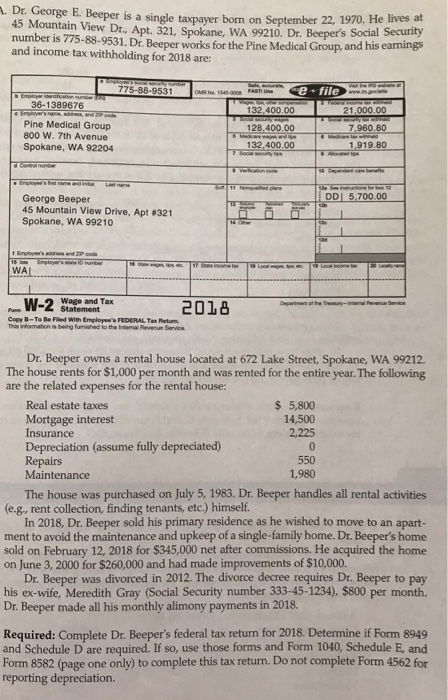

rge E. Beeper is a single taxpayer born on September 22, 1970. He lives at 45 Mountain View Dr, Apt. 321, Spokane, WA 992 number is 775-88-9531. Dr. Beeper works for the Pine Medical Group and income tax withholding for 2018 are: 10. Dr. Beepers Social Security nd his eamings 775-88-953145. AS e file 36-1389676 Pine Medical Group 800 W. 7th Avenue Spokane, WA 92204 132,400.00 128.400.00 132,400.00 7,960.80 1.919.80 George Beeper 45 Mountain View Drive, Apt #321 Spokane, WA 99210 WA W-2 State mer Wage and Tax 21 Copy B-To Be Fled With Employee' FEDERAL Tex Retum This information is being fumished to the Intemal Revenue Service Dr. Beeper owns a rental house located at 672 Lake Street, Spokane, WA 99212 The house rents for $1,000 per month and was rented for the entire year. The following are the related expenses for the rental house: s 5,800 14,500 2,225 Real estate taxes Mortgage interest Insurance Depreciation (assume fully depreciated) Repairs 550 1,980 Maintenance The house was purchased on July 5, 1983. Dr. Beeper handles all rental activities e.g, rent collection, finding tenants, etc.) himself. In 2018, Dr. Beeper sold his primary residence as he wished to move to an apart- ment to avoid the maintenance and upkeep of a single-family home. Dr. Beeper's home sold on February 12, 2018 for $345,000 net after commissions. He acquired the home on June 3, 2000 for $260,000 and had made improvements of $10,000. Dr. Beeper was divorced in 2012. The divorce decree requires Dr. Beeper to pay his ex-wife, Meredith Gray (Social Security number 333-45-1234), $800 per month. Dr. Beeper made all his monthly alimony payments in 2018. Required: Complete Dr. Beeper's federal tax return for 2018. Determine if Form 8949 and Schedule D are required. If so, use those forms and Form 1040, Schedule E, and Form 8582 (page one only) to complete this tax return. Do not complete Form 4562 for reporting depreciation. rge E. Beeper is a single taxpayer born on September 22, 1970. He lives at 45 Mountain View Dr, Apt. 321, Spokane, WA 992 number is 775-88-9531. Dr. Beeper works for the Pine Medical Group and income tax withholding for 2018 are: 10. Dr. Beepers Social Security nd his eamings 775-88-953145. AS e file 36-1389676 Pine Medical Group 800 W. 7th Avenue Spokane, WA 92204 132,400.00 128.400.00 132,400.00 7,960.80 1.919.80 George Beeper 45 Mountain View Drive, Apt #321 Spokane, WA 99210 WA W-2 State mer Wage and Tax 21 Copy B-To Be Fled With Employee' FEDERAL Tex Retum This information is being fumished to the Intemal Revenue Service Dr. Beeper owns a rental house located at 672 Lake Street, Spokane, WA 99212 The house rents for $1,000 per month and was rented for the entire year. The following are the related expenses for the rental house: s 5,800 14,500 2,225 Real estate taxes Mortgage interest Insurance Depreciation (assume fully depreciated) Repairs 550 1,980 Maintenance The house was purchased on July 5, 1983. Dr. Beeper handles all rental activities e.g, rent collection, finding tenants, etc.) himself. In 2018, Dr. Beeper sold his primary residence as he wished to move to an apart- ment to avoid the maintenance and upkeep of a single-family home. Dr. Beeper's home sold on February 12, 2018 for $345,000 net after commissions. He acquired the home on June 3, 2000 for $260,000 and had made improvements of $10,000. Dr. Beeper was divorced in 2012. The divorce decree requires Dr. Beeper to pay his ex-wife, Meredith Gray (Social Security number 333-45-1234), $800 per month. Dr. Beeper made all his monthly alimony payments in 2018. Required: Complete Dr. Beeper's federal tax return for 2018. Determine if Form 8949 and Schedule D are required. If so, use those forms and Form 1040, Schedule E, and Form 8582 (page one only) to complete this tax return. Do not complete Form 4562 for reporting depreciation