Richard Pitkin, CFO of Draper Corporation, was concerned by the long-term prospects for the Synectics product line. The product line had performed well historically,

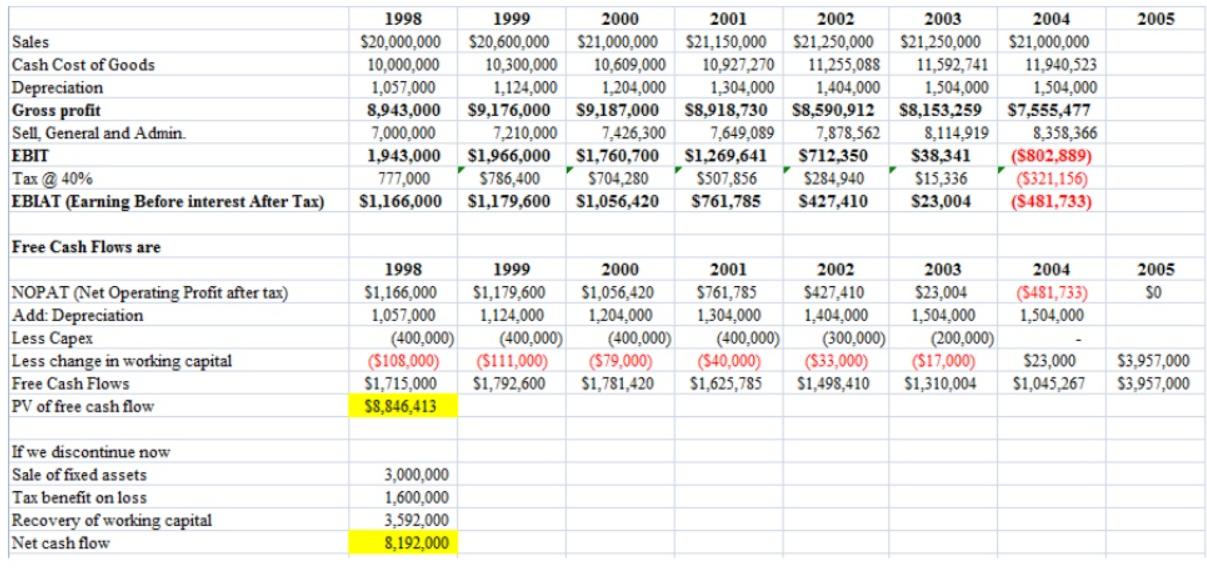

Richard Pitkin, CFO of Draper Corporation, was concerned by the long-term prospects for the Synectics product line. The product line had performed well historically, but the impending loss of its patent position seemed certain to attract new entrants and result in lower product prices and flat unit sales through the year of 2004. Management was considering the elimination of the product line as of year-end 1997. Would you recommend that the Synectics product line be discontinued at the beginning of 1998? 1998 1999 2000 2001 2002 2003 2004 2005 Sales Cash Cost of Goods Depreciation Gross profit $20,600,000 10,300,000 1,124,000 $9,176,000 $21,000,000 10,609,000 1,204,000 $9,187,000 $21,150,000 $21,250,000 $21,250,000 11,592,741 1,504,000 $8,153,259 8,114,919 $38,341 $20,000,000 10,000,000 $21,000,000 11,940,523 10,927,270 11,255,088 1,057,000 8,943,000 7,000,000 1,943,000 1,404,000 $8,590,912 1,304,000 1,504,000 $8,918,730 $7,555,477 8,358,366 7,210,000 $1,966,000 $786,400 $1,179,600 Sell, General and Admin. 7,426,300 7,649,089 7,878,562 EBIT $1,760,700 S1,269,641 $712,350 Tax @ 40% EBIAT (Earning Before interest After Tax) 777,000 $1,166,000 $704,280 $1,056,420 $507,856 $761,785 $284,940 $427,410 $15,336 $23,004 (S802,889) ($321,156) (S481,733) Free Cash Flows are 1998 1999 2000 2001 2002 2003 2004 2005 $1,166,000 1,057,000 (400,000) ($108,000) $1,715,000 $8,846,413 $1,179,600 1,124,000 (400,000) ($111,000) $1,792,600 $1,056,420 1,204,000 (400,000) (S79,000) $1,781,420 $761,785 1,304,000 (400,000) ($40,000) $1,625,785 $427,410 1,404,000 (300,000) ($33,000) $1,498,410 $23,004 1,504,000 (200,000) ($17,000) $1,310,004 ($481,733) 1,504,000 SO NOPAT (Net Operating Profit after tax) Add: Depreciation Less Capex Less change in working capital Free Cash Flows PV of free cash flow $23,000 $1,045,267 $3,957,000 $3,957,000 If we discontinue now Sale of fixed assets 3,000,000 1,600,000 3,592,000 8,192,000 Tax benefit on loss Recovery of working capital Net cash flow

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started