Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ricky Ricardo has asked you to prepare his 2021 Tax Return: Income Received with Documentation (Assume the documentation is attached and substantiated) Additional information which

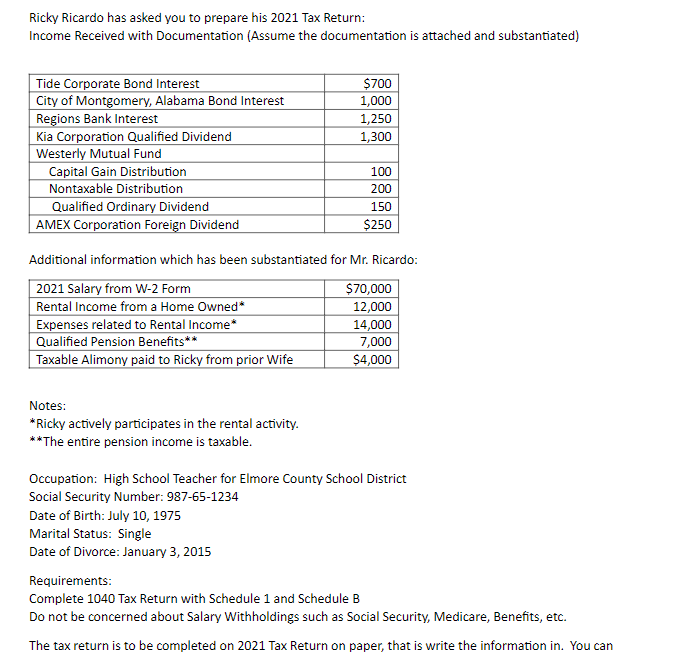

Ricky Ricardo has asked you to prepare his 2021 Tax Return: Income Received with Documentation (Assume the documentation is attached and substantiated) Additional information which has been substantiated for Mr. Ricardo: Notes: *Ricky actively participates in the rental activity. **The entire pension income is taxable. Occupation: High School Teacher for Elmore County School District Social Security Number: 987-65-1234 Date of Birth: July 10, 1975 Marital Status: Single Date of Divorce: January 3, 2015 Requirements: Complete 1040 Tax Return with Schedule 1 and Schedule B Do not be concerned about Salary Withholdings such as Social Security, Medicare, Benefits, etc. The tax return is to be completed on 2021 Tax Return on paper, that is write the information in. You can

Ricky Ricardo has asked you to prepare his 2021 Tax Return: Income Received with Documentation (Assume the documentation is attached and substantiated) Additional information which has been substantiated for Mr. Ricardo: Notes: *Ricky actively participates in the rental activity. **The entire pension income is taxable. Occupation: High School Teacher for Elmore County School District Social Security Number: 987-65-1234 Date of Birth: July 10, 1975 Marital Status: Single Date of Divorce: January 3, 2015 Requirements: Complete 1040 Tax Return with Schedule 1 and Schedule B Do not be concerned about Salary Withholdings such as Social Security, Medicare, Benefits, etc. The tax return is to be completed on 2021 Tax Return on paper, that is write the information in. You can Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started