Question

Ricoh India Limited (Ricoh India), On June 20, 2016, the national daily newspaper, the Indian Express, reported the fraud. Ricoh India admits to falsified accounts:

Ricoh India Limited (Ricoh India), On June 20, 2016, the national daily newspaper, the Indian Express, reported the fraud. Ricoh India admits to falsified accounts: 11.23 billion estimated loss. The suspected accounting fraud at Ricoh India is one of the biggest corporate frauds involving a local company since the Satyam scandal came to light in 2009.5 Another business news source suggested that the fraudulent activity should have been obvious. A cursory look at the nature of the irregularities reported suggested that only an extremely careless and happy-golucky auditor would have not noticed the deviations.6 What signs were missed in the companys financial statements that should have warned the auditors about possible fraud? After the auditors report was made public, what investment strategy was left for an investor to pursue? Knowing that the company had falsified financial statements, should an investor continue to hold, or divest, the Ricoh India shares?

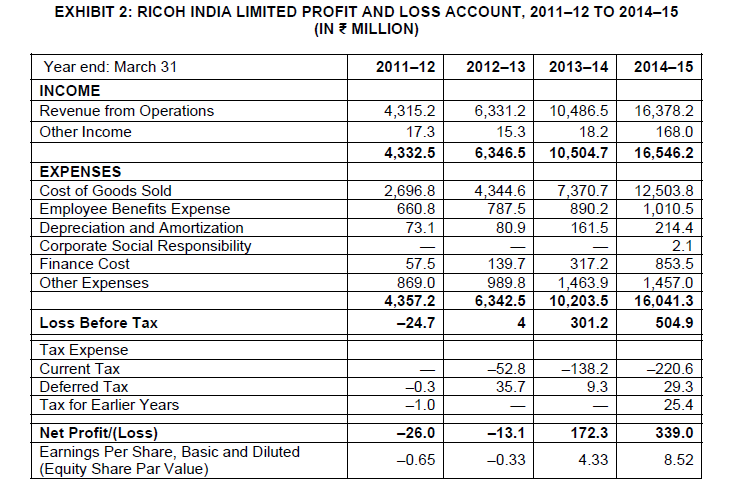

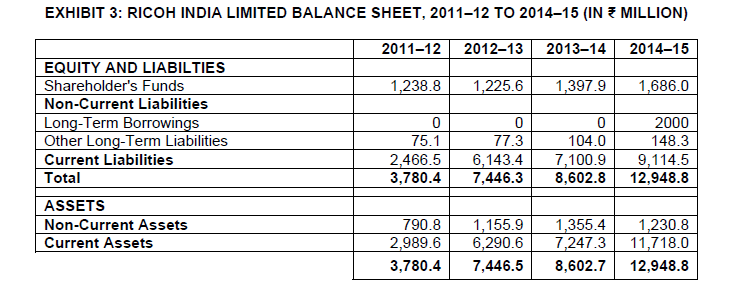

character-recognition technology.9 In 2000, Ricoh began strengthening its overseas sales network.10 The global technology giant had 230 consolidated companies, 108,195 employees, and a market capitalization of 135.3 billion11 on March 31, 2015.12 From its headquarters in Japan, Ricoh was led by Zenji Miura as its chairman and chief executive officer (CEO). Ricoh specialized in office-imaging equipment, production print solutions, document management systems, and information technology (IT) services.13 In 2015, Ricoh had global sales of 2,231 billion (approximately US$18.5 billion) and operated in 200 countries and regions.14 Known for its wide range of products and services, including printing, document services, IT services, and communication systems, Ricoh offered customized products and services for various business practices as a global company with one central point of coordination.15 The company was known for exceptional customer service and sustainability initiatives, having won various awards for its innovation and environmental initiatives.16 In 2016, the Ethisphere Institute honoured Ricoh as the Worlds Most Ethical Company for the seventh time.17 RICOH INDIA RPG Ricoh Ltd., incorporated on October 22, 1993, in Bombay, India, was renamed Ricoh India Limited in 1998. The companys business included office-imaging equipment, production print services, document management systems, and IT services.18 Ricoh India received awards for environmental initiatives related to resource extractions, chemical emissions, and discharges. The company also took part in socially responsible corporate activities through education, skill development, and community development.19 In March 2015, Ricoh India had an authorized capital of 45 million shares priced at 10 per share, of which the Ricoh parent company held 46.04 per cent and NRG Group Limited held 27.56 per cent.20 In India, the company operated through a robust network of 24 offices, with over 2,500 dealers and business associates spread across the country.21 In 2012, Ricoh India established Ricoh Thermal Media Asia Pacific Private Limited, which was responsible for thermal media and related business in Mumbai. In 2014, Ricoh India was chosen to supply rural information and communication technology services to Indias Department of Posts to modernize and automate approximately 129,000 post offices.22 In the companys 201415 annual report, the managing director and CEO boasted a growth rate of 213 per cent in IT services. The companys delivery of technology to its customers included