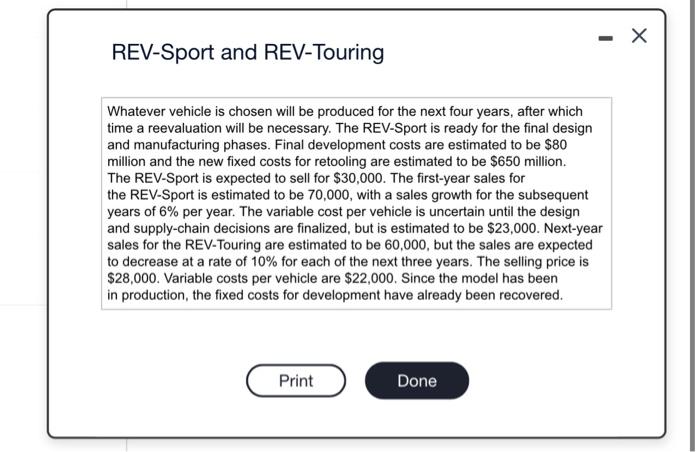

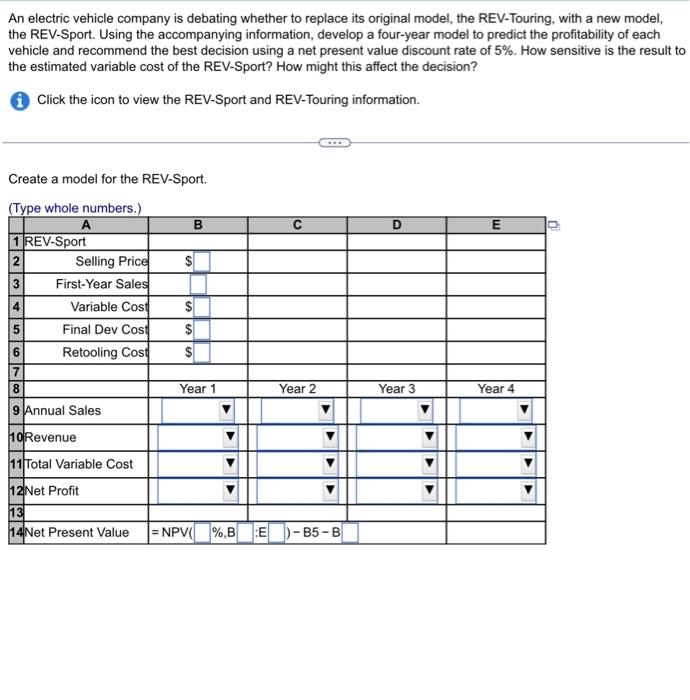

REV-Sport and REV-Touring Whatever vehicle is chosen will be produced for the next four years, after which time a reevaluation will be necessary. The REV-Sport is ready for the final design and manufacturing phases. Final development costs are estimated to be $80 million and the new fixed costs for retooling are estimated to be $650 million. The REV-Sport is expected to sell for $30,000. The first-year sales for the REV-Sport is estimated to be 70,000 , with a sales growth for the subsequent years of 6% per year. The variable cost per vehicle is uncertain until the design and supply-chain decisions are finalized, but is estimated to be $23,000. Next-year sales for the REV-Touring are estimated to be 60,000 , but the sales are expected to decrease at a rate of 10% for each of the next three years. The selling price is $28,000. Variable costs per vehicle are $22,000. Since the model has been in production, the fixed costs for development have already been recovered. An electric vehicle company is debating whether to replace its original model, the REV-Touring, with a new model, the REV-Sport. Using the accompanying information, develop a four-year model to predict the profitability of each vehicle and recommend the best decision using a net present value discount rate of 5%. How sensitive is the result to the estimated variable cost of the REV-Sport? How might this affect the decision? Click the icon to view the REV-Sport and REV-Touring information. Create a model for the REV-Sport. (TvDe whole numbers.) REV-Sport and REV-Touring Whatever vehicle is chosen will be produced for the next four years, after which time a reevaluation will be necessary. The REV-Sport is ready for the final design and manufacturing phases. Final development costs are estimated to be $80 million and the new fixed costs for retooling are estimated to be $650 million. The REV-Sport is expected to sell for $30,000. The first-year sales for the REV-Sport is estimated to be 70,000 , with a sales growth for the subsequent years of 6% per year. The variable cost per vehicle is uncertain until the design and supply-chain decisions are finalized, but is estimated to be $23,000. Next-year sales for the REV-Touring are estimated to be 60,000 , but the sales are expected to decrease at a rate of 10% for each of the next three years. The selling price is $28,000. Variable costs per vehicle are $22,000. Since the model has been in production, the fixed costs for development have already been recovered. An electric vehicle company is debating whether to replace its original model, the REV-Touring, with a new model, the REV-Sport. Using the accompanying information, develop a four-year model to predict the profitability of each vehicle and recommend the best decision using a net present value discount rate of 5%. How sensitive is the result to the estimated variable cost of the REV-Sport? How might this affect the decision? Click the icon to view the REV-Sport and REV-Touring information. Create a model for the REV-Sport. (TvDe whole numbers.)