Answered step by step

Verified Expert Solution

Question

1 Approved Answer

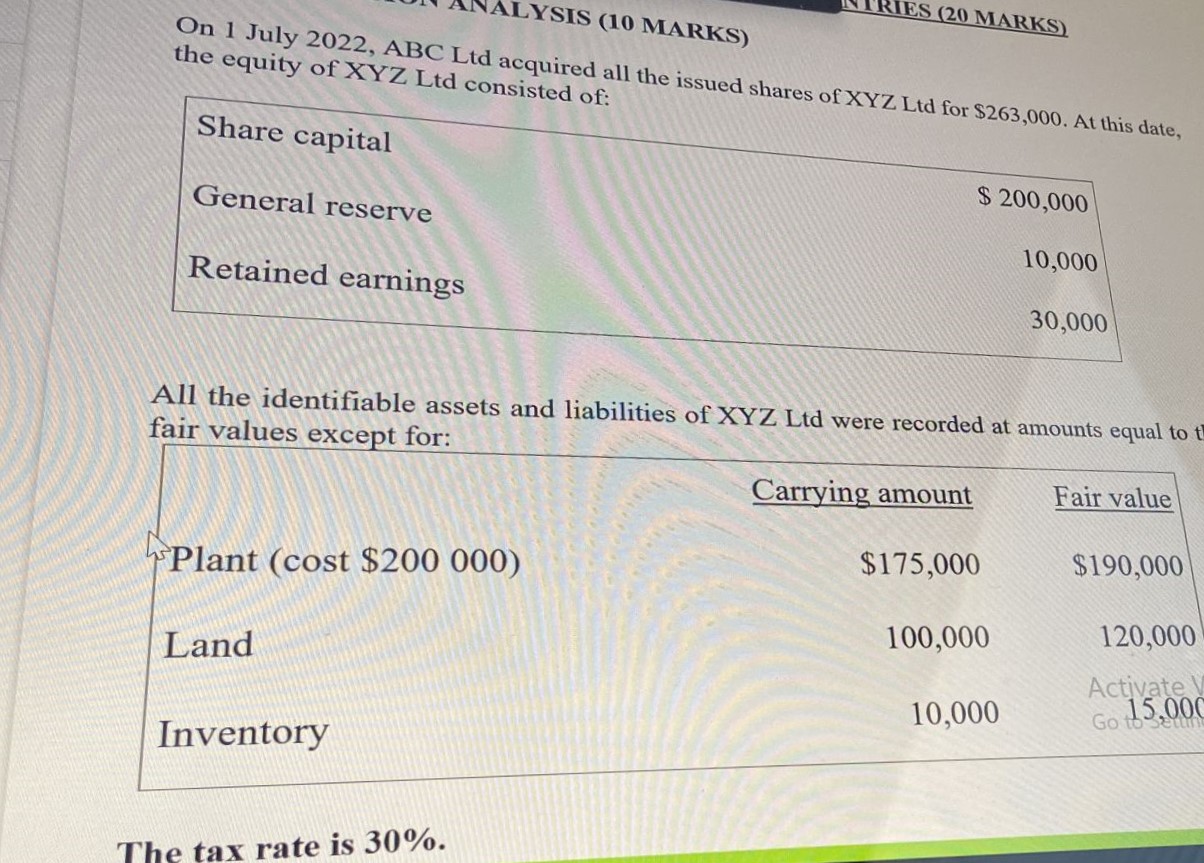

RIES (20 MARKS) ALYSIS (10 MARKS) On 1 July 2022, ABC Ltd acquired all the issued shares of XYZ Ltd for $263,000. At this

