Question

Rhett, who is solvent but suffering from financial difficulty, owes Friendly Bank $50,000 on an unsecured note. In order to avoid bankruptcy, Rhett negotiates

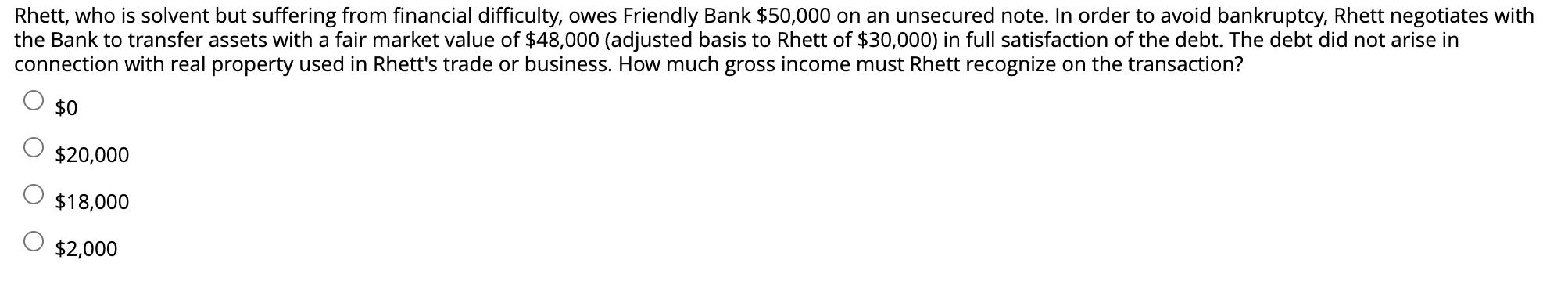

Rhett, who is solvent but suffering from financial difficulty, owes Friendly Bank $50,000 on an unsecured note. In order to avoid bankruptcy, Rhett negotiates with the Bank to transfer assets with a fair market value of $48,000 (adjusted basis to Rhett of $30,000) in full satisfaction of the debt. The debt did not arise in connection with real property used in Rhett's trade or business. How much gross income must Rhett recognize on the transaction? $0 $20,000 $18,000 $2,000

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Ans The first option is correct that is 18000 Calculation 4800030000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Tax Research

Authors: Barbara H. Karlin

4th Edition

013601531X, 978-0136015314

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App