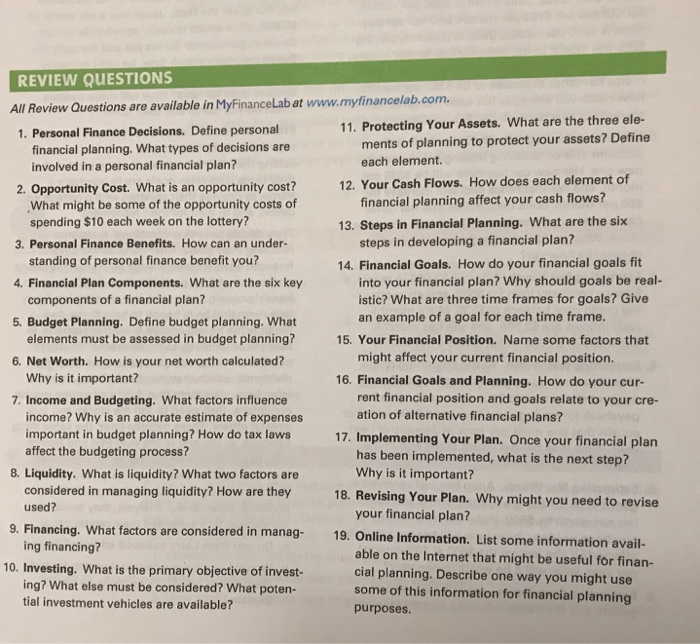

REVIEW QUESTIONS All Review Questions are available in MyFinanceLab at www.myfin ancelab.com. 11. Protecting Your Assets. What are the three ele- 1. Personal Finance Decisions. Define personal financial planning. What types of decisions are involved in a personal financial plan? ments of planning to protect your assets? Define each element 2. Opportunity Cost. What is an opportunity cost? 12. Your Cash Flows. How does each element of financial planning affect your cash flows? What might be some of the opportunity costs of spending $10 each week on the lottery? 13. Steps in Financial Planning. What are the six 3. Personal Finance Benefits. How can an under- steps in developing a financial plan? standing of personal finance benefit you? components of a financial plan? elements must be assessed in budget planning? Why is it important? 14. Financial Goals. How do your financial goals fit . Financial Plan Components. What are the six key 5. Budget Planning. Define budget planning. What 6. Net Worth. How is your net worth calculated? into your financial plan? Why should goals be real- istic? What are three time frames for goals? Give an example of a goal for each time frame. 15. Your Financial Position. Name some factors that might affect your current financial position. 16. Financial Goals and Planning. How do your cur- rent financial position and goals relate to your cre- ation of alternative financial plans? 7 Income and Budgeting. What factors influence income? Why is an accurate estimate of expenses important in budget planning? How do tax laws affect the budgeting process? 17. Implementing Your Plan. Once your financial plan has been implemented, what is the next step? Why is it important? 8 Liquidity. What is liquidity? What two factors are considered in managing liquidity? How are they used? 18. Revising Your Plan. Why might you need to revise your financial plan? are considered in manag 19. Online Information. List some information avail- ing financing? able on the Internet that might be useful for finan- cial planning. Describe one way you might use some of this information for financial planning purposes 10. Investing. What is the primary objective of invest- ing? What else must be considered? What poten tial investment vehicles are available