Answered step by step

Verified Expert Solution

Question

1 Approved Answer

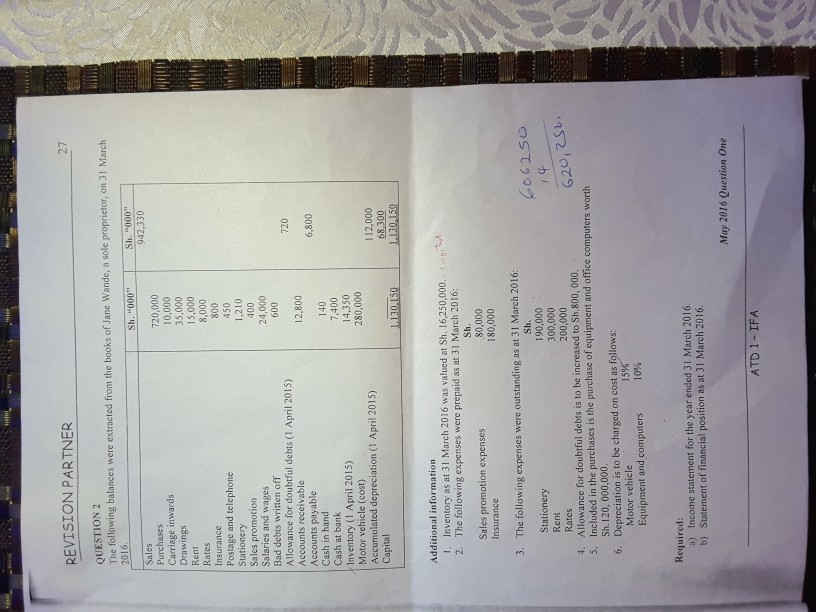

REVISION PARTNER 27 QUESTION 2 The following balances were extracted from the books of Jane Wande, a sole proprietor, on 31 March Sh. 000 942,330

REVISION PARTNER 27 QUESTION 2 The following balances were extracted from the books of Jane Wande, a sole proprietor, on 31 March Sh. "000" 942,330 Sh. "000" Purchases 720,000 10,000 35,000 15,000 8,000 800 450 1,210 Carriage inwards Drawings Rent Insurance Postage and telephone Stationery Sales promotion Salaries and wages Bad debts written off Allowance for doubtful debts (1 April 2015) Accounts receivable 24,000 720 Accounts payable Cash in hand Cash at bank 12.800 140 14,350 6,800 Inventory (1 April 2015) Motor vehicle (cost) Accumulated depreciation (1 April 2015) Capital 280,000 112,000 Additional information I. Inventory as at 31 March 2016 was valued at Sh. 16,250,000. 2. Th e following expenses were prepaid as at 31 March 2016 Sales promotion expenses 3. The following expenses were outstanding as at 31 March 2016 190,000 300,000 200,000 Stationery Rates Allowance for doubtful debts is to be increased to Sh.800, 000 Included in the purchases is the purchase of equipment and office computers worth 620,2su 4. 5. 6. Depreciation is to be charged on cost as follows: Motor vehicle Equipment and computers 10% Required a) Income statement for the year ended 31 March 2016 b) Statement of financial position as at 31 March 2016. May 2016 Question One ATD 1- IFA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started