Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Richard is learning the ropes in his new position, looking over the production department's budgets from the past two years. He notices that his

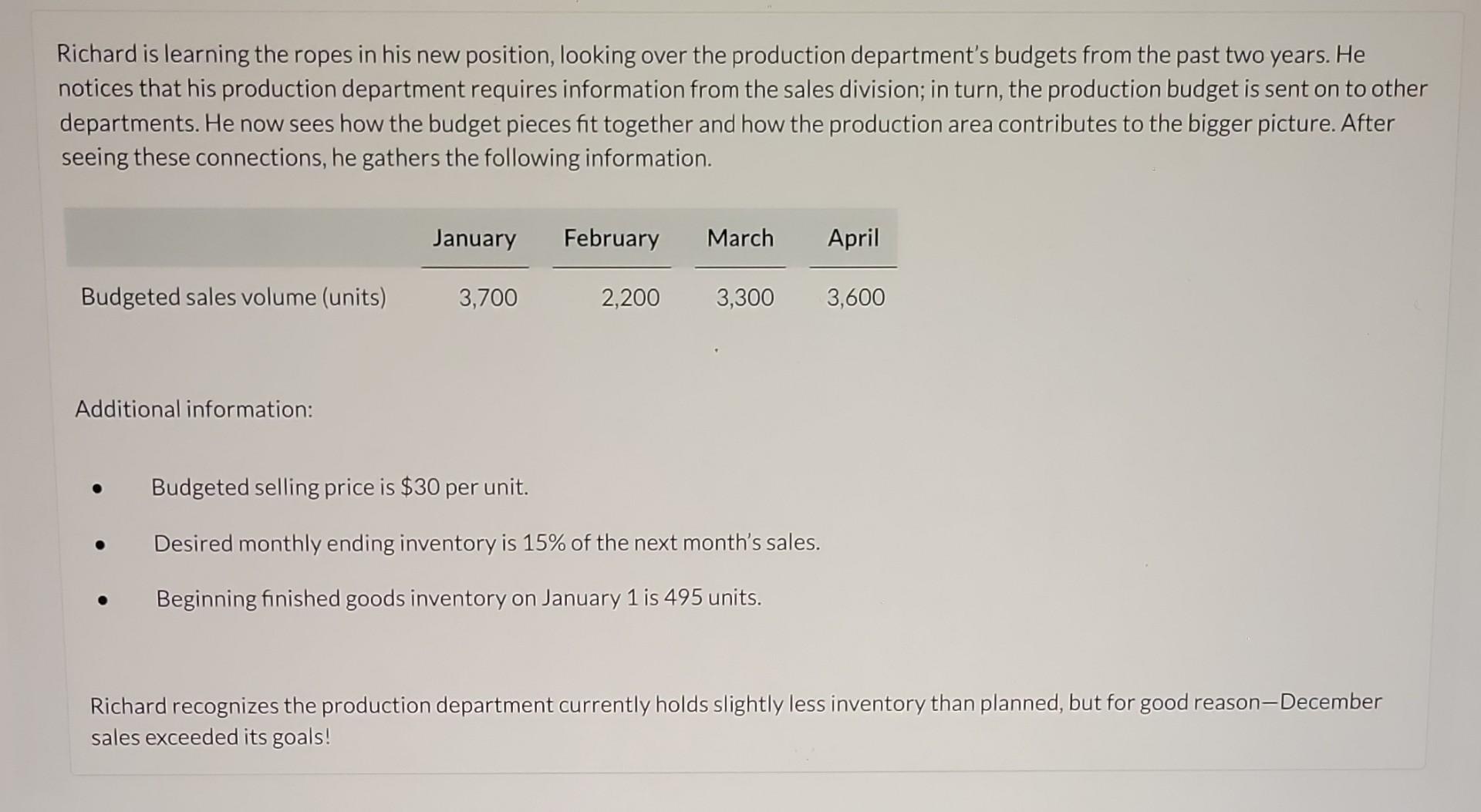

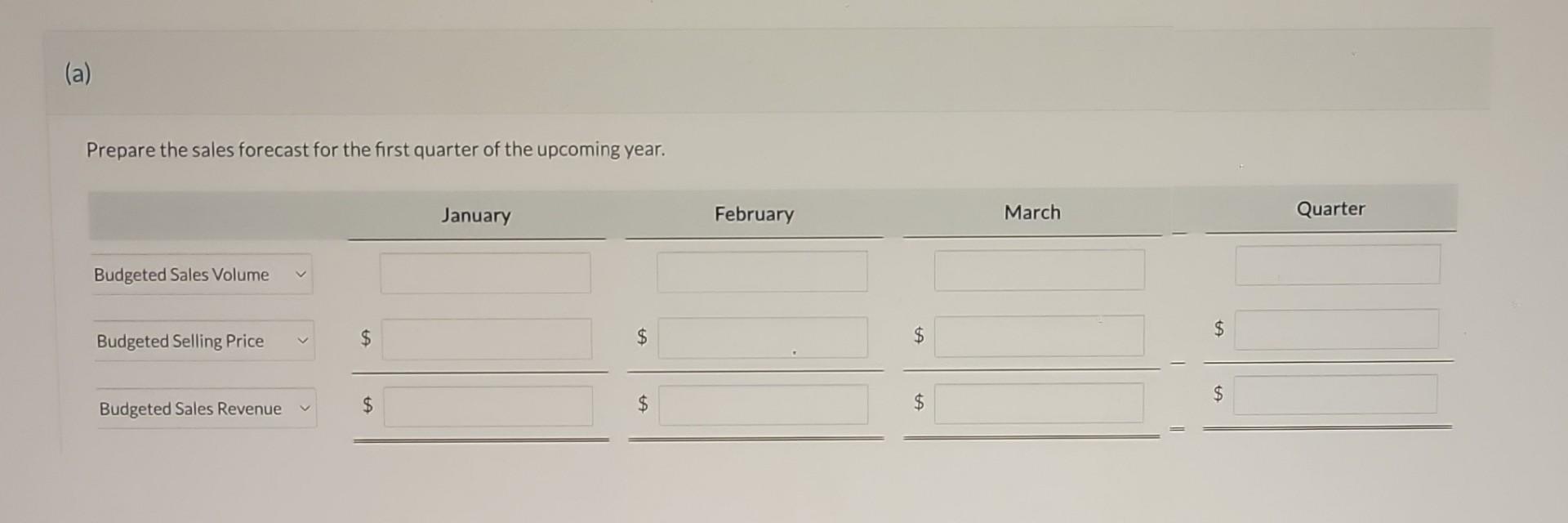

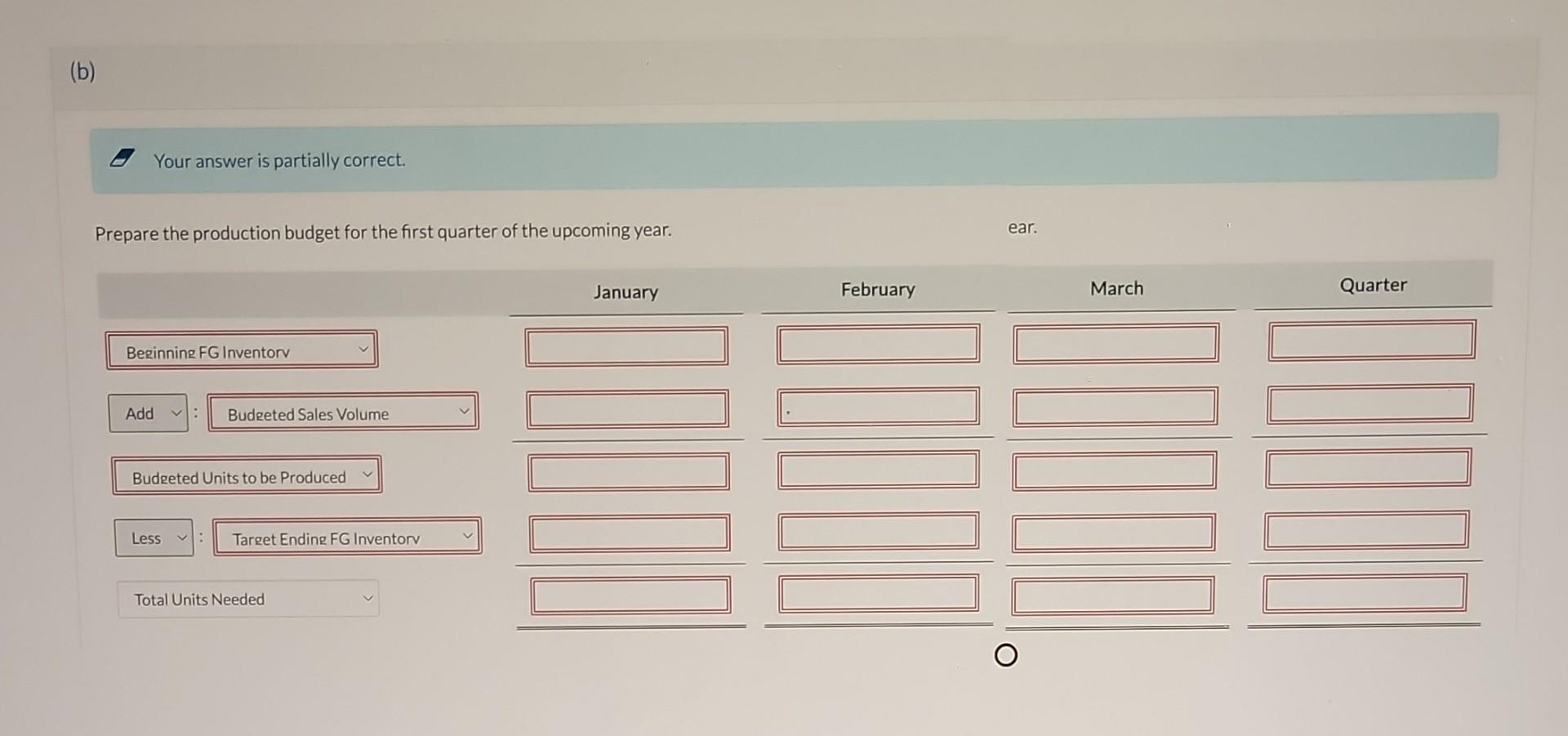

Richard is learning the ropes in his new position, looking over the production department's budgets from the past two years. He notices that his production department requires information from the sales division; in turn, the production budget is sent on to other departments. He now sees how the budget pieces fit together and how the production area contributes to the bigger picture. After seeing these connections, he gathers the following information. Budgeted sales volume (units) Additional information: January 3,700 February March April 2,200 3,300 3,600 Budgeted selling price is $30 per unit. Desired monthly ending inventory is 15% of the next month's sales. Beginning finished goods inventory on January 1 is 495 units. Richard recognizes the production department currently holds slightly less inventory than planned, but for good reason-December sales exceeded its goals! (a) Prepare the sales forecast for the first quarter of the upcoming year. Budgeted Sales Volume Budgeted Selling Price Budgeted Sales Revenue $ $ January $ $ February $ $ March $ $ Quarter (b) Your answer is partially correct. Prepare the production budget for the first quarter of the upcoming year. Beginning FG Inventorv Add : Budgeted Sales Volume Budgeted Units to be Produced Less Target Ending FG Inventorv Total Units Needed January [100 February CUNG ear. March Quarter 17073

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To prepare the sales forecast for the first quarter of the upcoming year we need to use the given information on budgeted sales volume and selling p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started