Answered step by step

Verified Expert Solution

Question

1 Approved Answer

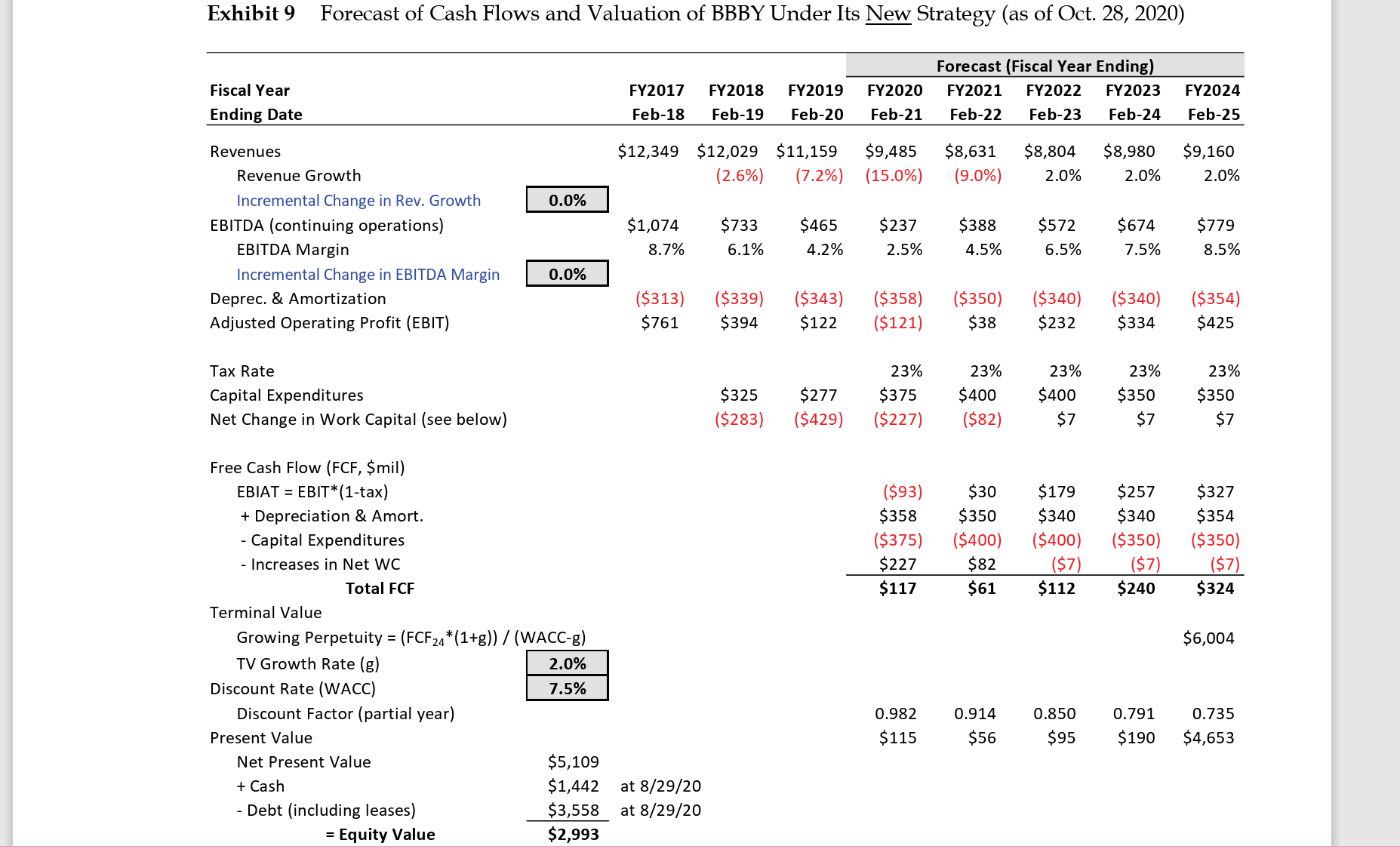

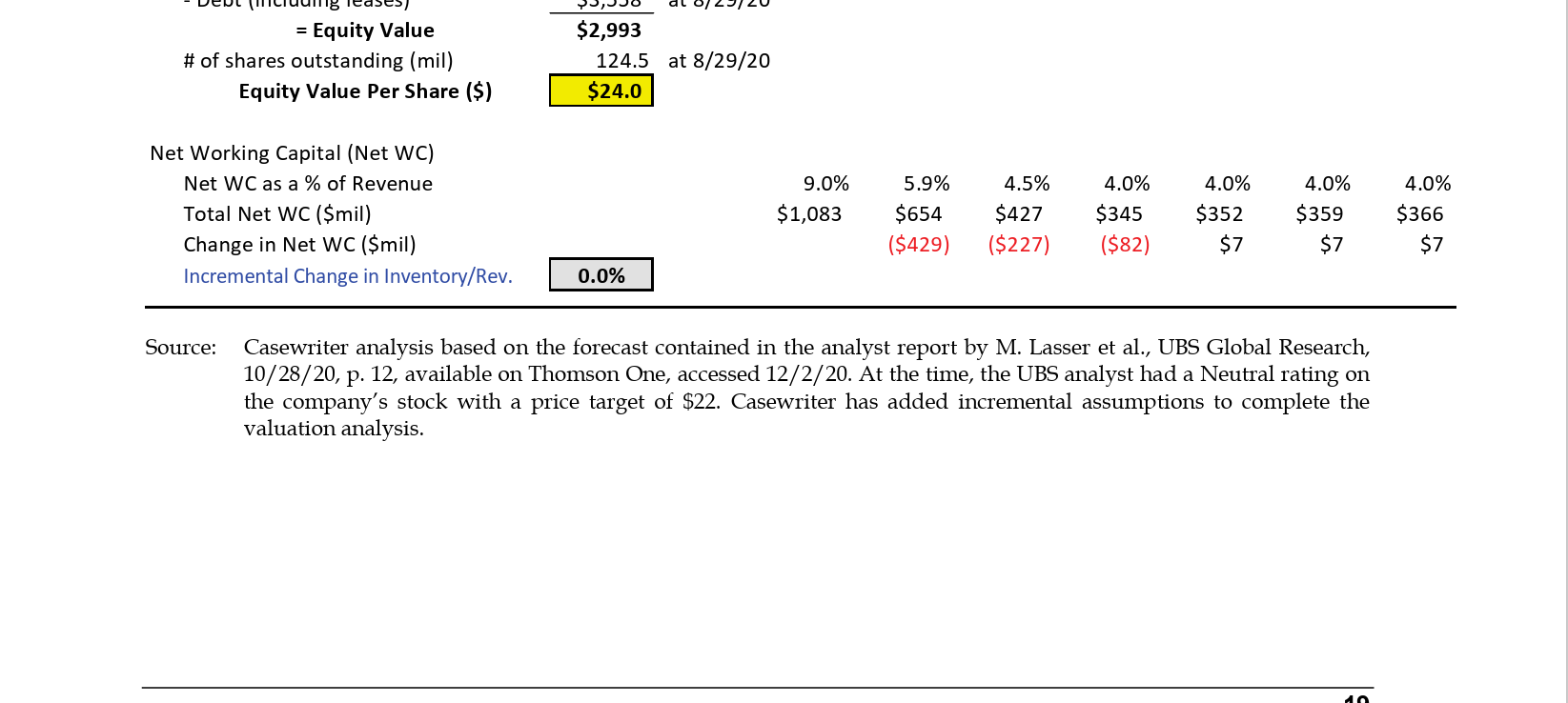

Review exhibit 9 (forecast of cash flows and valuations) and discuss how the financial projections of FY2020-2024 compared to FY2017-FY2019. What could the new management

Review exhibit 9 (forecast of cash flows and valuations) and discuss how the financial projections of FY2020-2024 compared to FY2017-FY2019. What could the new management team do differently to turnaround the company?