digitization services, applications, networking, data management, hosting, surveillance services, and other products.23 The companys multi-function printer helped Ricoh India dominate the market with significant sales growth of 16 per cent year on year. Within four years of launching a laser printer, the company secured a position among the top three market leaders.24 In March 2015, Ricoh Indias assets were 12.9 billion, for an increase of 50 per cent over the previous year. Its total revenue was 16.5 billion, for an increase of 57 per cent over the previous year, and profit after tax was 339 million, which was also an increase of 96.7 per cent over the previous year (see Exhibits 2 and 3).

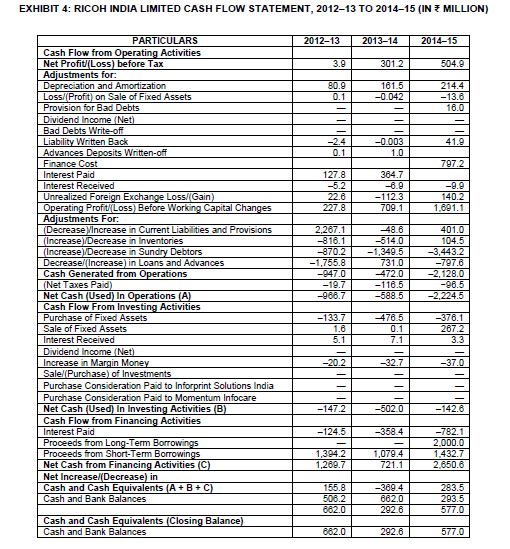

A FINANCIAL OVERVIEW OF RICOH INDIA Ricoh India went from no long-term debt in 201314 to a debt of 2 billion the following year. The new debt consisted of non-convertible debentures with a coupon rate of 7.8 per cent that were issued through private placements, to be redeemed on September 10, 2017.25 From 201112 to 201415, the companys compound annual growth rate (CAGR) grew by 56 per cent for sales and by 107 per cent for trade receivables. The companys other income also jumped by 871 per cent during the same period (see Exhibits 2 and 3). From 201314 to 201415, Ricoh India posted an increase in profit before tax of 67 per cent, from 301.2 million to 504.9 million. However, the company generated negative cash from operations of 588.5 million in 201314 and 2,224 million in 201415 (see Exhibit 4). Ricoh India had a negative cash flow from investment from 201112 onward, but saw a drop of 360 million in cash flow from investment in 201314 and 201415 (see Exhibit 4). Despite a robust increase in sales revenue and profit before tax, and a much lower outflow in cash outlay in investment activities in 201415 compared to the previous financial year, the companys positive cash from financing activities increased by 1.9 billion (see Exhibits 2, 3, and 4). CORPORATE GOVERNANCE IN RICOH INDIA According to its annual report, Ricoh India conducted its business with the highest ethical standards and sound corporate governance practices. The company believed that, to retain the trust and interest of investors, sound corporate governance practices and ethical standards were essential.26 The company also claimed that its board of directors provided strategic guidance with the highest level of integrity, values, and personal and professional ethics. As of March 31, 2015, the companys board of directors comprised an executive director, two non-executive directors, and three non-executive independent directors, one of whom was a woman. The fact that 50 per cent of the directors were independent was consistent with clause 49 of Indias listing requirements.27 Tetsuya Takano was appointed chairman on April 1, 2015, after completing his term as managing director and CEO. Manoj Kumar, an executive director who had been associated with Ricoh since 1995, replaced Takano as the companys managing director and CEO. None of the directors were related to other directors on the board in respect of the definition of relative under Indias Companies Act (2013). All directors were professionally qualified and had rich professional experience. Also, none of the directors held any shares in the company.28 The company had a proper internal control system in place. The directors report confirmed that Ricoh India consistently selected and applied accounting policies, and made judgments and estimates that provided a true and fair view of the financial statements of the company. The directors claimed to have maintained adequate accounting records, as required by the act. They also created a system that would prevent and detect fraud and other irregularities.29

