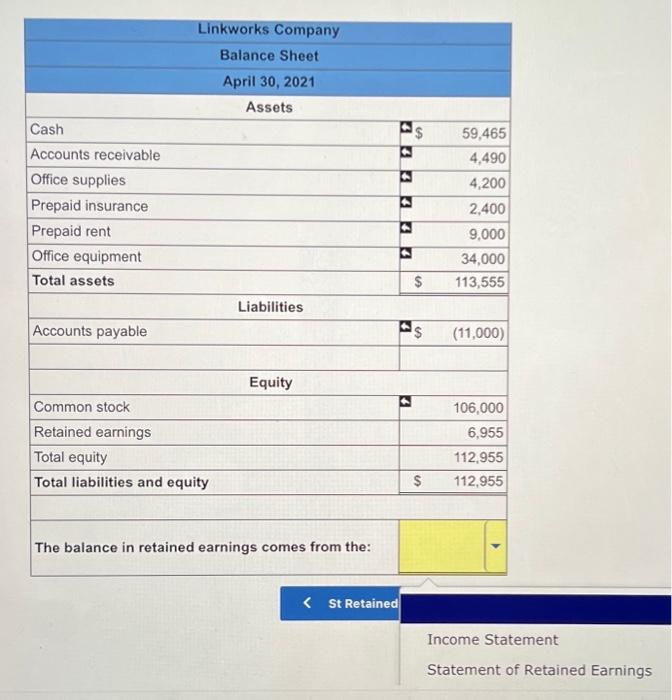

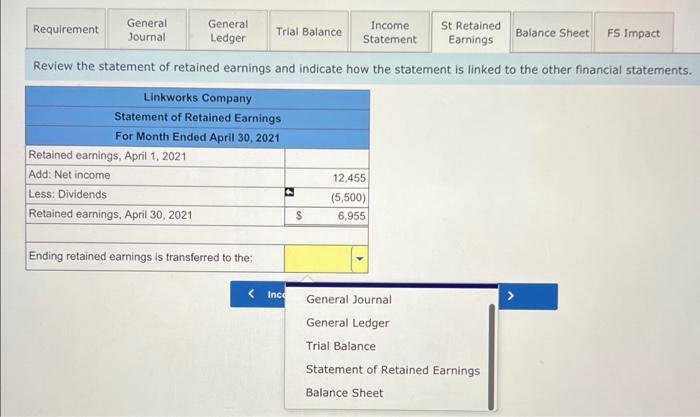

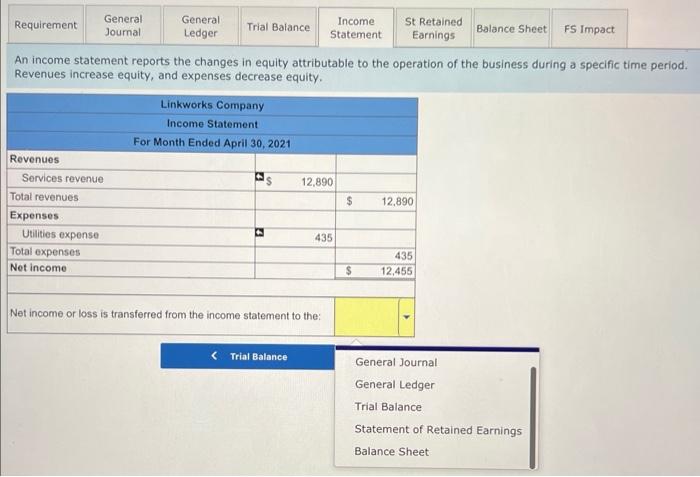

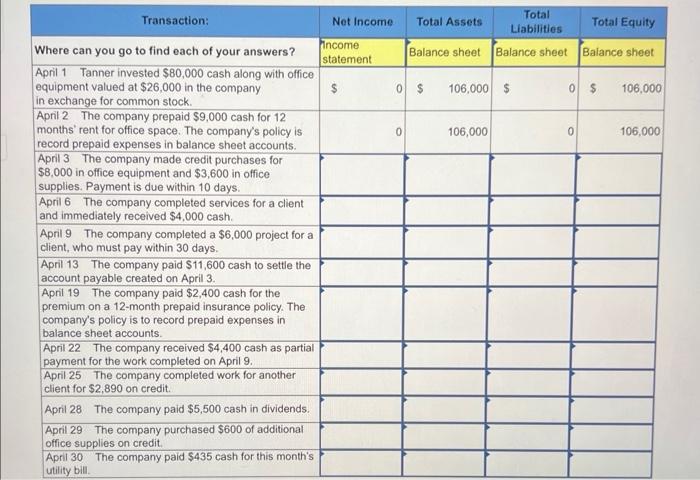

Review the statement of retained earnings and indicate how the statement is linked to the other financial statements \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Linkworks Company } \\ \hline \multicolumn{3}{|l|}{ Balance Sheet } \\ \hline \multicolumn{3}{|l|}{ April 30, 2021} \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline Cash & N$ & 59,465 \\ \hline Accounts receivable & & 4,490 \\ \hline Office supplies & E & 4,200 \\ \hline Prepaid insurance & & 2,400 \\ \hline Prepaid rent & & 9,000 \\ \hline Office equipment & a & 34,000 \\ \hline Total assets & $ & 113,555 \\ \hline \multicolumn{3}{|l|}{ Liabilities } \\ \hline Accounts payable & A$ & (11,000) \\ \hline \multicolumn{3}{|l|}{ Equity } \\ \hline Common stock & N & 106,000 \\ \hline Retained earnings & & 6,955 \\ \hline Total equity & & 112,955 \\ \hline Total liabilities and equity & $ & 112,955 \\ \hline The balance in retained earnings comes from the: & & \\ \hline \end{tabular} Income Statement Statement of Retained Earnings \begin{tabular}{|c|c|c|c|c|} \hline Transaction: & Net Income & Total Assets & \begin{tabular}{l} Total \\ Liabilities \end{tabular} & Total Equity \\ \hline Where can you go to find each of your answers? & \begin{tabular}{l} Income \\ statement \end{tabular} & Balance sheet & Balance sheet & Balance sheet \\ \hline \begin{tabular}{l} April 1 Tanner invested $80,000 cash along with office \\ equipment valued at $26,000 in the company \\ in exchange for common stock. \end{tabular} & $ & 106,000 & 0 & 106,000 \\ \hline \begin{tabular}{l} April 2 The company prepaid $9,000 cash for 12 \\ months' rent for