Answered step by step

Verified Expert Solution

Question

1 Approved Answer

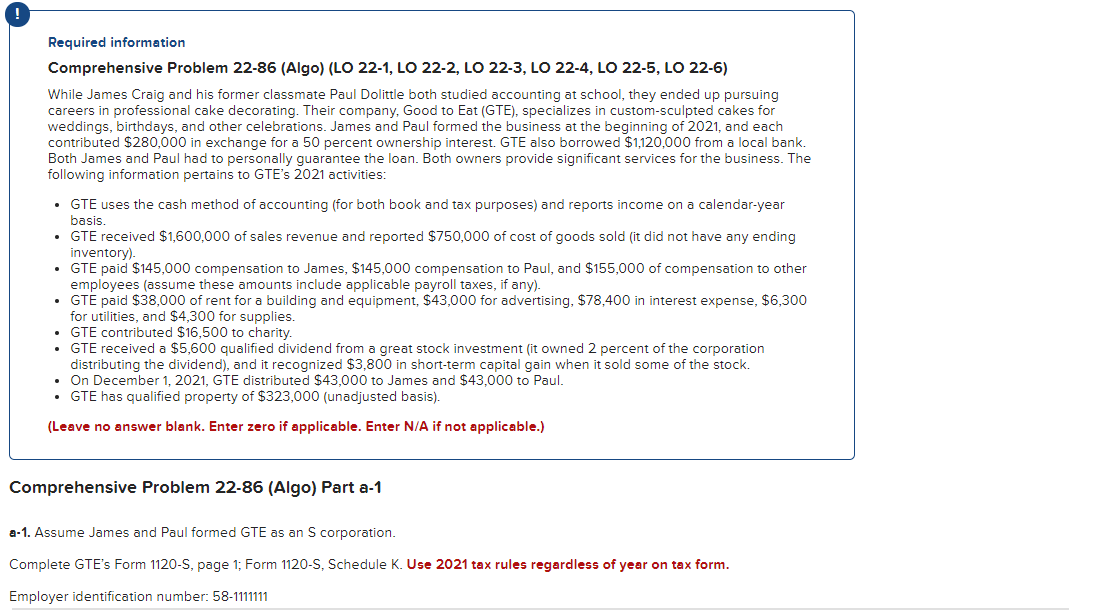

Right-click and open in new tab if too small Required information Comprehensive Problem 22-86 (Algo) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5,