SPECIAL INVESTIGATION OF THE COMPANY ACCOUNTS Although there was some indication that Ricoh India was having problems with its financial statements, the rating agency Credit Analysis and Research Limited upgraded the companys credit rating of non-convertible debentures from IND AA to IND AA in January 2016. The rating agencys motives were unclear, especially considering that the financial statements of the past two quarters were not available. J. N. Gupta, the former executive director of the Securities Exchange Board of India, suggested that the stock market regulator should investigate the issue. However, to retain the faith of investors in the stock market, Gupta advised that the investigation should be conducted as an isolated case, rather than making it indicative of widespread malaise.30 In July 2015, the accounting firm Sahni Natarajan and Bahl retired as auditors of Ricoh India. The companys audit committee then appointed BSR & Co. LLP (BSR) as its new statutory auditors. After a preliminary review, BSR requested that the company undergo a further review of certain transactions. On the recommendation of BSR, the audit committee appointed the accounting firm SS Kothari Mehta & Co. for additional services. However, the new firm offered recommendations that did not meet with the approval of BSR. The audit committee then appointed the law firm Shardul Amarchand Mangaldas & Co. as its counsel, which arranged for the accounting firm PricewaterhouseCoopers Private Limited (PWC) to conduct a forensic review. On April 1, 2016, Kumar was asked to step down from his position of managing director and CEO, to be replaced by A. T. Rajan. Also asked to step down were the companys chief financial officer, Arvind Singhal, and its chief operating officer, Anil Sahni.31 Based on PWCs preliminary findings from the forensic review of the two quarters beginning April 1, 2015, and July 1, 2015, the board and audit committee announced that the books of accounts and other relevant documents from the financial statements did not reflect a true and fair view of those two quarters. FACTS FROM THE AUDIT REPORT OF THE INDEPENDENT AUDITOR According to the revenue recognition policy detailed in Ricoh Indias annual report, funds should be recognized as revenue only when significant risks and rewards were transferred to the customer (usually when the goods were delivered). However, the preliminary findings of the independent auditor indicated that the revenue of the company was recognized based on orders on hand or on invoicing without the dispatch or delivery of goods, clearly contradicting company policy. In its report, BSR also mentioned that a considerable amount of the companys purchase and sales transactions added little value. The management of the company observed that some of the entries were recorded in the books of accounts without proper justification. The independent auditor drew attention to the notes of the financial results showing that, in its opinion, irregular and fraudulent transactions were present. Adjustments had been made in net sales, expenses, assets, and liabilities to show higher profits. The books also showed backdated transactions with inconsistent prices and no supporting evidence. There was a link between the prominent management personnel, suppliers, and customers of the company. In fact, certain customers had untraceable addresses. Reconciliation of some large advances of customers and vendors had not been done. Therefore, the auditors could not be sure that the stated amounts of provisions were adequate. The auditor had provided a qualified report for the year based on the assumption that the opening balances on April 1, 2015, had been correctly stated. If that assumption was proven incorrect, the financial results would need to change substantively.

