Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Richard Kerslake, a bond fund manager is considering the purchase of one of the following bonds to include in his portfolio. Bond Characteristics SUB

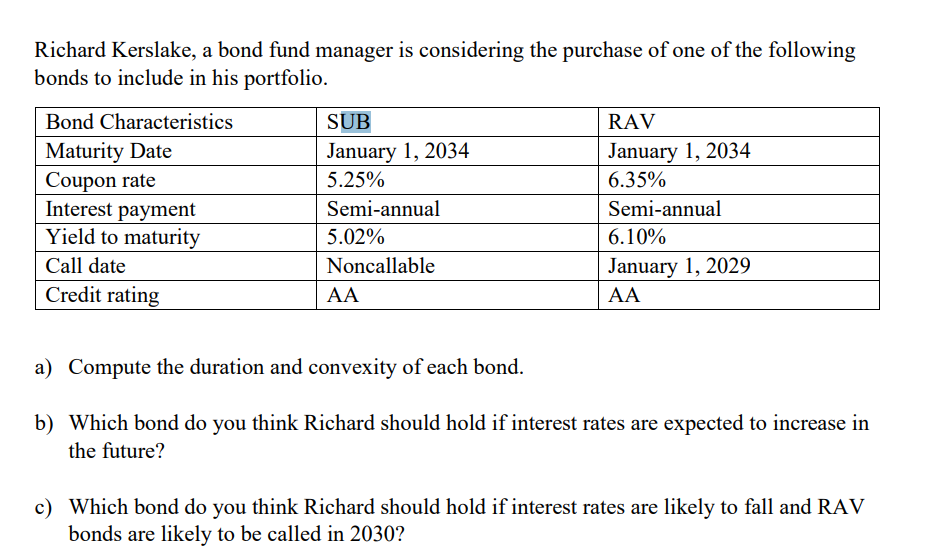

Richard Kerslake, a bond fund manager is considering the purchase of one of the following bonds to include in his portfolio. Bond Characteristics SUB RAV Maturity Date Coupon rate Interest payment January 1, 2034 January 1, 2034 5.25% 6.35% Semi-annual Semi-annual Yield to maturity 5.02% 6.10% Call date Noncallable January 1, 2029 Credit rating AA a) Compute the duration and convexity of each bond. b) Which bond do you think Richard should hold if interest rates are expected to increase in the future? c) Which bond do you think Richard should hold if interest rates are likely to fall and RAV bonds are likely to be called in 2030?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started