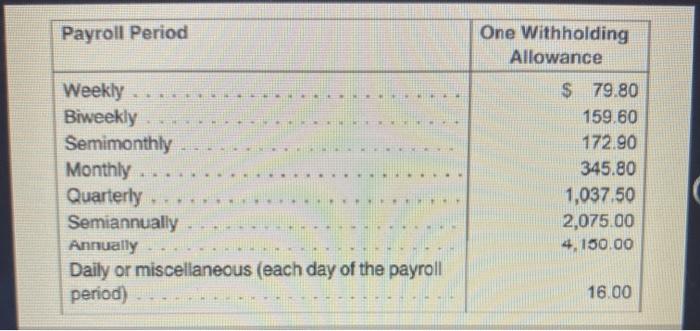

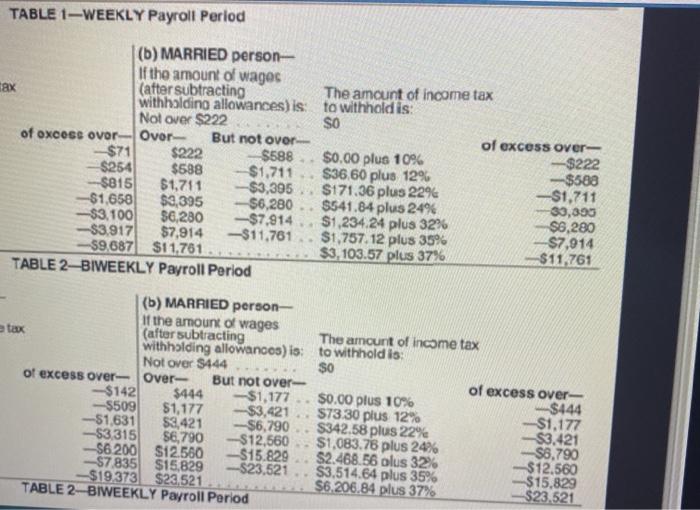

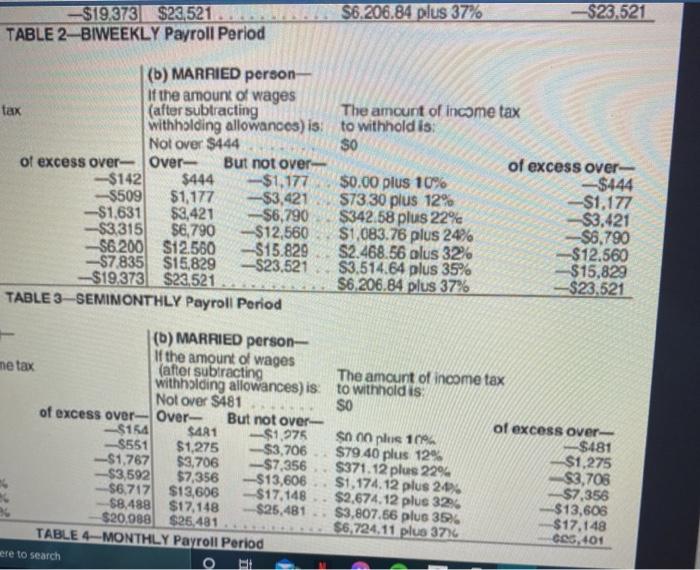

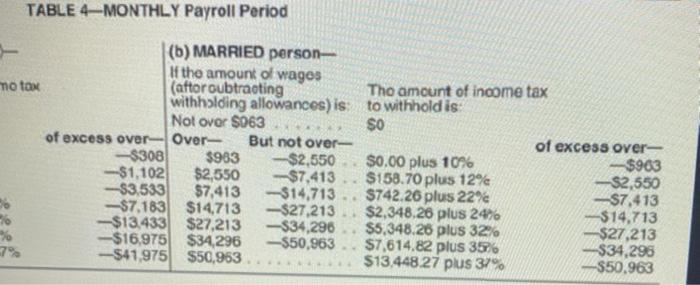

Richard Gaziano is a manager for Health Care, Inc. Health Care deducts Social Security Medicare, and FIT (by percentage method) from his earnings. Assume a rate of 6.2% on $128,400 for Social Security and 145% for Medicare Before this payroll, Richard is $1.000 below the maximum level for Social Security earnings Richard is married, is paid weekly, and claims 2 exemptions. What is Richard's net pay for the week if he earns $1,300? (Use Table 91 and Table 9.2) (Round your answer to the nearest cent.) Notpay Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 16.00 TABLE 1-WEEKLY Payroll Period (6) MARRIED person- If the amount of wages tax (after subtracting The amount of income tax withholding allowances) is: to withhold is Not over $222 $0 of oxcess over Over- But not over of excess over- $71 $222 $588 $0.00 plus 10% -$222 $254 $588 $1,711 $36.60 plus 12% $500 -$815 $1,711 $3,395 $171.36 plus 22% -$1,711 -$1,658 $3,395 $6,280..5541.84 plus 24% -20,200 $3.100 $6,280 -$7,814 $1,234.24 plus 326 $6,280 -$3,917 $7,914 -$11,761 $1,757.12 plus 35% $7,914 -59.687 $11.761 $3,103.57 plus 37% $11,761 TABLE 2-BIWEEKLY Payroll Period (b) MARRIED person- If the amount of wages tax (after subtracting The amount of income tax withholding allowances) is to withhold is: Not Over $444 $0 of excess over-Over- But not over- of excess over- - $142 $444 -$1,177. $0.00 plus 10% $444 -$509 $1,177 -$3,421 S73 30 plus 12% -$1,177 -$1,631 $3,421 -$6,790 $342.58 plus 22% -$3.421 -$3,315 56,790 $12,560 $1,083.76 plus 24% -$8,790 S6200 S12.560 $15.829 $2.468.56 olus 32% $12.560 $7835 $15.829 -$23.521 $3.514.64 plus 35% $15.829 $19 373 $23.521 $6.206.84 plus 