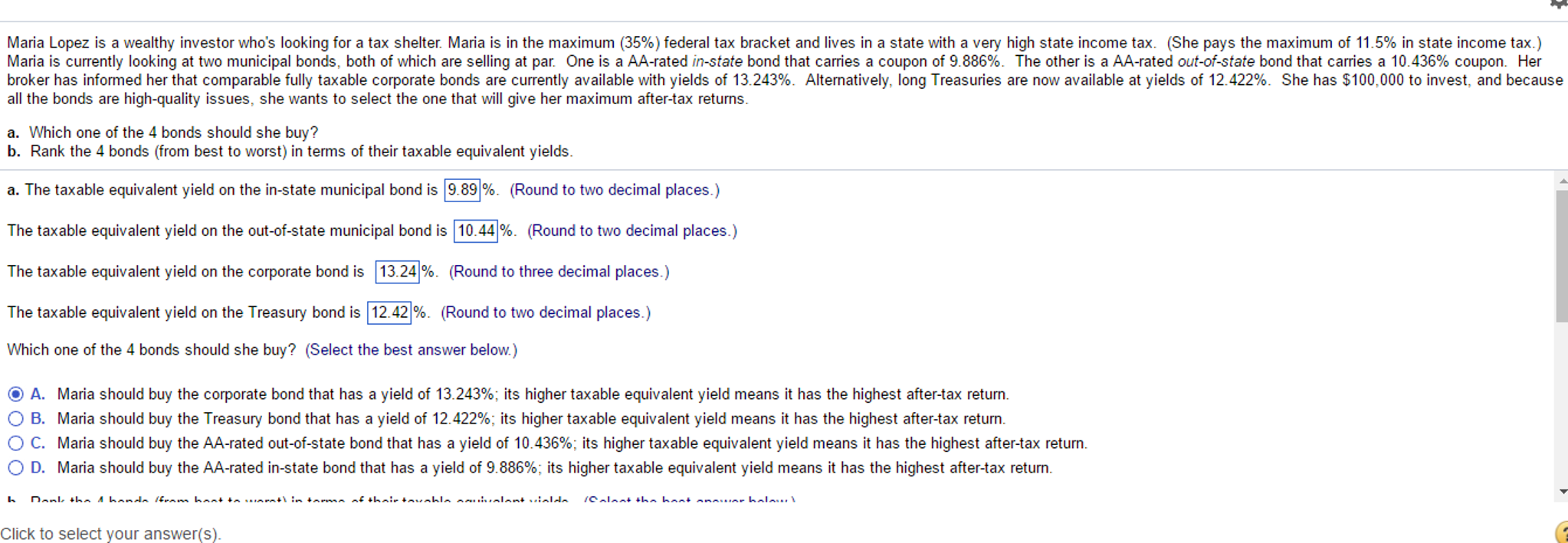

Rhett purchased a 12% zero-coupon bond with a 15-year maturity and a $15,000 par value 15 years ago. The bond matures tomorrow. How much will Rhett receive in total from this investment, assuming all payments are made on these bonds as expected? Rhett will receive the last interest payment of $1800 plus the principal repayment of $15,000. Rhett will receive the market price of the bond, which depends on the market interest rate tomorrow. Rhett will receive the last interest payment of $1800. Rhett will receive the $15,000 which represents the principal and accrued interest on the bond during its lifetime. Maria Lopez is a wealthy investor who's looking for a tax shelter. Maria is in the maximum (35%) federal tax bracket and lives in a state with a very high state income tax. (She pays the maximum of 11.5% in state income tax.) Maria is currently looking at two municipal bonds, both of which are selling at par. One is a AA-rated in-state bond that carries a coupon of 9.886%. The other is a AA-rated out-of-state bond that carries a 10.436% coupon. Her broker has informed her that comparable fully taxable corporate bonds are currently available with yields of 13.243%. Alternatively, long Treasuries are now available at yields of 12.422%. She has $100,000 to invest, and because all the bonds are high-quality issues, she wants to select the one that will give her maximum after-tax returns. Which one of the 4 bonds should she buy? Rank the 4 bonds (from best to worst) in terms of their taxable equivalent yields. The taxable equivalent yield on the in-state municipal bond is %. (Round to two decimal places.) The taxable equivalent yield on the out-of-state municipal bond is %. (Round to two decimal places.) The taxable equivalent yield on the corporate bond is %. (Round to three decimal places.) The taxable equivalent yield on the Treasury bond is %. (Round to two decimal places.) Which one of the 4 bonds should she buy? (Select the best answer below.) Maria should buy the corporate bond that has a yield of 13.243%; its higher taxable equivalent yield means it has the highest after-tax return. Maria should buy the Treasury bond that has a yield of 12.422%; its higher taxable equivalent yield means it has the highest after-tax return. Maria should buy the AA-rated out-of-state bond that has a yield of 10.436%; its higher taxable equivalent yield means it has the highest after-tax return. Maria should buy the AA-rated in-state bond that has a yield of 9.886%; its higher taxable equivalent yield means it has the highest after-tax return