Review the retirement planning section of the financial plan, which is attached in the link below this section. Summarize it. Give your opinion on the status of the sample clients' retirement. How are they doing? What suggestions do you think could be made? What other ideas do you have for the client if it appears that there might be a shortfall? Be as specific as you can as the clients don't fully understand how these matters work. They have to be educated as to the specific details on what this is all about. Make some recommendations and outline them for the clients.

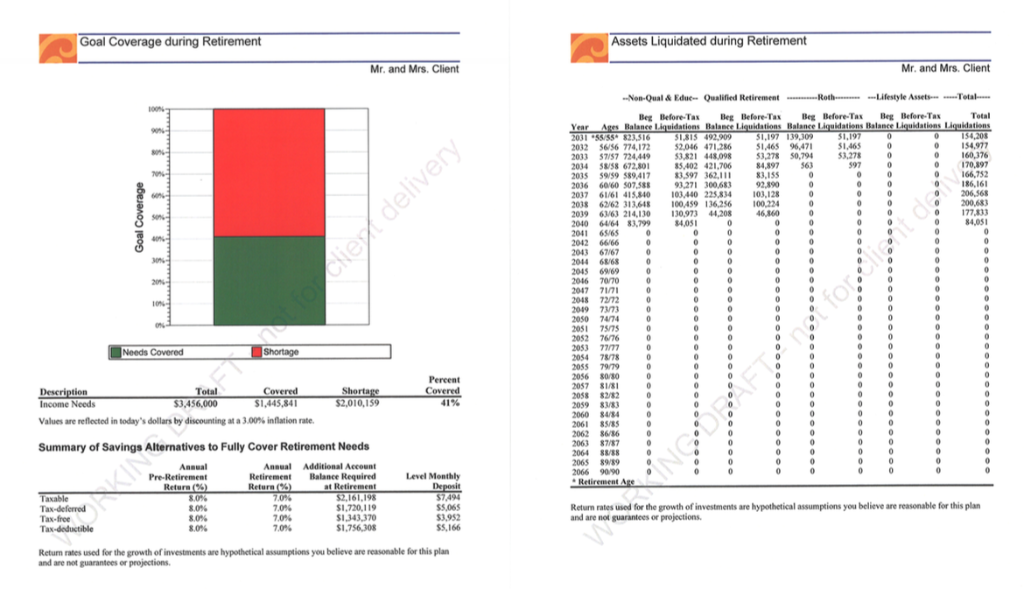

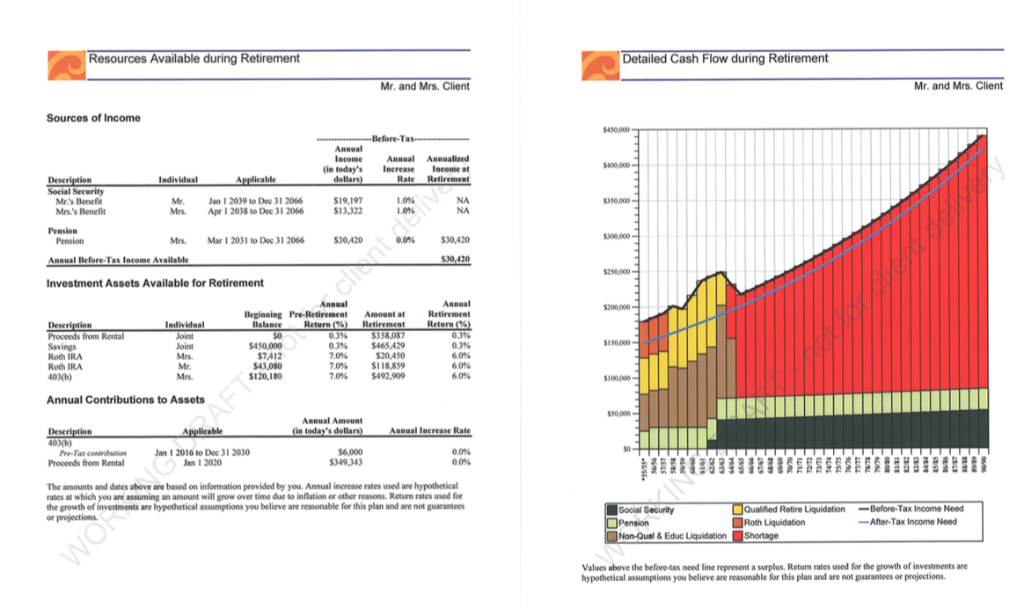

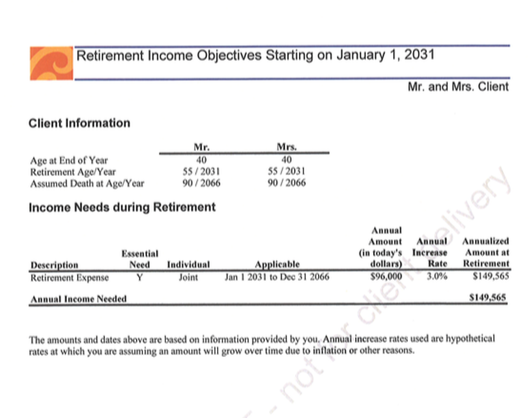

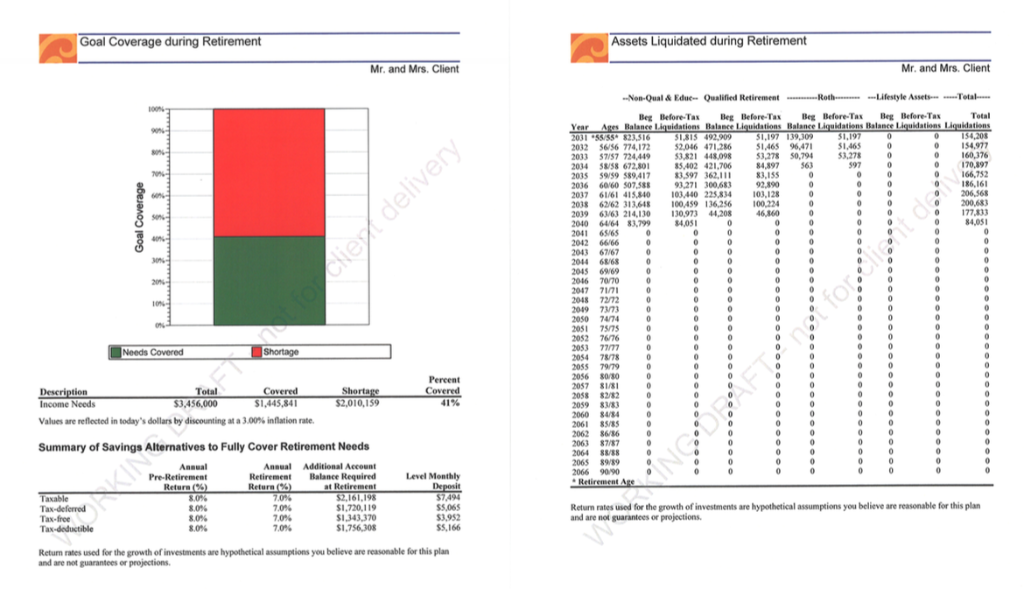

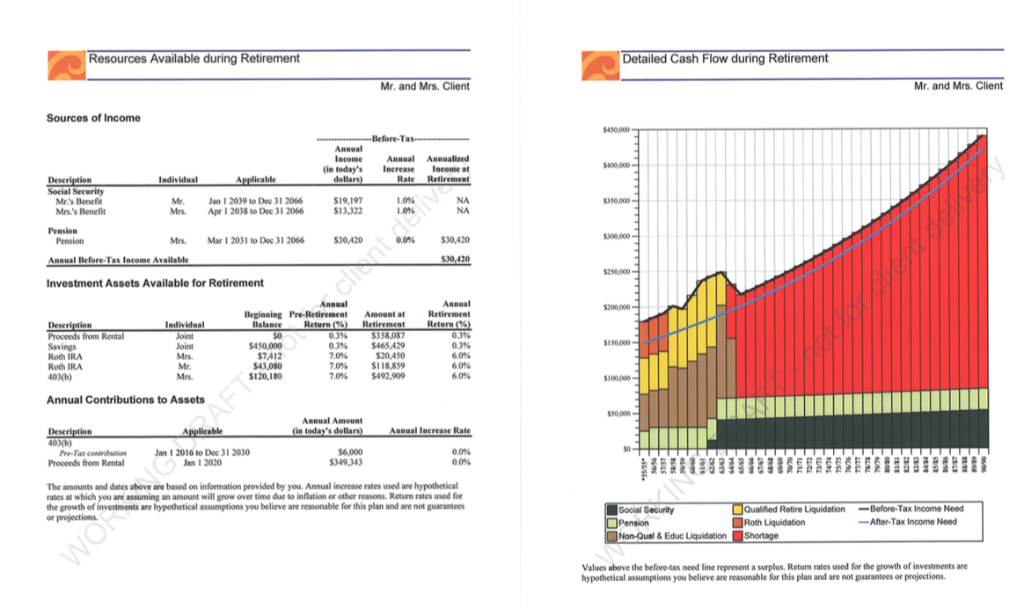

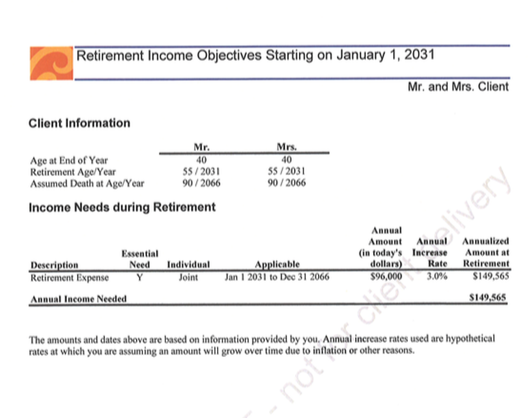

Assets Liquidated during Retirement age during Retirement Mr. and Mrs. Client Mr. and Mrs. Client Non-Qual & Edue-Qualified Retirement Beg Before-TaxBeg Before- Tas Beg Before-Tax Beg Before-Tas Balance 2037 6/61 415,840 103,440 225,834 103,128 39 663 214,130 130973 44208 Needs Covered Percent Covered 41% Total $2,010,159 Income Needs $1,445,841 Values are reflected in today's dollars by discounting at a 3.00% inflation rate. Summary of Savings Alternatives to Fully Cover Retirement Needs Anul Additional Account Retiremet Balance Required Level Monthly Return (% 70% Return rates used for the growth of investments are hypothetical assumptions you believe are reasonable for this plan 1,720,119 1,343,370 80% 70% Tax-free Return rates used for the growth of investments are hypothetical assumptions you believe are reasonable for this plan and are not guarantees er projections I Resources Available during Retirement Flow during Retirement