Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REVISED: REVISED: How do I complete the part below Operating Expenses? and is this how you would list the footnotes? Peyton Approved PREL Balance Sheet

REVISED:

REVISED:

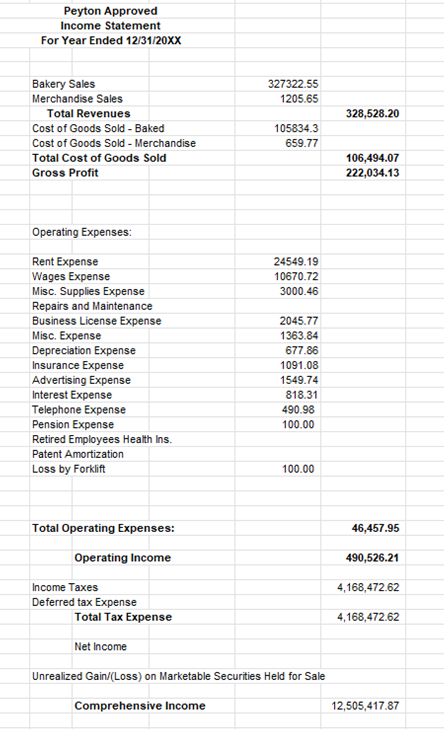

How do I complete the part below Operating Expenses?

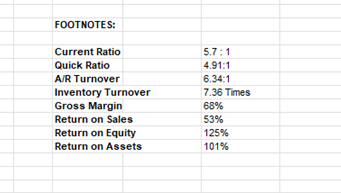

and is this how you would list the footnotes?

