Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REVIEW PROBLEM (TAKEN FROM CTP): Mr. Dennis Lane has been a widower for several years. For 2021, both his Net Income For Tax Purposes

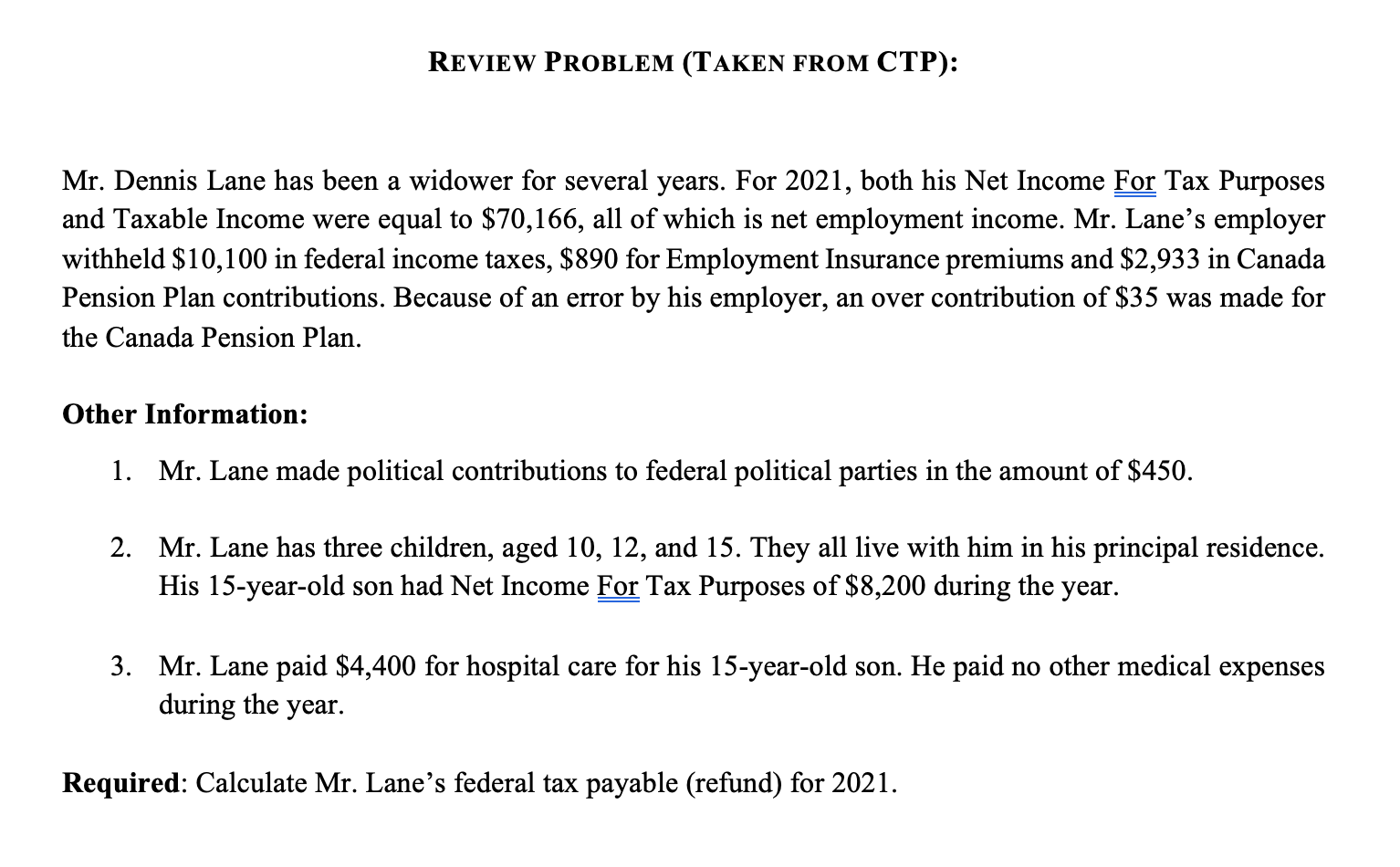

REVIEW PROBLEM (TAKEN FROM CTP): Mr. Dennis Lane has been a widower for several years. For 2021, both his Net Income For Tax Purposes and Taxable Income were equal to $70,166, all of which is net employment income. Mr. Lane's employer withheld $10,100 in federal income taxes, $890 for Employment Insurance premiums and $2,933 in Canada Pension Plan contributions. Because of an error by his employer, an over contribution of $35 was made for the Canada Pension Plan. Other Information: 1. Mr. Lane made political contributions to federal political parties in the amount of $450. 2. Mr. Lane has three children, aged 10, 12, and 15. They all live with him in his principal residence. His 15-year-old son had Net Income For Tax Purposes of $8,200 during the year. 3. Mr. Lane paid $4,400 for hospital care for his 15-year-old son. He paid no other medical expenses during the year. Required: Calculate Mr. Lane's federal tax payable (refund) for 2021.

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Mr Dennis Lanes 2021 Tax Calculation Net Income for Tax Purposes NITP 70166 Taxable Income same ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started