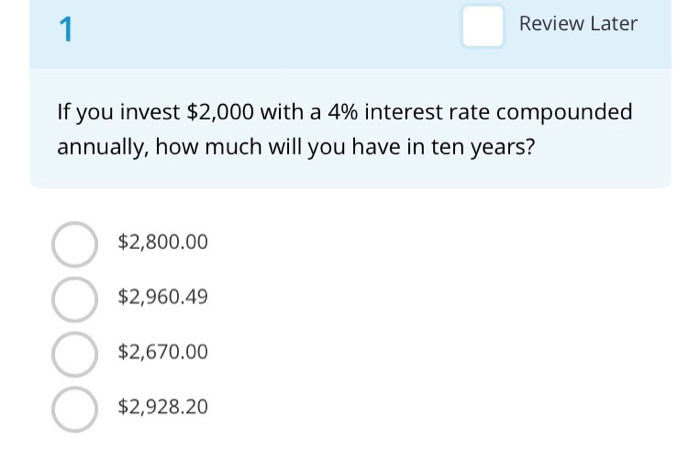

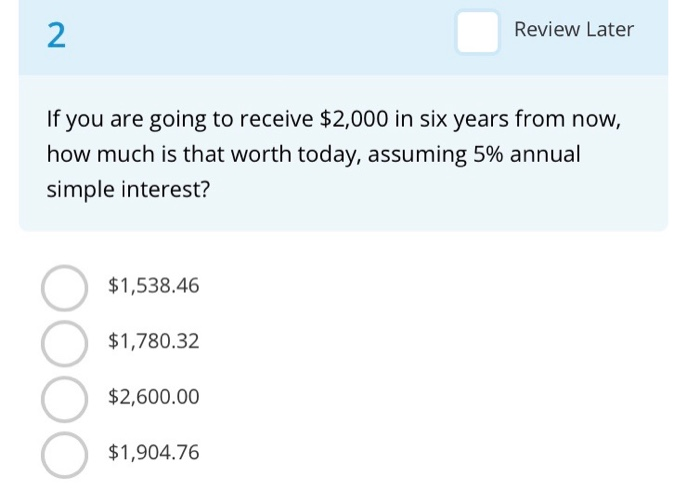

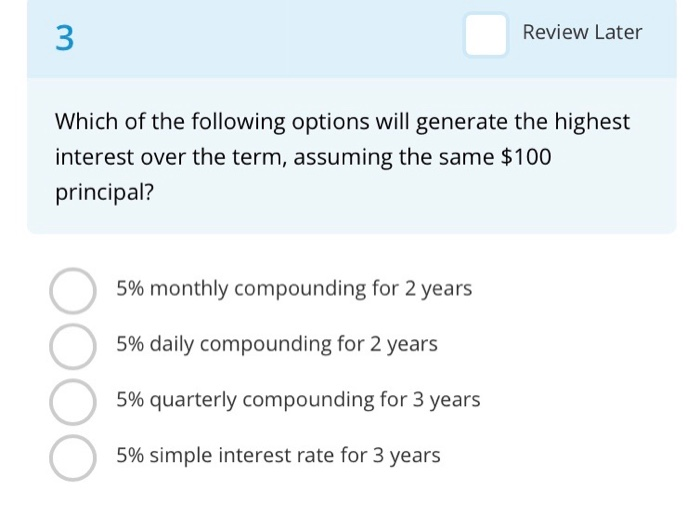

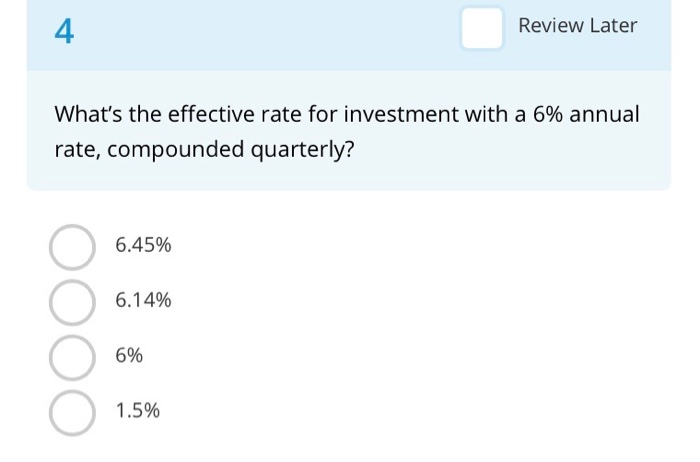

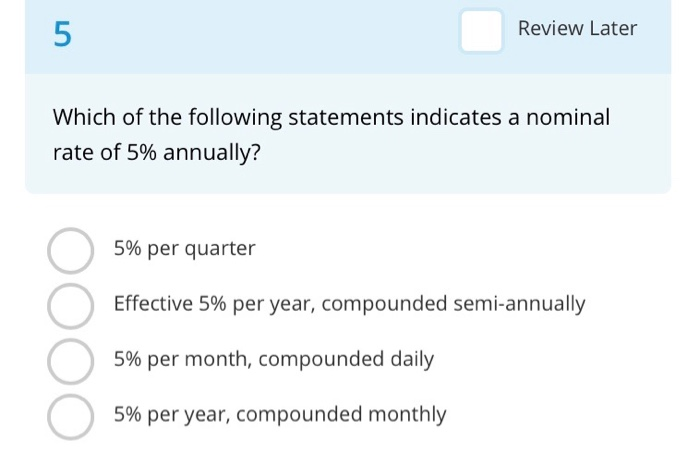

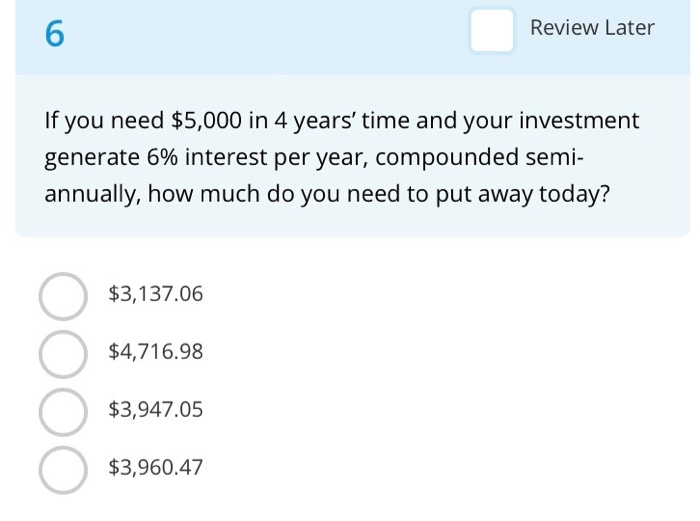

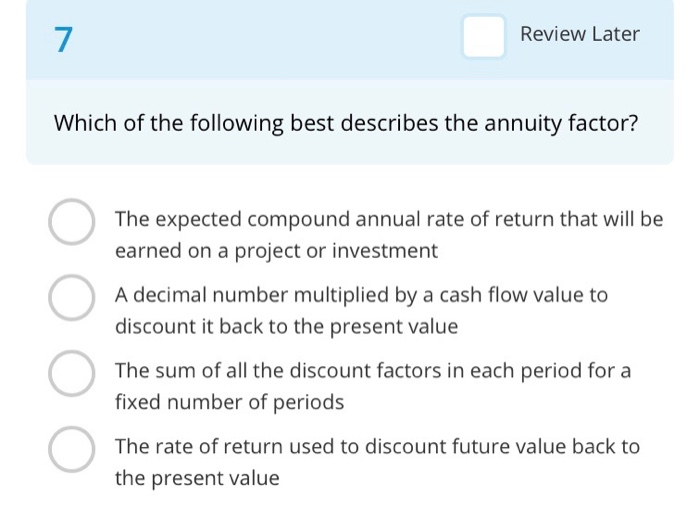

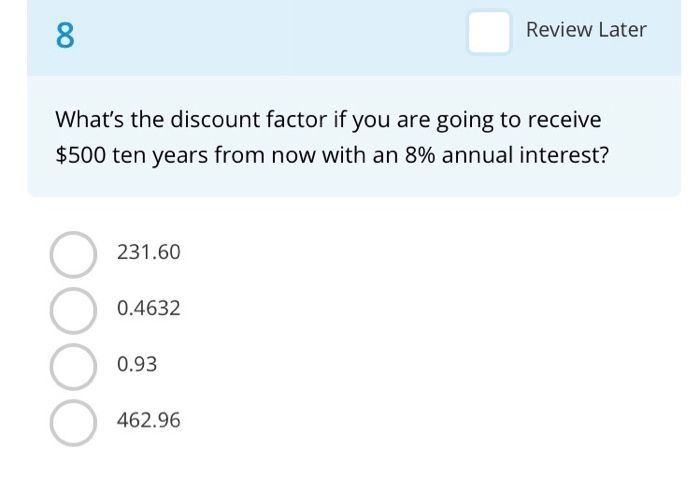

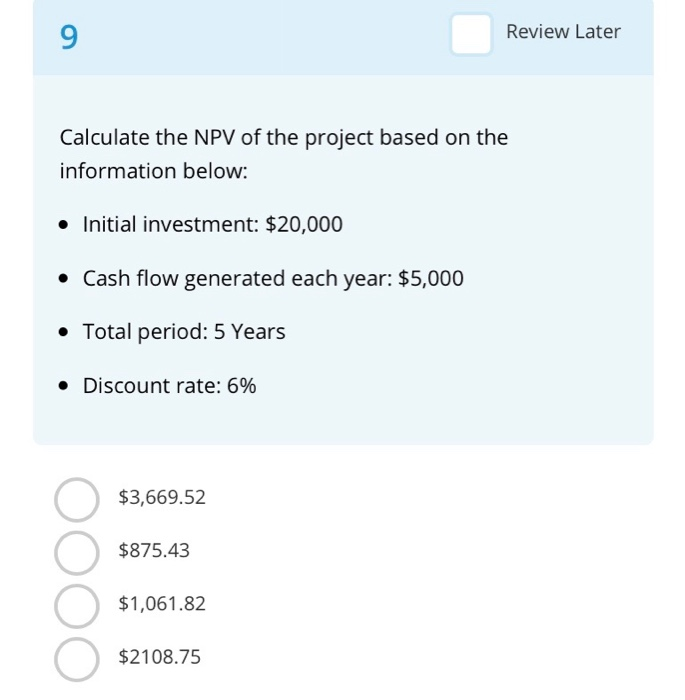

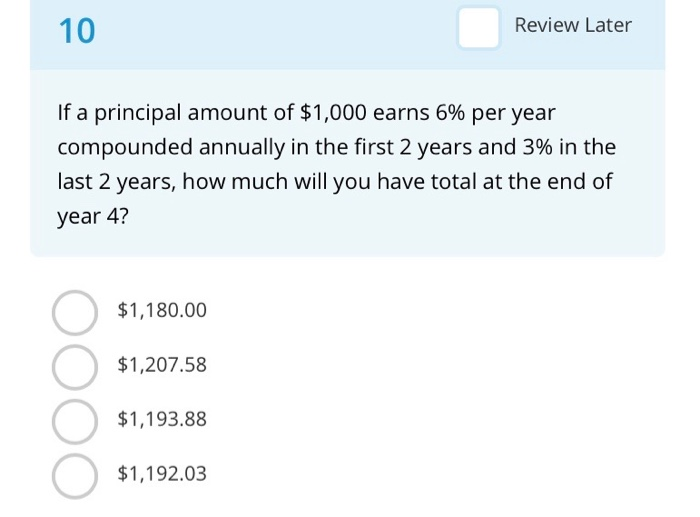

Review Later If you invest $2,000 with a 4% interest rate compounded annually, how much will you have in ten years? $2,800.00 $2,960.49 $2,670.00 $2,928.20 Review Later If you are going to receive $2,000 in six years from now, how much is that worth today, assuming 5% annual simple interest? $1,538.46 $1,780.32 OOOO $2,600.00 $1,904.76 Review Later Which of the following options will generate the highest interest over the term, assuming the same $100 principal? 