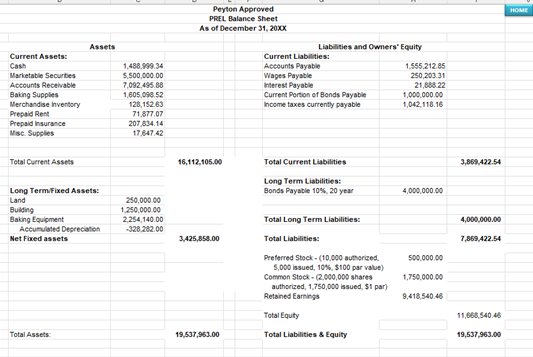

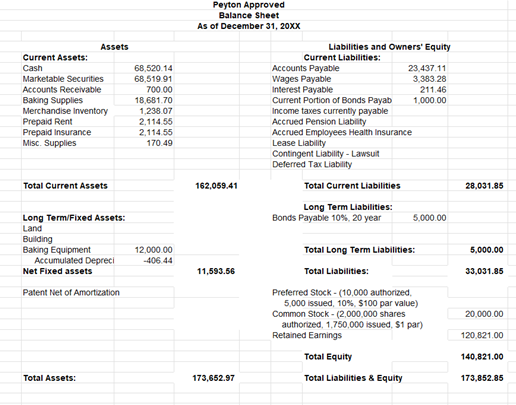

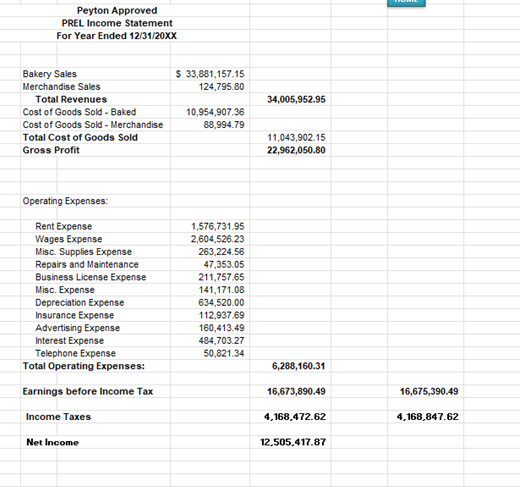

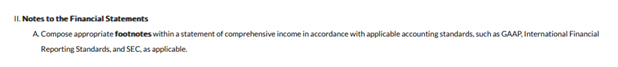

Peyton Approved PREL Balance Sheet As of December 31, 2000 Assets Liabilities and Owners' Equity Peyton Approved Balance sheet As of December 31, 20xx Peyton Approved PREL Income Statement For Year Ended 12/31/20XX \begin{tabular}{|l|r|r|} \hline Bakery Sales & $33,881,157.15 & \\ \hline Merchandise Sales & 124,795.80 & \\ \hline \multicolumn{1}{|c|}{ Total Revenues } & & 34,005,952.95 \\ \hline Cost of Goods Sold - Baked & 10,954,907.36 & \\ \hline Cost of Goods Sold - Merchandise & 88,994.79 & \\ \hline Total Cost of Goods Sold & & 11,043,902.15 \\ \hline Gross Profit & & 22,962,050.80 \\ \hline \end{tabular} Operating Expenses: \begin{tabular}{|l|r|r|} \hline Rent Expense & 1,576,731.95 \\ \hline Wages Expense & 2,604,526.23 \\ \hline Misc. Supplies Expense & 263,224.56 \\ \hline Repairs and Maintenance & 47,353.05 \\ \hline Business License Expense & 211,757.65 \\ \hline Misc. Expense & 141,171.08 \\ \hline Depreciation Expense & 634,520.00 \\ \hline Insurance Expense & 112,937.69 & \\ \hline Advertising Expense & 160,413.49 & \\ \hline Interest Expense & 484,703.27 & \\ \hline Telephone Expense & 50,821.34 & \\ \hline Total Operating Expenses: & & 6,288,160.31 \\ \hline Earnings before Income Tax & 16,673,890.49 \\ \hline Income Taxes & & 4,168,472.62 \\ \hline Net Income & & \\ \hline \end{tabular} Peyton Approved Income Statement For Year Ended 12/31/20XX \begin{tabular}{|l|r|r|} \hline Bakery Sales & 327322.55 & \\ \hline Merchandise Sales & 1205.65 & \\ \hline Total Revenues & & 328,528.20 \\ \hline Cost of Goods Sold - Baked & 105834.3 & \\ \hline Cost of Goods Sold - Merchandise & 659.77 & \\ \hline Total Cost of Goods Sold & & 106,494.07 \\ \hline Gross Profit & 222,034.13 \\ \hline \end{tabular} Operating Expenses: \begin{tabular}{|l|r|} \hline Rent Expense & 24549.19 \\ \hline Wages Expense & 10670.72 \\ \hline Misc. Supplies Expense & 3000.46 \\ \hline Repairs and Maintenance & \\ \hline Business License Expense & 2045.77 \\ \hline Misc. Expense & 1363.84 \\ \hline Depreciation Expense & 677.86 \\ \hline Insurance Expense & 1091.08 \\ \hline Advertising Expense & 1549.74 \\ \hline Interest Expense & 818.31 \\ \hline Telephone Expense & 490.98 \\ \hline Pension Expense & 100.00 \\ \hline Retired Employees Health Ins. & \\ \hline Patent Amortization & 100.00 \\ \hline Loss by Forklift & \end{tabular} Total Operating Expenses: 46,457.95 Operating Income 490,526.21 Income Taxes 4,168,472.62 Deferred tax Expense Total Tax Expense 4,168,472.62 Net income Unrealized Gain/(Loss) on Marketable Securities Held for Sale Comprehensive Income 12,505,417.87 II. Notes to the Financial Statements A Compose appropriate footnotes within a statement of comprehensive income in accordance with applicable accounting standards, such as GAAP. International Financial Reporting Standards, and SEC, as applicable. FOOTNOTES: \begin{tabular}{|l|l|} \hline Current Ratio & 5.7:1 \\ \hline Quick Ratio & 4.91:1 \\ \hline A/R Turnover & 6.34:1 \\ \hline Inventory Turnover & 7.36 Times \\ \hline Gross Margin & 68% \\ \hline Return on Sales & 53% \\ \hline