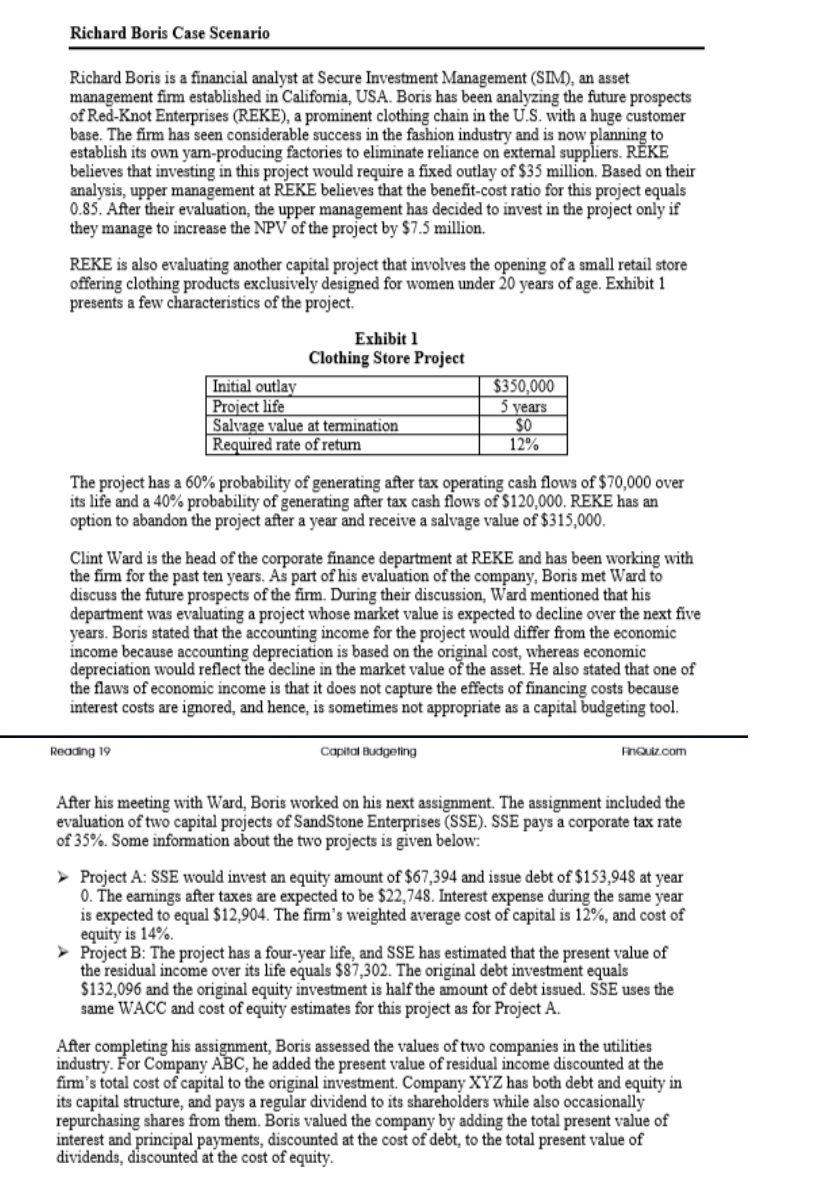

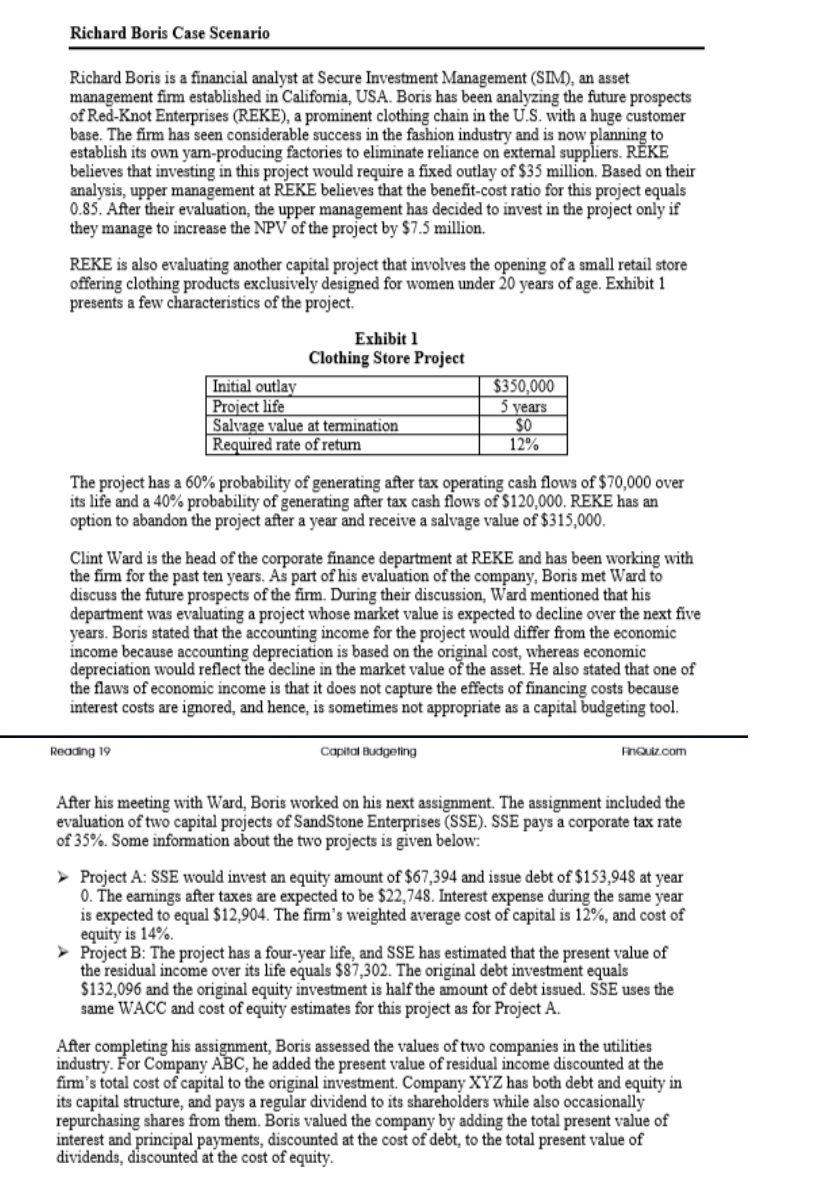

Richard Boris Case Scenario Richard Boris is a financial analyst at Secure Investment Management (SIM), an asset management firm established in Califomia, USA. Boris has been analyzing the future prospects of Red-Knot Enterprises (REKE), a prominent clothing chain in the U.S. with a huge customer base. The firm has seen considerable success in the fashion industry and is now planning to establish its own yam-producing factories to eliminate reliance on external suppliers. RKE believes that investing in this project would require a fixed outlay of $35 million. Based on their analysis, upper management at REKE believes that the benefit-cost ratio for this project equals 0.85. After their evaluation, the upper management has decided to invest in the project only if they manage to increase the NPV of the project by $7.5 million. REKE is also evaluating another capital project that involves the opening of a small retail store offering clothing products exclusively designed for women under 20 years of age. Exhibit 1 presents a few characteristics of the project. Exhibit 1 Clothing Store Project Initial outlay Project life Salvage value at termination Required rate of retum $350,000 5 years $0 12% The project has a 60% probability of generating after tax operating cash flows of $70,000 over its life and a 40% probability of generating after tax cash flows of $120,000, REKE has an option to abandon the project after a year and receive a salvage value of $315,000. Clint Ward is the head of the corporate finance department at REKE and has been working with the fim for the past ten years. As part of his evaluation of the company, Boris met Ward to discuss the future prospects of the firm. During their discussion, Ward mentioned that his department was evaluating a project whose market value is expected to decline over the next five years. Boris stated that the accounting income for the project would differ from the economic income because accounting depreciation is based on the original cost, whereas economic depreciation would reflect the decline in the market value of the asset. He also stated that one of the flaws of economic income is that it does not capture the effects of financing costs because interest costs are ignored, and hence, is sometimes not appropriate as a capital budgeting tool. Reading 19 Capital Budgeting FnQuiz.com After his meeting with Ward, Boris worked on his next assignment. The assignment included the evaluation of two capital projects of SandStone Enterprises (SSE). SSE pays a corporate tax rate of 35%. Some information about the two projects is given below: >> Project A: SSE would invest an equity amount of $67,394 and issue debt of $153,948 at year 0. The earnings after taxes are expected to be $22,748. Interest expense during the same year is expected to equal $12,904. The fimm's weighted average cost of capital is 12%, and cost of equity is 14%. Project B: The project has a four-year life, and SSE has estimated that the present value of the residual income over its life equals $87,302. The original debt investment equals $132,096 and the original equity investment is half the amount of debt issued. SSE uses the same WACC and cost of equity estimates for this project as for Project A. After completing his assignment, Boris assessed the values of two companies in the utilities industry. For Company ABC, he added the present value of residual income discounted at the firm's total cost of capital to the original investment Company XYZ has both debt and equity in its capital structure, and pays a regular dividend to its shareholders while also occasionally repurchasing shares from them. Boris valued the company by adding the total present value of interest and principal payments, discounted at the cost of debt, to the total present value of dividends, discounted at the cost of equity. Richard Boris Case Scenario Richard Boris is a financial analyst at Secure Investment Management (SIM), an asset management firm established in Califomia, USA. Boris has been analyzing the future prospects of Red-Knot Enterprises (REKE), a prominent clothing chain in the U.S. with a huge customer base. The firm has seen considerable success in the fashion industry and is now planning to establish its own yam-producing factories to eliminate reliance on external suppliers. RKE believes that investing in this project would require a fixed outlay of $35 million. Based on their analysis, upper management at REKE believes that the benefit-cost ratio for this project equals 0.85. After their evaluation, the upper management has decided to invest in the project only if they manage to increase the NPV of the project by $7.5 million. REKE is also evaluating another capital project that involves the opening of a small retail store offering clothing products exclusively designed for women under 20 years of age. Exhibit 1 presents a few characteristics of the project. Exhibit 1 Clothing Store Project Initial outlay Project life Salvage value at termination Required rate of retum $350,000 5 years $0 12% The project has a 60% probability of generating after