5% monthly compounding for 2 years 5% daily compounding for 2 years 5% quarterly compounding for 3 years 5% simple interest rate for 3 years Review Later What's the effective rate for investment with a 6% annual rate, compounded quarterly? 6.45% 06.14% 6.14% 6% 1.5% Review Later Which of the following statements indicates a nominal rate of 5% annually? 5% per quarter Effective 5% per year, compounded semi-annually 5% per month, compounded daily 5% per year, compounded monthly Review Later If you need $5,000 in 4 years' time and your investment generate 6% interest per year, compounded semi- annually, how much do you need to put away today? $3,137.06 $4,716.98 OOOO $3,947.05 $3,960.47 Review Later Which of the following best describes the annuity factor? The expected compound annual rate of return that will be earned on a project or investment A decimal number multiplied by a cash flow value to discount it back to the present value The sum of all the discount factors in each period for a fixed number of periods The rate of return used to discount future value back to the present value Review Later What's the discount factor if you are going to receive $500 ten years from now with an 8% annual interest? 231.60 0.4632 O 0.93 0.93 462.96 Review Later Calculate the NPV of the project based on the information below: Initial investment: $20,000 Cash flow generated each year: $5,000 Total period: 5 Years Discount rate: 6% $3,669.52 $875.43 $1,061.82 $2108.75 10 Review Later If a principal amount of $1,000 earns 6% per year compounded annually in the first 2 years and 3% in the last 2 years, how much will you have total at the end of year 4? $1,180.00 $1,207.58 OOOO $1,193.88 $1,192.03