Answered step by step

Verified Expert Solution

Question

1 Approved Answer

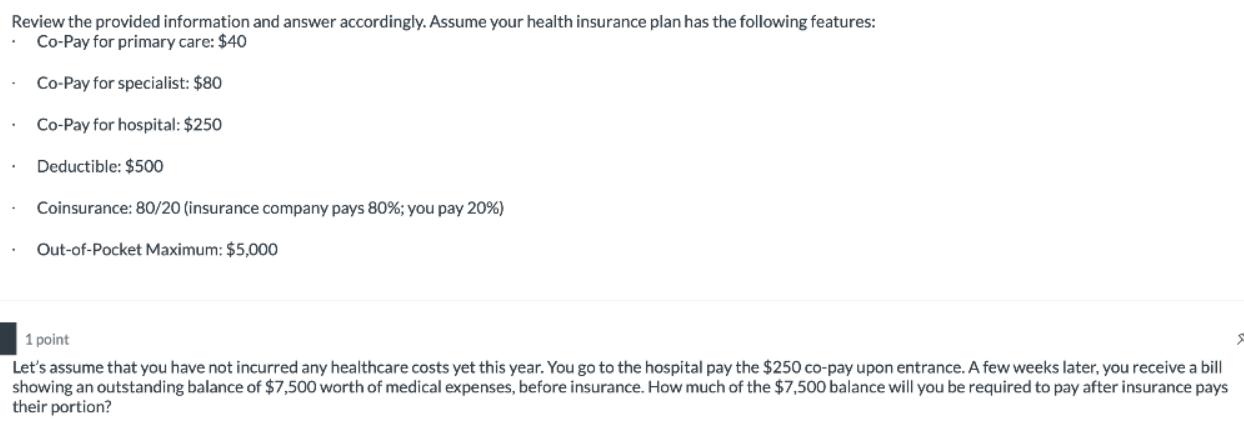

Review the provided information and answer accordingly. Assume your health insurance plan has the following features: Co-Pay for primary care: $40 Co-Pay for specialist:

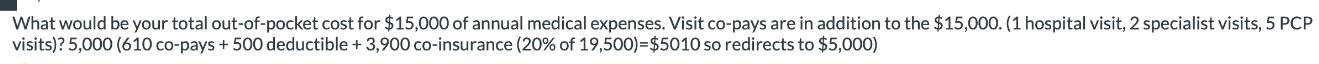

Review the provided information and answer accordingly. Assume your health insurance plan has the following features: Co-Pay for primary care: $40 Co-Pay for specialist: $80 Co-Pay for hospital: $250 Deductible: $500 Coinsurance: 80/20 (insurance company pays 80%; you pay 20%) Out-of-Pocket Maximum: $5,000 1 point Let's assume that you have not incurred any healthcare costs yet this year. You go to the hospital pay the $250 co-pay upon entrance. A few weeks later, you receive a bill showing an outstanding balance of $7,500 worth of medical expenses, before insurance. How much of the $7,500 balance will you be required to pay after insurance pays their portion? What would be your total out-of-pocket cost for $15,000 of annual medical expenses. Visit co-pays are in addition to the $15,000. (1 hospital visit, 2 specialist visits, 5 PCP visits)? 5,000 (610 co-pays + 500 deductible + 3,900 co-insurance (20% of 19,500)=$5010 so redirects to $5,000) What would be your total out-of-pocket cost for $40,000 of annual medical expenses? Visit co-pays are in addition to the $40,000 (2 hospital visits, 3 specialist visits, 6 PCP visits)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate how much you will be required to pay after insurance pays their portion we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started