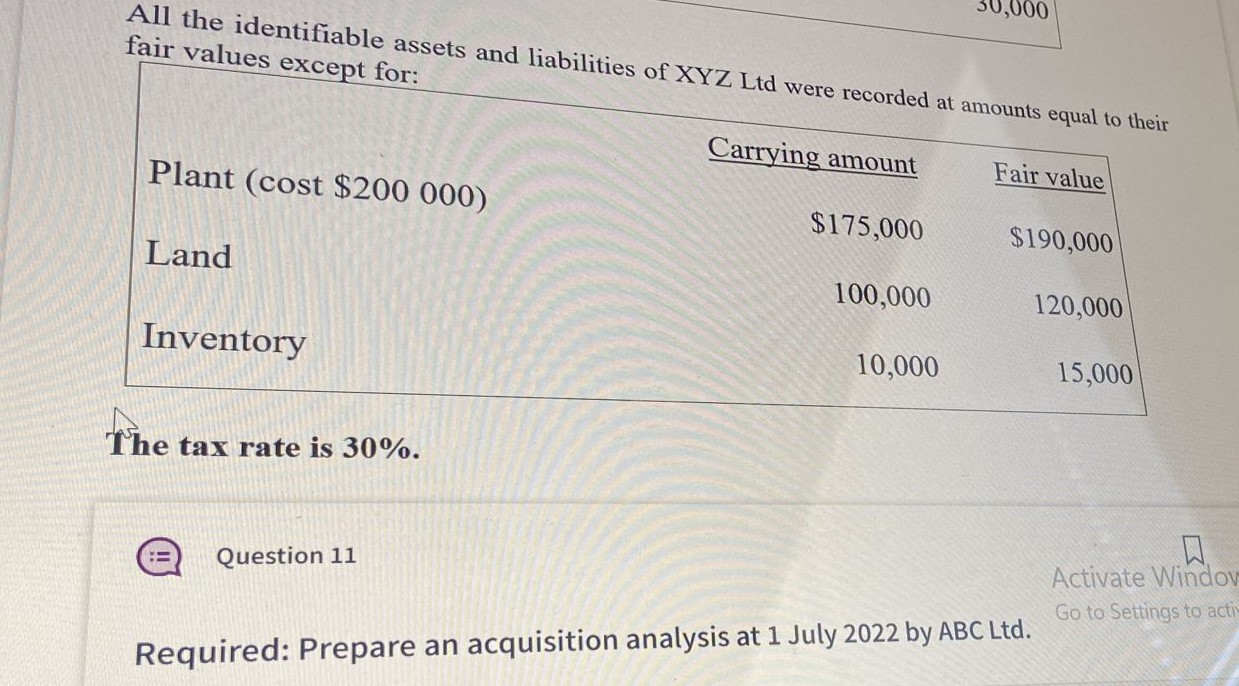

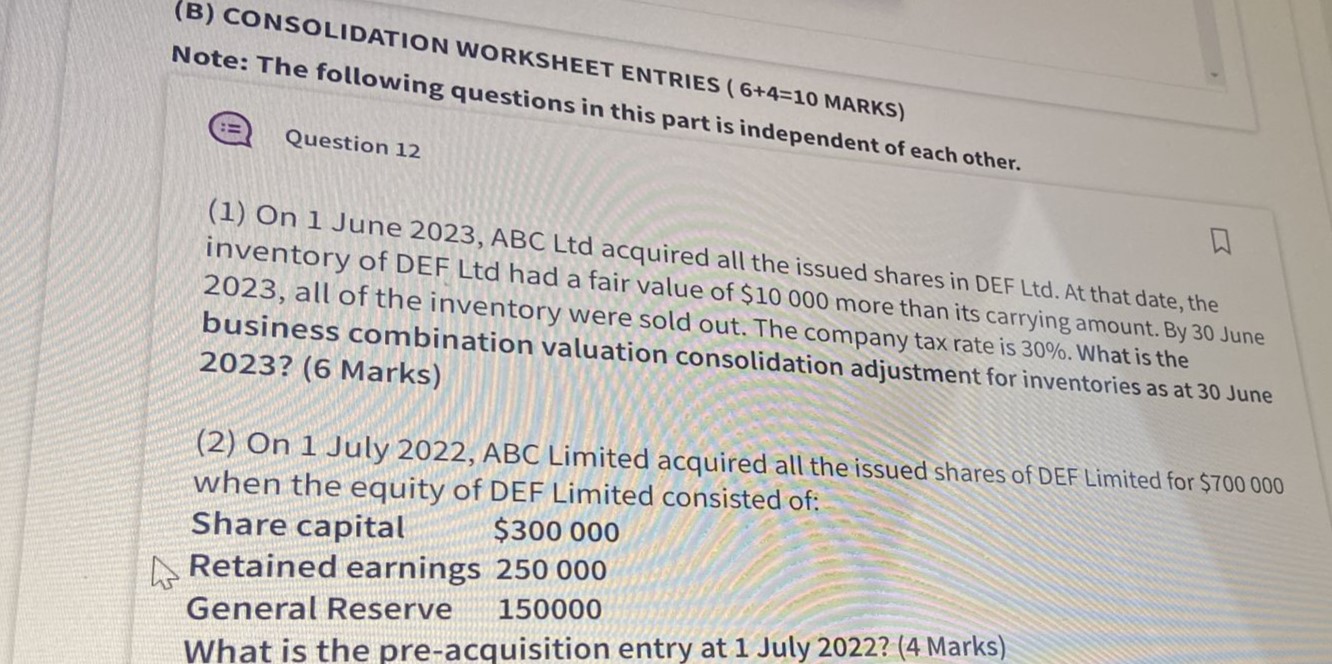

RIES (20 MARKS) ALYSIS (10 MARKS) On 1 July 2022, ABC Ltd acquired all the issued shares of XYZ Ltd for $263,000. At this date, the equity of XYZ Ltd consisted of: Share capital General reserve Retained earnings $200,000 10,000 30,000 All the identifiable assets and liabilities of XYZ Ltd were recorded at amounts equal to t fair values except for: Plant (cost $200 000) Land Inventory The tax rate is 30%. Carrying amount Fair value $175,000 $190,000 100,000 120,000 10,000 Activate V 15,000 Go to Settin 30,000 All the identifiable assets and liabilities of XYZ Ltd were recorded at amounts equal to their fair values except for: Plant (cost $200 000) Land Inventory The tax rate is 30%. Question 11 Carrying amount Fair value $175,000 $190,000 100,000 120,000 10,000 15,000 Required: Prepare an acquisition analysis at 1 July 2022 by ABC Ltd. Activate Window Go to Settings to acti (B) CONSOLIDATION WORKSHEET ENTRIES (6+4=10 MARKS) Note: The following questions in this part is independent of each other. Question 12 (1) On 1 June 2023, ABC Ltd acquired all the issued shares in DEF Ltd. At that date, the inventory of DEF Ltd had a fair value of $10 000 more than its carrying amount. By 30 June 2023, all of the inventory were sold out. The company tax rate is 30%. What is the business combination valuation consolidation adjustment for inventories as at 30 June 2023? (6 Marks) (2) On 1 July 2022, ABC Limited acquired all the issued shares of DEF Limited for $700 000 when the equity of DEF Limited consisted of: Share capital $300 000 Retained earnings 250 000 General Reserve 150000 What is the pre-acquisition entry at 1 July 2022? (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started