Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Richard is a Native American Indian who has an enrollment number and is living on his tribe's reservation. Richard is a security guard for

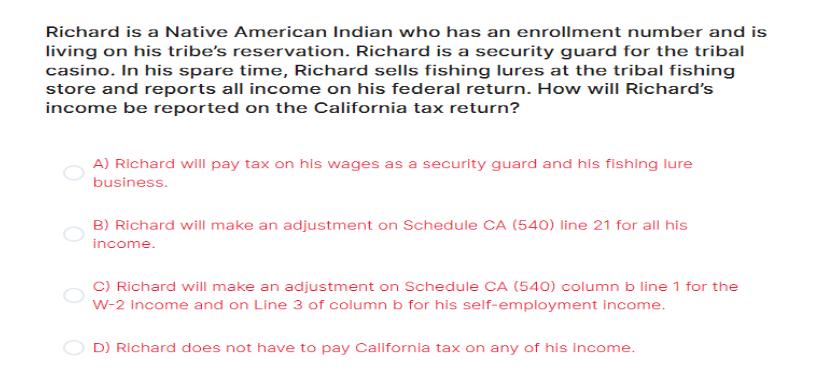

Richard is a Native American Indian who has an enrollment number and is living on his tribe's reservation. Richard is a security guard for the tribal casino. In his spare time, Richard sells fishing lures at the tribal fishing store and reports all income on his federal return. How will Richard's income be reported on the California tax return? A) Richard will pay tax on his wages as a security guard and his fishing lure business. B) Richard will make an adjustment on Schedule CA (540) line 21 for all his income. C) Richard will make an adjustment on Schedule CA (540) column b line 1 for the W-2 Income and on Line 3 of column b for his self-employment income. D) Richard does not have to pay California tax on any of his income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This question pertains to the tax implications for a Native American living and working on their tri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started