Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reville LLP is auditing the Year 1 financial records of Renschler LLC, a publicly traded manufacturing company. Renschler has a December 31 year-end. Reville

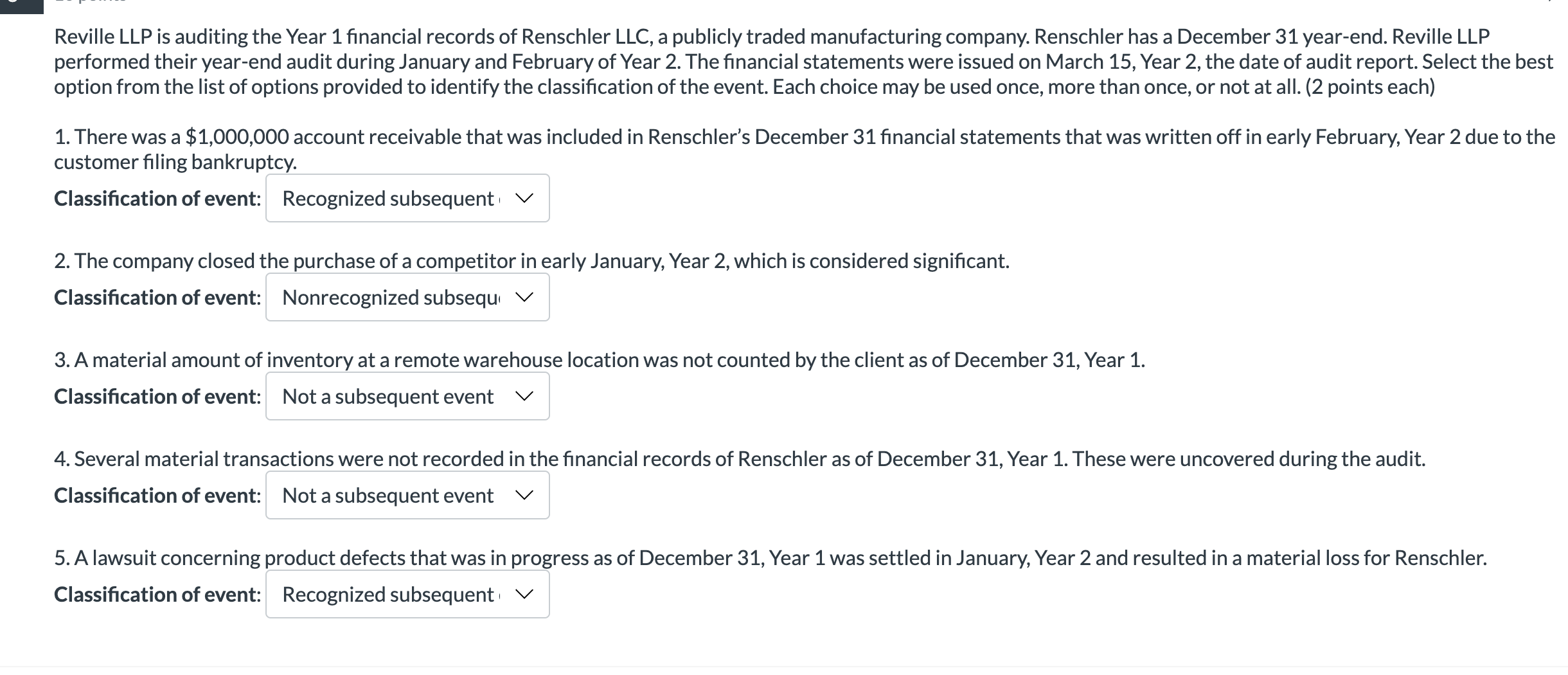

Reville LLP is auditing the Year 1 financial records of Renschler LLC, a publicly traded manufacturing company. Renschler has a December 31 year-end. Reville LLP performed their year-end audit during January and February of Year 2. The financial statements were issued on March 15, Year 2, the date of audit report. Select the best option from the list of options provided to identify the classification of the event. Each choice may be used once, more than once, or not at all. (2 points each) 1. There was a $1,000,000 account receivable that was included in Renschler's December 31 financial statements that was written off in early February, Year 2 due to the customer filing bankruptcy. Classification of event: Recognized subsequent 2. The company closed the purchase of a competitor in early January, Year 2, which is considered significant. Classification of event: Nonrecognized subsequ 3. A material amount of inventory at a remote warehouse location was not counted by the client as of December 31, Year 1. Classification of event: Not a subsequent event 4. Several material transactions were not recorded in the financial records of Renschler as of December 31, Year 1. These were uncovered during the audit. Classification of event: Not a subsequent event 5. A lawsuit concerning product defects that was in progress as of December 31, Year 1 was settled in January, Year 2 and resulted in a material loss for Renschler. Classification of event: Recognized subsequent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres the breakdown of the event classifications 1 There was a 1000000 account receivable that was included in Renschlers December 31 financial statements that was written off in early February Year 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started