Therefore, the audit committee issued its findings that the books and accounts for the two quarters of the company ending June 30 and September 30, 2015, did not reflect a true and fair view of the companys state of affairs.37 INVESTMENT DECISION Ricoh India had posted profits of 172.3 million in 201314 and 339.0 million 201415, after a negative profit result of 13.1 million in 201213. The companys earnings per share (EPS) of 8.52 in 201415 was almost double the EPS of the previous financial year, and share prices were continuing to rise. And then, on July 20, 2016, leading newspapers in India published the news that Ricoh India had admitted to manipulating 11.23 billion in funds on its accounts.38 Based on the companys published annual reports, Ricoh India appeared to be a well-governed company. Therefore, the prospect of analyzing the financial health of a company based on its public financial statements had become a questionable exercise. The news raised concerns about the quality of the companys earnings. On June 20, 2016, after the company publicly admitted to having falsified its accounts, the opening share price of the company was 219.50 per share, down from 595.75 per share in January. The Indian proxy advisory firm Institutional Investor Advisory Services, commented that Ricoh Indias parent company had admitted to having been caught unaware of its subsidiarys affairs.39 Once news about fraud committed by a company was made public in a leading national newspaper, how should investors react? Should investors continue to hold the companys shares, hoping that the parent company might infuse funds in the embattled subsidiary? The value of Ricoh Indias shares had already eroded by 75 per cent between June 20, 2015, and June 20, 2016. Could the shares regain their value; and if so, was it the right time to buy even more company shares, while the value was so low? Or would it be a better decision to sell the shares to prevent further losses? Could an analysis of the companys financial statements help an investor determine whether there were signs of financial gain in the future? Investment decisions needed to be madewhile there was still time.

Questions

1) Explain the Fraud Triangle Theory using the company under consideration as an example.

2) From the financial statements and notes attached, enlist the indications of financial shenanigans.

3) What are the warning signs in financial statements that indicate possibilities of fraud?

4) Based on the qualifications given by the auditors and the admission of the manipulations of accounts by the company, should an investor, buy, sell, or hold the Ricoh India stocks?

