2008

Review Coke Cola’s financial statements and answer the following questions:

- What is Coke’s percent of current assets to total assets on its December 31, 2008 balance sheet?

- What is Coke’s percentage of current liabilities to total stockholders’ equity on its December 31, 2008 balance sheet?

- What is the percentage increase in cash and cash equivalents from 2007 to 2008?

- What percentage did total assets decreased from 2007 to 2008?

December 31, In millions except par value) ASSETS THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS CURRENT ASSETS Cash and cash equivalents Marketable securities Trade accounts receivable, less allowances of $51 and $56, respectively Inventories Prepaid expenses and other assets TOTAL CURRENT ASSETS INVESTMENTS Equity method investments: Coca-Cola Hellenic Bottling Company S.A. Coca-Cola FEMSA, S.A.B. de C.V. Coca-Cola Amatil Limited Coca-Cola Enterprises Inc. Other, principally bottling companies and joint ventures Other investments, principally bottling companies TOTAL INVESTMENTS OTHER ASSETS PROPERTY, PLANT AND EQUIPMENT - net TRADEMARKS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND SHAREOWNERS' EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes TOTAL CURRENT LIABILITIES LONG-TERM DERT OTHER LIABILITIES DEFERRED INCOME TAXES SHAREOWNERS' EQUITY Common stock, $0.25 par value; Authorized - 5,600 shares; Issued 3,519 and 3,519 shares, respectively Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost-1,207 and 1,201 shares, respectively TOTAL SHAREOWNERS' EQUITY TOTAL LIABILITIES AND SHAREOWNERS' EQUITY Refer to Notes to Consolidated Financial Statements. 2008 $ 4,701 278 3,090 2,187 1,920 12,176 1,487 877 63.8 2,314 5,779 1,733 8,326 6,059 4,029 2,417 $ 40,519 $ 6,205 6,066 465 252 12,988 2,781 3,401 877 2007 $ 4,093 215 3,317 2,220 2,260 12,105 1,549 996 806 1,637 2.301 488 7,777 2,675 8,493 5,153 4,256 2,810 $ 43,269 $6,915 5,919 133 258 13,225 3,277 3,133 1,890 880 7,966 38,513 (2,674) (24,213) (23,375) 20,472 21,744 $ 40,519 $ 43,269 880 7,378 36,235 626

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started