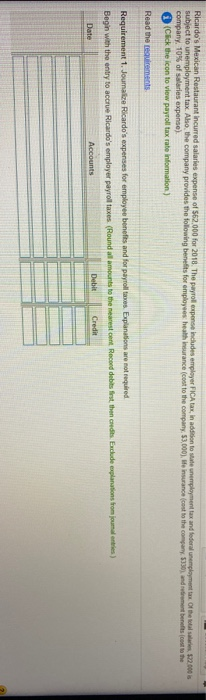

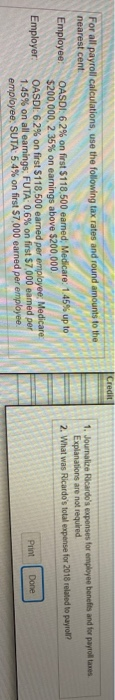

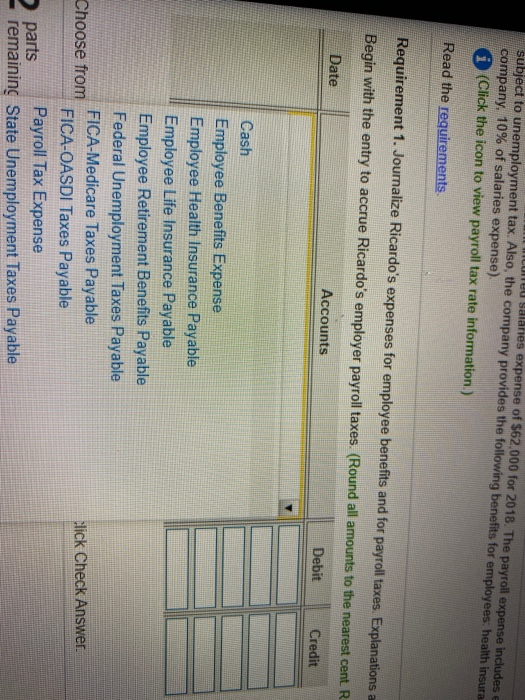

Ricardo's Mexican Restaurant incurred salaries expense of 562.000 for 2018. The payroll expense includes employer FICA tax, in addition to state unemployment tax and federal unemployment to the balle 22.000 subject to unemployment tax. Also, the company provides the following benefits for employees health insurance cost to the company, 53,000), life insurance cost to the company, 5330), and met bereits co to the company. 10% of salaries expense) (Click the icon to view payroll tax rate information) Read the requirements Requirement 1. Joumalze Ricardo's expenses for employee benefits and for payroll taxes Explanations are not required Begin with the entry to accrue Ricardo's employer payroll taxes (Round all amounts to the nearest cant Record debts first, then its Exclude explanations from jounalis) Date Accounts Debit Credit Credit 1. Journalize Ricardo's expenses for employee benefits and for payroll taxes Explanations are not required 2. What was Ricardo's total expense for 2018 related to payroll For all payroll calculations, use the following tax rates and round amounts to the nearest cent Employee OASDI: 6.2% on first $118,500 earned, Medicare: 1.45% up to $200,000,2 35% on earnings above $200,000 Employer OASDI: 6.2% on first $118.500 earned per employee: Medicare 1.45% on all earnings: FUTA: 0.6% on first $7,000 eamed per employee: SUTA: 5.4% on first $7,000 earned per employee Print Done Neu Salanes expense of $62,000 for 2018. The payroll expense includes e subject to unemployment tax. Also, the company provides the following benefits for employees, health insura company, 10% of salaries expense) (Click the icon to view payroll tax rate information.) Read the requirements Requirement 1. Journalize Ricardo's expenses for employee benefits and for payroll taxes. Explanations a Begin with the entry to accrue Ricardo's employer payroll taxes. (Round all amounts to the nearest cent R Date Accounts Debit Credit Cash Employee Benefits Expense Employee Health Insurance Payable Employee Life Insurance Payable Employee Retirement Benefits Payable Federal Unemployment Taxes Payable FICA-Medicare Taxes Payable Choose from FICA-OASDI Taxes Payable parts Payroll Tax Expense remaining State Unemployment Taxes Payable Click Check