Answered step by step

Verified Expert Solution

Question

1 Approved Answer

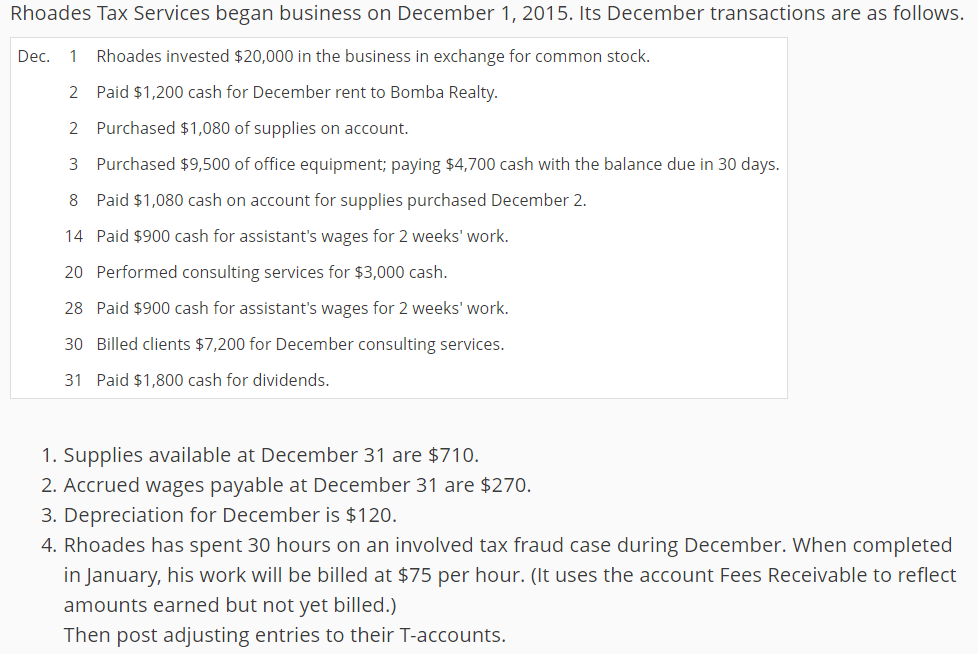

Rhoades Tax Services began business on December 1, 2015. Its December transactions are as follows. Dec. 1 Rhoades invested $20,000 in the business in

Rhoades Tax Services began business on December 1, 2015. Its December transactions are as follows. Dec. 1 Rhoades invested $20,000 in the business in exchange for common stock. 2 Paid $1,200 cash for December rent to Bomba Realty. 2 Purchased $1,080 of supplies on account. 3 Purchased $9,500 of office equipment; paying $4,700 cash with the balance due in 30 days. 8 Paid $1,080 cash on account for supplies purchased December 2. 14 Paid $900 cash for assistant's wages for 2 weeks' work. 20 Performed consulting services for $3,000 cash. 28 Paid $900 cash for assistant's wages for 2 weeks' work. 30 Billed clients $7,200 for December consulting services. 31 Paid $1,800 cash for dividends. 1. Supplies available at December 31 are $710. 2. Accrued wages payable at December 31 are $270. 3. Depreciation for December is $120. 4. Rhoades has spent 30 hours on an involved tax fraud case during December. When completed in January, his work will be billed at $75 per hour. (It uses the account Fees Receivable to reflect amounts earned but not yet billed.) Then post adjusting entries to their T-accounts.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

636454fa67498_239220.pdf

180 KBs PDF File

636454fa67498_239220.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started