- Review the income statement. What was recorded as discontinued operations for the most recent fiscal year? What was managements explanation for this amount?

- What is the functional currency of the company (Hint: refer to Note 2 to the financial statements)?

- Refer to Note 2 to the financial statements. Summarize the various revenue recognition policies of the company.

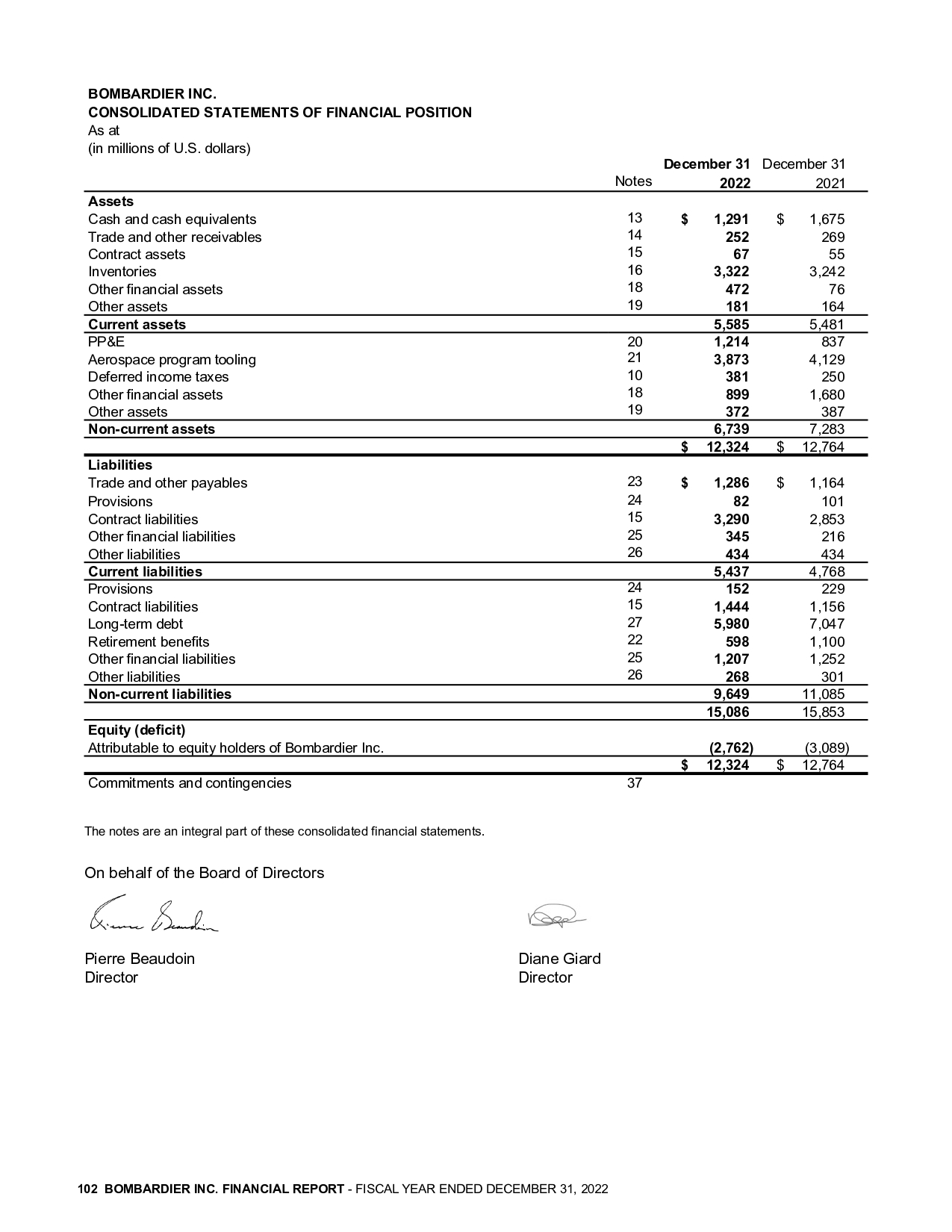

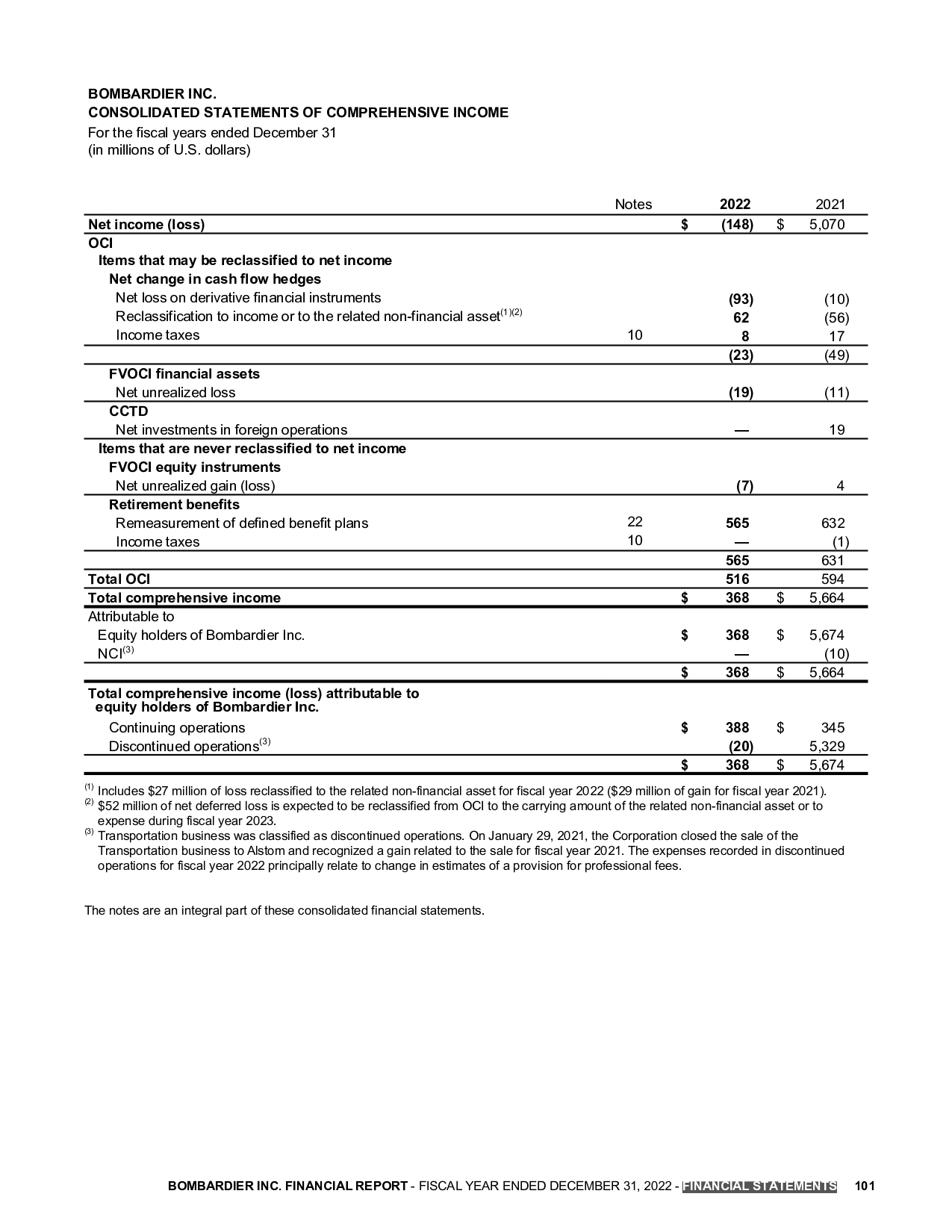

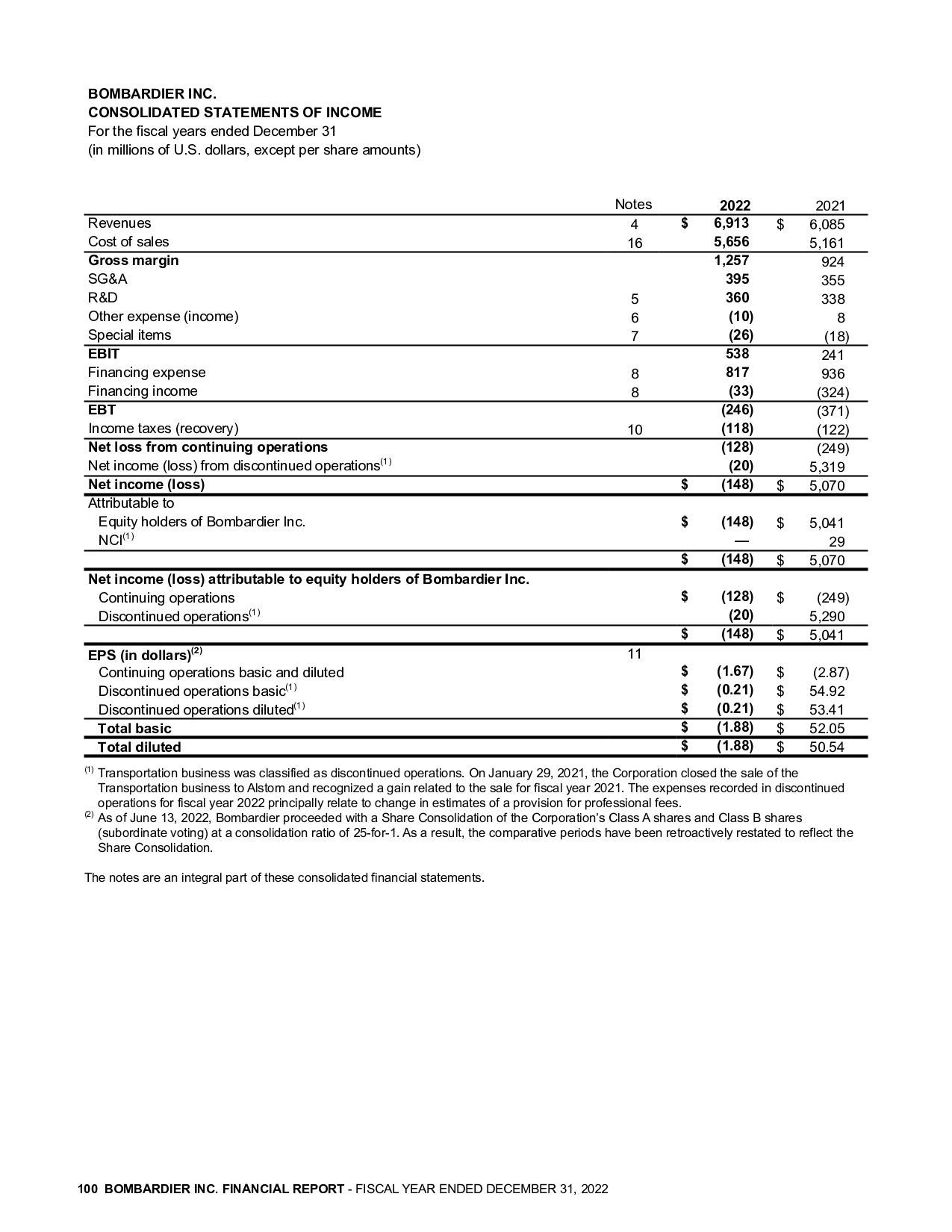

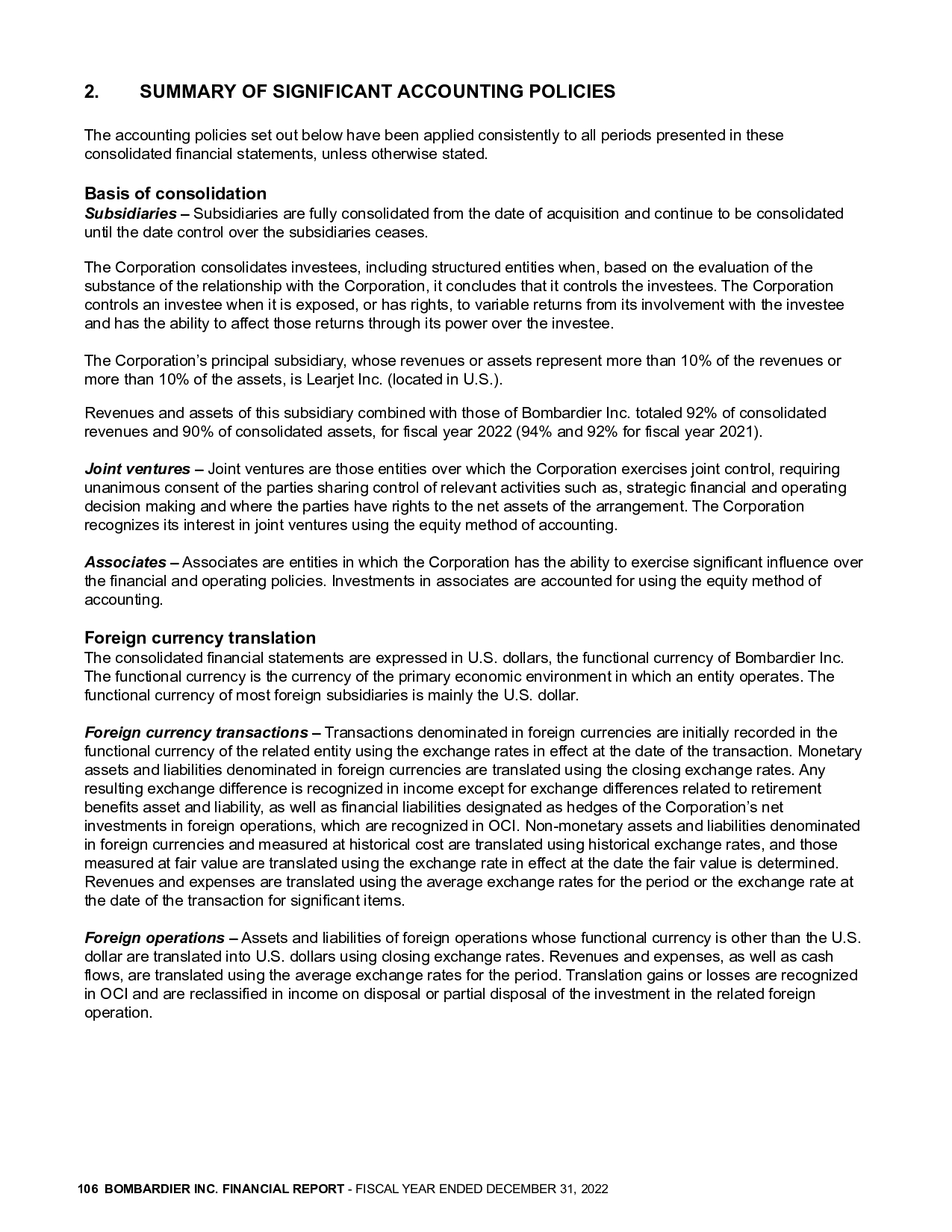

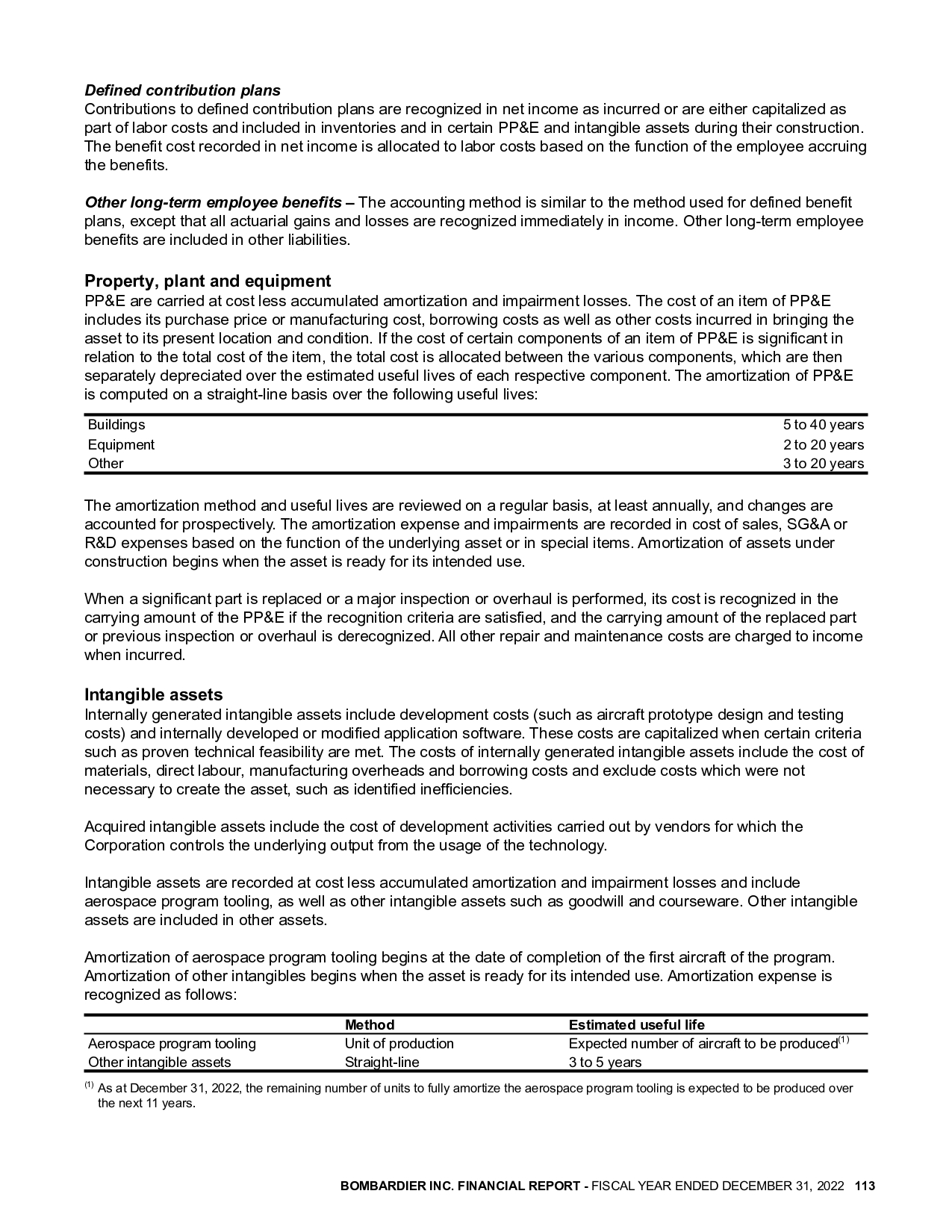

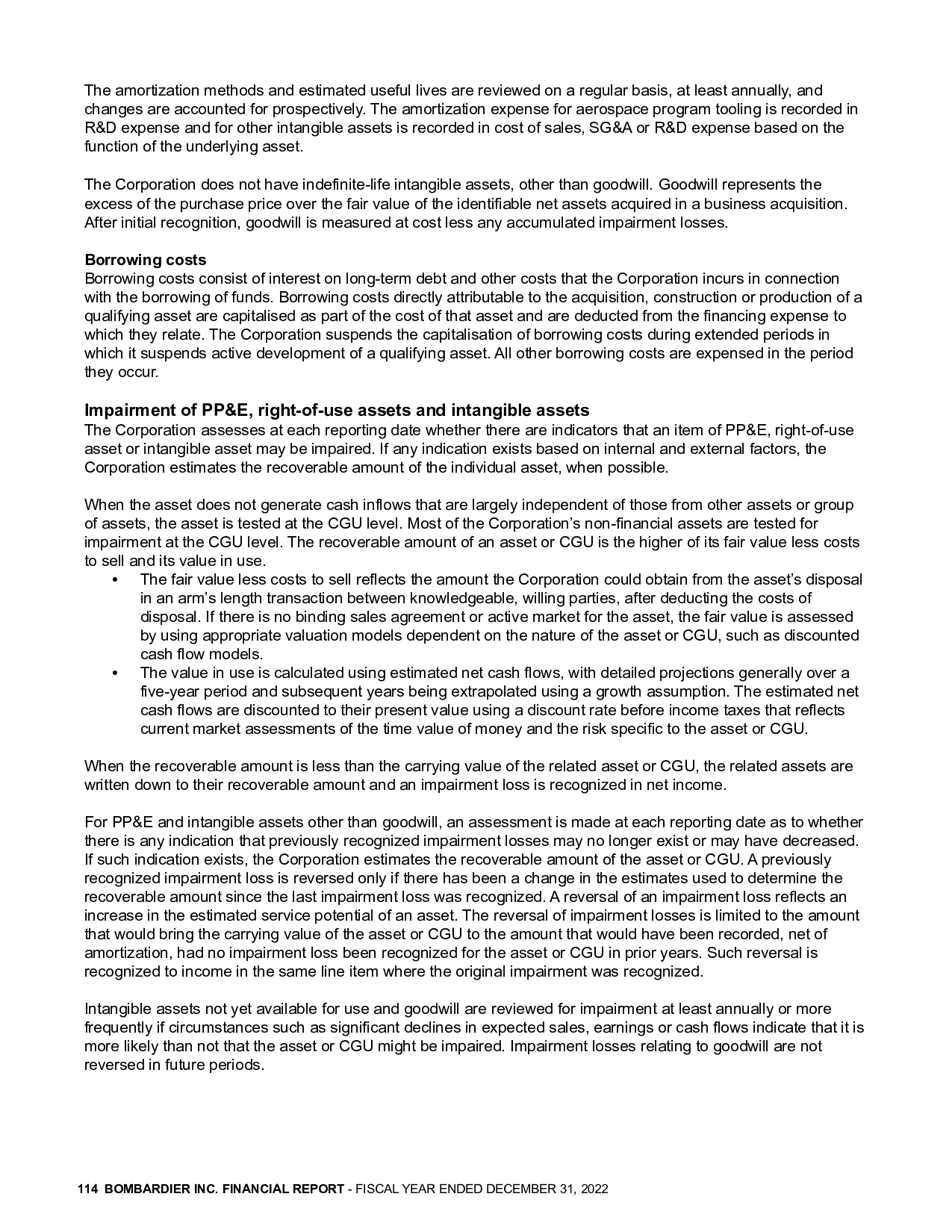

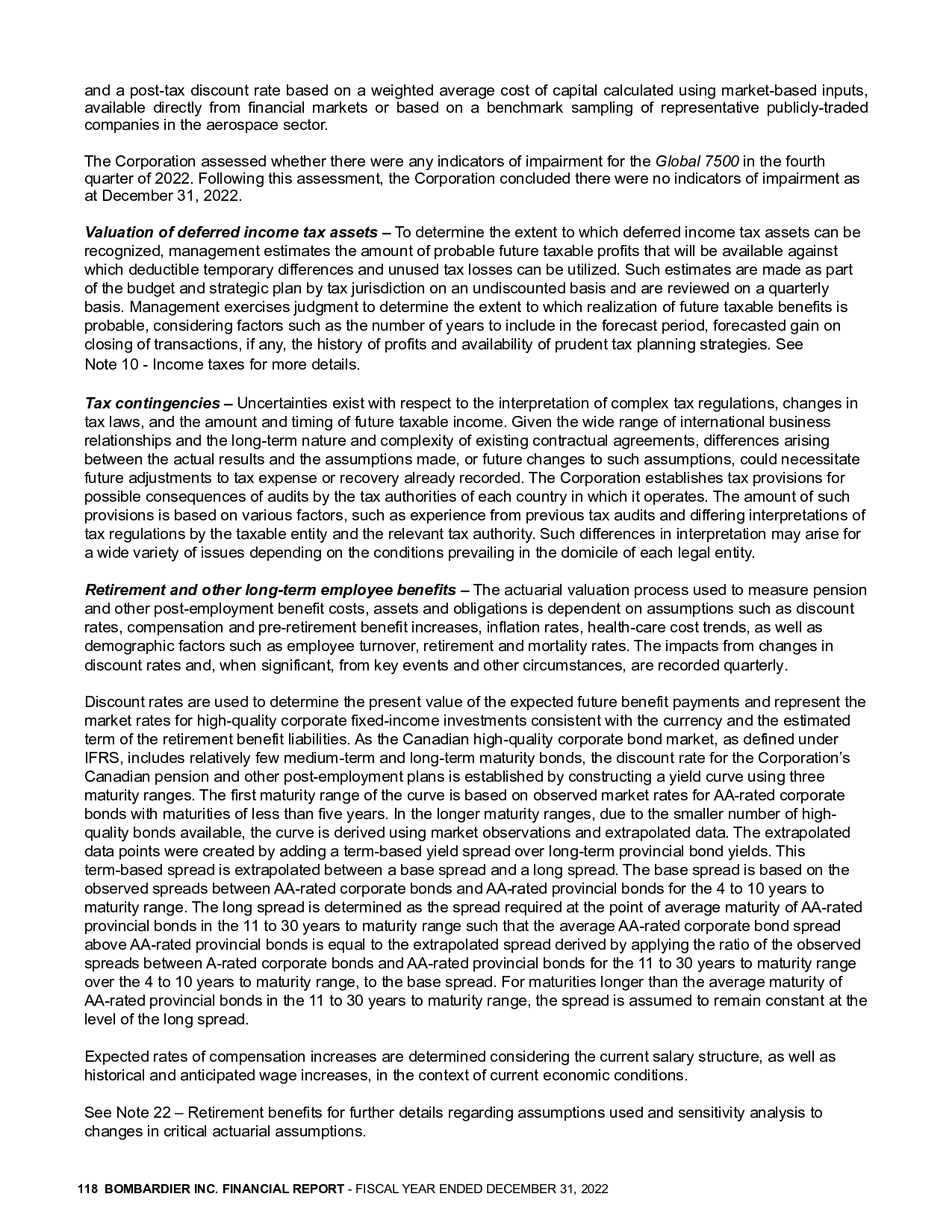

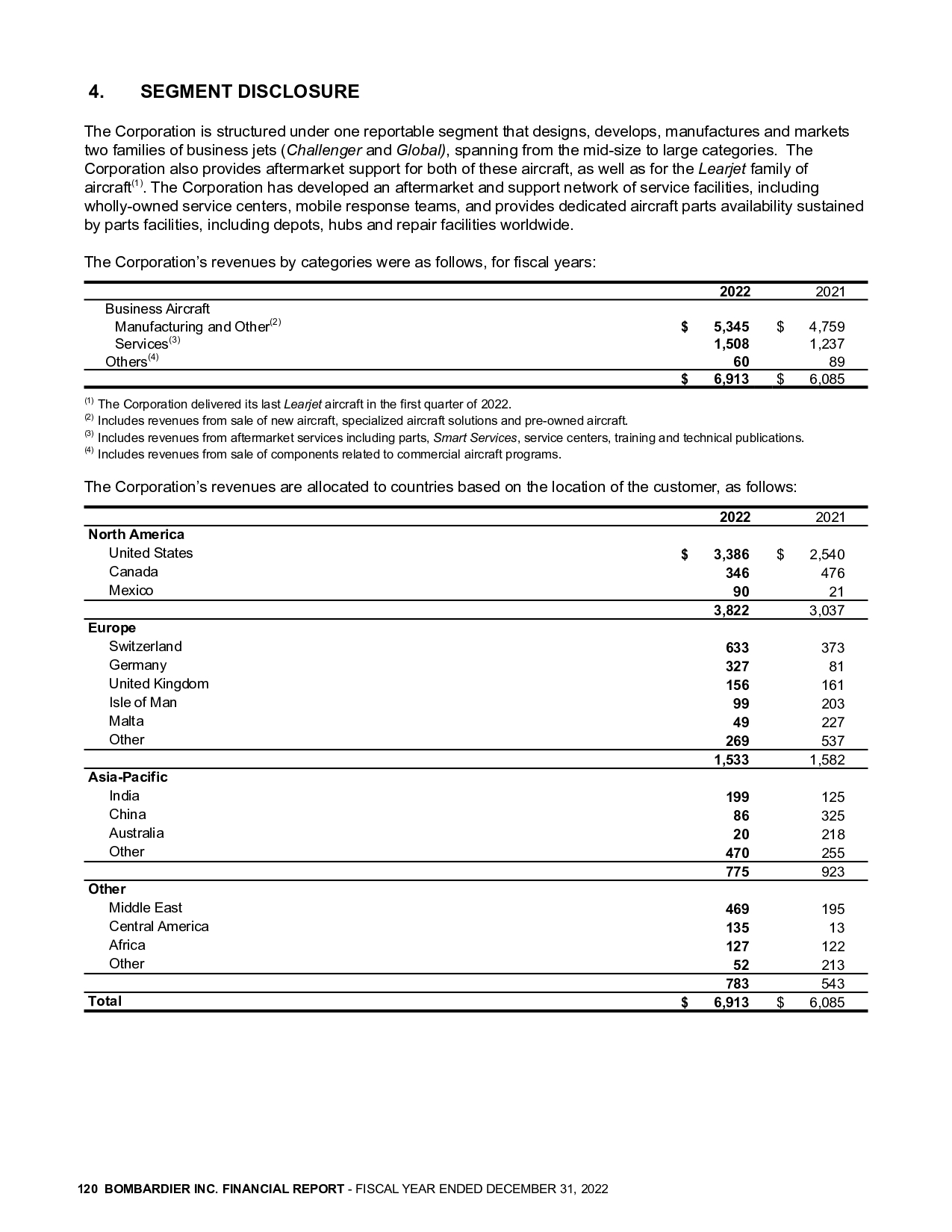

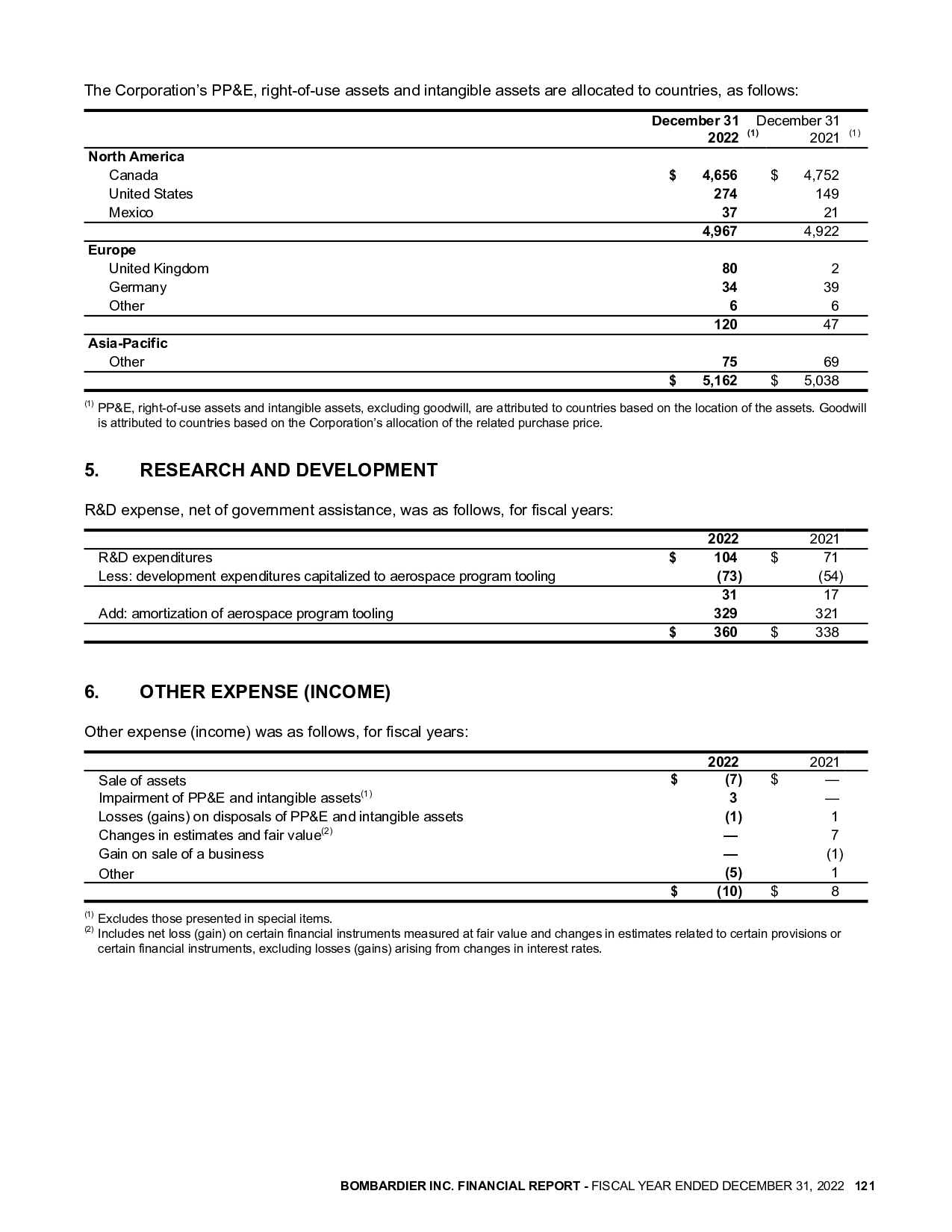

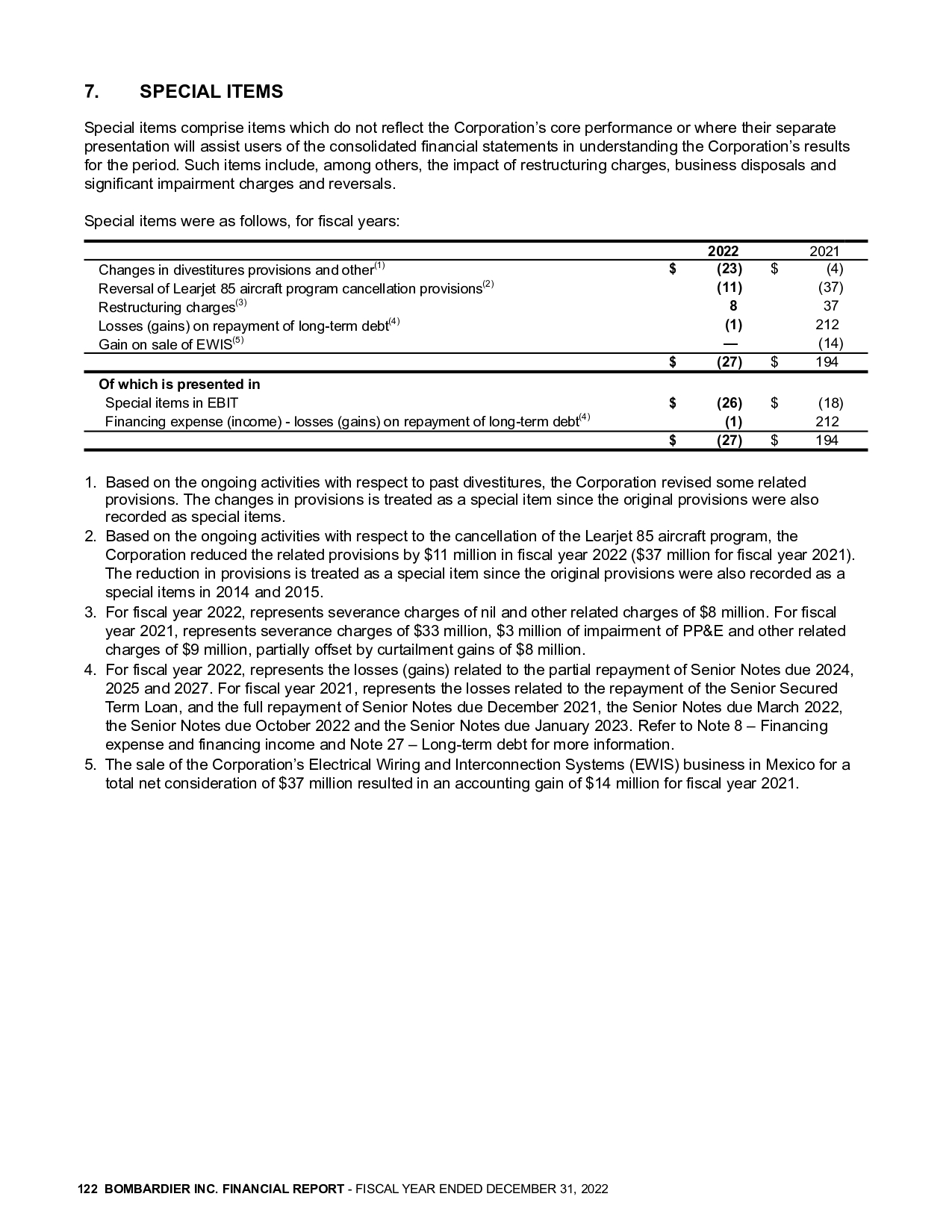

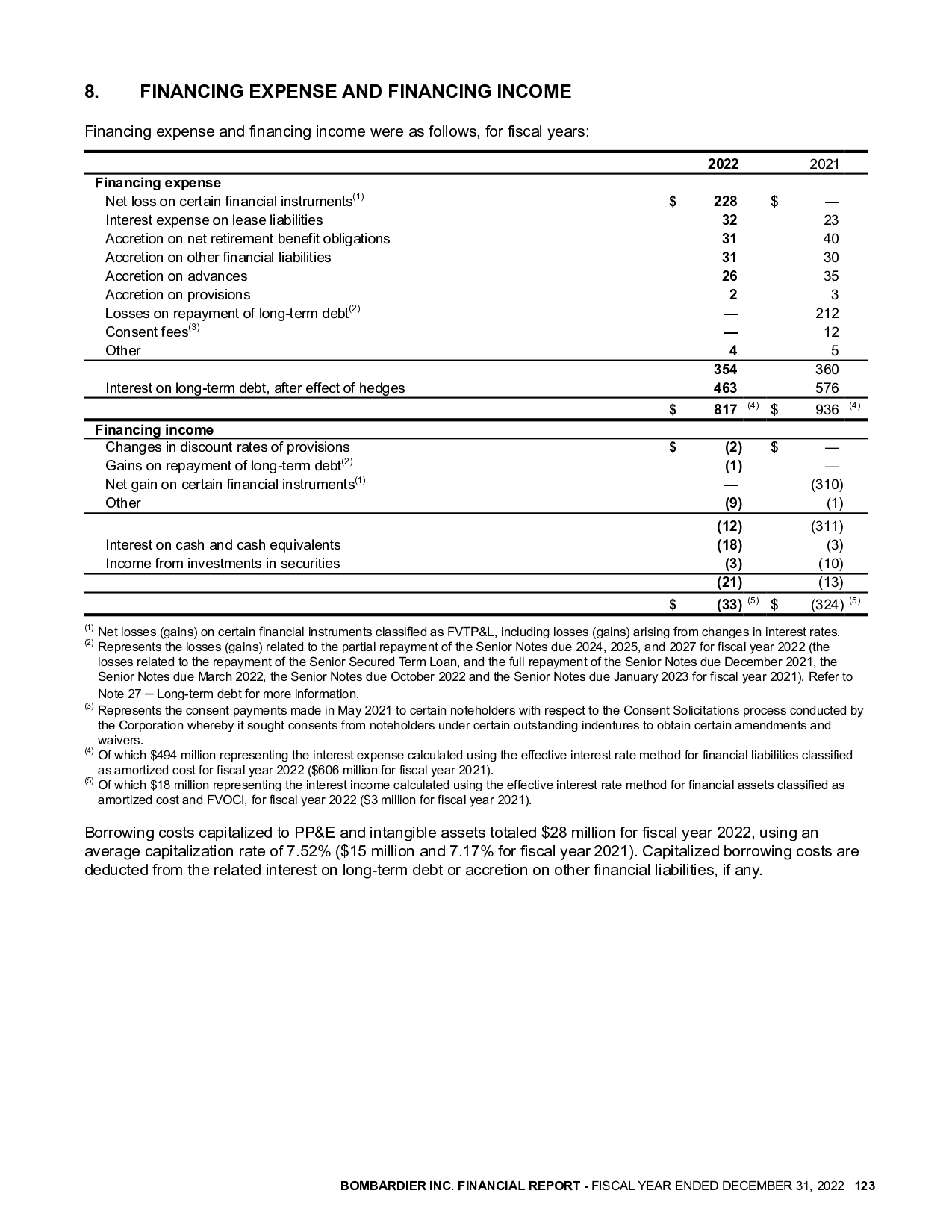

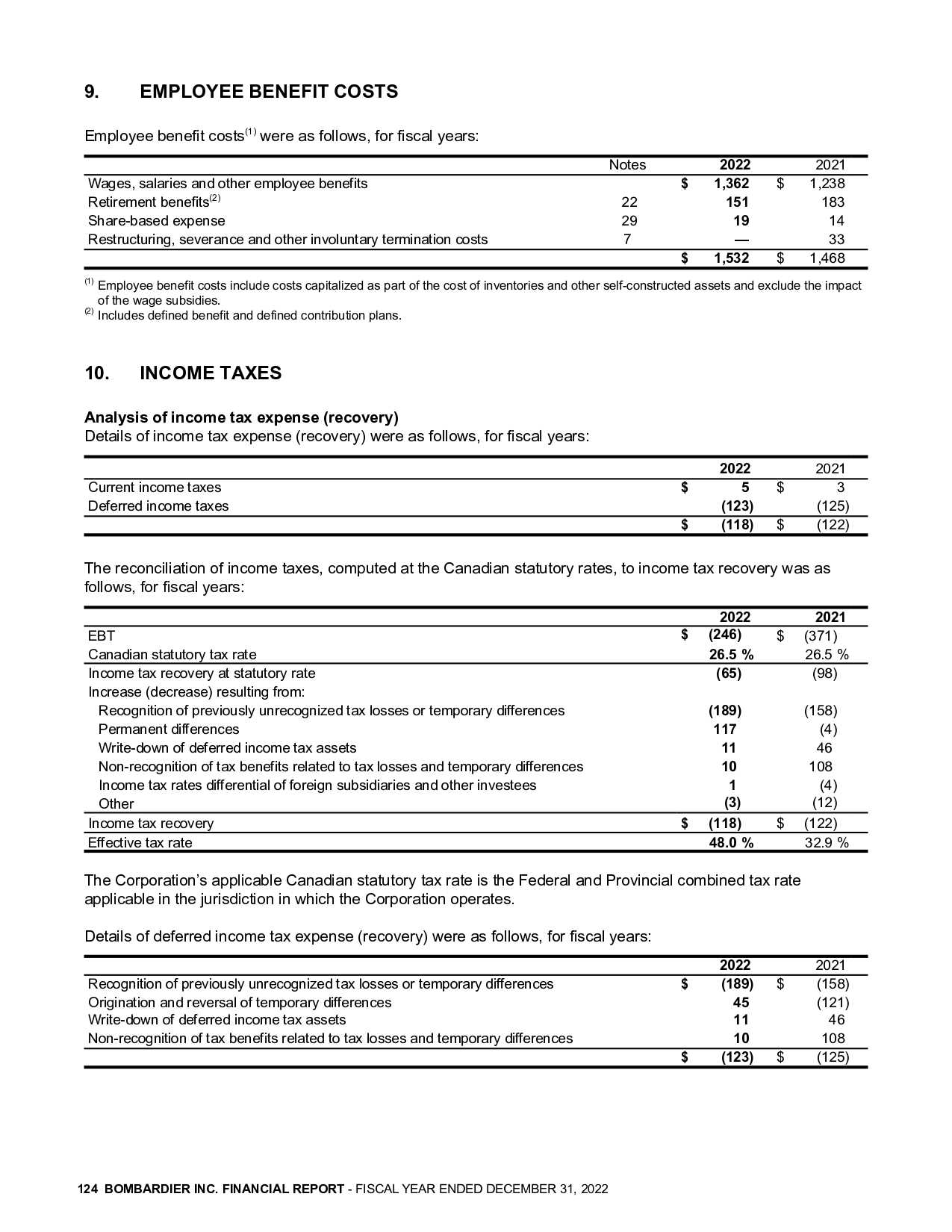

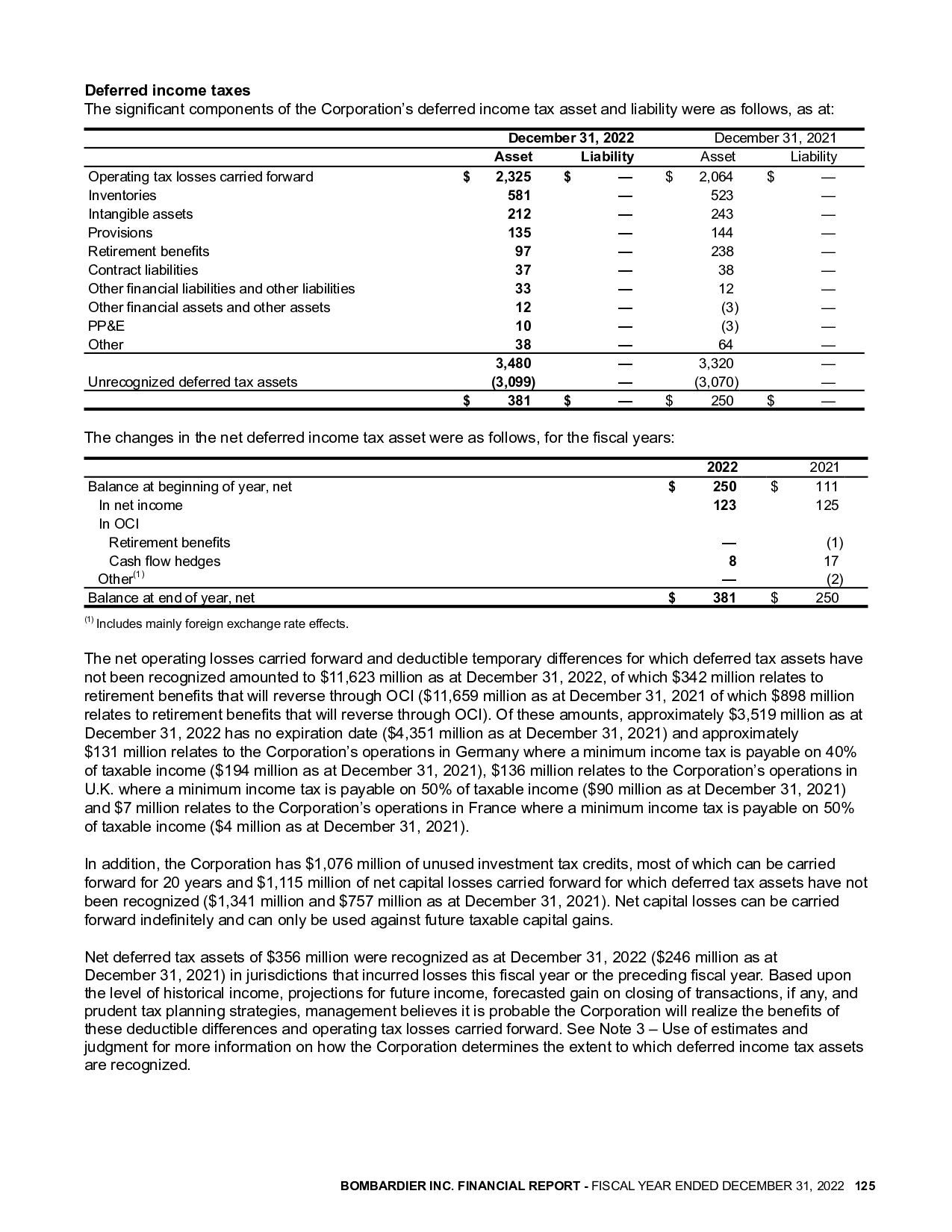

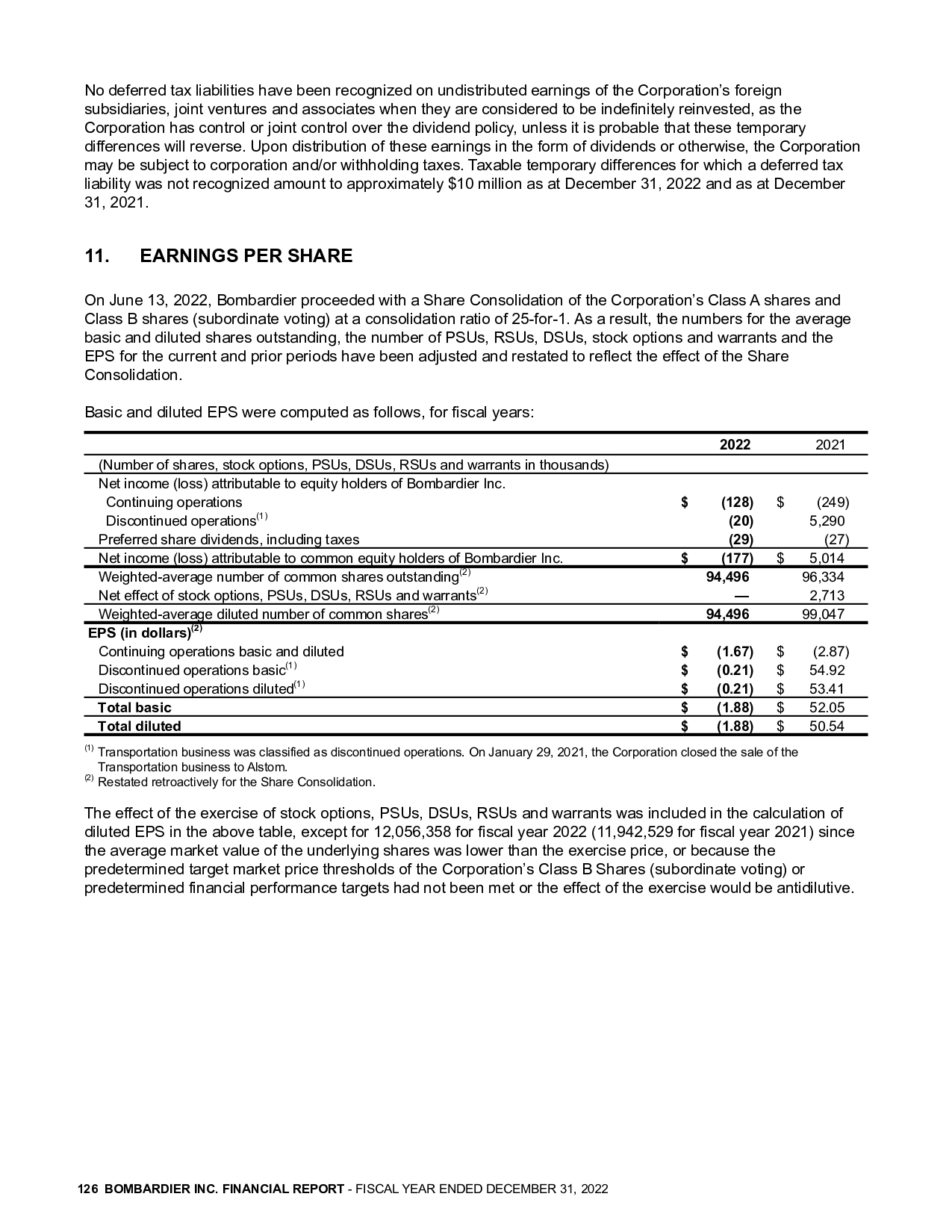

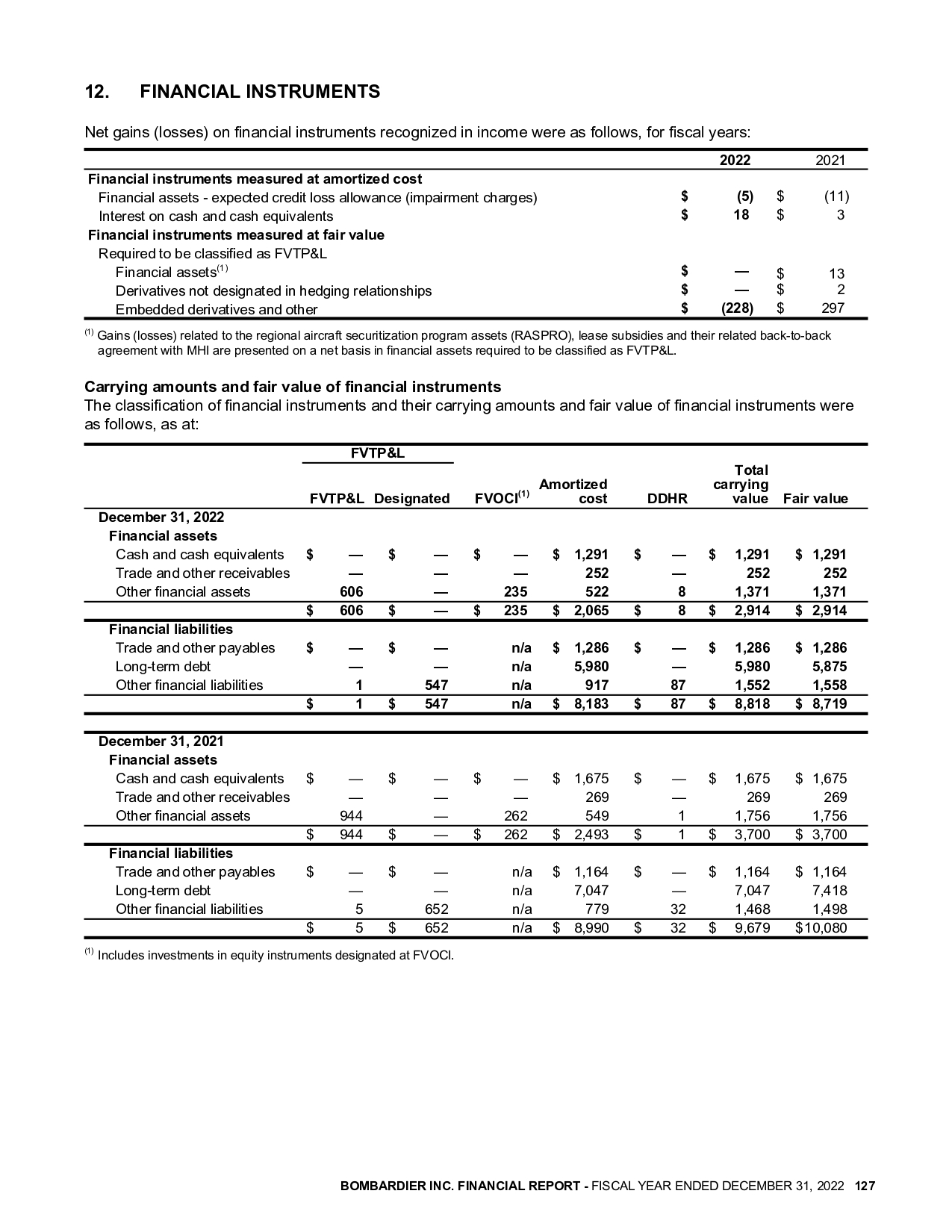

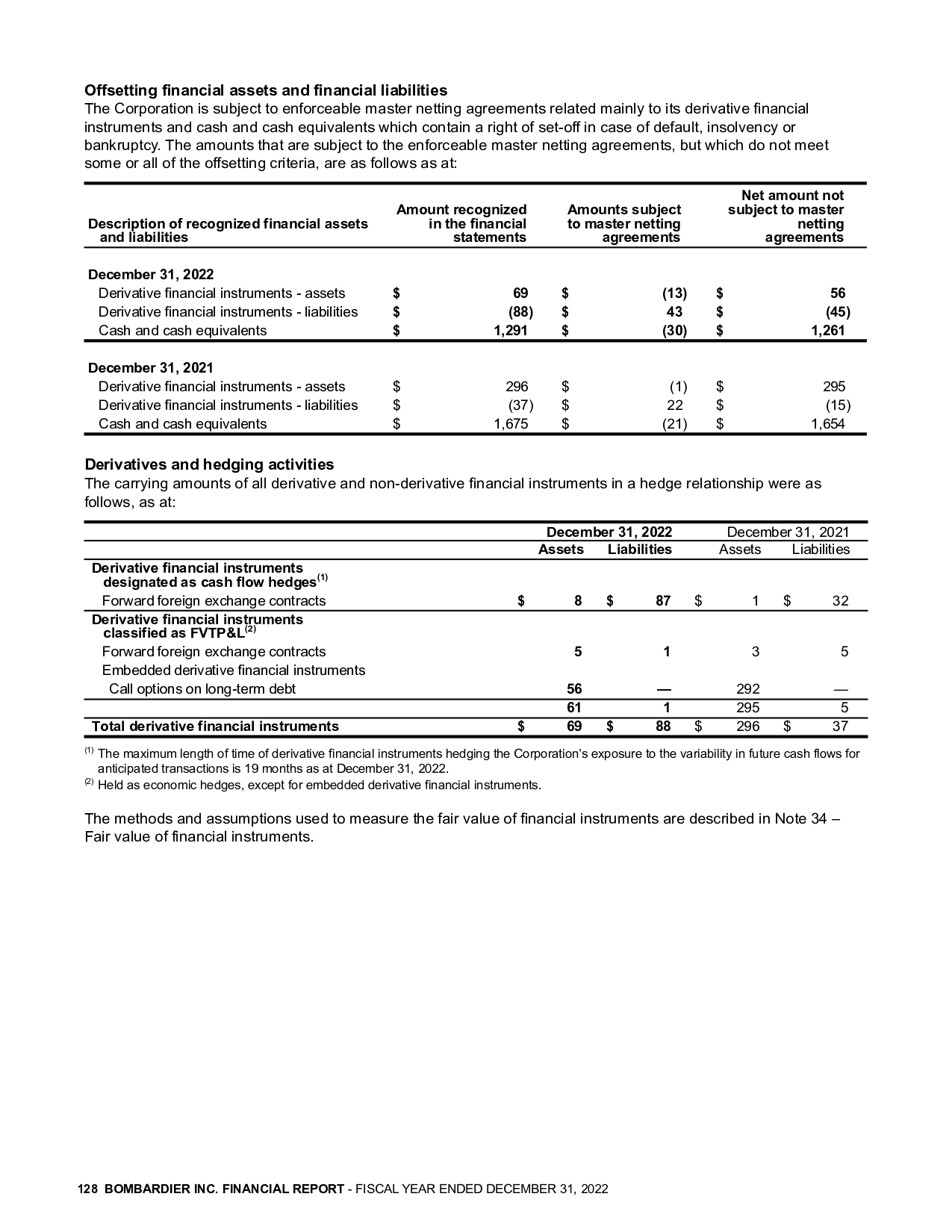

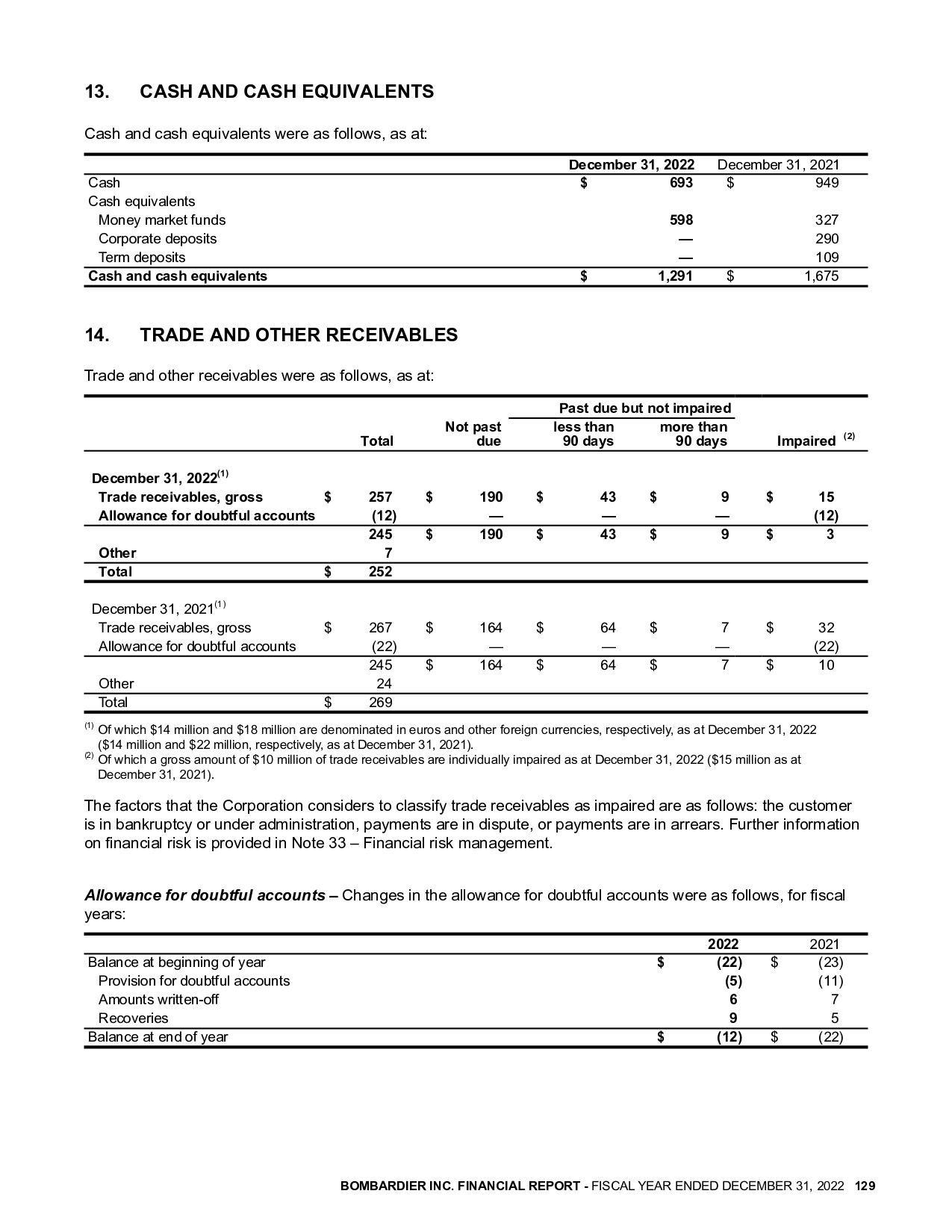

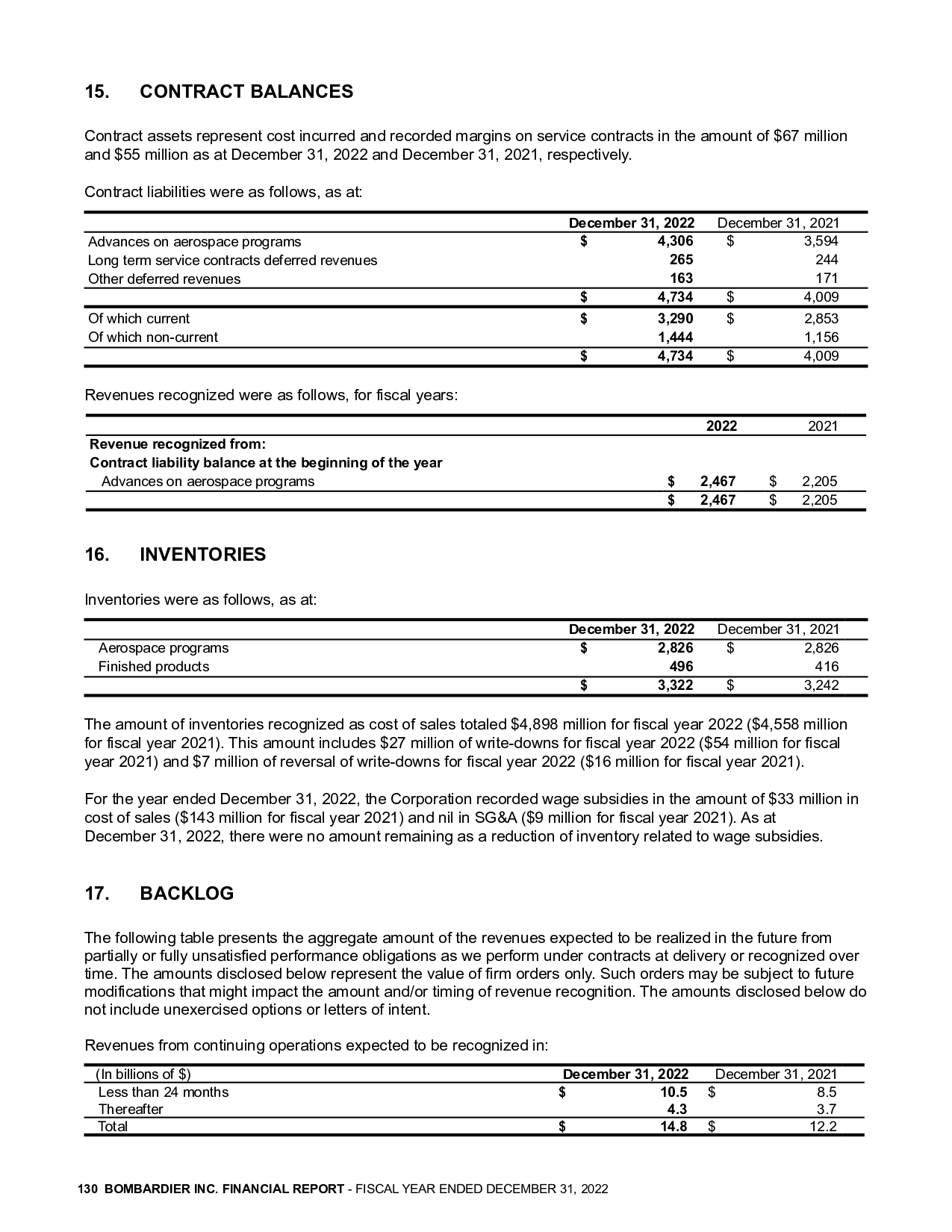

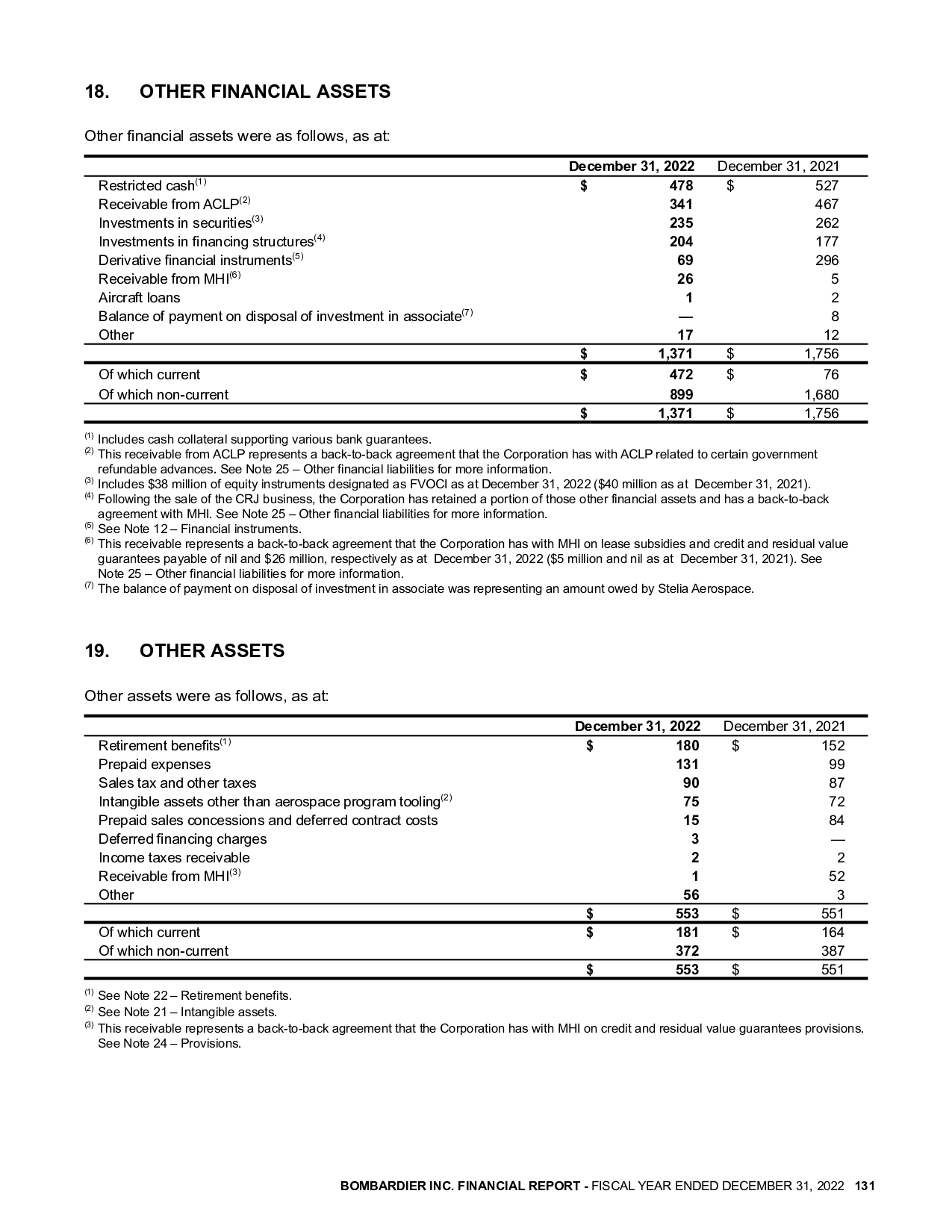

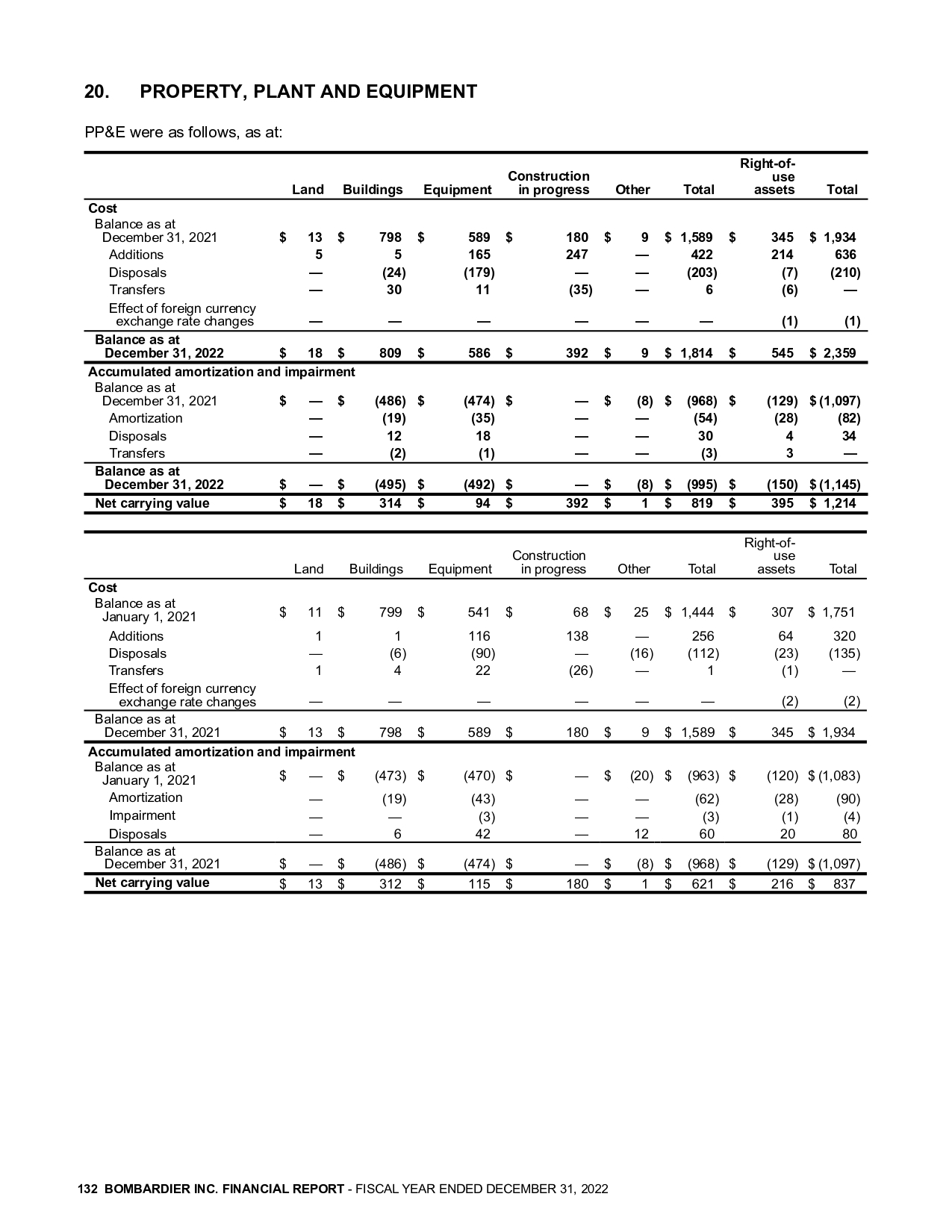

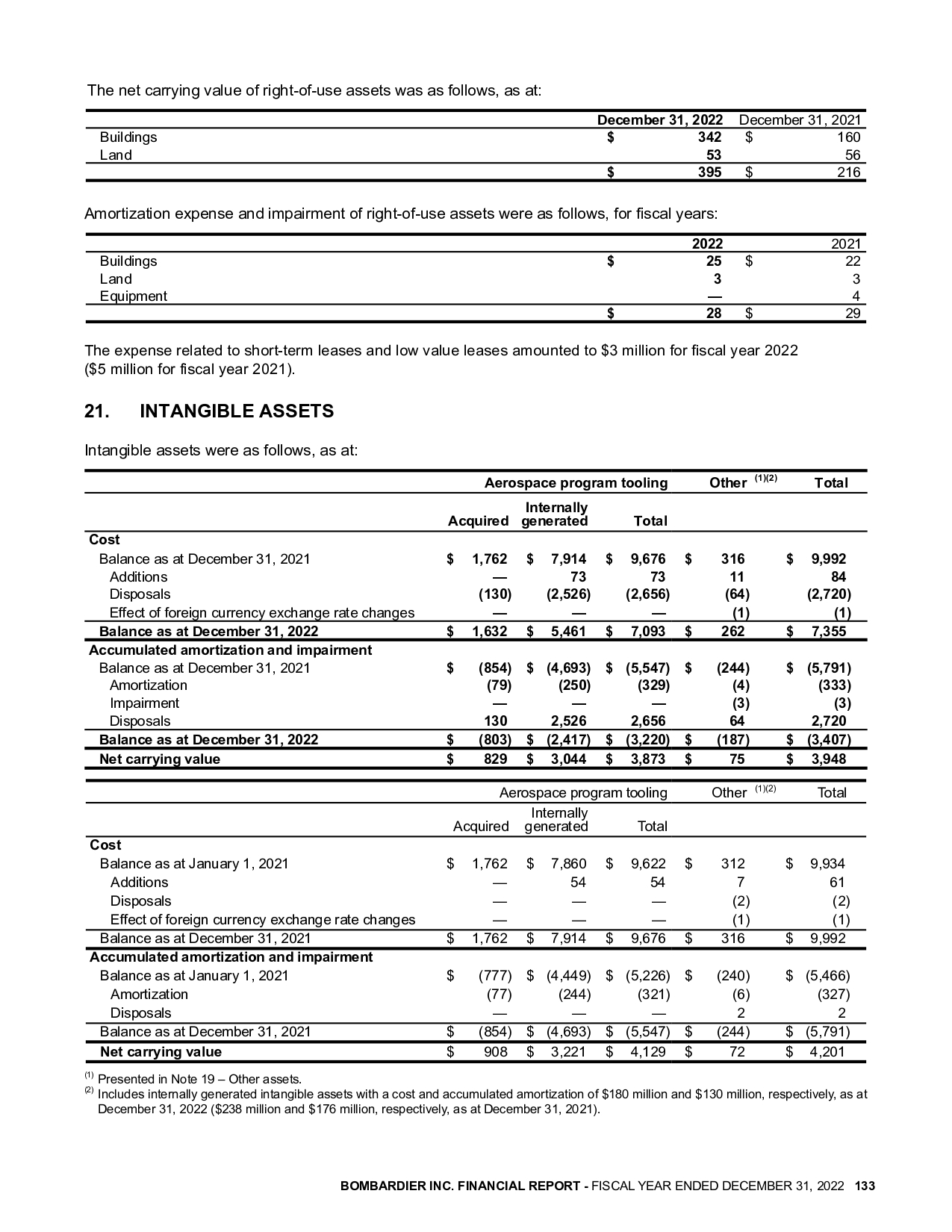

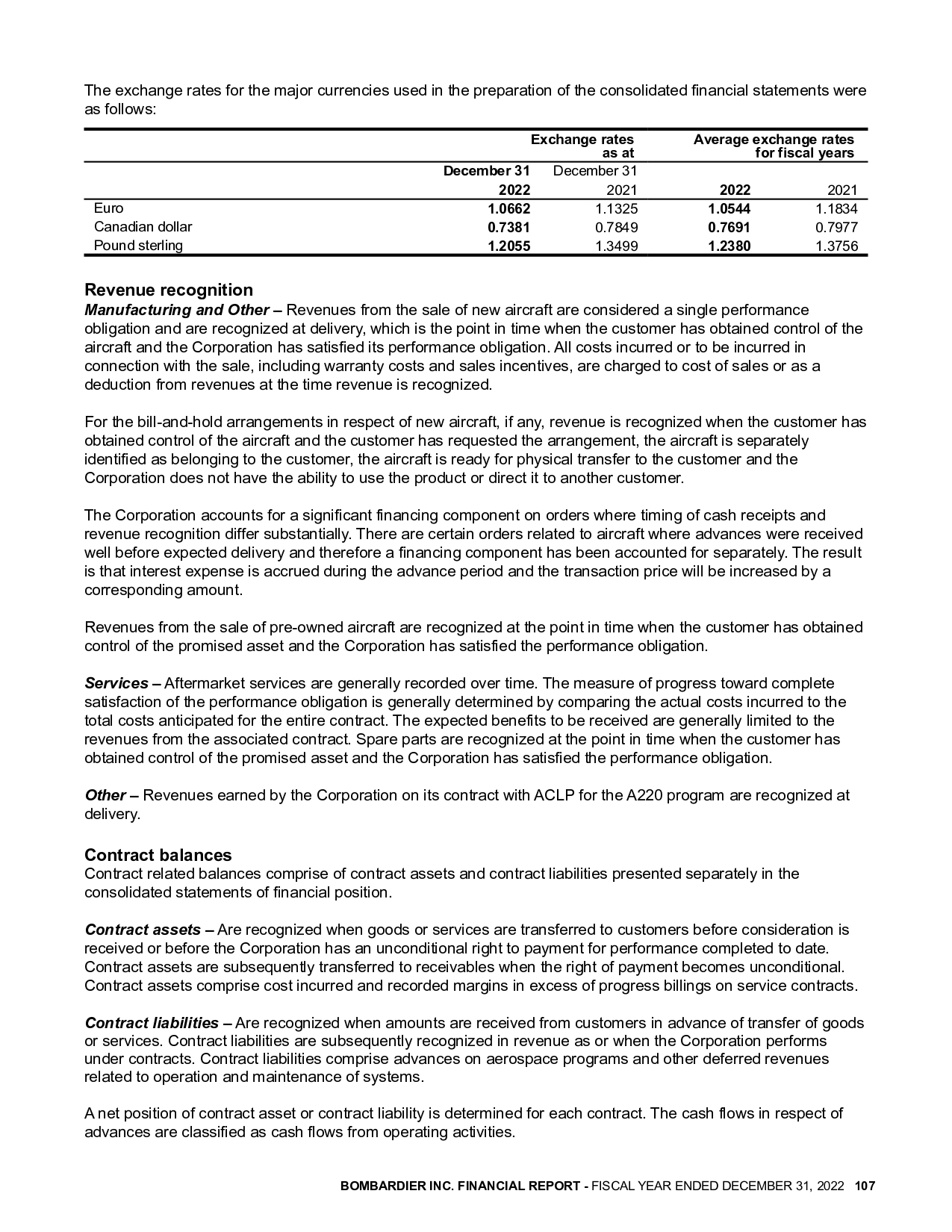

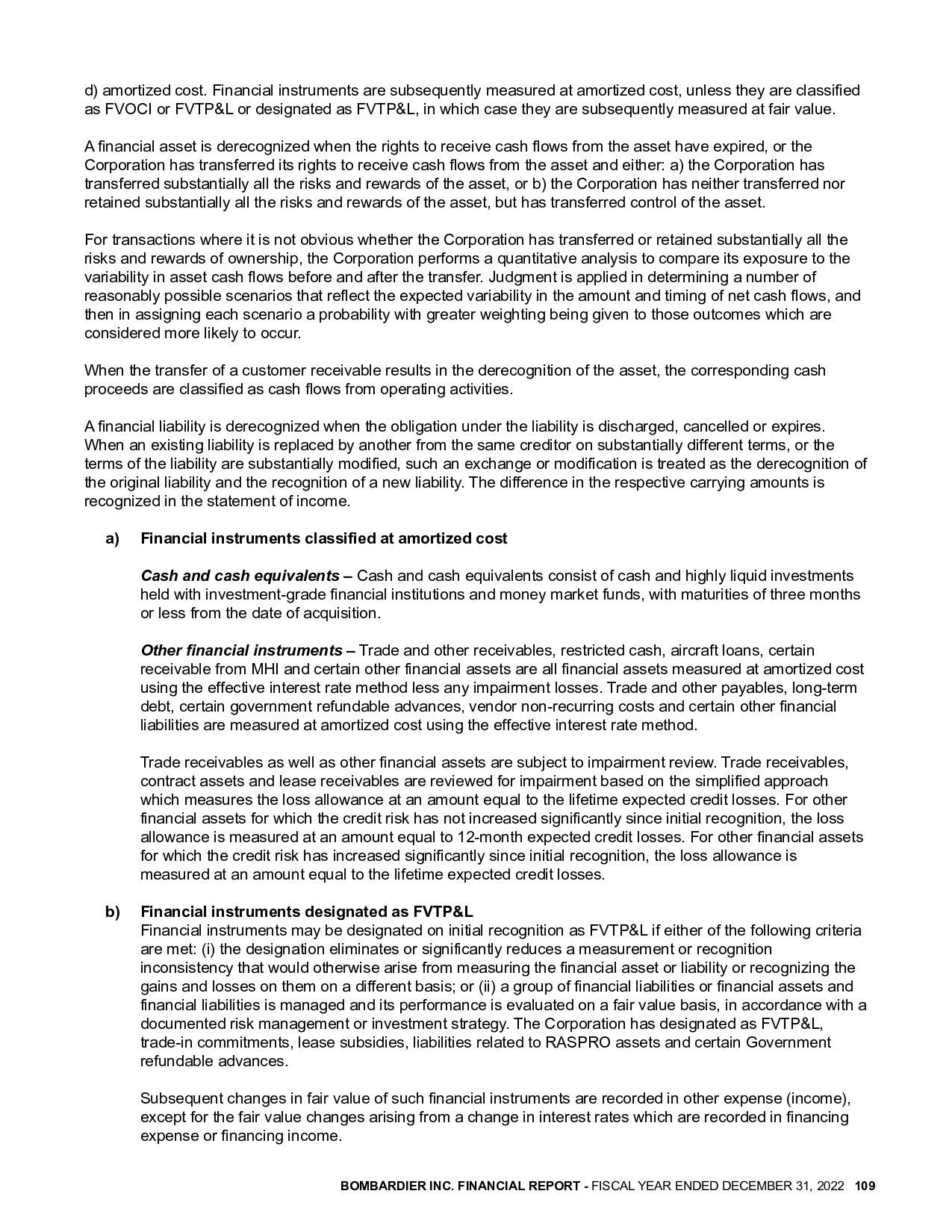

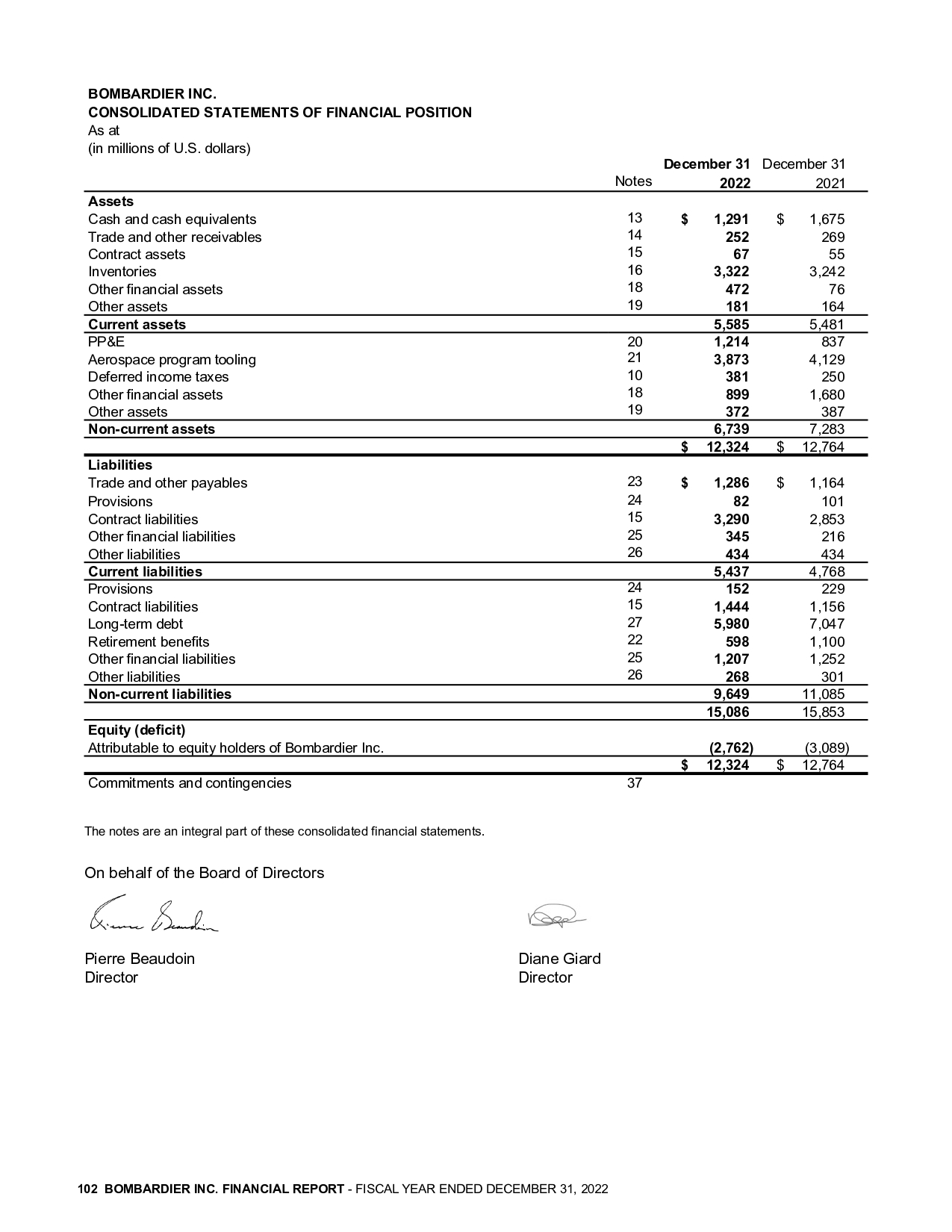

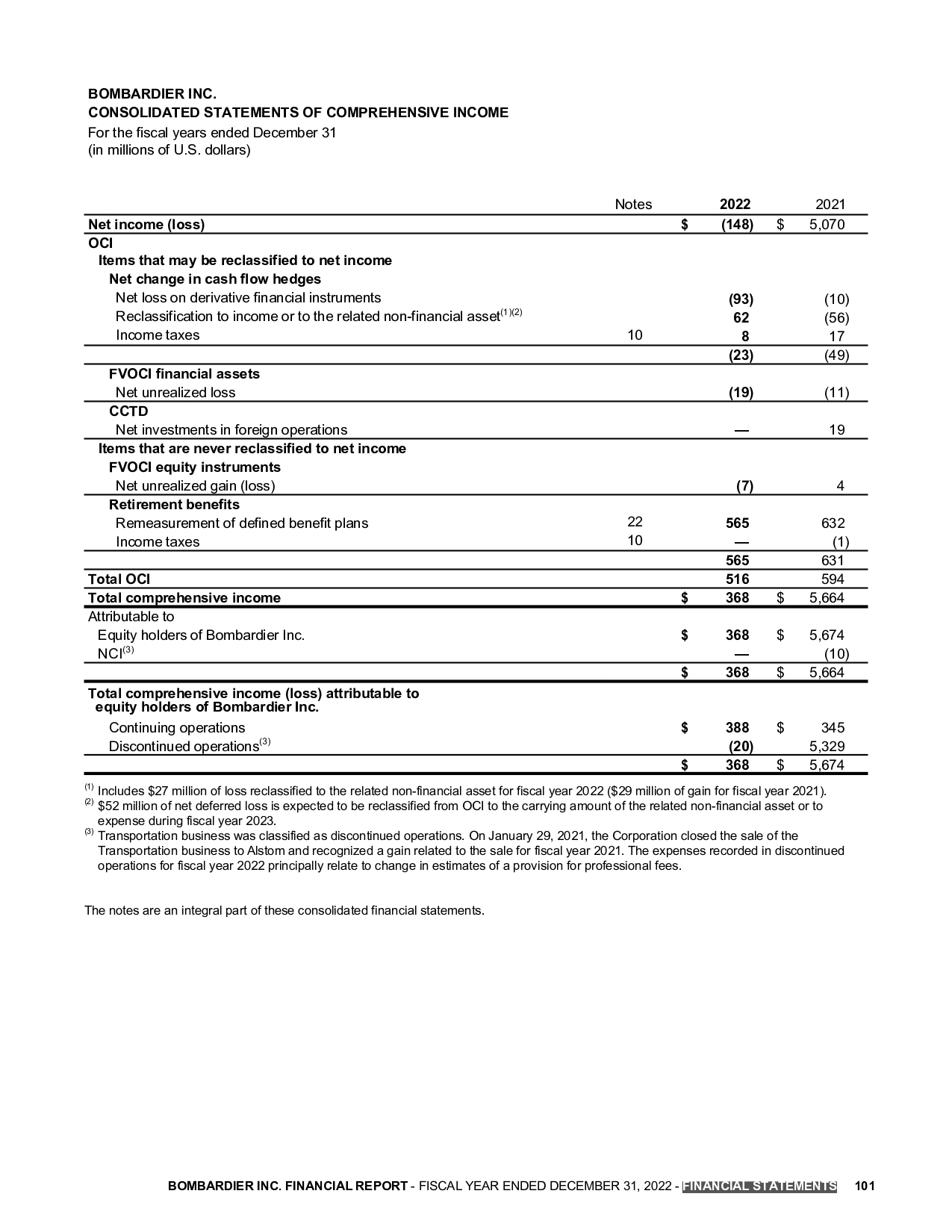

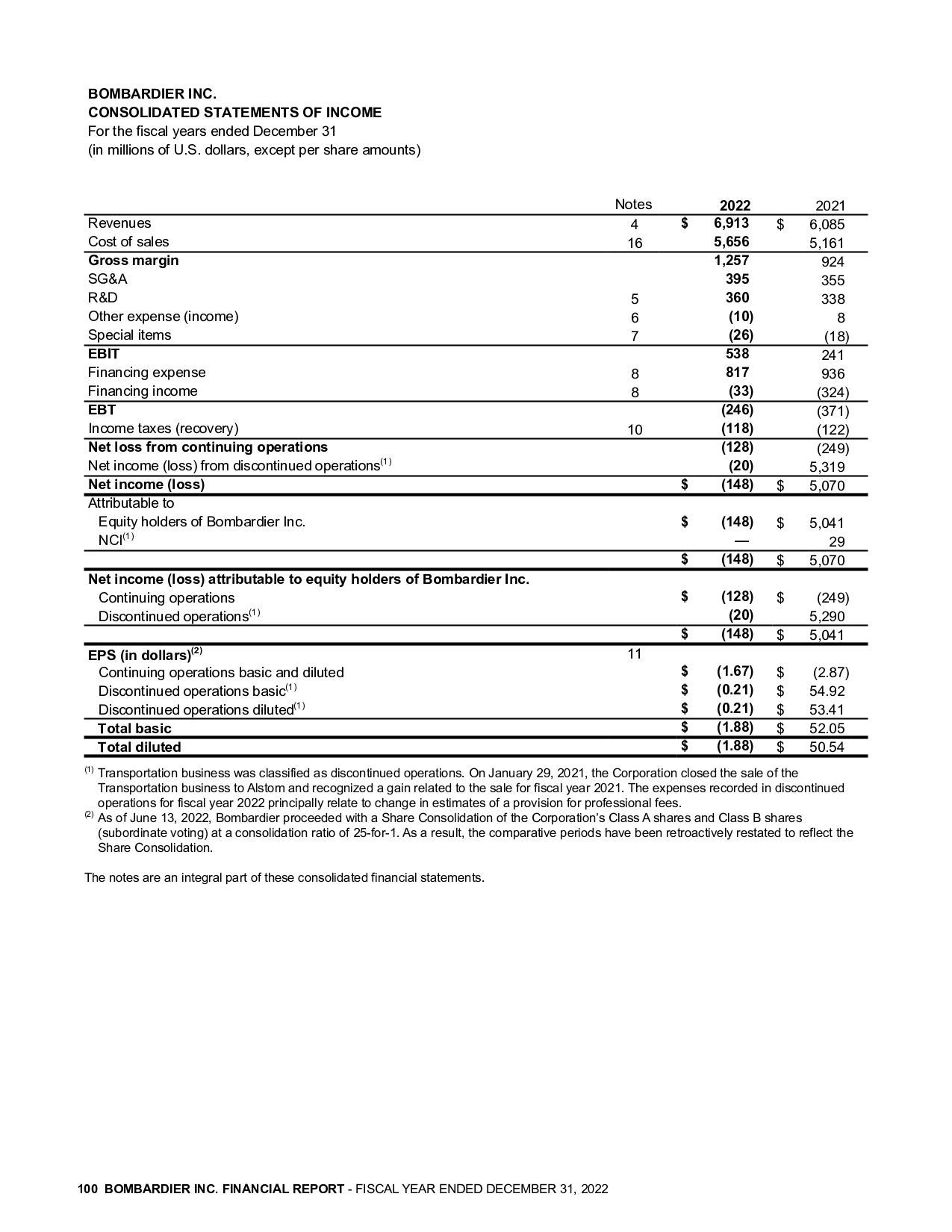

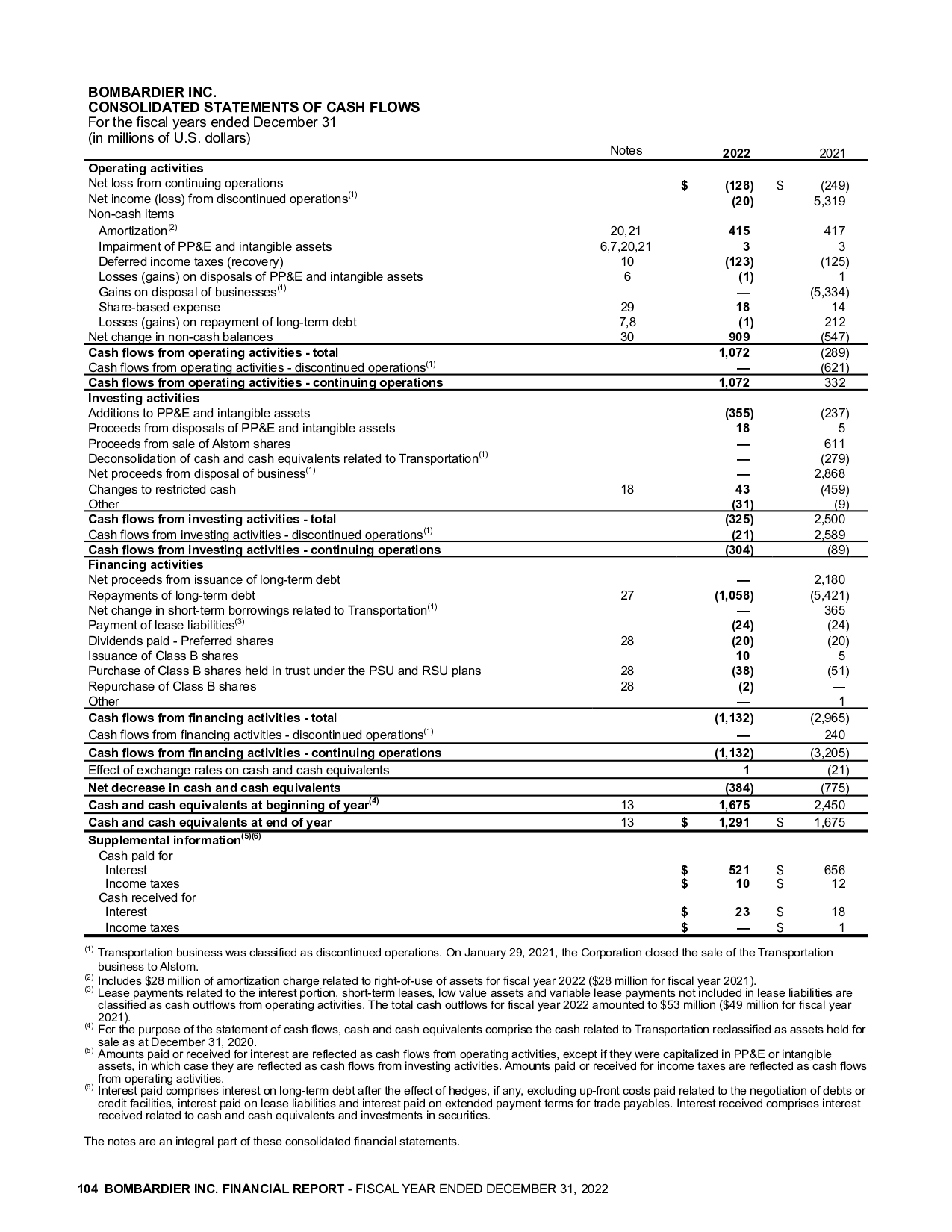

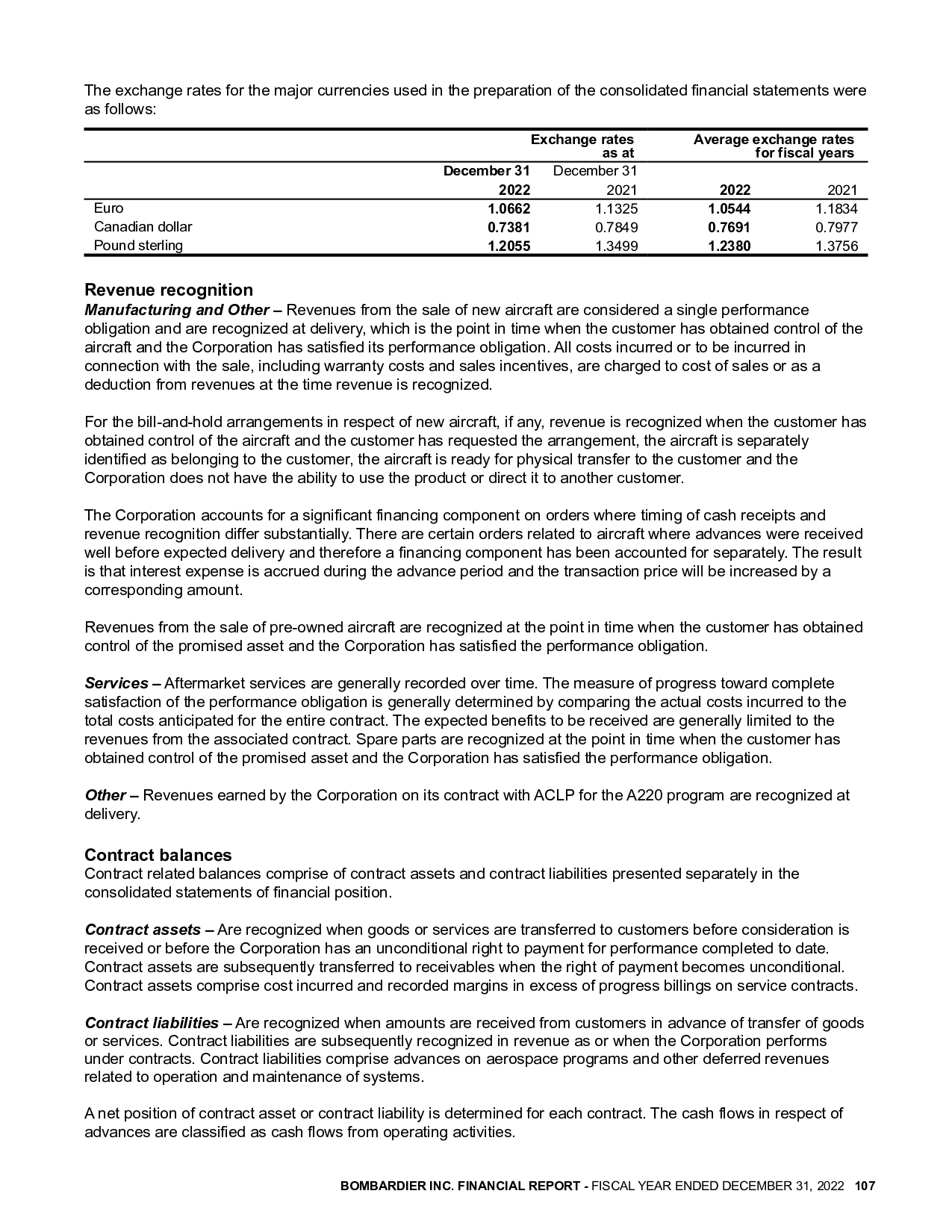

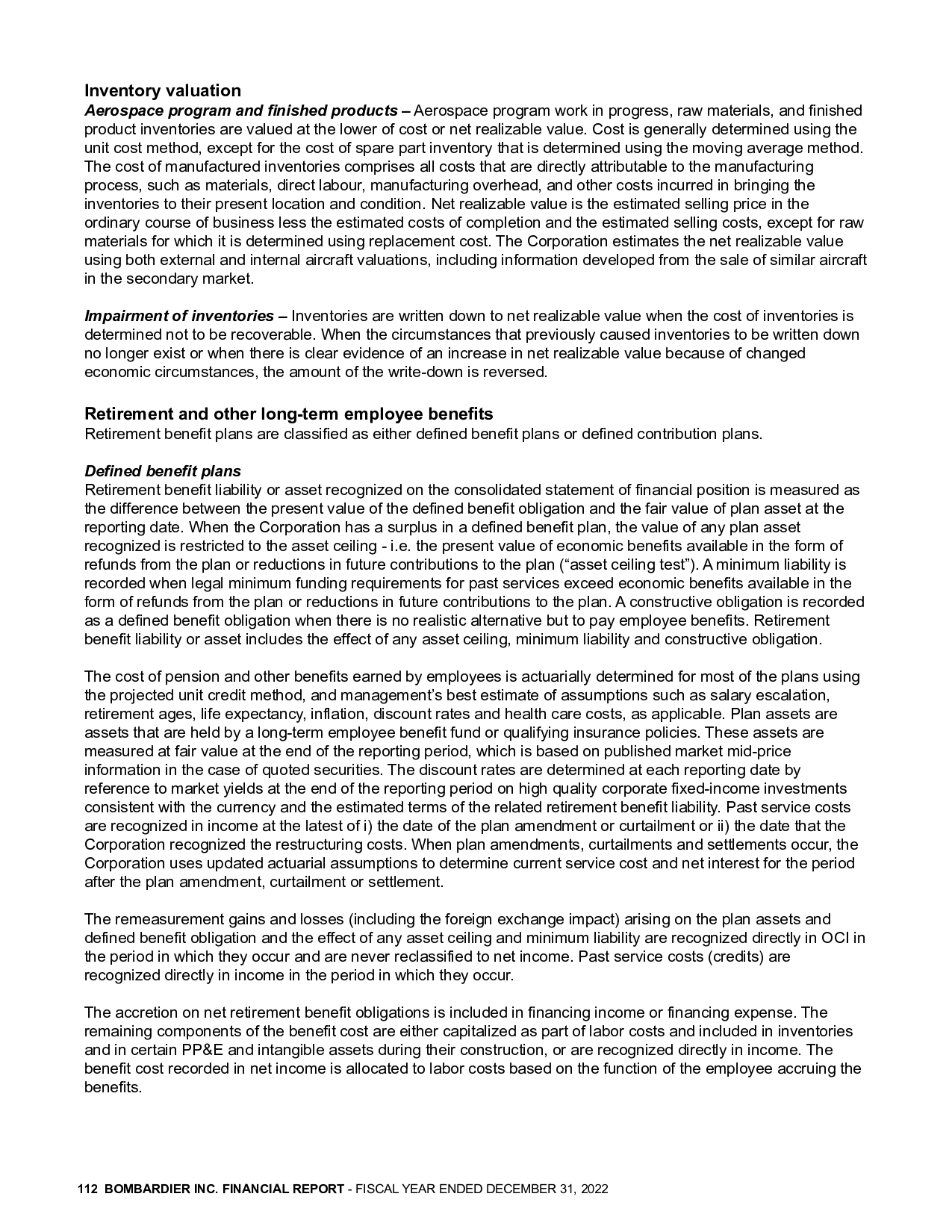

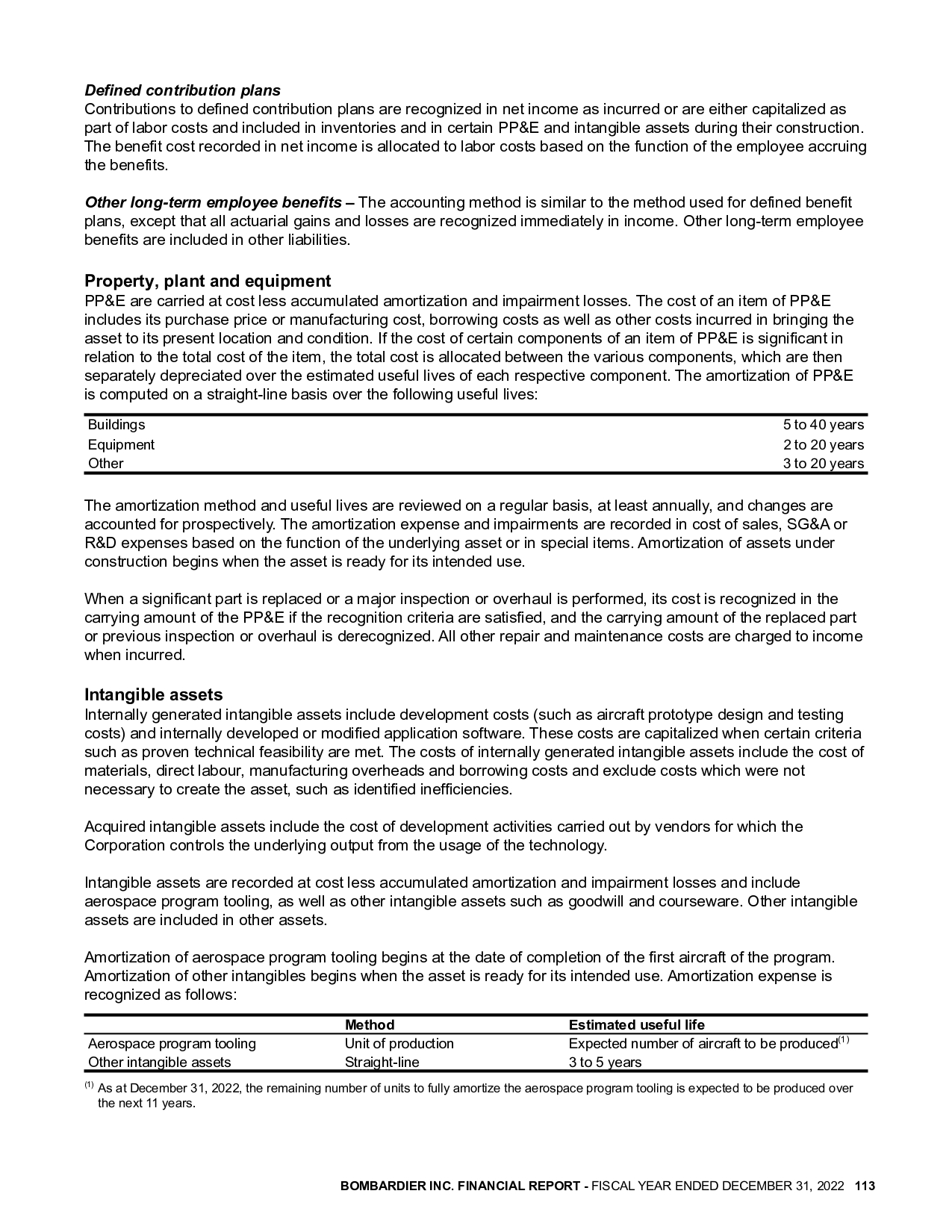

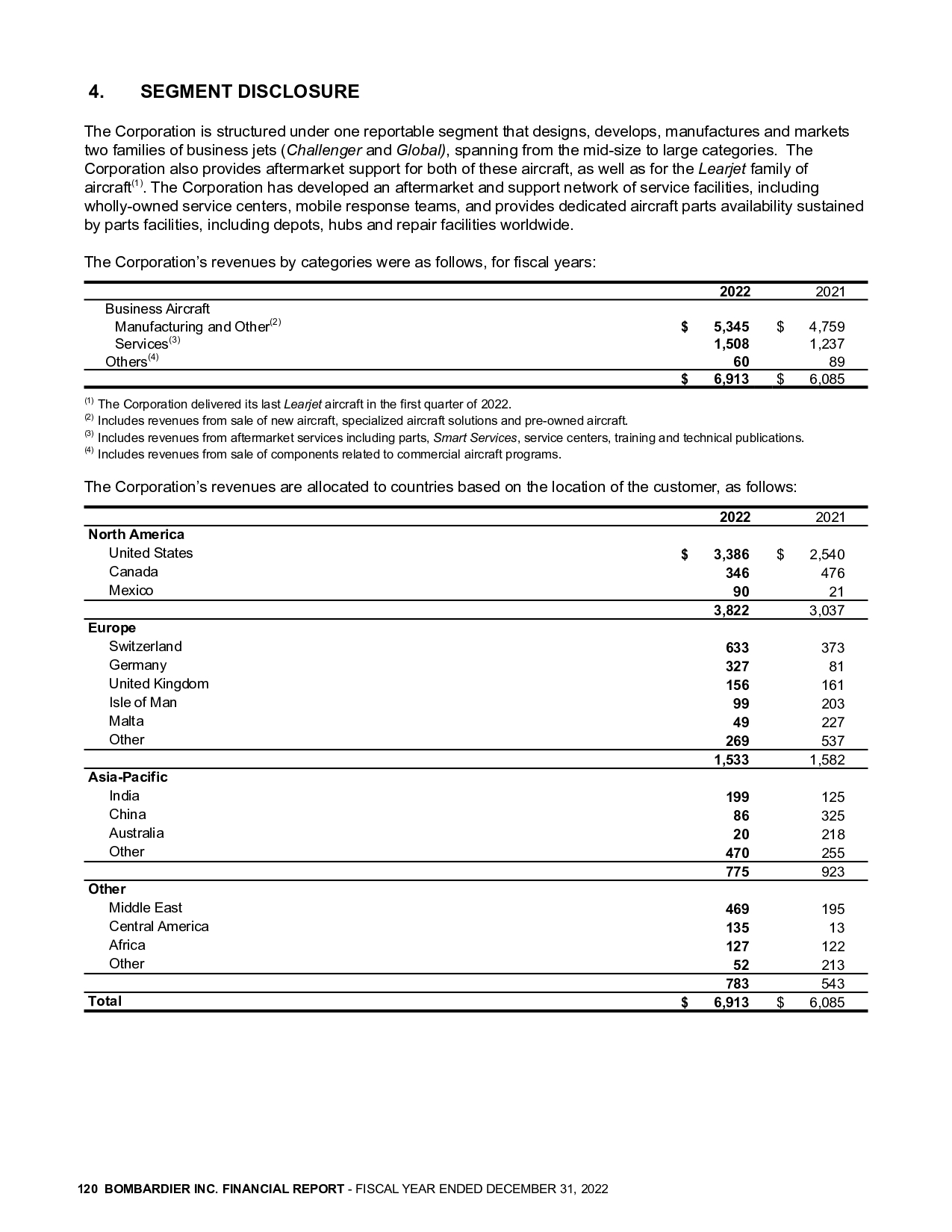

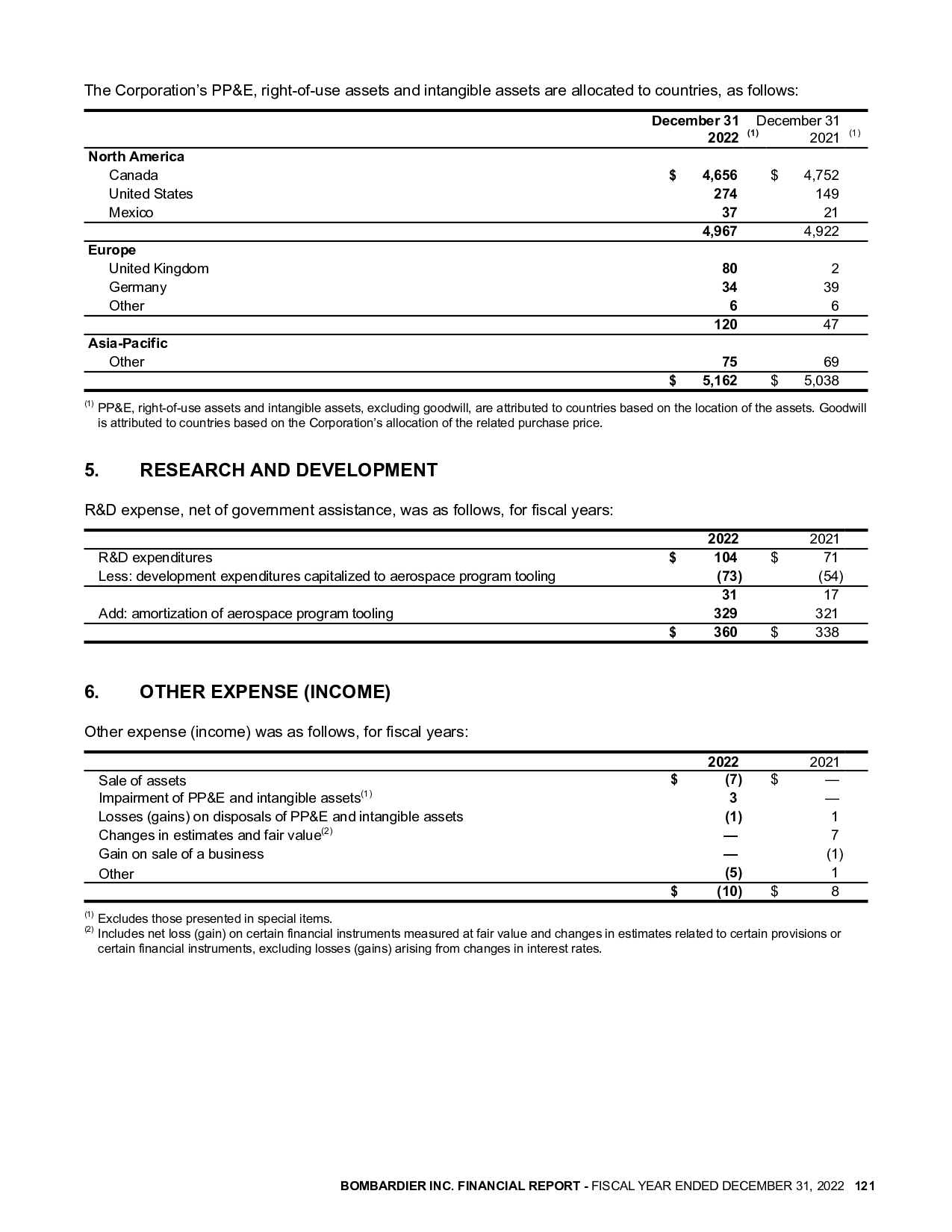

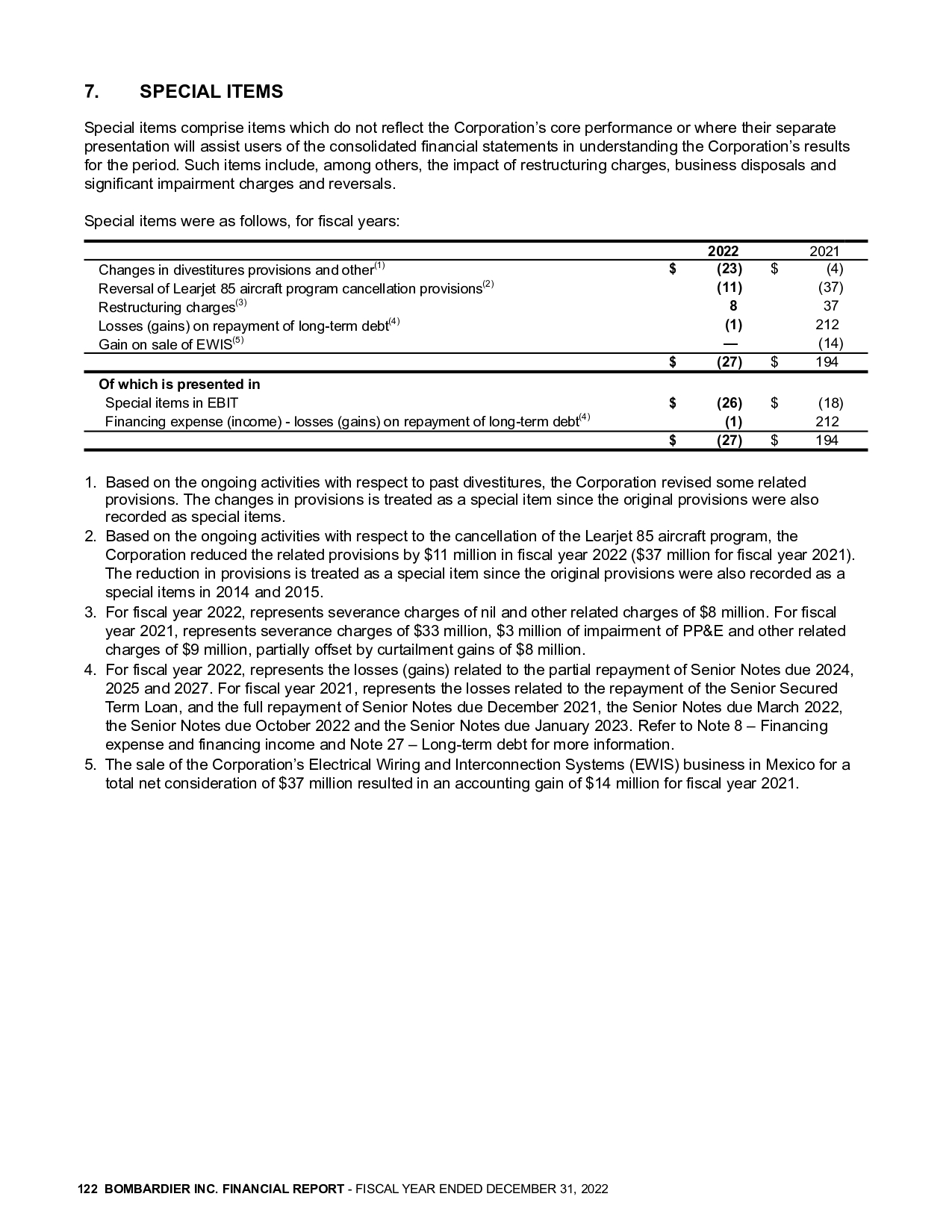

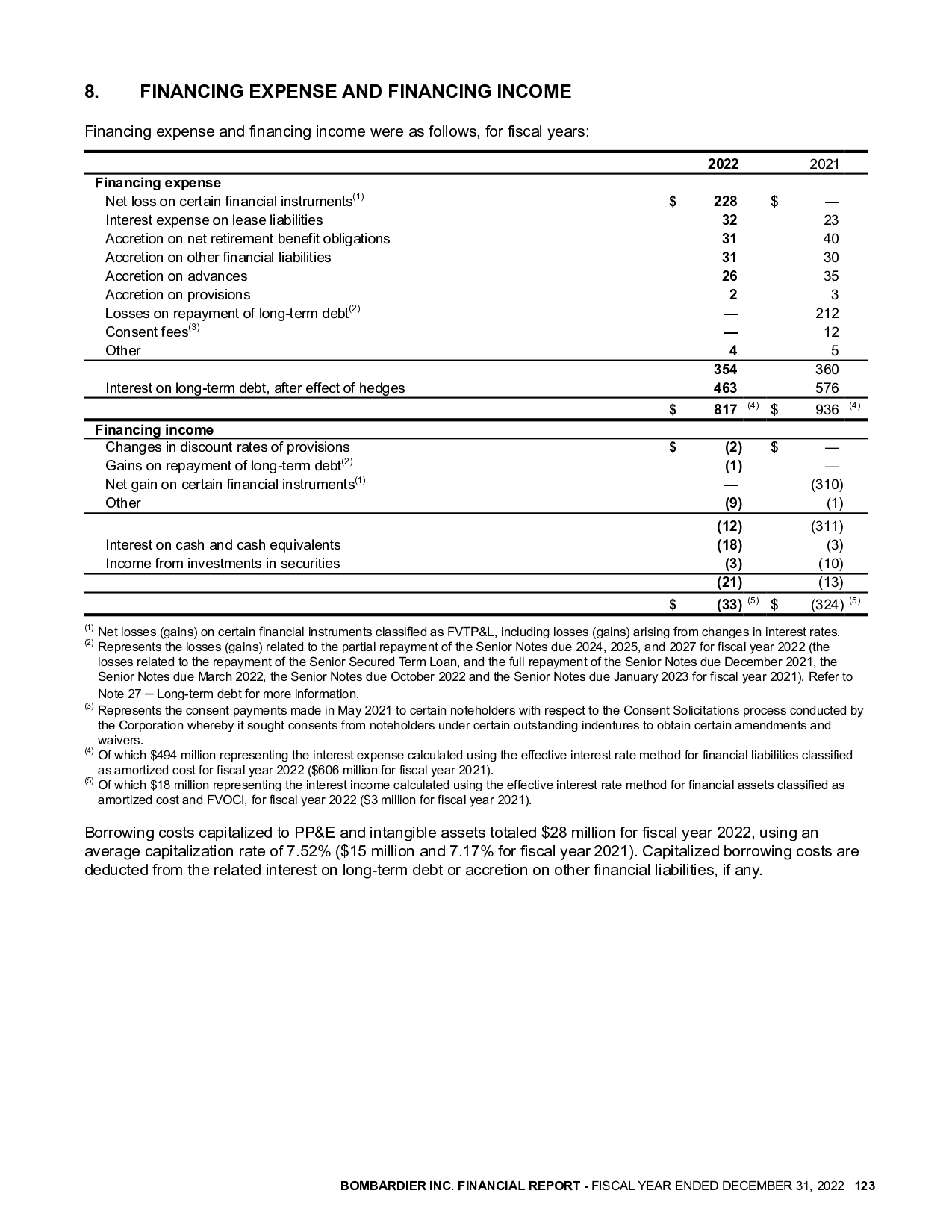

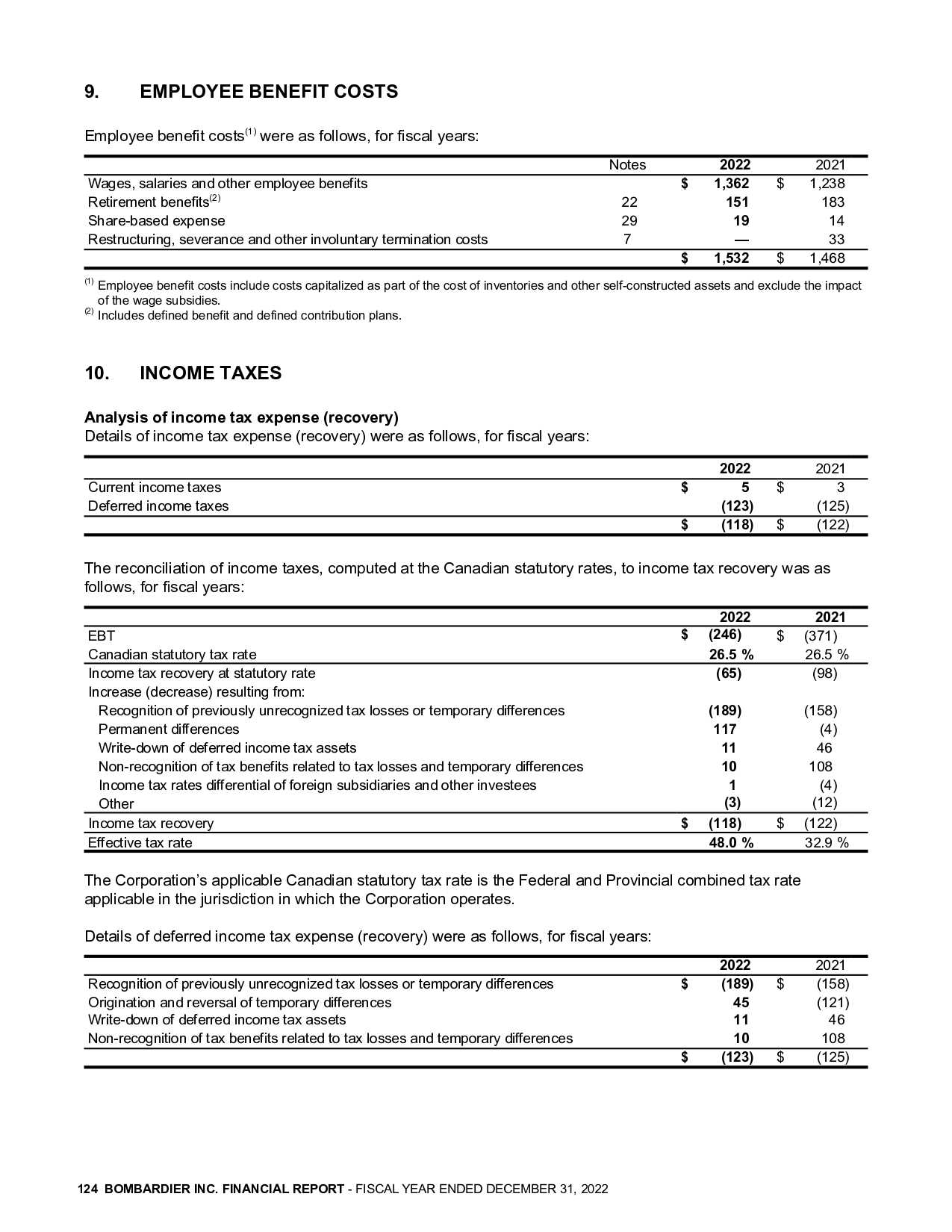

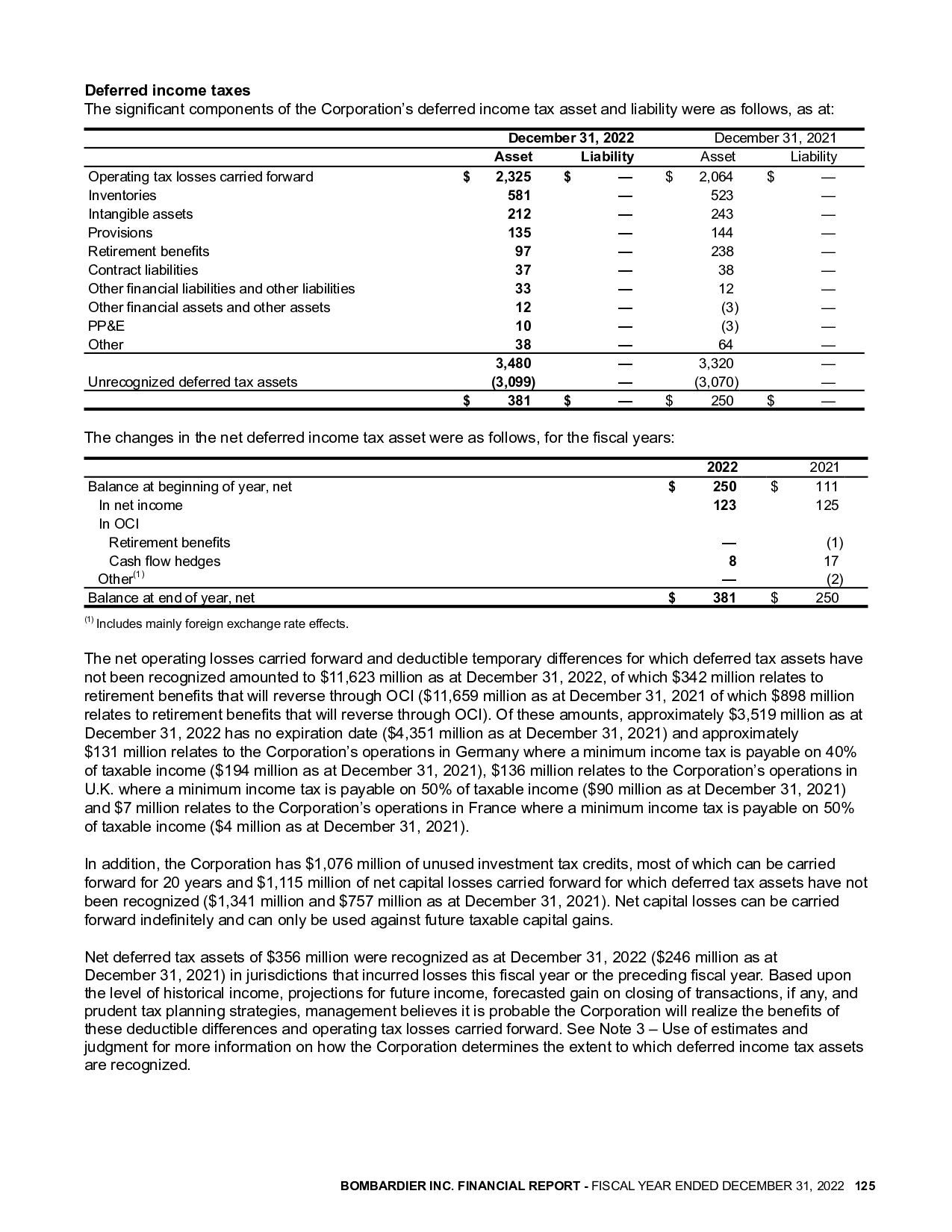

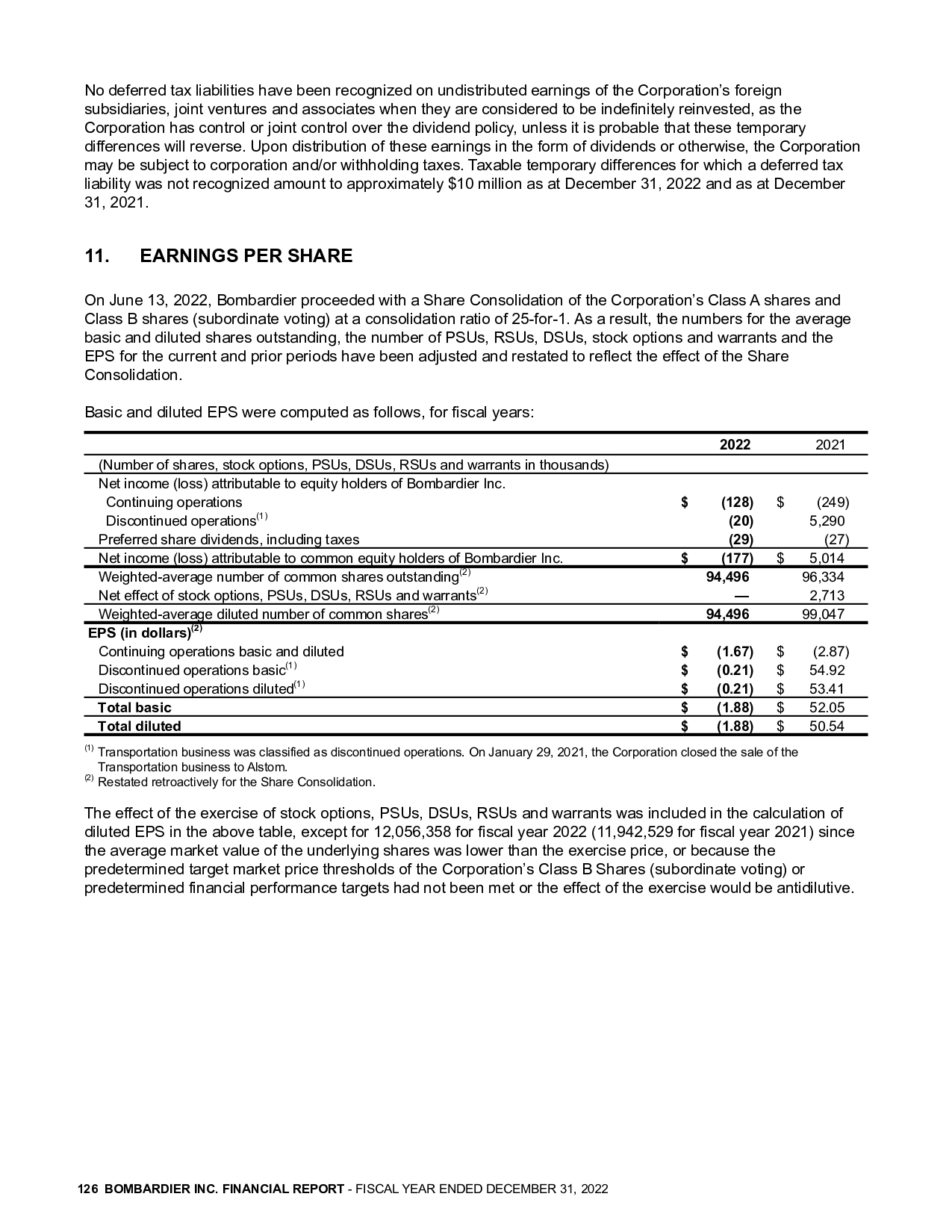

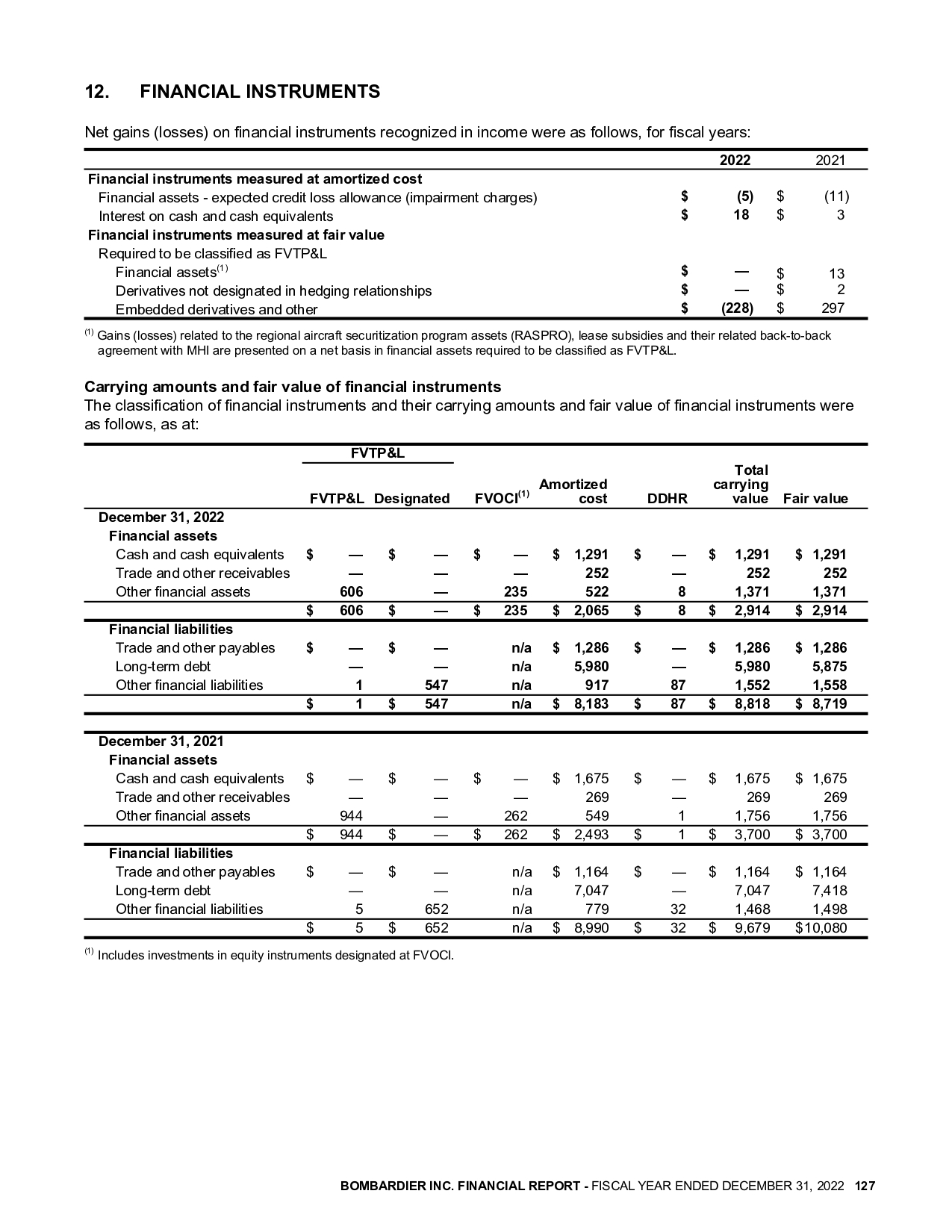

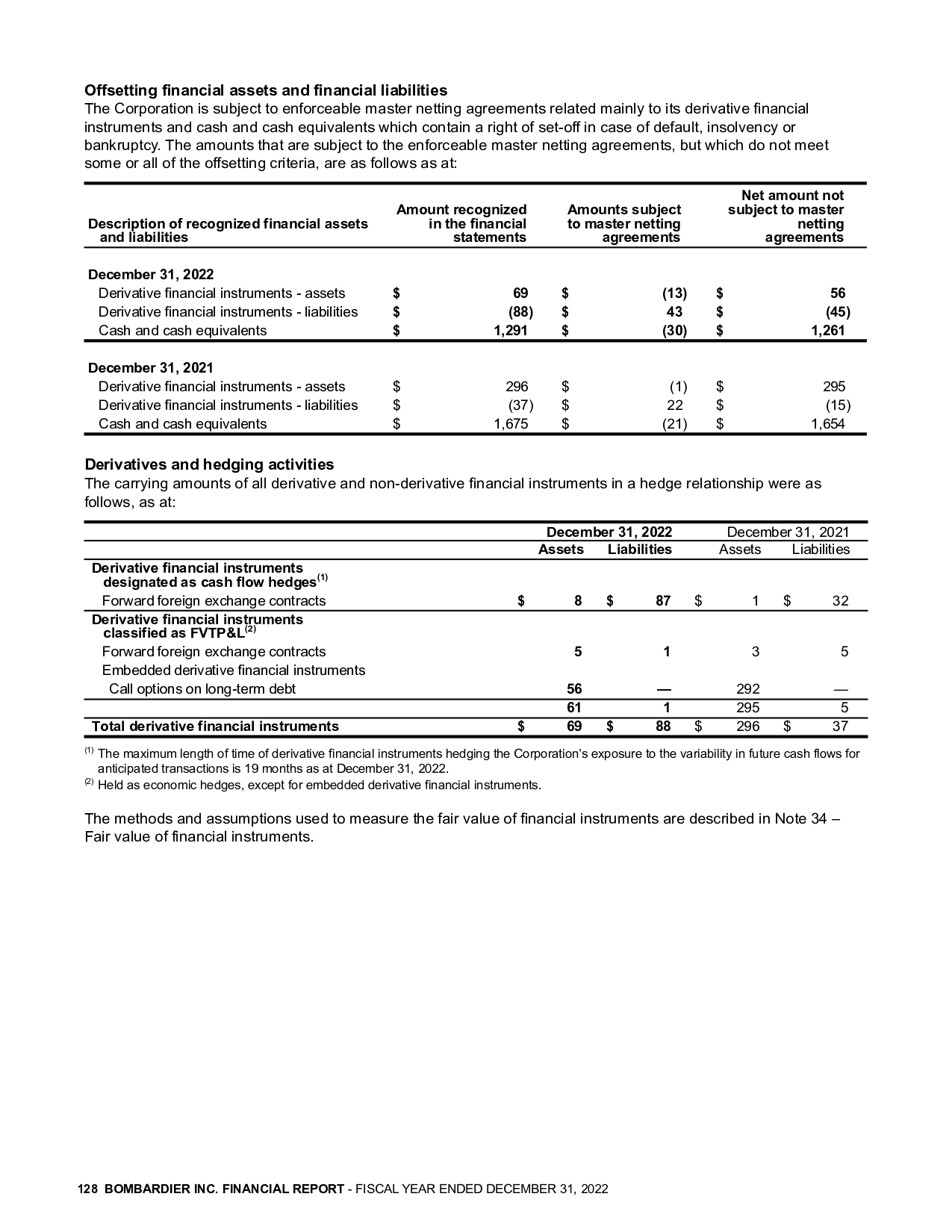

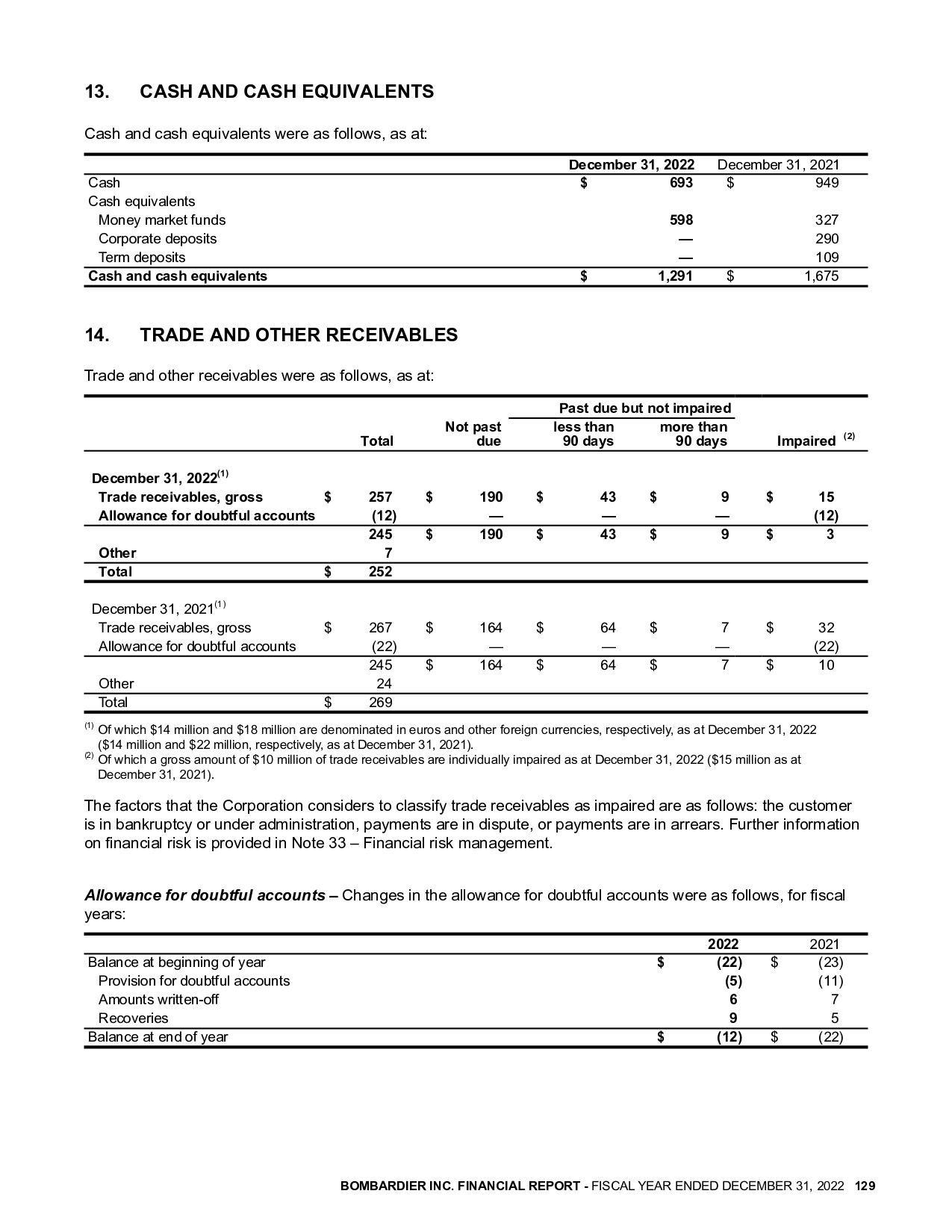

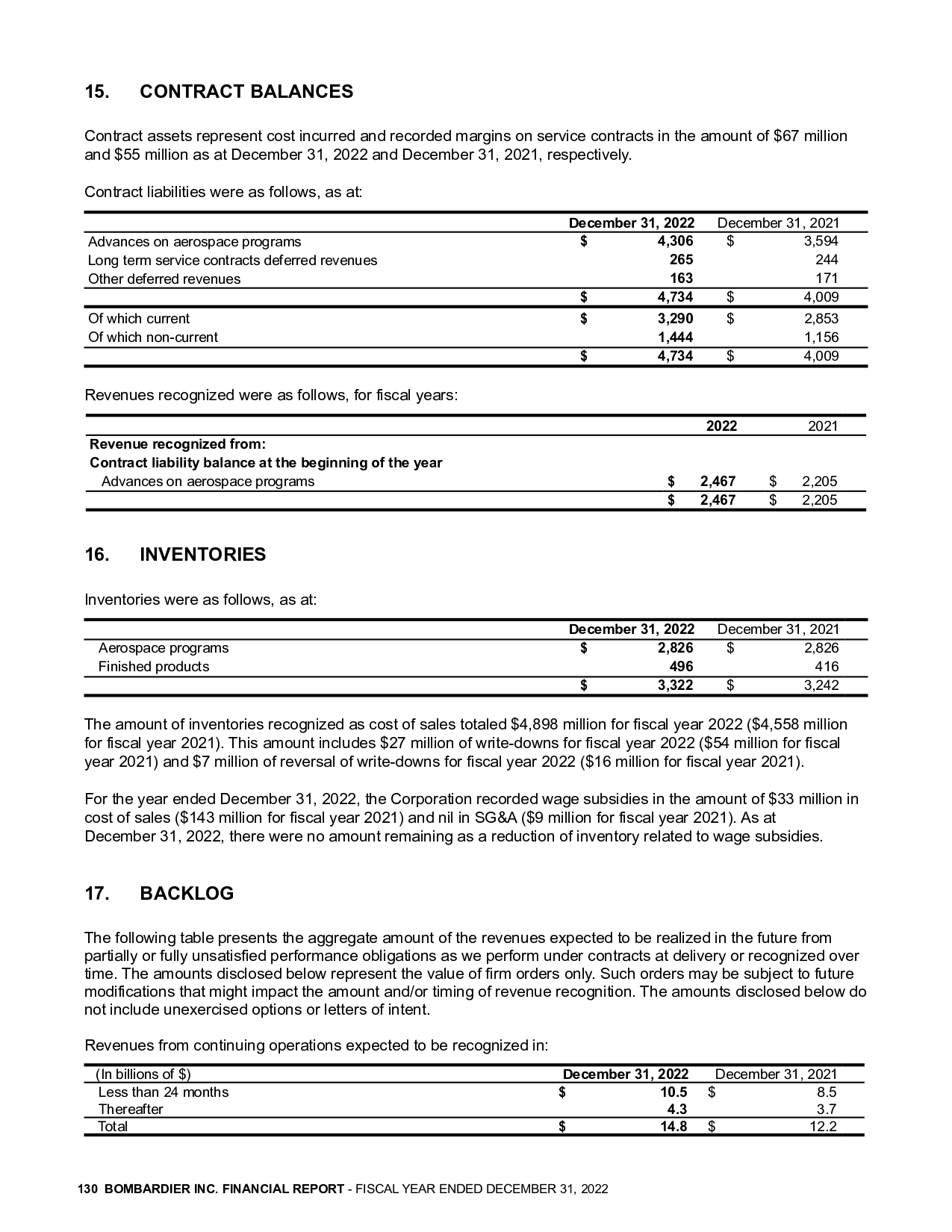

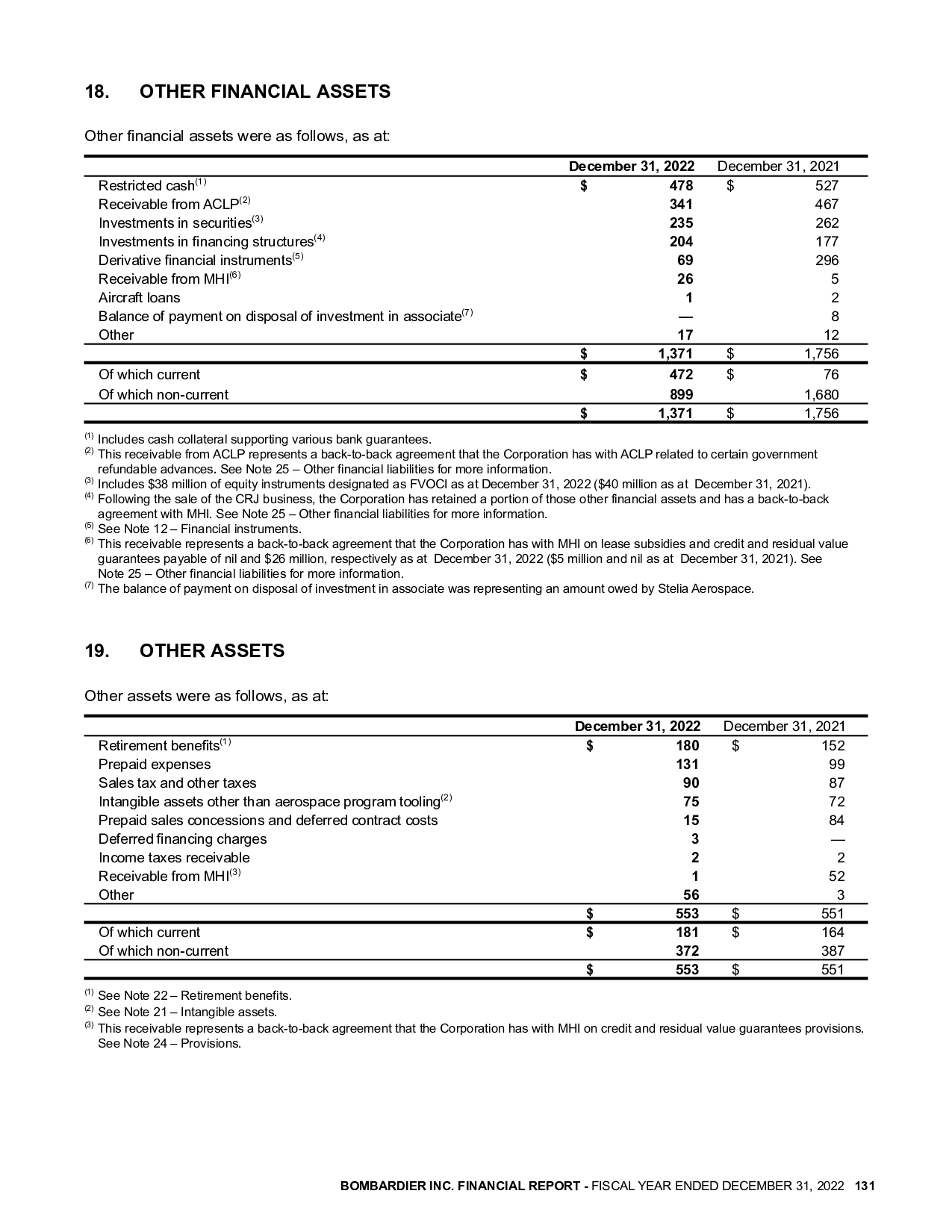

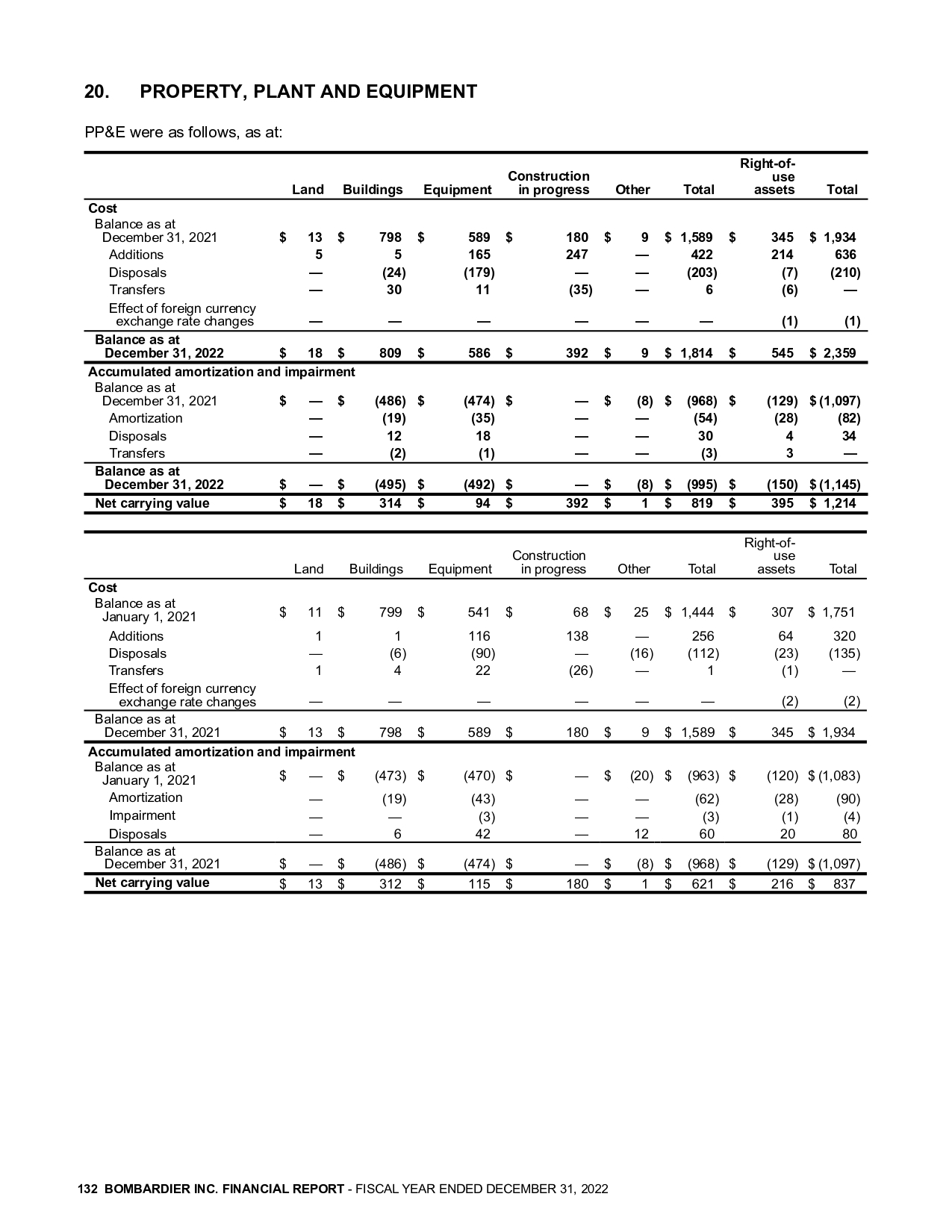

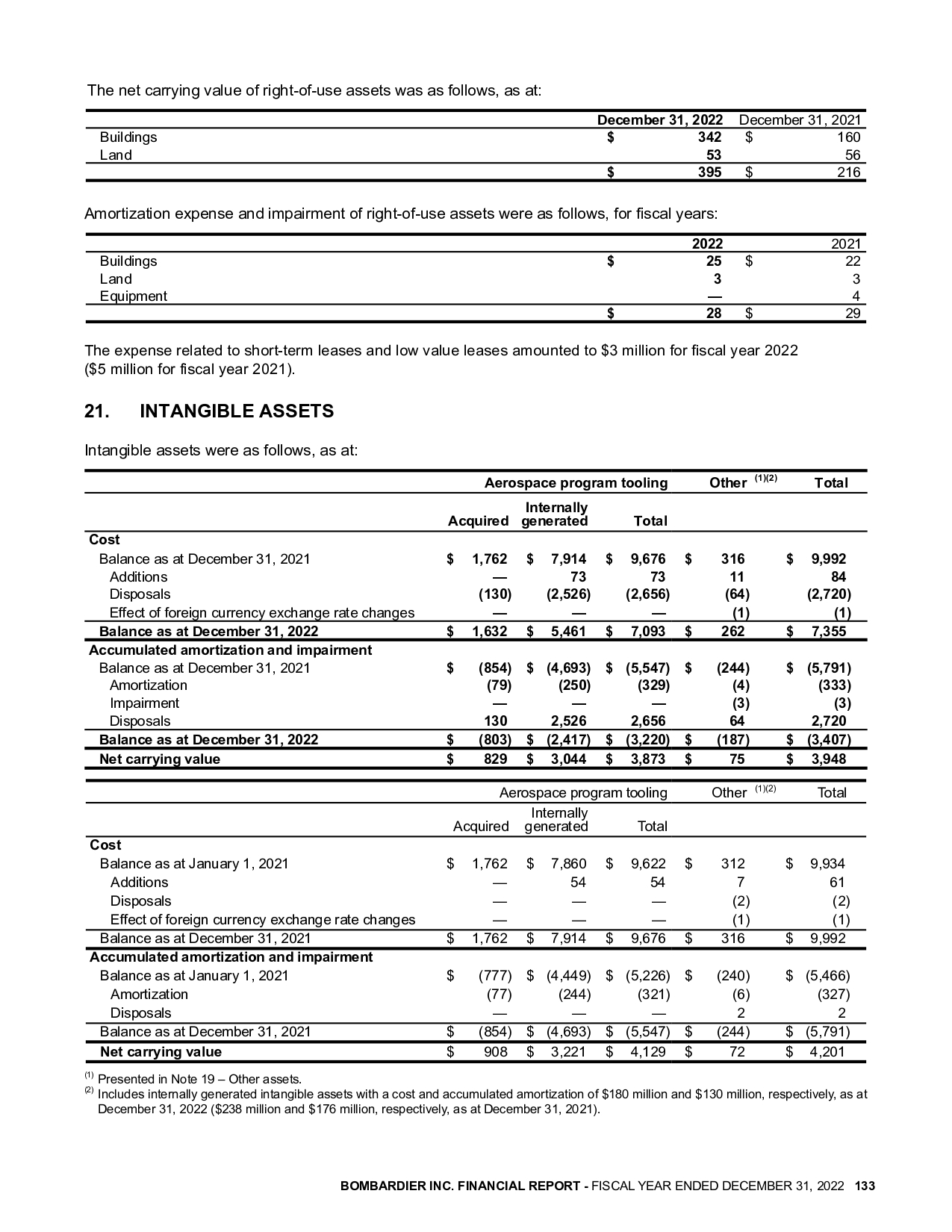

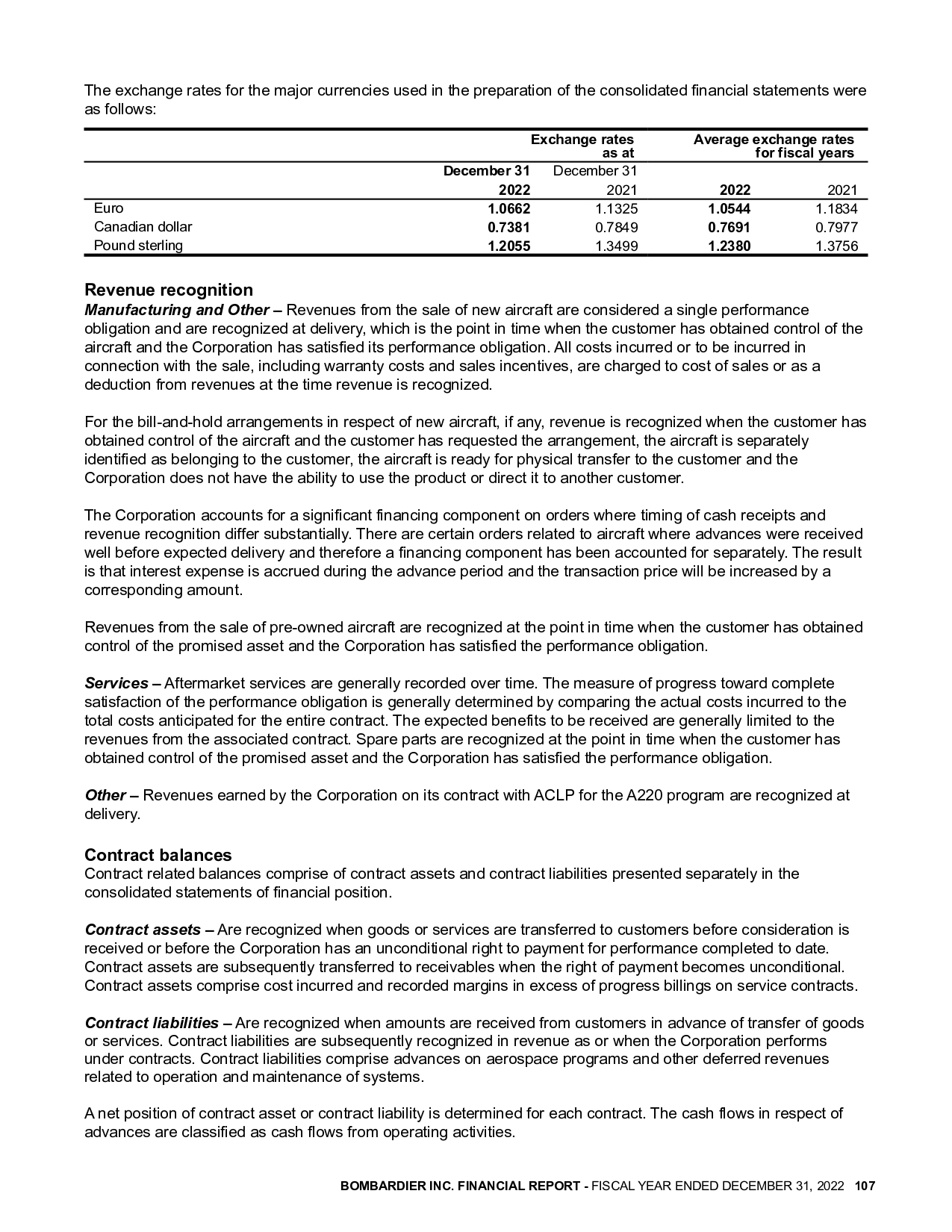

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS For the fiscal years ended December 31, 2022 and 2021 (Tabular figures are in millions of U.S. dollars, unless otherwise indicated) 1. BASIS OF PREPARATION Bombardier Inc. ("the Corporation" or "our" or "we") is incorporated under the laws of Canada. The Corporation is a manufacturer of business aircraft, as well as certain major aircraft structural components, and is a provider of related services. On September 16, 2020, the Transportation business was classified as discontinued operations. On January 29, 2021, the Corporation closed the sale of the Transportation business to Alstom. Following the sale, the Corporation carries out its operations under one segment. On June 13, 2022, Bombardier proceeded with a share consolidation of the Corporation's Class A shares and Class B shares (subordinate voting) at a consolidation ratio of 25 -for-1 (the "Share Consolidation"). As a result, the numbers for the average basic and diluted shares outstanding, the EPS, and the number of PSUs, RSUs, DSUs, stock options and warrants for all periods presented in the annual consolidated financial statements have been restated to reflect the effect of the Share Consolidation. The Corporation's consolidated financial statements for fiscal years 2022 and 2021 were authorized for issuance by the Board of Directors on February 8, 2023. Statement of compliance The Corporation's consolidated financial statements are expressed in U.S. dollars and have been prepared in accordance with IFRS, as issued by the IASB. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022105 3. USE OF ESTIMATES AND JUDGMENT The application of the Corporation's accounting policies requires management to use estimates and judgments that can have a significant effect on the revenues, expenses, comprehensive income, assets and liabilities recognized and disclosures made in the consolidated financial statements. An accounting estimate and judgement is considered critical if: - the estimate requires us to make assumptions about matters that are highly uncertain at the time the estimate is made; and - we could have reasonably used different estimates in the current period, or changes in the estimate are reasonably likely to occur from period to period that would have a material impact on our financial condition, our changes in financial condition or our results of operations. Management's best estimates regarding the future are based on the facts and circumstances available at the time estimates are made. Management uses historical experience, general economic conditions and trends, as well as assumptions regarding probable future outcomes as the basis for determining estimates. Estimates and their underlying assumptions are reviewed periodically and the effects of any changes are recognized immediately. Actual results will differ from the estimates used, and such differences could be material. Management's budget and strategic plan cover a five-year period and are fundamental information used as a basis for many estimates necessary to prepare financial information. Management prepares a budget and a strategic plan covering a five-year period, on an annual basis, using a process whereby a detailed one-year budget and four-year strategic plan are prepared and then consolidated. Cash flows and profitability included in the budget and strategic plan are based on existing and future contracts and orders, general market conditions, current cost structures, anticipated cost variations and in-force collective agreements. The budget and strategic plan are subject to approval at various levels, including senior management and the Board of Directors. Management uses the budget and strategic plan, as well as additional projections or assumptions, to derive the expected results for periods thereafter. Management then tracks performance as compared to the budget and strategic plan at various levels within the Corporation. Significant variances in actual performance are a key trigger to assess whether certain estimates used in the preparation of financial information must be revised. The following areas require management's most critical estimates and judgments, including the impact of the COVID-19 pandemic and the ongoing conflict between Russia and Ukraine, if any. The sensitivity analyses below should be used with caution as the changes are hypothetical and the impact of changes in each key assumption may not be linear. Aerospace program tooling - The Corporation assesses at each reporting date whether there are any indicators that Aerospace program tooling may be impaired. If any indicators of impairment exist, the Corporation estimates the recoverable amount of the relevant CGU. The assessment of indicators of impairment, and the calculation of recoverable amounts, when indicators exist, requires judgements, which are reviewed in detail as part of the budget and strategic plan process during the fourth quarter of 2022. For purposes of impairment testing, management also exercises judgment to identify independent cash inflows to identify CGUs by family of aircraft. In addition, estimation is required in the determination of the amortization of the Aerospace program tooling. Internal and external factors are considered in assessing whether indicators of impairment exist. If indicators