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Fiscal Year } & & \multirow[b]{2}{*}{ FY2017 } & \multirow[b]{2}{*}{ FY2018 } & \multirow[b]{2}{*}{ FY2019 } & \multicolumn{5}{|c|}{ Forecast (Fiscal Year Ending) } \\ \hline & & & & & FY2020 & FY2021 & FY2022 & FY2023 & FY2024 \\ \hline Ending Date & & Feb-18 & Feb-19 & Feb-20 & Feb-21 & Feb-22 & Feb-23 & Feb-24 & Feb-25 \\ \hline Revenues & & $12,349 & $12,029 & $11,159 & $9,485 & $8,631 & $8,804 & $8,980 & $9,160 \\ \hline Revenue Growth & & & (2.6%) & (7.2%) & (15.0%) & (9.0%) & 2.0% & 2.0% & 2.0% \\ \hline Incremental Change in Rev. Growth & 0.0% & & & & & & & & \\ \hline EBITDA (continuing operations) & & $1,074 & $733 & $465 & $237 & $388 & $572 & $674 & $779 \\ \hline EBITDA Margin & & 8.7% & 6.1% & 4.2% & 2.5% & 4.5% & 6.5% & 7.5% & 8.5% \\ \hline Incremental Change in EBITDA Margin & 0.0% & & & & & & & & \\ \hline Deprec. \& Amortization & & ($313) & ($339) & ($343) & ($358) & ($350) & ($340) & ($340) & ($354) \\ \hline Adjusted Operating Profit (EBIT) & & $761 & $394 & $122 & ($121) & $38 & $232 & $334 & $425 \\ \hline Tax Rate & & & & & 23% & 23% & 23% & 23% & 23% \\ \hline Capital Expenditures & & & $325 & $277 & $375 & $400 & $400 & $350 & $350 \\ \hline Net Change in Work Capital (see below) & & & ($283) & ($429) & ($227) & ($82) & $7 & $7 & $7 \\ \hline \multicolumn{10}{|l|}{ Free Cash Flow (FCF, \$mil) } \\ \hline EBIAT=EBIT(1tax) & & & & & ($93) & $30 & $179 & $257 & $327 \\ \hline + Depreciation \& Amort. & & & & & $358 & $350 & $340 & $340 & $354 \\ \hline - Capital Expenditures & & & & & ($375) & ($400) & ($400) & ($350) & ($350) \\ \hline - Increases in Net WC & & & & & $227 & $82 & ($7) & ($7) & ($7) \\ \hline Total FCF & & & & & $117 & $61 & $112 & $240 & $324 \\ \hline \multicolumn{10}{|l|}{ Terminal Value } \\ \hline \multicolumn{2}{|c|}{ Growing Perpetuity =(FCF24(1+g))/( WACC-g )} & & & & & & & & $6,004 \\ \hline TV Growth Rate (g) & 2.0% & & & & & & & & \\ \hline Discount Rate (WACC) & 7.5% & & & & & & & & \\ \hline Discount Factor (partial year) & & & & & 0.982 & 0.914 & 0.850 & 0.791 & 0.735 \\ \hline Present Value & & & & & $115 & $56 & $95 & $190 & $4,653 \\ \hline Net Present Value & $5,109 & & & & & & & & \\ \hline+ Cash & $1,442 & at 8/29/20 & & & & & & & \\ \hline - Debt (including leases) & $3,558 & at 8/29/20 & & & & & & & \\ \hline= Equity Value & $2,993 & & & & & & & & \\ \hline \end{tabular} Source: Casewriter analysis based on the forecast contained in the analyst report by M. Lasser et al., UBS Global Research, 10/28/20, p. 12, available on Thomson One, accessed 12/2/20. At the time, the UBS analyst had a Neutral rating on the company's stock with a price target of $22. Casewriter has added incremental assumptions to complete the valuation analysis