37% $23.521 TABLE 2-BIWEEKLY Payroll Period $6.206.84 plus 37% -$23.521 $19.373 $23,521 TABLE 2-BIWEEKLY Payroll Period |(6) MARRIED person- If the amount of wages tax (after subtracting The amount of income tax withholding allowances) is: to withholdis: Not over $444 SO of excess over-Over- But not over- of excess over- -$142 $444 -$1,177 $0.00 plus 10% $444 -$509 $1,177 $3,421 S73 30 plus 12% --$1,177 -$1.631 $3,421 $6,790 $342.58 plus 22% S3,421 -$3,315 $8,790 -$12,560 $1.083.76 plus 24% $6.790 $6.200 $12.560 -$15.829 S2.468.56 olus 32% S12.560 -S7.835 $15,829 -$23,521 $3.514.64 plus 35% $15.829 $19.373 $23,521 S6.206.84 plus 37% -$23.521 TABLE 3-SEMINONTHLY Payroll Period me tax - |() MARRIED person- If the amount of wages (after subtracting The amount of income tax withholding allowances) is to withhold is Not over $481 SO of excess over-Over- But not over- of excess over- -$154 $481 $1,975 SO00 plus 10% -$481 S551 $1,275 $3,706 $79.40 plus 12% $1,275 $1,767 $3,706 -$7,356 $371.12 plus 229 $3,706 -S3,592 $7,356 -$13,606. $1,174.12 plus 20% $7,356 $6.717 $13,606 -$17,148 $2,674.12 plus 32% $13,606 58.488 $17,148 $25,481 $3,807.56 plus 356 $17,148 $20.088 $26.481 $6,724.11 plus 3714 GES, 401 TABLE 4 MONTHLY Payroll Period were to search TABLE 4-MONTHLY Payroll Period $0 (b) MARRIED person- If the amount of wages mo tax (aftoroubtracting Tho amount of income tax withholding allowances) is to withhold is: Not Over $063 of excess over Over But not over- of excess over- -$308 $963 $2,550 $0.00 plus 10% $903 -$1,102 $2,550 $7,413 $158.70 plus 12% $2,550 -$3.533 $7,413 -$14,713 $742.26 plus 22% -S7,413 -$7.183 $14713 -$27.213 $2,348,26 plus 24% $14.713 $13.433 $27.213 -$34,296 $5,348.26 plus 32 -$27,213 % $16,975 $34.296 -$50,963 $7,614.82 plus 356 $34.295 -$41,975 $50,963 $13,448.27 plus 37% -$50.963