office space. The company's policy is \\ record prepaid expenses in balance sheet accounts. \end{tabular} & 0 & 106,000 & 0 & 106,000 \\ \hline \begin{tabular}{l} April 3 The company made credit purchases for \\ $8,000 in office equipment and $3,600 in office \\ supplies. Payment is due within 10 days. \end{tabular} & & & & \\ \hline \begin{tabular}{l} April 6 The company completed services for a client \\ and immediately received $4,000 cash. \end{tabular} & & & & \\ \hline \begin{tabular}{l} April 9 The company completed a $6,000 project for a \\ client, who must pay within 30 days. \end{tabular} & & & & \\ \hline \begin{tabular}{l} April 13 The company paid $11,600 cash to settle the \\ account payable created on April 3 . \end{tabular} & & & & \\ \hline \begin{tabular}{l} April 19 The company paid $2,400 cash for the \\ premium on a 12 -month prepaid insurance policy. The \\ company's policy is to record prepaid expenses in \\ balance sheet accounts. \end{tabular} & & & & \\ \hline \begin{tabular}{l} April 22 The company received $4,400 cash as partial \\ payment for the work completed on April 9 . \end{tabular} & & & & \\ \hline \begin{tabular}{l} April 25 The company completed work for another \\ client for $2,890 on credit. \end{tabular} & & & & \\ \hline April 28 The company paid $5,500 cash in dividends. & & & & \\ \hline \begin{tabular}{l} April 29 The company purchased $600 of additional \\ office supplies on credit. \end{tabular} & & & & \\ \hline \begin{tabular}{l} April 30 The company paid $435 cash for this month's \\ utility bill. \end{tabular} & & & & \\ \hline \end{tabular} An income statement reports the changes in equity attributable to the operation of the business during a specific time period. Revenues increase equity, and expenses decrease equity