Question

Rich and Cathy Ovechkin are married and have 2 young children, ages 5 & 10 Income items are as follows: Salary - $105,600, Savings

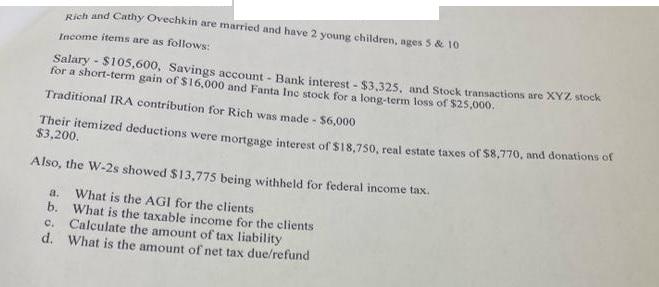

Rich and Cathy Ovechkin are married and have 2 young children, ages 5 & 10 Income items are as follows: Salary - $105,600, Savings account - Bank interest - $3,325, and Stock transactions are XYZ stock for a short-term gain of $16,000 and Fanta Inc stock for a long-term loss of $25,000. Traditional IRA contribution for Rich was made - $6,000 Their itemized deductions were mortgage interest of $18,750, real estate taxes of $8,770, and donations of $3,200. Also, the W-2s showed $13,775 being withheld for federal income tax. What is the AGI for the clients What is the taxable income for the clients Calculate the amount of tax liability C. d. What is the amount of net tax due/refund a. b.

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

step 1 step 2 step 3 NB Capital loss deduction is limited to 3000 per year Passive loss is not deduc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App