Richard and Stephanie are in the process of obtaining a divorce. The couple has two children: Chandler, age 16, and Connie, age 20. The

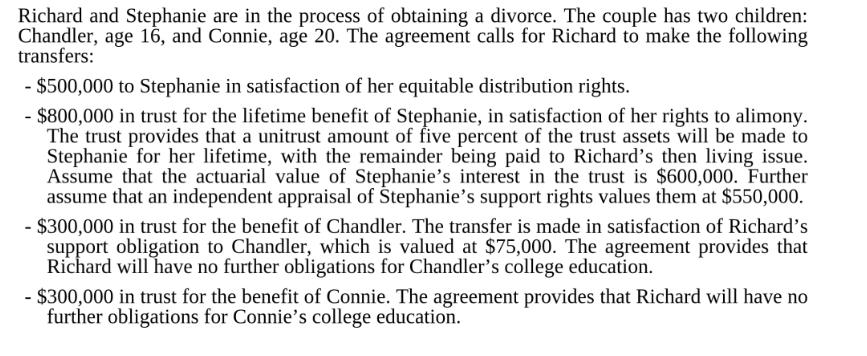

Richard and Stephanie are in the process of obtaining a divorce. The couple has two children: Chandler, age 16, and Connie, age 20. The agreement calls for Richard to make the following transfers: - $500,000 to Stephanie in satisfaction of her equitable distribution rights. - $800,000 in trust for the lifetime benefit of Stephanie, in satisfaction of her rights to alimony. The trust provides that a unitrust amount of five percent of the trust assets will be made to Stephanie for her lifetime, with the remainder being paid to Richard's then living issue. Assume that the actuarial value of Stephanie's interest in the trust is $600,000. Further assume that an independent appraisal of Stephanie's support rights values them at $550,000. - $300,000 in trust for the benefit of Chandler. The transfer is made in satisfaction of Richard's support obligation to Chandler, which is valued at $75,000. The agreement provides that Richard will have no further obligations for Chandler's college education. - $300,000 in trust for the benefit of Connie. The agreement provides that Richard will have no further obligations for Connie's college education. The agreement requires the approval of the divorce court, and will be operative only upon the issuance of a judicial decree of divorce. The divorce court issues the decree [93/94]eight months after the agreement was executed, and the decree incorporates the agreement without modification. a. Discuss the gift tax consequences of the transfers to Richard. b. Same as (a), except the judicial decree of divorce is not issued until three years after the settlement agreement was executed. c. Same as (b), except the divorce court did not possess the authority to modify the parties' agreement. d. Same as (a), except that Richard dies shortly after the divorce decree was entered and prior to making any of the required transfers. To what extent will Richard's estate be entitled to a deduction under 2053(a)(3) assuming his estate is required to fulfill his obligations under the decree?

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Discuss the gift tax consequences of the transfers to Richard The gift tax consequences of the transfers to Richard will depend on the value of the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started