Return on Equity & 125% \\ \hline Return on Assets & 101% \\ \hline \end{tabular} Peyton Approved PREL Balance Sheet As of December 31, 2000 Assets Liabilities and Owners' Equity Peyton Approved Balance sheet As of December 31, 20xx Peyton Approved PREL Income Statement For Year Ended 12/31/20XX \begin{tabular}{|l|r|r|} \hline Bakery Sales & $33,881,157.15 & \\ \hline Merchandise Sales & 124,795.80 & \\ \hline \multicolumn{1}{|c|}{ Total Revenues } & & 34,005,952.95 \\ \hline Cost of Goods Sold - Baked & 10,954,907.36 & \\ \hline Cost of Goods Sold - Merchandise & 88,994.79 & \\ \hline Total Cost of Goods Sold & & 11,043,902.15 \\ \hline Gross Profit & & 22,962,050.80 \\ \hline \end{tabular} Operating Expenses: \begin{tabular}{|l|r|r|} \hline Rent Expense & 1,576,731.95 \\ \hline Wages Expense & 2,604,526.23 \\ \hline Misc. Supplies Expense & 263,224.56 \\ \hline Repairs and Maintenance & 47,353.05 \\ \hline Business License Expense & 211,757.65 \\ \hline Misc. Expense & 141,171.08 \\ \hline Depreciation Expense & 634,520.00 \\ \hline Insurance Expense & 112,937.69 & \\ \hline Advertising Expense & 160,413.49 & \\ \hline Interest Expense & 484,703.27 & \\ \hline Telephone Expense & 50,821.34 & \\ \hline Total Operating Expenses: & & 6,288,160.31 \\ \hline Earnings before Income Tax & 16,673,890.49 \\ \hline Income Taxes & & 4,168,472.62 \\ \hline Net Income & & \\ \hline \end{tabular} Peyton Approved Income Statement For Year Ended 12/31/20XX \begin{tabular}{|l|r|r|} \hline Bakery Sales & 327322.55 & \\ \hline Merchandise Sales & 1205.65 & \\ \hline Total Revenues & & 328,528.20 \\ \hline Cost of Goods Sold - Baked & 105834.3 & \\ \hline Cost of Goods Sold - Merchandise & 659.77 & \\ \hline Total Cost of Goods Sold & & 106,494.07 \\ \hline Gross Profit & 222,034.13 \\ \hline \end{tabular} Operating Expenses: \begin{tabular}{|l|r|} \hline Rent Expense & 24549.19 \\ \hline Wages Expense & 10670.72 \\ \hline Misc. Supplies Expense & 3000.46 \\ \hline Repairs and Maintenance & \\ \hline Business License Expense & 2045.77 \\ \hline Misc. Expense & 1363.84 \\ \hline Depreciation Expense & 677.86 \\ \hline Insurance Expense & 1091.08 \\ \hline Advertising Expense & 1549.74 \\ \hline Interest Expense & 818.31 \\ \hline Telephone Expense & 490.98 \\ \hline Pension Expense & 100.00 \\ \hline Retired Employees Health Ins. & \\ \hline Patent Amortization & 100.00 \\ \hline Loss by Forklift & \end{tabular} Total Operating Expenses: 46,457.95 Operating Income 490,526.21 Income Taxes 4,168,472.62 Deferred tax Expense Total Tax Expense 4,168,472.62 Net income Unrealized Gain/(Loss) on Marketable Securities Held for Sale Comprehensive Income 12,505,417.87 II. Notes to the Financial Statements A Compose appropriate footnotes within a statement of comprehensive income in accordance with applicable accounting standards, such as GAAP. International Financial Reporting Standards, and SEC, as applicable. FOOTNOTES: \begin{tabular}{|l|l|} \hline Current Ratio & 5.7:1 \\ \hline Quick Ratio & 4.91:1 \\ \hline A/R Turnover & 6.34:1 \\ \hline Inventory Turnover & 7.36 Times \\ \hline Gross Margin & 68% \\ \hline Return on Sales & 53% \\ \hline Return on Equity & 125% \\ \hline Return on Assets & 101% \\ \hline \end{tabular}