EXHIBIT 2: RICOH INDIA LIMITED PROFIT AND LOSS ACCOUNT, 2011-12 TO 2014-15 (IN MILLION) 2011-12 2012-13 2013-14 2014-15 Year end: March 31 INCOME Revenue from Operations Other Income 4,315.2 17.3 4,332.5 6,331.2 15.3 6,346.5 10,486.5 18.2 10,504.7 16,378.2 168.0 16,546.2 EXPENSES Cost of Goods Sold Employee Benefits Expense Depreciation and Amortization Corporate Social Responsibility Finance Cost Other Expenses 2,696.8 660.8 73.1 4,344.6 787.5 80.9 7,370.7 890.2 161.5 57.5 869.0 4,357.2 -24.7 139.7 989.8 6,342.5 4 317.2 1,463.9 10,203.5 301.2 12,503.8 1,010.5 214.4 2.1 853.5 1,457.0 16,041.3 504.9 -138.2 -52.8 35.7 9.3 Loss Before Tax Tax Expense Current Tax Deferred Tax Tax for Earlier Years Net Profit/(Loss) Earnings Per Share, Basic and Diluted (Equity Share Par Value) -0.3 -1.0 -220.6 29.3 25.4 -26.0 -13.1 172.3 339.0 -0.65 -0.33 4.33 8.52 EXHIBIT 3: RICOH INDIA LIMITED BALANCE SHEET, 2011-12 TO 2014-15 (IN MILLION) 2011-12 2012-13 2013-14 2014-15 1,238.8 1,225.6 1,397.9 1,686.0 EQUITY AND LIABILTIES Shareholder's Funds Non-Current Liabilities Long-Term Borrowings Other Long-Term Liabilities Current Liabilities Total ASSETS Non-Current Assets Current Assets 0 75.1 2,466.5 3,780.4 0 77.3 6,143.4 7,446.3 0 104.0 7,100.9 8,602.8 2000 148.3 9,114.5 12,948.8 790.8 2,989.6 3,780.4 1,155.9 6,290.6 7,446.5 1,355.4 7,247.3 8,602.7 1,230.8 11,718.0 12,948.8 EXHIBIT 4: RICOH INDIA LIMITED CASH FLOW STATEMENT, 2012-13 TO 2014-15 (IN MILLION) 2012-13 2013-14 2014-15 3.9 301.2 504.9 80.9 0.1 181.3 -0.042 214.4 -13.0 16.0 i -2.4 41.9 0.1 -0.003 1.0 797.2 127.8 -5.2 22.6 227.8 384.7 -6.9 -112.3 709.1 -9.9 140.2 1.691.1 PARTICULARS Cash Flow from Operating Activities Net Profit (Loss) before Tax Adjustments for: Depreciation and Amortization Loss/(Profit) on Sale of Fixed Assets Provision for Bad Debts Dividend Income (Net) Bad Debts Write-off Liability Written Back Advances Deposits Written-off Finance Cost Interest Paid Interest Received Unrealized Foreign Exchange Loss/Gain) Operating Profit/(Loss) Before Working Capital Changes Adjustments For: (Decrease Increase in Current Liabilities and Provisions (Increase) /Decrease in Inventories (Increase)/Decrease in Sundry Debtors Decrease Increase in Loans and Advances Cash Generated from Operations (Net Taxes Paid) Net Cash Used In Operations (A) Cash Flow From Investing Activities Purchase of Fixed Assets Sale of Fixed Assets Interest Received Dividend Income (Net) Increase in Margin Money Sale/(Purchase) of Investments Purchase Consideration Paid to Inforprint Solutions India Purchase Consideration Paid to Momentum Infocare Net Cash (Used) In Investing Activities (B) Cash Flow from Financing Activities Interest Paid Proceeds from Long-Term Borrowings Proceeds from Short-Term Borrowings Net Cash from Financing Activities (C) Net Increase/Decrease) in Cash and Cash Equivalents (A + B + C) Cash and Bank Balances 2.267.1 -816.1 -870.2 -1.755.8 -947.0 -19.7 -988.7 48.6 -514.0 -1,349.5 731.0 472.0 -110.5 -588.5 401.0 104.5 -3,443.2 -797.6 -2,128.0 -06.5 -2.224.5 -133.7 1.6 5.1 470.5 0.1 7.1 -378.1 267.2 3.3 -20.2 -32.7 -37.0 -147.2 -502.0 -142.6 -124.5 -358.4 -782.1 2.000.0 1.432.7 2,650.6 1,394.2 1,289.7 1,079.4 721.1 155.8 500.2 662.0 -369.4 662.0 292.6 283.5 293.5 577.0 Cash and Cash Equivalents Closing Balance) Cash and Bank Balances 862.0 292.6 577.0 EXHIBIT 2: RICOH INDIA LIMITED