Answered step by step

Verified Expert Solution

Question

1 Approved Answer

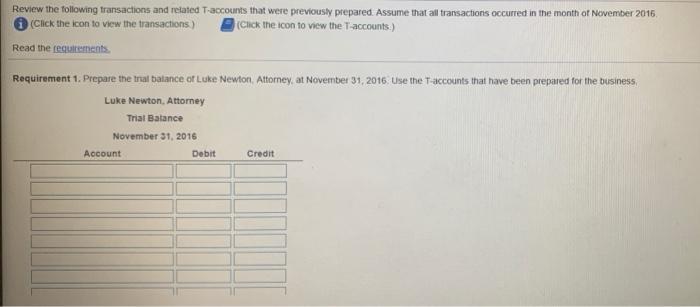

Review the following transactions and related T-accounts that were previously prepared Assume that all transactions occurred in the month of November 2016. (Click the

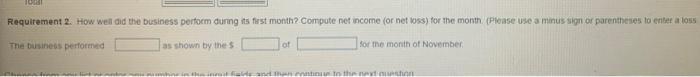

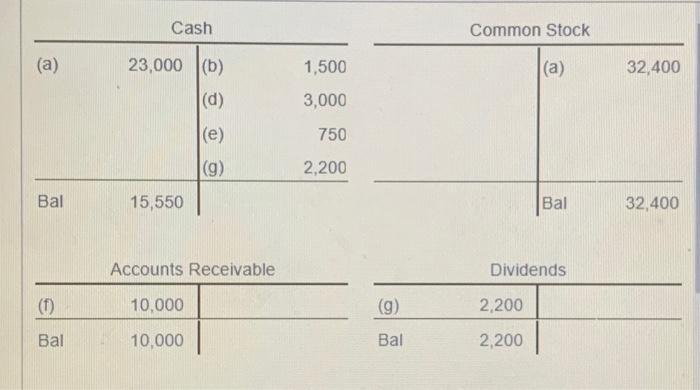

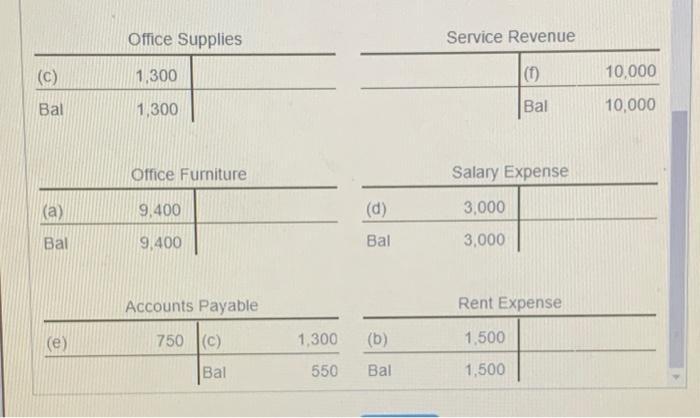

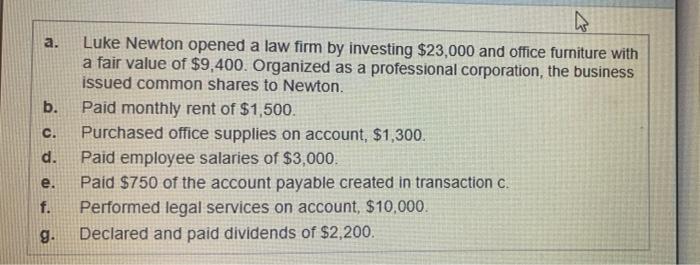

Review the following transactions and related T-accounts that were previously prepared Assume that all transactions occurred in the month of November 2016. (Click the icon to view the transactions) (Click the icon to view the Taccounts.) Read the requirements. Requirement 1. Prepare the tral balance of Luke Newton, Attorney, at November 31, 2016. Use the T-accounts that have been prepared for the business, Luke Newton, Attorney Trial Balance November 31, 2016 Account Debit Credit Requirement 2. How well did the business perform during its first month? Compute net income (or net loss) for the month (Please use a minus sign or parentheses to enter a loss The business performed as shown by the s Lof for the month of November Cash Common Stock (a) 23,000 (b) 1,500 (a) 32,400 (d) 3,000 (e) 750 (g) 2,200 Bal 15,550 Bal 32,400 Accounts Receivable Dividends (f) 10,000 (g) 2,200 Bal 10,000 Bal 2,200 Office Supplies Service Revenue (c) 1,300 (1) 10,000 Bal 1,300 Bal 10,000 Office Furniture Salary Expense (a) 9,400 (d) 3,000 Bal 9,400 Bal 3,000 Accounts Payable Rent Expense (e) 750 (C) 1,300 (b) 1,500 Bal 550 Bal 1,500 Luke Newton opened a law firm by investing $23,000 and office furniture with a fair value of $9,400. Organized as a professional corporation, the business issued common shares to Newton. a. b. Paid monthly rent of $1,500. Purchased office supplies on account, $1,300. c. d. Paid employee salaries of $3,000. Paid $750 of the account payable created in transaction c. Performed legal services on account, $10,000. e. f. g. Declared and paid dividends of $2,200.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer to Requirement 1 Answer to Requirement 2 Net I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started