of impairment exist, the recoverable amounts of the relevant CGUs are determined on fair value less costs of disposal, which are determined using forecasted future cash flows. The fair value measurements are categorized within Level 3 of the fair value hierarchy since the inputs used in the discounted cash flow model are Level 3 inputs (inputs that are not based on observable market data). The estimated future cash flows for the first five years are based on the budget and strategic plan. After the initial five years, long-range forecasts prepared by management are used. Internal and external factors are considered by management in exercising judgment in assessing whether indicators of impairment are present that would necessitate a quantitative impairment test. Factors include management's best estimate of future sales under existing firm orders, expected future orders, timing of payments based on expected delivery schedules, revenues from related aftermarket activities, procurement costs based on existing contracts with suppliers, future labor costs, general market conditions, foreign exchange rates, costs to complete the development activities, if any, potential upgrades and derivatives expected over the life of the program based on past experience with previous programs, and applicable long-range forecast income tax rates BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022117 4. SEGMENT DISCLOSURE The Corporation is structured under one reportable segment that designs, develops, manufactures and markets two families of business jets (Challenger and Global), spanning from the mid-size to large categories. The Corporation also provides aftermarket support for both of these aircraft, as well as for the Learjet family of aircraft (1). The Corporation has developed an aftermarket and support network of service facilities, including wholly-owned service centers, mobile response teams, and provides dedicated aircraft parts availability sustained by parts facilities, including depots, hubs and repair facilities worldwide. The Corporation's revenues by categories were as follows, for fiscal years: (1) The Corporation delivered its last Learjet aircraft in the first quarter of 2022. (2) Includes revenues from sale of new aircraft, specialized aircraft solutions and pre-owned aircraft. (3) Includes revenues from aftermarket services including parts, Smart Services, service centers, training and technical publications. (4) Includes revenues from sale of components related to commercial aircraft programs. The Corporation's revenues are allocated to countries based on the location of the customer, as follows: 120 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 Consolidation - From time to time, the Corporation participates in structured entities where voting rights are not the dominant factor in determining control. In these situations, management may use a variety of complex estimation processes involving both qualitative and quantitative factors to determine whether the Corporation is exposed to, or has rights to, significant variable returns. The quantitative analyses involve estimating the future cash flows and performance of the investee and analyzing the variability in those cash flows. The qualitative analyses involve consideration of factors such as the purpose and design of the investee and whether the Corporation is acting as an agent or principal. There is a significant amount of judgment exercised in evaluating the results of these analyses as well as in determining if the Corporation has power to affect the investee's returns, including an assessment of the impact of potential voting rights, contractual agreements and de facto control. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022119 Government assistance and refundable advances Government assistance, including wage subsidies and investment tax credits, is recognized when there is a reasonable assurance that the assistance will be received and that the Corporation will comply with all relevant conditions. Government assistance related to the acquisition of inventories, PP\&E and intangible assets is recorded as a reduction of the cost of the related asset. Government assistance related to incurred expenses is recorded as a reduction of the related expenses. Wage subsidies are recorded as a reduction of inventories or the related wage expenses. Government refundable advances are recorded as a financial liability if there is reasonable assurance that the amount will be repaid. Government refundable advances are adjusted if there is a change in the number of aircraft to be delivered and the timing of delivery of aircraft. Government refundable advances provided to the Corporation to finance research and development activities on a risk-sharing basis are considered part of the Corporation's operating activities and are therefore presented as cash flows from operating activities in the statement of cash flows. Special items Special items comprise items which do not reflect the Corporation's core performance or where their separate presentation will assist users of the consolidated financial statements in understanding the Corporation's results for the period. Such items include, among others, the impact of restructuring charges, business disposals and significant impairment charges and reversals. Income taxes The Corporation applies the liability method of accounting for income taxes. Deferred income tax assets and liabilities are recognized for the future income tax consequences of temporary differences between the carrying amounts of assets and liabilities and their respective tax bases, and for tax losses carried forward. Deferred income tax assets and liabilities are measured using the substantively enacted tax rates that will be in effect for the year in which the differences are expected to reverse. Deferred income tax assets are recognized to the extent that it is probable that future taxable income will be available against which the deductible temporary differences and unused tax losses can be utilized. Deferred income tax assets and liabilities are recognized directly in income, OCl or equity based on the classification of the item to which they relate. Earnings per share Basic EPS is computed based on net income attributable to equity holders of Bombardier Inc. less dividends on preferred shares, including taxes, divided by the weighted-average number of Class A Shares (multiple voting) and Class B Shares (subordinate voting) outstanding during the fiscal year. Diluted EPS are computed using the treasury stock method, giving effect to the exercise of all dilutive elements. Financial instruments A financial instrument is any contract that gives rise to a financial asset of one party and a financial liability or equity instrument of another party. Financial assets of the Corporation include cash and cash equivalents, trade and other receivables, aircraft loans, investments in securities, receivable from MHI, receivables from ACLP, investments in financing structures, restricted cash and derivative financial instruments with a positive fair value. Financial liabilities of the Corporation include trade and other payables, long-term debt, lease subsidies, lease liabilities, liabilities related to RASPRO assets, government refundable advances, credit and residual value guarantees payable, vendor non-recurring costs and derivative financial instruments with a negative fair value. Financial instruments are recognized in the consolidated statement of financial position when the Corporation becomes a party to the contractual