Answered step by step

Verified Expert Solution

Question

1 Approved Answer

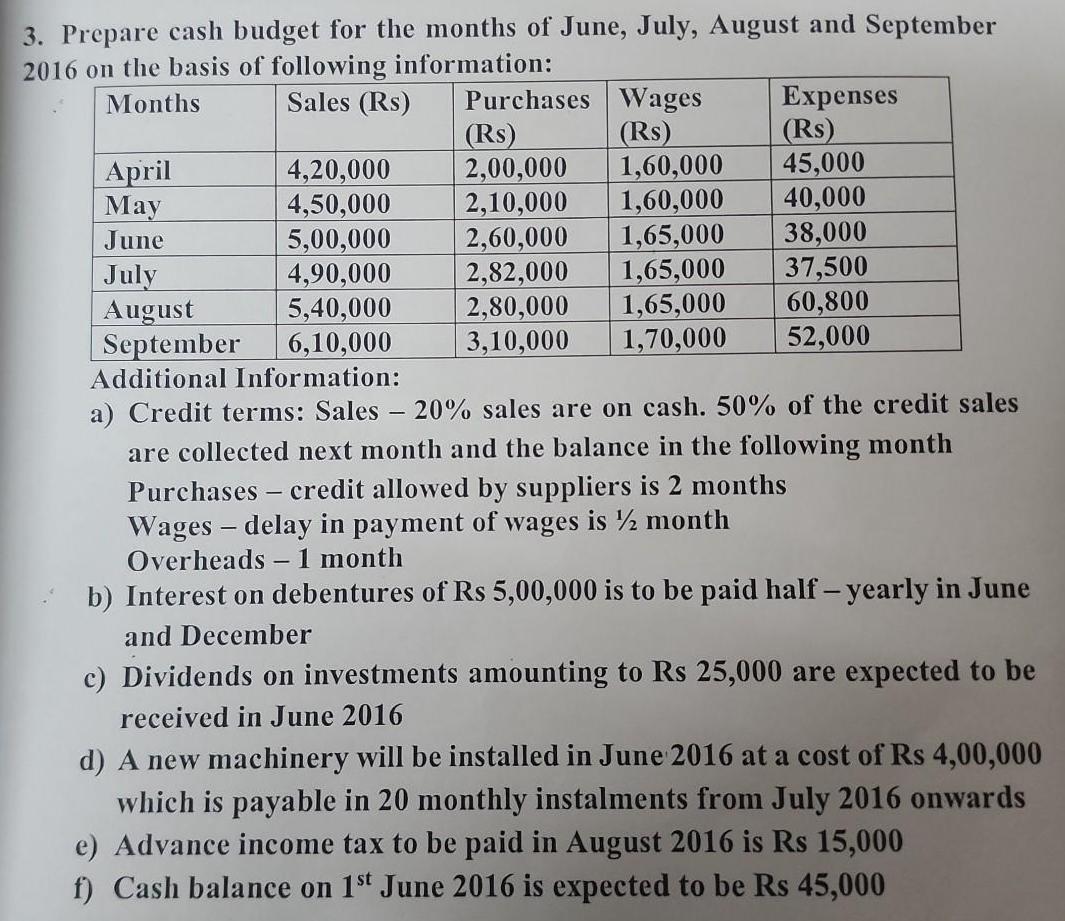

3. Prepare cash budget for the months of June, July, August and September 2016 on the basis of following information: Months Sales (Rs) April

3. Prepare cash budget for the months of June, July, August and September 2016 on the basis of following information: Months Sales (Rs) April May June July August - Purchases Wages (Rs) 4,20,000 4,50,000 5,00,000 4,90,000 5,40,000 September 6,10,000 Additional Information: a) Credit terms: Sales 20% sales are on cash. 50% of the credit sales are collected next month and the balance in the following month Purchases credit allowed by suppliers is 2 months Wages - delay in payment of wages is month Overheads - 1 month b) Interest on debentures of Rs 5,00,000 is to be paid half-yearly in June and December - (Rs) 2,00,000 1,60,000 2,10,000 1,60,000 2,60,000 1,65,000 2,82,000 1,65,000 2,80,000 1,65,000 3,10,000 1,70,000 Expenses (Rs) 45,000 40,000 38,000 37,500 60,800 52,000 c) Dividends on investments amounting to Rs 25,000 are expected to be received in June 2016 d) A new machinery will be installed in June 2016 at a cost of Rs 4,00,000 which is payable in 20 monthly instalments from July 2016 onwards e) Advance income tax to be paid in August 2016 is Rs 15,000 f) Cash balance on 1st June 2016 is expected to be Rs 45,000

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the cash budget for the months of June July August and September 2016 we need to consider the cash inflows and outflows based on the provid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started