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Fiscal Year } & & \multirow[b]{2}{*}{ FY2017 } & \multirow[b]{2}{*}{ FY2018 } & \multirow[b]{2}{*}{ FY2019 } & \multicolumn{5}{|c|}{ Forecast (Fiscal Year Ending) } \\ \hline & & & & & FY2020 & FY2021 & FY2022 & FY2023 & FY2024 \\ \hline Ending Date & & Feb-18 & Feb-19 & Feb-20 & Feb-21 & Feb-22 & Feb-23 & Feb-24 & Feb-25 \\ \hline Revenues & & $12,349 & $12,029 & $11,159 & $9,485 & $8,631 & $8,804 & $8,980 & $9,160 \\ \hline Revenue Growth & & & (2.6%) & (7.2%) & (15.0%) & (9.0%) & 2.0% & 2.0% & 2.0% \\ \hline Incremental Change in Rev. Growth & 0.0% & & & & & & & & \\ \hline EBITDA (continuing operations) & & $1,074 & $733 & $465 & $237 & $388 & $572 & $674 & $779 \\ \hline EBITDA Margin & & 8.7% & 6.1% & 4.2% & 2.5% & 4.5% & 6.5% & 7.5% & 8.5% \\ \hline Incremental Change in EBITDA Margin & 0.0% & & & & & & & & \\ \hline Deprec. \& Amortization & & ($313) & ($339) & ($343) & ($358) & ($350) & ($340) & ($340) & ($354) \\ \hline Adjusted Operating Profit (EBIT) & & $761 & $394 & $122 & ($121) & $38 & $232 & $334 & $425 \\ \hline Tax Rate & & & & & 23% & 23% & 23% & 23% & 23% \\ \hline Capital Expenditures & & & $325 & $277 & $375 & $400 & $400 & $350 & $350 \\ \hline Net Change in Work Capital (see below) & & & ($283) & ($429) & ($227) & ($82) & $7 & $7 & $7 \\ \hline \multicolumn{10}{|l|}{ Free Cash Flow (FCF, \$mil) } \\ \hline EBIAT=EBIT(1tax) & & & & & ($93) & $30 & $179 & $257 & $327 \\ \hline + Depreciation \& Amort. & & & & & $358 & $350 & $340 & $340 & $354 \\ \hline - Capital Expenditures & & & & & ($375) & ($400) & ($400) & ($350) & ($350) \\ \hline - Increases in Net WC & & & & & $227 & $82 & ($7) & ($7) & ($7) \\ \hline Total FCF & & & & & $117 & $61 & $112 & $240 & $324 \\ \hline \multicolumn{10}{|l|}{ Terminal Value } \\ \hline \multicolumn{2}{|c|}{ Growing Perpetuity =(FCF24(1+g))/( WACC-g )} & & & & & & & & $6,004 \\ \hline TV Growth Rate (g) & 2.0% & & & & & & & & \\ \hline Discount Rate (WACC) & 7.5% & & & & & & & & \\ \hline Discount Factor (partial year) & & & & & 0.982 & 0.914 & 0.850 & 0.791 & 0.735 \\ \hline Present Value & & & & & $115 & $56 & $95 & $190 & $4,653 \\ \hline Net Present Value & $5,109 & & & & & & & & \\ \hline+ Cash & $1,442 & at 8/29/20 & & & & & & & \\ \hline - Debt (including leases) & $3,558 & at 8/29/20 & & & & & & & \\ \hline= Equity Value & $2,993 & & & & & & & & \\ \hline \end{tabular} Source: Casewriter analysis based on the forecast contained in the analyst report by M. Lasser et al., UBS Global Research, 10/28/20, p. 12, available on Thomson One, accessed 12/2/20. At the time, the UBS analyst had a Neutral rating on the company's stock with a price target of $22. Casewriter has added incremental assumptions to complete the valuation analysis Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started