Detailed Mr. and Mrs. Client Mr. and Mrs. Client Sources of Income Annual Annualized (in today's Increase Income at Rate Retirement Individual able Social Security Mr.'s Benefit Mrs.'s Benefit Mr. Mrs. Jan 1 2039 to Dee 31 2066 Apr 1 2038 to Dec 31 2066 19,197 13,322 1.0% 19% NA NA s30,420 Mrs. Mar 1 2031 to Dec 31 2066 $30,420 30,420 Annual Before-Tas Inceme Available Investment Assets Available for Retirement Individual Return (%) Retirement Retura (% Balance Proceeds from Rental $150,000 450,000 7.412 $43,080 $120,180 0.3% 7.0% 7.0% 7.0% $465,429 $20,450 $118,859 $492.909 0.3% Roth IRA Roth IRA 6,0% Mrs. Annual Contributions to Assets $50.000 Asnual Amount teday's dolla nnual Increase Ra ble 403(b) 00% 00% Jan 1 2016 to Dee 31 2030 Jan 1 2020 Pre-Tax coninibution Proceeds from Rental 349,343 The amounts and dates above are based on information provided by you. Annual increase rates used are hypothetical rates at which you are assuming an amount will grow over time due to the growth of investments are hypothetical assumptions you believe are reasonable for this plan and are not guarantees or projections inflation or other reasons, Return rates used for Qualified Retire Liquidation Before-Tax Income Need Roth Liquidation Social Security After-Tax Income Need Non-Qual & Educ Liquidation Shortage Values above the before-tax need line represent a surplus, Retum rates used for the growth of investments are hypothetical assumptions you believe are reasonable for this plan and are not guarantees or projections. Retirement Income Objectives Starting on January 1, 2031 Mr. and Mrs. Client Client Information Mrs. 40 55/2031 90/2066 Age at End of Year Retirement Age/Year Assumed Death at Age/Year 40 5S/ 2031 90/2066 Income Needs during Retirement Annual Amount