Peyton Approved PREL Balance Sheet As of December 31, 2000 Assets Liabilities and Owners' Equity Peyton Approved Balance sheet As of December 31, 20xx Peyton Approved PREL Income Statement For Year Ended 12/31/20XX \begin{tabular}{|l|r|r|} \hline Bakery Sales & $33,881,157.15 & \\ \hline Merchandise Sales & 124,795.80 & \\ \hline \multicolumn{1}{|c|}{ Total Revenues } & & 34,005,952.95 \\ \hline Cost of Goods Sold - Baked & 10,954,907.36 & \\ \hline Cost of Goods Sold - Merchandise & 88,994.79 & \\ \hline Total Cost of Goods Sold & & 11,043,902.15 \\ \hline Gross Profit & & 22,962,050.80 \\ \hline \end{tabular} Operating Expenses: \begin{tabular}{|l|r|r|} \hline Rent Expense & 1,576,731.95 \\ \hline Wages Expense & 2,604,526.23 \\ \hline Misc. Supplies Expense & 263,224.56 \\ \hline Repairs and Maintenance & 47,353.05 \\ \hline Business License Expense & 211,757.65 \\ \hline Misc. Expense & 141,171.08 \\ \hline Depreciation Expense & 634,520.00 \\ \hline Insurance Expense & 112,937.69 & \\ \hline Advertising Expense & 160,413.49 & \\ \hline Interest Expense & 484,703.27 & \\ \hline Telephone Expense & 50,821.34 & \\ \hline Total Operating Expenses: & & 6,288,160.31 \\ \hline Earnings before Income Tax & 16,673,890.49 \\ \hline Income Taxes & & 4,168,472.62 \\ \hline Net Income & & \\ \hline \end{tabular} Peyton Approved Income Statement For Year Ended 12/31/20XX \begin{tabular}{|l|r|r|} \hline Bakery Sales & 327322.55 & \\ \hline Merchandise Sales & 1205.65 & \\ \hline Total Revenues & & 328,528.20 \\ \hline Cost of Goods Sold - Baked & 105834.3 & \\ \hline Cost of Goods Sold - Merchandise & 659.77 & \\ \hline Total Cost of Goods Sold & & 106,494.07 \\ \hline Gross Profit & 222,034.13 \\ \hline \end{tabular} Operating Expenses: \begin{tabular}{|l|r|} \hline Rent Expense & 24549.19 \\ \hline Wages Expense & 10670.72 \\ \hline Misc. Supplies Expense & 3000.46 \\ \hline Repairs and Maintenance & \\ \hline Business License Expense & 2045.77 \\ \hline Misc. Expense & 1363.84 \\ \hline Depreciation Expense & 677.86 \\ \hline Insurance Expense & 1091.08 \\ \hline Advertising Expense & 1549.74 \\ \hline Interest Expense & 818.31 \\ \hline Telephone Expense & 490.98 \\ \hline Pension Expense & 100.00 \\ \hline Retired Employees Health Ins. & \\ \hline Patent Amortization & 100.00 \\ \hline Loss by Forklift & \end{tabular} Total Operating Expenses: 46,457.95 Operating Income 490,526.21 Income Taxes 4,168,472.62 Deferred tax Expense Total Tax Expense 4,168,472.62 Net income Unrealized Gain/(Loss) on Marketable Securities Held for Sale Comprehensive Income 12,505,417.87 II. Notes to the Financial Statements A Compose appropriate footnotes within a statement of comprehensive income in accordance with applicable accounting standards, such as GAAP. International Financial Reporting Standards, and SEC, as applicable. FOOTNOTES: \begin{tabular}{|l|l|} \hline Current Ratio & 5.7:1 \\ \hline Quick Ratio & 4.91:1 \\ \hline A/R Turnover & 6.34:1 \\ \hline Inventory Turnover & 7.36 Times \\ \hline Gross Margin & 68% \\ \hline Return on Sales & 53% \\ \hline Return on Equity & 125% \\ \hline Return on Assets & 101% \\ \hline \end{tabular} Peyton Approved