tax operating cash flows of $70,000 over its life and a 40% probability of generating after tax cash flows of $120,000, REKE has an option to abandon the project after a year and receive a salvage value of $315,000. Clint Ward is the head of the corporate finance department at REKE and has been working with the fim for the past ten years. As part of his evaluation of the company, Boris met Ward to discuss the future prospects of the firm. During their discussion, Ward mentioned that his department was evaluating a project whose market value is expected to decline over the next five years. Boris stated that the accounting income for the project would differ from the economic income because accounting depreciation is based on the original cost, whereas economic depreciation would reflect the decline in the market value of the asset. He also stated that one of the flaws of economic income is that it does not capture the effects of financing costs because interest costs are ignored, and hence, is sometimes not appropriate as a capital budgeting tool. Reading 19 Capital Budgeting FnQuiz.com After his meeting with Ward, Boris worked on his next assignment. The assignment included the evaluation of two capital projects of SandStone Enterprises (SSE). SSE pays a corporate tax rate of 35%. Some information about the two projects is given below: >> Project A: SSE would invest an equity amount of $67,394 and issue debt of $153,948 at year 0. The earnings after taxes are expected to be $22,748. Interest expense during the same year is expected to equal $12,904. The fimm's weighted average cost of capital is 12%, and cost of equity is 14%. Project B: The project has a four-year life, and SSE has estimated that the present value of the residual income over its life equals $87,302. The original debt investment equals $132,096 and the original equity investment is half the amount of debt issued. SSE uses the same WACC and cost of equity estimates for this project as for Project A. After completing his assignment, Boris assessed the values of two companies in the utilities industry. For Company ABC, he added the present value of residual income discounted at the firm's total cost of capital to the original investment Company XYZ has both debt and equity in its capital structure, and pays a regular dividend to its shareholders while also occasionally repurchasing shares from them. Boris valued the company by adding the total present value of interest and principal payments, discounted at the cost of debt, to the total present value of dividends, discounted at the cost of equity