obligations of the instrument. On initial recognition, financial instruments are recognized at their fair value plus, in the case of financial instruments not at FVTP\&L, transaction costs that are directly attributable to the acquisition or issue of financial instruments. Subsequent to initial recognition, financial instruments are measured according to the category to which they are classified, which are: a) financial instruments classified as FVTP\&L, b) financial instruments designated as FVTP\&L, c) FVOCl financial assets, or 108 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 and a post-tax discount rate based on a weighted average cost of capital calculated using market-based inputs, available directly from financial markets or based on a benchmark sampling of representative publicly-traded companies in the aerospace sector. The Corporation assessed whether there were any indicators of impairment for the Global 7500 in the fourth quarter of 2022. Following this assessment, the Corporation concluded there were no indicators of impairment as at December 31, 2022. Valuation of deferred income tax assets - To determine the extent to which deferred income tax assets can be recognized, management estimates the amount of probable future taxable profits that will be available against which deductible temporary differences and unused tax losses can be utilized. Such estimates are made as part of the budget and strategic plan by tax jurisdiction on an undiscounted basis and are reviewed on a quarterly basis. Management exercises judgment to determine the extent to which realization of future taxable benefits is probable, considering factors such as the number of years to include in the forecast period, forecasted gain on closing of transactions, if any, the history of profits and availability of prudent tax planning strategies. See Note 10 - Income taxes for more details. Tax contingencies - Uncertainties exist with respect to the interpretation of complex tax regulations, changes in tax laws, and the amount and timing of future taxable income. Given the wide range of international business relationships and the long-term nature and complexity of existing contractual agreements, differences arising between the actual results and the assumptions made, or future changes to such assumptions, could necessitate future adjustments to tax expense or recovery already recorded. The Corporation establishes tax provisions for possible consequences of audits by the tax authorities of each country in which it operates. The amount of such provisions is based on various factors, such as experience from previous tax audits and differing interpretations of tax regulations by the taxable entity and the relevant tax authority. Such differences in interpretation may arise for a wide variety of issues depending on the conditions prevailing in the domicile of each legal entity. Retirement and other long-term employee benefits - The actuarial valuation process used to measure pension and other post-employment benefit costs, assets and obligations is dependent on assumptions such as discount rates, compensation and pre-retirement benefit increases, inflation rates, health-care cost trends, as well as demographic factors such as employee turnover, retirement and mortality rates. The impacts from changes in discount rates and, when significant, from key events and other circumstances, are recorded quarterly. Discount rates are used to determine the present value of the expected future benefit payments and represent the market rates for high-quality corporate fixed-income investments consistent with the currency and the estimated term of the retirement benefit liabilities. As the Canadian high-quality corporate bond market, as defined under IFRS, includes relatively few medium-term and long-term maturity bonds, the discount rate for the Corporation's Canadian pension and other post-employment plans is established by constructing a yield curve using three maturity ranges. The first maturity range of the curve is based on observed market rates for AA-rated corporate bonds with maturities of less than five years. In the longer maturity ranges, due to the smaller number of highquality bonds available, the curve is derived using market observations and extrapolated data. The extrapolated data points were created by adding a term-based yield spread over long-term provincial bond yields. This term-based spread is extrapolated between a base spread and a long spread. The base spread is based on the observed spreads between AA-rated corporate bonds and AA-rated provincial bonds for the 4 to 10 years to maturity range. The long spread is determined as the spread required at the point of average maturity of AA-rated provincial bonds in the 11 to 30 years to maturity range such that the average AA-rated corporate bond spread above AA-rated provincial bonds is equal to the extrapolated spread derived by applying the ratio of the observed spreads between A-rated corporate bonds and AA-rated provincial bonds for the 11 to 30 years to maturity range over the 4 to 10 years to maturity range, to the base spread. For maturities longer than the average maturity of AA-rated provincial bonds in the 11 to 30 years to maturity range, the spread is assumed to remain constant at the level of the long spread. Expected rates of compensation increases are determined considering the current salary structure, as well as historical and anticipated wage increases, in the context of current economic conditions. See Note 22 - Retirement benefits for further details regarding assumptions used and sensitivity analysis to changes in critical actuarial assumptions. 118 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 The accompanying notes to the consolidated financial statements are an integral part of these statements. Defined contribution plans Contributions to defined contribution plans are recognized in net income as incurred or are either capitalized as part of labor costs and included in inventories and in certain PP\&E and intangible assets during their construction. The benefit cost recorded in net income is allocated to labor costs based on the function of the employee accruing the benefits. Other long-term employee benefits - The accounting method is similar to the method used for defined benefit plans, except that all actuarial gains and losses are recognized immediately in income. Other long-term employee benefits are included in other liabilities. Property, plant and equipment PP\&E are carried at cost less accumulated amortization and impairment losses. The cost of an item of PP\&E includes its purchase price or manufacturing cost, borrowing costs as well as other costs incurred in bringing the asset to its present location and condition. If the cost of certain components of an item of PP\&E is significant in relation to the total cost of the item, the total cost is allocated between the various components, which are then separately depreciated over the estimated useful lives of each respective component. The amortization of PP\&E is computed on a straight-line basis over the following useful lives: The amortization method and useful lives are reviewed on a regular basis, at least annually, and changes are accounted for prospectively. The amortization expense and impairments are recorded in cost of sales, SG\&A or R&D expenses based on the function of the underlying asset or in special items. Amortization of assets under construction begins when the asset is ready for its intended use. When a significant part is replaced or a major