Annual Annualized (in today's Increase Amount at Essential Applicable Jan 1 2031 to Dee 31 2066 dollars $96,000 Rate Retirement 3.0% Need Individual Retirement Expense Joint $149.56S Annual Income Needed The amounts and dates above are based on information provided by you. Annual increase rates used are hypothetical rates at which you are assuming an amount will grow over time due to inflation or other reasons. Assets Liquidated during Retirement age during Retirement Mr. and Mrs. Client Mr. and Mrs. Client Non-Qual & Edue-Qualified Retirement Beg Before-TaxBeg Before- Tas Beg Before-Tax Beg Before-Tas Balance 2037 6/61 415,840 103,440 225,834 103,128 39 663 214,130 130973 44208 Needs Covered Percent Covered 41% Total $2,010,159 Income Needs $1,445,841 Values are reflected in today's dollars by discounting at a 3.00% inflation rate. Summary of Savings Alternatives to Fully Cover Retirement Needs Anul Additional Account Retiremet Balance Required Level Monthly Return (% 70% Return rates used for the growth of investments are hypothetical assumptions you believe are reasonable for this plan 1,720,119 1,343,370 80% 70% Tax-free Return rates used for the growth of investments are hypothetical assumptions you believe are reasonable for this plan and are not guarantees er projections I Resources Available during Retirement Flow during Retirement Detailed Mr. and Mrs. Client Mr. and Mrs. Client Sources of Income Annual Annualized (in today's Increase Income at Rate Retirement Individual able Social Security Mr.'s Benefit Mrs.'s Benefit Mr. Mrs. Jan 1 2039 to Dee 31 2066 Apr 1 2038 to Dec 31 2066 19,197 13,322 1.0% 19% NA NA s30,420 Mrs. Mar 1 2031 to Dec 31 2066 $30,420 30,420 Annual Before-Tas Inceme Available Investment Assets Available for Retirement