PREL Balance Sheet As of December 31, 2000 Assets Liabilities and Owners' Equity Peyton Approved Balance sheet As of December 31, 20xx Peyton Approved PREL Income Statement For Year Ended 12/31/20XX \begin{tabular}{|l|r|r|} \hline Bakery Sales & $33,881,157.15 & \\ \hline Merchandise Sales & 124,795.80 & \\ \hline \multicolumn{1}{|c|}{ Total Revenues } & & 34,005,952.95 \\ \hline Cost of Goods Sold - Baked & 10,954,907.36 & \\ \hline Cost of Goods Sold - Merchandise & 88,994.79 & \\ \hline Total Cost of Goods Sold & & 11,043,902.15 \\ \hline Gross Profit & & 22,962,050.80 \\ \hline \end{tabular} Operating Expenses: \begin{tabular}{|l|r|r|} \hline Rent Expense & 1,576,731.95 \\ \hline Wages Expense & 2,604,526.23 \\ \hline Misc. Supplies Expense & 263,224.56 \\ \hline Repairs and Maintenance & 47,353.05 \\ \hline Business License Expense & 211,757.65 \\ \hline Misc. Expense & 141,171.08 \\ \hline Depreciation Expense & 634,520.00 \\ \hline Insurance Expense & 112,937.69 & \\ \hline Advertising Expense & 160,413.49 & \\ \hline Interest Expense & 484,703.27 & \\ \hline Telephone Expense & 50,821.34 & \\ \hline Total Operating Expenses: & & 6,288,160.31 \\ \hline Earnings before Income Tax & 16,673,890.49 \\ \hline Income Taxes & & 4,168,472.62 \\ \hline Net Income & & \\ \hline \end{tabular} Peyton Approved Income Statement For Year Ended 12/31/20XX \begin{tabular}{|l|r|r|} \hline Bakery Sales & 327322.55 & \\ \hline Merchandise Sales & 1205.65 & \\ \hline Total Revenues & & 328,528.20 \\ \hline Cost of Goods Sold - Baked & 105834.3 & \\ \hline Cost of Goods Sold - Merchandise & 659.77 & \\ \hline Total Cost of Goods Sold & & 106,494.07 \\ \hline Gross Profit & 222,034.13 \\ \hline \end{tabular} Operating Expenses: \begin{tabular}{|l|r|} \hline Rent Expense & 24549.19 \\ \hline Wages Expense & 10670.72 \\ \hline Misc. Supplies Expense & 3000.46 \\ \hline Repairs and Maintenance & \\ \hline Business License Expense & 2045.77 \\ \hline Misc. Expense & 1363.84 \\ \hline Depreciation Expense & 677.86 \\ \hline Insurance Expense & 1091.08 \\ \hline Advertising Expense & 1549.74 \\ \hline Interest Expense & 818.31 \\ \hline Telephone Expense & 490.98 \\ \hline Pension Expense & 100.00 \\ \hline Retired Employees Health Ins. & \\ \hline Patent Amortization & 100.00 \\ \hline Loss by Forklift & \end{tabular} Total Operating Expenses: 46,457.95 Operating Income 490,526.21 Income Taxes 4,168,472.62 Deferred tax Expense Total Tax Expense 4,168,472.62 Net income Unrealized Gain/(Loss) on Marketable Securities Held for Sale Comprehensive Income 12,505,417.87 II. Notes to the Financial Statements A Compose appropriate footnotes within a statement of comprehensive income in accordance with applicable accounting standards, such as GAAP. International Financial Reporting Standards, and SEC, as applicable. FOOTNOTES: \begin{tabular}{|l|l|} \hline Current Ratio & 5.7:1 \\ \hline Quick Ratio & 4.91:1 \\ \hline A/R Turnover & 6.34:1 \\ \hline Inventory Turnover & 7.36 Times \\ \hline Gross Margin & 68% \\ \hline Return on Sales & 53% \\ \hline Return on Equity & 125% \\ \hline Return on Assets & 101% \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started