inspection or overhaul is performed, its cost is recognized in the carrying amount of the PP\&E if the recognition criteria are satisfied, and the carrying amount of the replaced part or previous inspection or overhaul is derecognized. All other repair and maintenance costs are charged to income when incurred. Intangible assets Internally generated intangible assets include development costs (such as aircraft prototype design and testing costs) and internally developed or modified application software. These costs are capitalized when certain criteria such as proven technical feasibility are met. The costs of internally generated intangible assets include the cost of materials, direct labour, manufacturing overheads and borrowing costs and exclude costs which were not necessary to create the asset, such as identified inefficiencies. Acquired intangible assets include the cost of development activities carried out by vendors for which the Corporation controls the underlying output from the usage of the technology. Intangible assets are recorded at cost less accumulated amortization and impairment losses and include aerospace program tooling, as well as other intangible assets such as goodwill and courseware. Other intangible assets are included in other assets. Amortization of aerospace program tooling begins at the date of completion of the first aircraft of the program. Amortization of other intangibles begins when the asset is ready for its intended use. Amortization expense is recognized as follows: (1) As at December 31,2022 , the remaining number of units to fully amortize the aerospace program tooling is expected to be produced over the next 11 years. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 113 No deferred tax liabilities have been recognized on undistributed earnings of the Corporation's foreign subsidiaries, joint ventures and associates when they are considered to be indefinitely reinvested, as the Corporation has control or joint control over the dividend policy, unless it is probable that these temporary differences will reverse. Upon distribution of these earnings in the form of dividends or otherwise, the Corporation may be subject to corporation and/or withholding taxes. Taxable temporary differences for which a deferred tax liability was not recognized amount to approximately $10 million as at December 31, 2022 and as at December 31, 2021. 11. EARNINGS PER SHARE On June 13, 2022, Bombardier proceeded with a Share Consolidation of the Corporation's Class A shares and Class B shares (subordinate voting) at a consolidation ratio of 25 for- 1 . As a result, the numbers for the average basic and diluted shares outstanding, the number of PSUs, RSUs, DSUs, stock options and warrants and the EPS for the current and prior periods have been adjusted and restated to reflect the effect of the Share Consolidation. Basic and diluted EPS were computed as follows, for fiscal years: (1) Transportation business was classified as discontinued operations. On January 29, 2021, the Corporation closed the sale of the Transportation business to Alstom. (2) Restated retroactively for the Share Consolidation. The effect of the exercise of stock options, PSUs, DSUs, RSUs and warrants was included in the calculation of diluted EPS in the above table, except for 12,056,358 for fiscal year 2022 (11,942,529 for fiscal year 2021) since the average market value of the underlying shares was lower than the exercise price, or because the predetermined target market price thresholds of the Corporation's Class B Shares (subordinate voting) or predetermined financial performance targets had not been met or the effect of the exercise would be antidilutive. 126 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 d) amortized cost. Financial instruments are subsequently measured at amortized cost, unless they are classified as FVOCl or FVTP\&L or designated as FVTP\&L, in which case they are subsequently measured at fair value. A financial asset is derecognized when the rights to receive cash flows from the asset have expired, or the Corporation has transferred its rights to receive cash flows from the asset and either: a) the Corporation has transferred substantially all the risks and rewards of the asset, or b) the Corporation has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset. For transactions where it is not obvious whether the Corporation has transferred or retained substantially all the risks and rewards of ownership, the Corporation performs a quantitative analysis to compare its exposure to the variability in asset cash flows before and after the transfer. Judgment is applied in determining a number of reasonably possible scenarios that reflect the expected variability in the amount and timing of net cash flows, and then in assigning each scenario a probability with greater weighting being given to those outcomes which are considered more likely to occur. When the transfer of a customer receivable results in the derecognition of the asset, the corresponding cash proceeds are classified as cash flows from operating activities. A financial liability is derecognized when the obligation under the liability is discharged, cancelled or expires. When an existing liability is replaced by another from the same creditor on substantially different terms, or the terms of the liability are substantially modified, such an exchange or modification is treated as the derecognition of the original liability and the recognition of a new liability. The difference in the respective carrying amounts is recognized in the statement of income. a) Financial instruments classified at amortized cost Cash and cash equivalents - Cash and cash equivalents consist of cash and highly liquid investments held with investment-grade financial institutions and money market funds, with maturities of three months or less from the date of acquisition. Other financial instruments - Trade and other receivables, restricted cash, aircraft loans, certain receivable from MHI and certain other financial assets are all financial assets measured at amortized cost using the effective interest rate method less any impairment losses. Trade and other payables, long-term debt, certain government refundable advances, vendor non-recurring costs and certain other financial liabilities are measured at amortized cost using the effective interest rate method. Trade receivables as well as other financial assets are subject to impairment review. Trade receivables, contract assets and lease receivables are reviewed for impairment based on the simplified approach which measures the loss allowance at an amount equal to the lifetime expected credit losses. For other financial assets for which the credit risk has not increased significantly since initial recognition, the loss allowance is measured at an amount equal to 12-month expected credit losses. For other financial assets for which the credit risk has increased significantly since initial recognition, the loss allowance is measured at an amount equal to the lifetime expected credit losses. b) Financial instruments designated as FVTP\&L Financial instruments may be designated on initial recognition as FVTP\&L if either of the following criteria are met: (i) the designation eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise arise from measuring the financial asset or liability or recognizing the gains and losses on them on a different basis; or (ii) a group of financial liabilities or financial assets and financial liabilities is managed and its performance is evaluated on a fair value basis, in accordance with a documented risk management or investment strategy. The Corporation has designated as FVTP\&L, trade-in commitments, lease subsidies, liabilities related to RASPRO assets and certain Government refundable advances. Subsequent changes in fair value of such financial instruments are recorded in other expense (income), except for the fair value changes arising from a change in interest rates which are recorded in financing expense or financing income. