Answered step by step

Verified Expert Solution

Question

1 Approved Answer

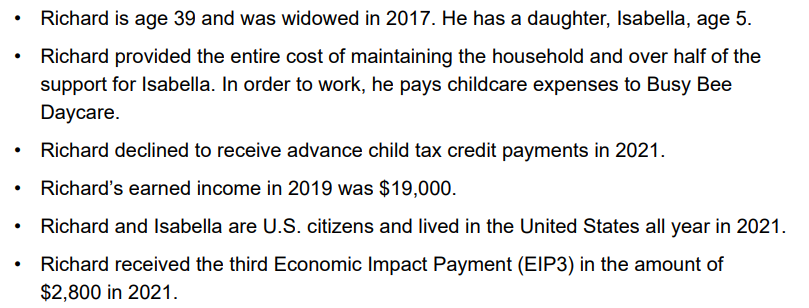

Richards Retirement Savings Contributions Credit on Form 8800 is $_______. Richard is age 39 and was widowed in 2017. He has a daughter, Isabella, age

Richards Retirement Savings Contributions Credit on Form 8800 is $_______.

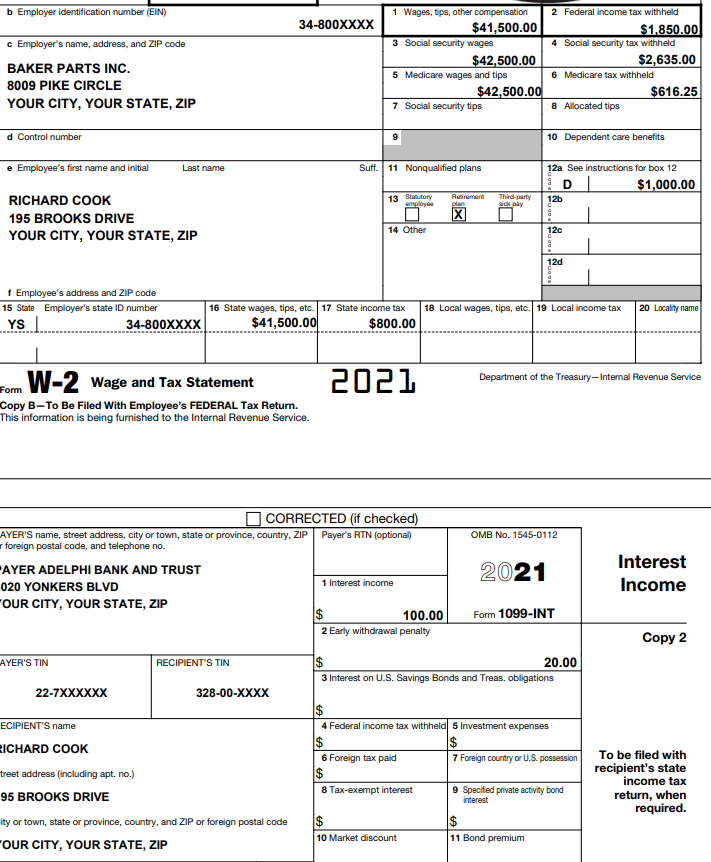

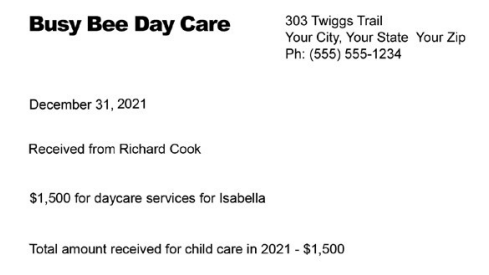

Richard is age 39 and was widowed in 2017. He has a daughter, Isabella, age 5. Richard provided the entire cost of maintaining the household and over half of the support for Isabella. In order to work, he pays childcare expenses to Busy Bee Daycare. Richard declined to receive advance child tax credit payments in 2021. Richard's earned income in 2019 was $19,000. Richard and Isabella are U.S. citizens and lived in the United States all year in 2021. Richard received the third Economic Impact Payment (EIP3) in the amount of $2,800 in 2021. b Employer identification number (EIN) 34-800XXXX c Employer's name, address, and ZIP code BAKER PARTS INC. 8009 PIKE CIRCLE YOUR CITY, YOUR STATE, ZIP 1 Wages, tips, other compensation $41,500.00 3 Social Security wages $42,500.00 5 Medicare wages and tips $42,500.00 7 Social Security tips 2 Federal income tax withheld $1.850.00 4 Social security tax withheld $2,635.00 6 Medicare tax withheld $616.25 8 Allocated tips d Control number 9 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 13 Statutory employee Retirement plan Third-party sick pay RICHARD COOK 195 BROOKS DRIVE YOUR CITY, YOUR STATE, ZIP 12a See instructions for box 12 $1,000.00 12b a 12c a 14 Other 12d f Employee's address and ZIP code 15 State Employer's state ID number YS L. 34-800XXXX 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 16 State wages, tips, etc. 17 State income tax $41,500.00 $800.00 2021 Department of the Treasury - Internal Revenue Service W-2 wage and Tax Statement Form Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. OMB No. 1545-0112 CORRECTED (if checked) AYER'S name, street address, city or town, state or province, country, ZIP Payer's RTN (optional) foreign postal code, and telephone no. -AYER ADELPHI BANK AND TRUST 020 YONKERS BLVD 1 Interest income OUR CITY, YOUR STATE, ZIP $ 100.00 2 Early withdrawal penalty 2021 Interest Income Form 1099-INT Copy 2 AYER'S TIN RECIPIENT'S TIN $ 20.00 3 Interest on U.S. Savings Bonds and Treas. obligations 22-7XXXXXX 328-00-XXXX ECIPIENT'S name RICHARD COOK treet address (including apt. no.) 95 BROOKS DRIVE ity or town, state or province, country, and ZIP or foreign postal code FOUR CITY, YOUR STATE, ZIP $ 4 Federal income tax withheld 5 Investment expenses $ $ 6 Foreign tax paid 7 Foreign country or U.S. possession $ 8 Tax-exempt interest 9 Specified private activity bond interest $ $ 10 Market discount 11 Bond premium To be filed with recipient's state income tax return, when required. Busy Bee Day Care 303 Twiggs Trail Your City, Your State Your Zip Ph: (555) 555-1234 December 31, 2021 Received from Richard Cook $1,500 for daycare services for Isabella Total amount received for child care in 2021 - $1,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started