PROFIT AND LOSS ACCOUNT, 2011-12 TO 2014-15 (IN MILLION) 2011-12 2012-13 2013-14 2014-15 Year end: March 31 INCOME Revenue from Operations Other Income 4,315.2 17.3 4,332.5 6,331.2 15.3 6,346.5 10,486.5 18.2 10,504.7 16,378.2 168.0 16,546.2 EXPENSES Cost of Goods Sold Employee Benefits Expense Depreciation and Amortization Corporate Social Responsibility Finance Cost Other Expenses 2,696.8 660.8 73.1 4,344.6 787.5 80.9 7,370.7 890.2 161.5 57.5 869.0 4,357.2 -24.7 139.7 989.8 6,342.5 4 317.2 1,463.9 10,203.5 301.2 12,503.8 1,010.5 214.4 2.1 853.5 1,457.0 16,041.3 504.9 -138.2 -52.8 35.7 9.3 Loss Before Tax Tax Expense Current Tax Deferred Tax Tax for Earlier Years Net Profit/(Loss) Earnings Per Share, Basic and Diluted (Equity Share Par Value) -0.3 -1.0 -220.6 29.3 25.4 -26.0 -13.1 172.3 339.0 -0.65 -0.33 4.33 8.52 EXHIBIT 3: RICOH INDIA LIMITED BALANCE SHEET, 2011-12 TO 2014-15 (IN MILLION) 2011-12 2012-13 2013-14 2014-15 1,238.8 1,225.6 1,397.9 1,686.0 EQUITY AND LIABILTIES Shareholder's Funds Non-Current Liabilities Long-Term Borrowings Other Long-Term Liabilities Current Liabilities Total ASSETS Non-Current Assets Current Assets 0 75.1 2,466.5 3,780.4 0 77.3 6,143.4 7,446.3 0 104.0 7,100.9 8,602.8 2000 148.3 9,114.5 12,948.8 790.8 2,989.6 3,780.4 1,155.9 6,290.6 7,446.5 1,355.4 7,247.3 8,602.7 1,230.8 11,718.0 12,948.8 EXHIBIT 4: RICOH INDIA LIMITED CASH FLOW STATEMENT, 2012-13 TO 2014-15 (IN MILLION) 2012-13 2013-14 2014-15 3.9 301.2 504.9 80.9 0.1 181.3 -0.042 214.4 -13.0 16.0 i -2.4 41.9 0.1 -0.003 1.0 797.2 127.8 -5.2 22.6 227.8 384.7 -6.9 -112.3 709.1 -9.9 140.2 1.691.1 PARTICULARS Cash Flow from Operating Activities Net Profit (Loss) before Tax Adjustments for: Depreciation and Amortization Loss/(Profit) on Sale of Fixed Assets Provision for Bad Debts Dividend Income (Net) Bad Debts Write-off Liability Written Back Advances Deposits Written-off Finance Cost Interest Paid Interest Received Unrealized Foreign Exchange Loss/Gain) Operating Profit/(Loss) Before Working Capital Changes Adjustments For: (Decrease Increase in Current Liabilities and Provisions (Increase) /Decrease in Inventories (Increase)/Decrease in Sundry Debtors Decrease Increase in Loans and Advances Cash Generated from Operations (Net Taxes Paid) Net Cash Used In Operations (A) Cash Flow From Investing Activities Purchase of Fixed Assets Sale of Fixed Assets Interest Received Dividend Income (Net) Increase in Margin Money Sale/(Purchase) of Investments Purchase Consideration Paid to Inforprint Solutions India Purchase Consideration Paid to Momentum Infocare Net Cash (Used) In Investing Activities (B) Cash Flow from Financing Activities Interest Paid Proceeds from Long-Term Borrowings Proceeds from Short-Term Borrowings Net Cash from Financing Activities (C) Net Increase/Decrease) in Cash and Cash Equivalents (A + B + C) Cash and Bank Balances 2.267.1 -816.1 -870.2 -1.755.8 -947.0 -19.7 -988.7 48.6 -514.0 -1,349.5 731.0 472.0 -110.5 -588.5 401.0 104.5 -3,443.2 -797.6 -2,128.0 -06.5 -2.224.5 -133.7 1.6 5.1 470.5 0.1 7.1 -378.1 267.2 3.3 -20.2 -32.7 -37.0 -147.2 -502.0 -142.6 -124.5 -358.4 -782.1 2.000.0 1.432.7 2,650.6 1,394.2 1,289.7 1,079.4 721.1 155.8 500.2 662.0 -369.4 662.0 292.6 283.5 293.5 577.0 Cash and Cash Equivalents Closing Balance) Cash and Bank Balances 862.0 292.6 577.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started