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 109 The accounting policies set out below have been applied consistently to all periods presented in these consolidated financial statements, unless otherwise stated. Basis of consolidation Subsidiaries - Subsidiaries are fully consolidated from the date of acquisition and continue to be consolidated until the date control over the subsidiaries ceases. The Corporation consolidates investees, including structured entities when, based on the evaluation of the substance of the relationship with the Corporation, it concludes that it controls the investees. The Corporation controls an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. The Corporation's principal subsidiary, whose revenues or assets represent more than 10% of the revenues or more than 10% of the assets, is Learjet Inc. (located in U.S.). Revenues and assets of this subsidiary combined with those of Bombardier Inc. totaled 92% of consolidated revenues and 90% of consolidated assets, for fiscal year 2022 ( 94% and 92% for fiscal year 2021). Joint ventures - Joint ventures are those entities over which the Corporation exercises joint control, requiring unanimous consent of the parties sharing control of relevant activities such as, strategic financial and operating decision making and where the parties have rights to the net assets of the arrangement. The Corporation recognizes its interest in joint ventures using the equity method of accounting. Associates - Associates are entities in which the Corporation has the ability to exercise significant influence over the financial and operating policies. Investments in associates are accounted for using the equity method of accounting. Foreign currency translation The consolidated financial statements are expressed in U.S. dollars, the functional currency of Bombardier Inc. The functional currency is the currency of the primary economic environment in which an entity operates. The functional currency of most foreign subsidiaries is mainly the U.S. dollar. Foreign currency transactions - Transactions denominated in foreign currencies are initially recorded in the functional currency of the related entity using the exchange rates in effect at the date of the transaction. Monetary assets and liabilities denominated in foreign currencies are translated using the closing exchange rates. Any resulting exchange difference is recognized in income except for exchange differences related to retirement benefits asset and liability, as well as financial liabilities designated as hedges of the Corporation's net investments in foreign operations, which are recognized in OCl. Non-monetary assets and liabilities denominated in foreign currencies and measured at historical cost are translated using historical exchange rates, and those measured at fair value are translated using the exchange rate in effect at the date the fair value is determined. Revenues and expenses are translated using the average exchange rates for the period or the exchange rate at the date of the transaction for significant items. Foreign operations - Assets and liabilities of foreign operations whose functional currency is other than the U.S. dollar are translated into U.S. dollars using closing exchange rates. Revenues and expenses, as well as cash flows, are translated using the average exchange rates for the period. Translation gains or losses are recognized in OCl and are reclassified in income on disposal or partial disposal of the investment in the related foreign operation. 106 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 Litigation - A provision for litigation is recorded in case of legal actions, governmental investigations or proceedings when it is probable that an outflow of resources will be required to settle the obligation and the cost can be reliably estimated. Non-current assets (or disposal group) held for sale and discontinued operations Non-current assets (or disposal groups) are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather than through continuing use. The criteria for held for sale classification is regarded as met only when the sale is highly probable, and the asset or disposal group is available for immediate sale in its present condition. Actions required to complete the sale should indicate that it is unlikely that significant changes to the sale will be made or that the decision to sell will be withdrawn. Management must be committed to the plan to sell the asset and the sale expected to be completed within one year from the date of the classification. Non-current assets classified as held for sale are measured at the lower of their carrying amount and fair value less costs to sell. Costs to sell are the incremental costs directly attributable to the disposal of an asset or a disposal group, excluding finance costs and income tax expense. Property, plant and equipment and intangible assets are not depreciated or amortized once classified as held for sale. Interest and other expenses attributable to the liabilities of a disposal group classified as held for sale continue to be recognized. The assets and liabilities of a disposal group classified as held for sale are presented separately as current items in the statement of financial position. A discontinued operation is a component of the entity that has been disposed of or is classified as held for sale and that represents a separate major line of business or geographical area of operations, is part of a single co-ordinated plan to dispose of such a line of business or area of operations, or is a subsidiary acquired exclusively with a view to resale. Discontinued operations are excluded from the results of continuing operations and are presented as a single amount as net income (loss) after tax from discontinued operations in the consolidated statements of income. Share-based payments Equity-settled share-based payment plans - Equity-settled share-based payments are measured at fair value at the grant date. For the PSUs, DSUs and RSUs, the value of the compensation is measured based on the closing price of a Class B Share (subordinate voting) of the Corporation on the Toronto Stock Exchange adjusted to take into account the terms and conditions upon which the shares were granted, if any, and is based on the PSUs, DSUs and RSUs that are expected to vest. For share option plans, the value of the compensation is measured using a Black-Scholes option pricing model. The effect of any change in the number of options, PSUs, DSUs and RSUs that are expected to vest is accounted for in the period in which the estimate is revised. Compensation expense is recognized on a straight-line basis over the vesting period, with a corresponding increase in contributed surplus. Any consideration paid by plan participants on the exercise of stock options is credited to share capital. Cash-settled share-based payments - Cash-settled share-based payments are measured at fair value at the grant date with a corresponding liability. Until the liability is settled, the fair value of the liability is remeasured at the end of each reporting period and at the date of settlement, with any changes in fair value recognized in income. Limited PSUs, DSUs and RSUs are cash-settled share-based payments, for which the value of the compensation is measured based on the closing price of a Class B Share (subordinate voting) of the Corporation on the Toronto Stock Exchange adjusted to take into account the terms and conditions upon which the shares were granted, if any, and is based on the PSUs, DSUs and RSUs that are expected to vest. Employee share purchase plan - The Corporation's contributions to the employee share purchase plan are measured at cost and accounted for in the same manner as the related employee payroll costs. Compensation expense is recorded at the time of the employee contribution. 