Individual Return (%) Retirement Retura (% Balance Proceeds from Rental $150,000 450,000 7.412 $43,080 $120,180 0.3% 7.0% 7.0% 7.0% $465,429 $20,450 $118,859 $492.909 0.3% Roth IRA Roth IRA 6,0% Mrs. Annual Contributions to Assets $50.000 Asnual Amount teday's dolla nnual Increase Ra ble 403(b) 00% 00% Jan 1 2016 to Dee 31 2030 Jan 1 2020 Pre-Tax coninibution Proceeds from Rental 349,343 The amounts and dates above are based on information provided by you. Annual increase rates used are hypothetical rates at which you are assuming an amount will grow over time due to the growth of investments are hypothetical assumptions you believe are reasonable for this plan and are not guarantees or projections inflation or other reasons, Return rates used for Qualified Retire Liquidation Before-Tax Income Need Roth Liquidation Social Security After-Tax Income Need Non-Qual & Educ Liquidation Shortage Values above the before-tax need line represent a surplus, Retum rates used for the growth of investments are hypothetical assumptions you believe are reasonable for this plan and are not guarantees or projections. Retirement Income Objectives Starting on January 1, 2031 Mr. and Mrs. Client Client Information Mrs. 40 55/2031 90/2066 Age at End of Year Retirement Age/Year Assumed Death at Age/Year 40 5S/ 2031 90/2066 Income Needs during Retirement Annual Amount Annual Annualized (in today's Increase Amount at Essential Applicable Jan 1 2031 to Dee 31 2066 dollars $96,000 Rate Retirement 3.0% Need Individual Retirement Expense Joint $149.56S Annual Income Needed The amounts and dates above are based on information provided by you. Annual increase rates used are hypothetical rates at which you are assuming an amount will grow over time due to inflation or other reasons