Answered step by step

Verified Expert Solution

Question

1 Approved Answer

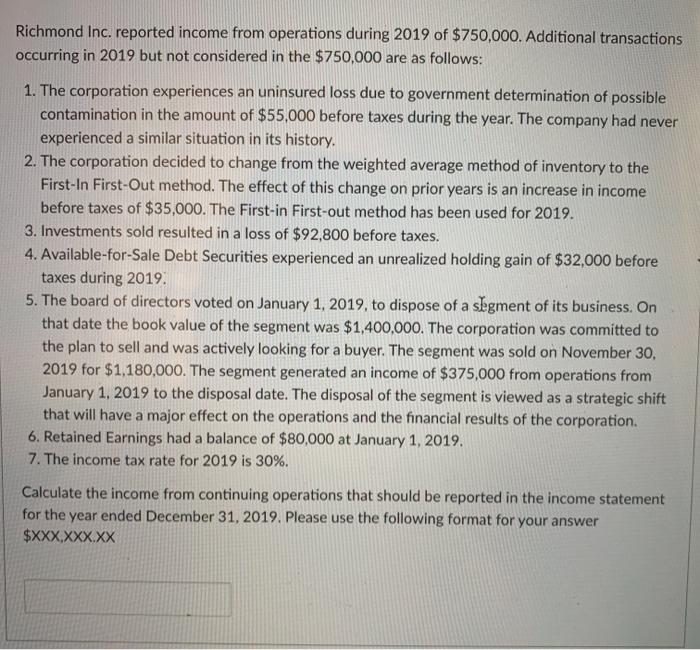

Richmond Inc. reported income from operations during 2019 of $750,000. Additional transactions occurring in 2019 but not considered in the $750,000 are as follows:

Richmond Inc. reported income from operations during 2019 of $750,000. Additional transactions occurring in 2019 but not considered in the $750,000 are as follows: 1. The corporation experiences an uninsured loss due to government determination of possible contamination in the amount of $55,000 before taxes during the year. The company had never experienced a similar situation in its history. 2. The corporation decided to change from the weighted average method of inventory to the First-In First-Out method. The effect of this change on prior years is an increase in income before taxes of $35,000. The First-in First-out method has been used for 2019. 3. Investments sold resulted in a loss of $92,800 before taxes. 4. Available-for-Sale Debt Securities experienced an unrealized holding gain of $32,000 before taxes during 2019. 5. The board of directors voted on January 1, 2019, to dispose of a segment of its business. On that date the book value of the segment was $1,400,000. The corporation was committed to the plan to sell and was actively looking for a buyer. The segment was sold on November 30, 2019 for $1,180,000. The segment generated an income of $375,000 from operations from January 1, 2019 to the disposal date. The disposal of the segment is viewed as a strategic shift that will have a major effect on the operations and the financial results of the corporation. 6. Retained Earnings had a balance of $80,000 at January 1, 2019. 7. The income tax rate for 2019 is 30%. Calculate the income from continuing operations that should be reported in the income statement for the year ended December 31, 2019. Please use the following format for your answer $XXX,XXX.XX

Step by Step Solution

★★★★★

3.59 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Refer the solution in the image and understand what are discontinued operations and extraordinary items as written below A discontinued operation occurs when a business sells a segment usually an unpr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started