116 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 d) amortized cost. Financial instruments are subsequently measured at amortized cost, unless they are classified as FVOCl or FVTP\&L or designated as FVTP\&L, in which case they are subsequently measured at fair value. A financial asset is derecognized when the rights to receive cash flows from the asset have expired, or the Corporation has transferred its rights to receive cash flows from the asset and either: a) the Corporation has transferred substantially all the risks and rewards of the asset, or b) the Corporation has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset. For transactions where it is not obvious whether the Corporation has transferred or retained substantially all the risks and rewards of ownership, the Corporation performs a quantitative analysis to compare its exposure to the variability in asset cash flows before and after the transfer. Judgment is applied in determining a number of reasonably possible scenarios that reflect the expected variability in the amount and timing of net cash flows, and then in assigning each scenario a probability with greater weighting being given to those outcomes which are considered more likely to occur. When the transfer of a customer receivable results in the derecognition of the asset, the corresponding cash proceeds are classified as cash flows from operating activities. A financial liability is derecognized when the obligation under the liability is discharged, cancelled or expires. When an existing liability is replaced by another from the same creditor on substantially different terms, or the terms of the liability are substantially modified, such an exchange or modification is treated as the derecognition of the original liability and the recognition of a new liability. The difference in the respective carrying amounts is recognized in the statement of income. a) Financial instruments classified at amortized cost Cash and cash equivalents - Cash and cash equivalents consist of cash and highly liquid investments held with investment-grade financial institutions and money market funds, with maturities of three months or less from the date of acquisition. Other financial instruments - Trade and other receivables, restricted cash, aircraft loans, certain receivable from MHI and certain other financial assets are all financial assets measured at amortized cost using the effective interest rate method less any impairment losses. Trade and other payables, long-term debt, certain government refundable advances, vendor non-recurring costs and certain other financial liabilities are measured at amortized cost using the effective interest rate method. Trade receivables as well as other financial assets are subject to impairment review. Trade receivables, contract assets and lease receivables are reviewed for impairment based on the simplified approach which measures the loss allowance at an amount equal to the lifetime expected credit losses. For other financial assets for which the credit risk has not increased significantly since initial recognition, the loss allowance is measured at an amount equal to 12-month expected credit losses. For other financial assets for which the credit risk has increased significantly since initial recognition, the loss allowance is measured at an amount equal to the lifetime expected credit losses. b) Financial instruments designated as FVTP\&L Financial instruments may be designated on initial recognition as FVTP\&L if either of the following criteria are met: (i) the designation eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise arise from measuring the financial asset or liability or recognizing the gains and losses on them on a different basis; or (ii) a group of financial liabilities or financial assets and financial liabilities is managed and its performance is evaluated on a fair value basis, in accordance with a documented risk management or investment strategy. The Corporation has designated as FVTP\&L, trade-in commitments, lease subsidies, liabilities related to RASPRO assets and certain Government refundable advances. Subsequent changes in fair value of such financial instruments are recorded in other expense (income), except for the fair value changes arising from a change in interest rates which are recorded in financing expense or financing income. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 109 The Corporation's PP\&E, right-of-use assets and intangible assets are allocated to countries, as follows: (1) PP\&E, right-of-use assets and intangible assets, excluding goodwill, are attributed to countries based on the location of the assets. Goodwill is attributed to countries based on the Corporation's allocation of the related purchase price. 5. RESEARCH AND DEVELOPMENT R\&D expense, net of government assistance, was as follows, for fiscal years: 6. OTHER EXPENSE (INCOME) Other expense (income) was as follows, for fiscal years: (1) Excludes those presented in special items. (2) Includes net loss (gain) on certain financial instruments measured at fair value and changes in estimates related to certain provisions or certain financial instruments, excluding losses (gains) arising from changes in interest rates. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 121 The amortization methods and estimated useful lives are reviewed on a regular basis, at least annually, and changes are accounted for prospectively. The amortization expense for aerospace program tooling is recorded in R\&D expense and for other intangible assets is recorded in cost of sales, SG\&A or R\&D expense based on the function of the underlying asset. The Corporation does not have indefinite-life intangible assets, other than goodwill. Goodwill represents the excess of the purchase price over the fair value of the identifiable net assets acquired in a business acquisition. After initial recognition, goodwill is measured at cost less any accumulated impairment losses. Borrowing costs Borrowing costs consist of interest on long-term debt and other costs that the Corporation incurs in connection with the borrowing of funds. Borrowing costs directly attributable to the acquisition, construction or production of a qualifying asset are capitalised as part of the cost of that asset and are deducted from the financing expense to which they relate. The Corporation suspends the capitalisation of borrowing costs during extended periods in which it suspends active development of a qualifying asset. All other borrowing costs are expensed in the period they occur. Impairment of PP\&E, right-of-use assets and intangible assets The Corporation assesses at each reporting date whether there are indicators that an item of PP\&E, right-of-use asset or intangible asset may be impaired. If any indication exists based on internal and external factors, the Corporation estimates the recoverable amount of the individual asset, when possible. When the asset does not generate cash inflows that are largely independent of those from other assets or group of assets, the asset is tested at the CGU level. Most of the Corporation's non-financial assets are tested for impairment at the CGU level. The recoverable amount of an asset or CGU is the higher of its fair value less costs to sell and its value in use. - The fair value less costs to sell reflects the amount the Corporation could obtain from the asset's disposal in an arm's length transaction between knowledgeable, willing parties, after deducting the costs of disposal. If there is no binding sales agreement or active market for the asset, the fair value is assessed by using appropriate valuation models dependent on the nature of the asset or CGU, such as discounted cash flow models. - The value in use is calculated using estimated net cash flows, with detailed projections generally over a five-year period and subsequent years being extrapolated using a growth assumption. The estimated net cash flows are discounted to their present value using a discount rate before income taxes that reflects current market assessments of the time value of money and the risk specific to the asset or CGU. When the recoverable amount is less than the carrying value of the related asset or CGU, the related assets are written down to their recoverable amount and an impairment loss is recognized in net income. For PP\&E and intangible assets other than goodwill, an assessment is made at each reporting date as to whether there is any indication that previously recognized impairment losses may no longer exist or may have decreased. If such indication exists, the Corporation estimates the recoverable amount of the asset or CGU. A previously recognized impairment loss is reversed only if there has been a change in the estimates used to determine the recoverable amount since the last impairment loss was recognized. A reversal of an impairment loss reflects an increase in the estimated service potential of an asset. The reversal of impairment losses is limited to the amount that would bring the carrying value of the asset or CGU to the amount that would have been recorded, net of amortization, had no impairment loss been recognized for the asset or CGU in prior years. Such reversal is recognized to income in the same line item where the original impairment was recognized. Intangible assets not yet available for use and goodwill are reviewed for impairment at least annually or more frequently if circumstances such as significant declines in expected sales, earnings or cash flows indicate that it is more likely than not that the asset or CGU might be impaired. Impairment losses relating to goodwill are not reversed in future periods. 114 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 12. FINANCIAL INSTRUMENTS Net gains (losses) on financial instruments recognized in income were as follows, for fiscal years: (1) Gains (losses) related to the regional aircraft securitization program assets (RASPRO), lease subsidies and their related back-to-back agreement with MHI are presented on a net basis in financial assets required to be classified as FVTP\&L. Carrying amounts and fair value of financial instruments The classification of financial instruments and their carrying amounts and fair value of financial instruments were as follows, as at: BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 127 Deferred income taxes The significant components of the Corporation's deferred income tax asset and liability were as follows, as at: The changes in the net deferred income tax asset were as follows, for the fiscal years: (1) Includes mainly foreign exchange rate effects. The net operating losses carried forward and deductible temporary differences for which deferred tax assets have not been recognized amounted to $11,623 million as at December 31,2022 , of which $342 million relates to retirement benefits that will reverse through OCI (\$11,659 million as at December 31, 2021 of which $898 million relates to retirement benefits that will reverse through OCl). Of these amounts, approximately $3,519 million as at December 31,2022 has no expiration date ($4,351 million as at December 31,2021) and approximately $131 million relates to the Corporation's operations in Germany where a minimum income tax is payable on 40% of taxable income (\$194 million as at December 31, 2021), \$136 million relates to the Corporation's operations in U.K. where a minimum income tax is payable on 50% of taxable income ( $90 million as at December 31,2021 ) and $7 million relates to the Corporation's operations in France where a minimum income tax is payable on 50% of taxable income ( $4 million as at December 31, 2021). In addition, the Corporation has $1,076 million of unused investment tax credits, most of which can be carried forward for 20 years and $1,115 million of net capital losses carried forward for which deferred tax assets have not been recognized ($1,341 million and $757 million as at December 31,2021). Net capital losses can be carried forward indefinitely and can only be used against future taxable capital gains. Net deferred tax assets of \$356 million were recognized as at December 31, 2022 (\$246 million as at December 31, 2021) in jurisdictions that incurred losses this fiscal year or the preceding fiscal year. Based upon the level of historical income, projections for future income, forecasted gain on closing of transactions, if any, and prudent tax planning strategies, management believes it is probable the Corporation will realize the benefits of these deductible differences and operating tax losses carried forward. See Note 3 - Use of estimates and judgment for more information on how the Corporation determines the extent to which deferred income tax assets are recognized. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022125 13. CASH AND CASH EQUIVALENTS Cash and cash equivalents were as follows, as at: 14. TRADE AND OTHER RECEIVABLES Trade and other receivables were as follows, as at: (1) Of which \$14 million and \$18 million are denominated in euros and other foreign currencies, respectively, as at December 31 , 2022 (\$14 million and \$22 million, respectively, as at December 31, 2021). (2) Of which a gross amount of $10 million of trade receivables are individually impaired as at December 31, 2022 ( $15 million as at December 31, 2021). The factors that the Corporation considers to classify trade receivables as impaired are as follows: the customer is in bankruptcy or under administration, payments are in dispute, or payments are in arrears. Further information on financial risk is provided in Note 33 - Financial risk management. Allowance for doubtful accounts - Changes in the allowance for doubtful accounts were as follows, for fiscal years: BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 129 15. CONTRACT BALANCES Contract assets represent cost incurred and recorded margins on service contracts in the amount of $67 million and \$55 million as at December 31, 2022 and December 31, 2021, respectively. Contract liabilities were as follows, as at: Revenues recognized were as follows, for fiscal vears: 16. INVENTORIES Inventories were as follows, as at: The amount of inventories recognized as cost of sales totaled $4,898 million for fiscal year 2022 ( $4,558 million for fiscal year 2021). This amount includes $27 million of write-downs for fiscal year 2022 (\$54 million for fiscal year 2021) and \$7 million of reversal of write-downs for fiscal year 2022 (\$16 million for fiscal year 2021). For the year ended December 31, 2022, the Corporation recorded wage subsidies in the amount of $33 million in cost of sales (\$143 million for fiscal year 2021) and nil in SG\&A (\$9 million for fiscal year 2021). As at December 31, 2022, there were no amount remaining as a reduction of inventory related to wage subsidies. 17. BACKLOG The following table presents the aggregate amount of the revenues expected to be realized in the future from partially or fully unsatisfied performance obligations as we perform under contracts at delivery or recognized over time. The amounts disclosed below represent the value of firm orders only. Such orders may be subject to future modifications that might impact the amount and/or timing of revenue recognition. The amounts disclosed below do not include unexercised options or letters of intent. Revenues from continuing operations expected to be recognized in: 130 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 Offsetting financial assets and financial liabilities The Corporation is subject to enforceable master netting agreements related mainly to its derivative financial instruments and cash and cash equivalents which contain a right of set-off in case of default, insolvency or bankruptcy. The amounts that are subject to the enforceable master netting agreements, but which do not meet some or all of the offsetting criteria, are as follows as at: Derivatives and hedging activities The carrying amounts of all derivative and non-derivative financial instruments in a hedge relationship were as follows, as at: (1) The maximum length of time of derivative financial instruments hedging the Corporation's exposure to the variability in future cash flows for anticipated transactions is 19 months as at December 31, 2022. (2) Held as economic hedges, except for embedded derivative financial instruments. The methods and assumptions used to measure the fair value of financial instruments are described in Note 34 Fair value of financial instruments. 128 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 BOMBARDIER INC. CONSOLIDATED STATEMENTS OF INCOME For the fiscal years ended December 31 (in millions of U.S. dollars, except per share amounts) operations for fiscal year 2022 principally relate to change in estimates of a provision for professional fees. (2) As of June 13, 2022, Bombardier proceeded with a Share Consolidation of the Corporation's Class A shares and Class B shares (subordinate voting) at a consolidation ratio of 25-for-1. As a result, the comparative periods have been retroactively restated to reflect the Share Consolidation. The notes are an integral part of these consolidated financial statements. 100 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 The exchange rates for the major currencies used in the preparation of the consolidated financial statements were as follows: Revenue recognition Manufacturing and Other - Revenues from the sale of new aircraft are considered a single performance obligation and are recognized at delivery, which is the point in time when the customer has obtained control of the aircraft and the Corporation has satisfied its performance obligation. All costs incurred or to be incurred in connection with the sale, including warranty costs and sales incentives, are charged to cost of sales or as a deduction from revenues at the time revenue is recognized. For the bill-and-hold arrangements in respect of new aircraft, if any, revenue is recognized when the customer has obtained control of the aircraft and the customer has requested the arrangement, the aircraft is separately identified as belonging to the customer, the aircraft is ready for physical transfer to the customer and the Corporation does not have the ability to use the product or direct it to another customer. The Corporation accounts for a significant financing component on orders where timing of cash receipts and revenue recognition differ substantially. There are certain orders related to aircraft where advances were received well before expected delivery and therefore a financing component has been accounted for separately. The result is that interest expense is accrued during the advance period and the transaction price will be increased by a corresponding amount. Revenues from the sale of pre-owned aircraft are recognized at the point in time when the customer has obtained control of the promised asset and the Corporation has satisfied the performance obligation. Services - Aftermarket services are generally recorded over time. The measure of progress toward complete satisfaction of the performance obligation is generally determined by comparing the actual costs incurred to the total costs anticipated for the entire contract. The expected benefits to be received are generally limited to the revenues from the associated contract. Spare parts are recognized at the point in time when the customer has obtained control of the promised asset and the Corporation has satisfied the performance obligation. Other - Revenues earned by the Corporation on its contract with ACLP for the A220 program are recognized at delivery. Contract balances Contract related balances comprise of contract assets and contract liabilities presented separately in the consolidated statements of financial position. Contract assets - Are recognized when goods or services are transferred to customers before consideration is received or before the Corporation has an unconditional right to payment for performance completed to date. Contract assets are subsequently transferred to receivables when the right of payment becomes unconditional. Contract assets comprise cost incurred and recorded margins in excess of progress billings on service contracts. Contract liabilities - Are recognized when amounts are received from customers in advance of transfer of goods or services. Contract liabilities are subsequently recognized in revenue as or when the Corporation performs under contracts. Contract liabilities comprise advances on aerospace programs and other deferred revenues related to operation and maintenance of systems. A net position of contract asset or contract liability is determined for each contract. The cash flows in respect of advances are classified as cash flows from operating activities. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 107 BOMBARDIER INC. CONSOLIDATED STATEMENTS OF FINANCIAL POSITION As at The notes are an integral part of these consolidated financial statements. On behalf of the Board of Directors Pierre Beaudoin Diane Giard Director Director 102 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022 Provisions Provisions are recognized when the Corporation has a present legal or constructive obligation as a result of a past event, it is probable that an outflow of resources will be required to settle the obligation and the cost can be reliably estimated. These liabilities are presented as provisions when they are of uncertain timing or amount. Provisions are measured at their present value. Product warranties - A provision for assurance type warranties is recorded in cost of sales when the revenue for the related product is recognized. The interest component associated with product warranties, when applicable, is recorded in financing expense. The cost is estimated based on a number of factors, including the historical warranty claims and cost experience, the type and duration of warranty coverage, the nature of products sold and in service and counter-warranty coverage available from