Right-click and open in new tab if too small

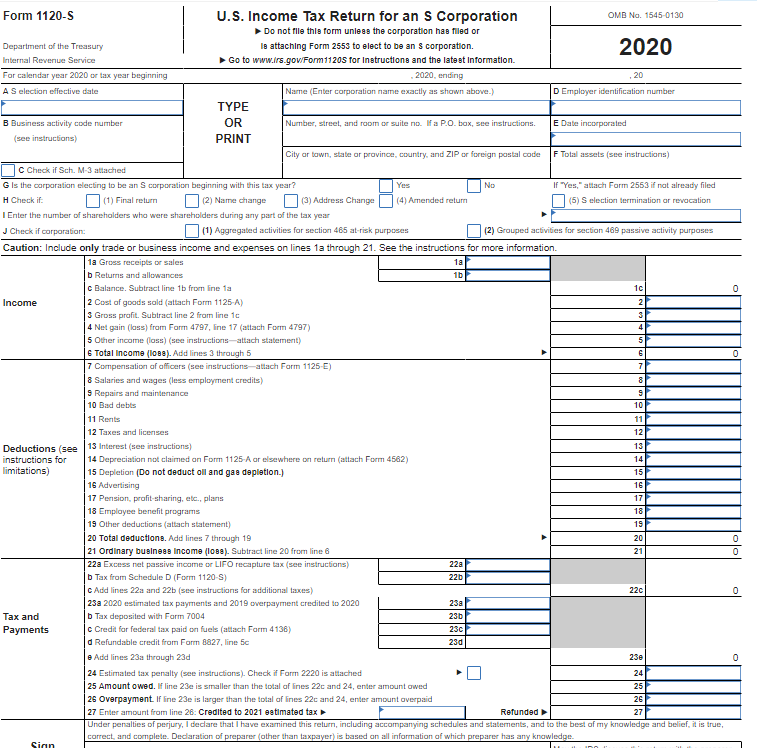

Required information Comprehensive Problem 22-86 (Algo) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Their company, Good to Eat (GTE), specializes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contributed $280,000 in exchange for a 50 percent ownership interest. GTE also borrowed $1,120,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following information pertains to GTE's 2021 activities: GTE uses the cash method of accounting (for both book and tax purposes) and reports income on a calendar-year basis. GTE received $1,600,000 of sales revenue and reported $750,000 of cost of goods sold (it did not have any ending inventory). GTE paid $145,000 compensation to James, $145,000 compensation to Paul, and $155,000 of compensation to other e me loves bessume these fama unisainclude applicable para el taxes, if any LAM paid $38,000 of rent for a building and equipment, $43,000 for advertising, $78,400 in interest expense, $6,300 for utilities, and $4,300 for supplies GTE contributed $16,500 to charity. GTE received a $5,600 qualified dividend from a great stock investment (it owned 2 percent of the corporation distributing the dividend), and it recognized $3,800 in short-term capital gain when it sold some of the stock. On December 1, 2021, GTE distributed $43,000 to James and $43,000 to Paul. GTE has qualified property of $323,000 (unadjusted basis). (Leave no answer blank. Enter zero if applicable. Enter N/A if not applicable.) Comprehensive Problem 22-86 (Algo) Part a-1 a-1. Assume James and Paul formed GTE as an S corporation. Complete GTE's Form 1120-S, page 1; Form 1120-S, Schedule K. Use 2021 tax rules regardless of year on tax form. Employer identification number: 58-1111111 Form 1120-S U.S. Income Tax Return for an s Corporation OMB No. 1545-0130 Do not file this form unless the corporation has filled or Department of the Treasury le attaching Form 2553 to elect to be an corporation. 2020 Internal Revenue Service Go to www.lrs.gov/Form11205 for Instructions and the latest Information For calendar year 2020 or tax year beginning 2020, ending 20 A Selection effective date Name (Enter corporation name exactly as shown above.) D Employer identification number TYPE B Business activity code number OR Number, street, and room or suite no. If a P.O. bax, see instructions. E Date incorporated (see instructions) PRINT City ar town, state or province, country, and ZIP or foreign postal code F Total assets (see instructions C Check if Sch. M-3 attached G is the corporation electing to be an Scorporation beginning with this tax year? Yes No If "Yes," attach Form 2553 if not already filed H Check if: (1) Final return (2) Name change (3) Address Change (4) Amended retum (5) Selection termination or revacation I Enter the number of shareholders who were shareholders during any part of the tax year J Check if corporation: (1) Aggregated activities for section 465 at-risk purposes (2) Grouped activities for section 469 passive activity purposes Caution: Include only trade or business income and expenses on lines 1a through 21. See the instructions for more information 1a Gross receipts or sales 1a b Returns and allowances 1b c Balance. Subtract line 1b from line 1a 10 Income | 2 Cost of goods sold (attach Form 1125-A) 2 3 Gross profit. Subtract line 2 from line 10 3 4 Net gain (loss) from Form 4797, line 17 (attach Form 4797) 4 5 Other income (loss) (see instructions-attach statement) 5 6 Total Income (1088). Add lines 3 through 5 6 7 Compensation of officers (see instructions-attach Form 1125-E) 7 8 Salaries and wages (less employment credits) 8 9 Repairs and maintenance 9 10 Bad debts 101 11 Rents 11 12 Taxes and licenses 12 Deductions (see 13 Interest (see instructions) 13 instructions for 14 Depreciation not claimed on Form 1125 A or elsewhere on return (attach Form 4562) 14 limitations) 15 Depletion (Do not deduct oll and gas depletion.) 15 16 Advertising 16 17 Pension, profit sharing, etc., plans 17 18 Employee benefit programs 18 19 Other deductions (attach statement) 19 20 Total deductions. Add lines 7 through 19 20 | 21 Ordinary business Income (1088). Subtract line 20 from line 6 21 22a Excess net passive income or LIFO recapture tax (see instructions) 22a b Tax from Schedule D (Form 1120-S) 22b c Add lines 22a and 22b (see instructions for additional taxes) 22c 23a 2020 estimated tax payments and 2019 overpayment credited to 2020 23a Tax and b Tax deposited with Form 7004 23b Payments c Credit for federal tax paid on fuels (attach Form 4136) 23c d Refundable credit from Form Ba27, line 5c 23d e Add lines 23a through 23d 23e 24 Estimated tax penalty (see instructions). Check if Form 2220 is attached 24 25 Amount owed. If line 23e is smaller than the total af lines 220 and 24, enter amount owed 25 | 26 Overpayment. If line 23e is larger than the total of lines 220 and 24, enter amount overpaid 26 27 Enter amount from line 26. Credited to 2021 estimated tax Refunded 27 Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge Sian 0 0 0 inn Required information Comprehensive Problem 22-86 (Algo) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Their company, Good to Eat (GTE), specializes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contributed $280,000 in exchange for a 50 percent ownership interest. GTE also borrowed $1,120,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following information pertains to GTE's 2021 activities: GTE uses the cash method of accounting (for both book and tax purposes) and reports income on a calendar-year basis. GTE received $1,600,000 of sales revenue and reported $750,000 of cost of goods sold (it did not have any ending inventory). GTE paid $145,000 compensation to James, $145,000 compensation to Paul, and $155,000 of compensation to other e me loves bessume these fama unisainclude applicable para el taxes, if any LAM paid $38,000 of rent for a building and equipment, $43,000 for advertising, $78,400 in interest expense, $6,300 for utilities, and $4,300 for supplies GTE contributed $16,500 to charity. GTE received a $5,600 qualified dividend from a great stock investment (it owned 2 percent of the corporation distributing the dividend), and it recognized $3,800 in short-term capital gain when it sold some of the stock. On December 1, 2021, GTE distributed $43,000 to James and $43,000 to Paul. GTE has qualified property of $323,000 (unadjusted basis). (Leave no answer blank. Enter zero if applicable. Enter N/A if not applicable.) Comprehensive Problem 22-86 (Algo) Part a-1 a-1. Assume James and Paul formed GTE as an S corporation. Complete GTE's Form 1120-S, page 1; Form 1120-S, Schedule K. Use 2021 tax rules regardless of year on tax form. Employer identification number: 58-1111111 Form 1120-S U.S. Income Tax Return for an s Corporation OMB No. 1545-0130 Do not file this form unless the corporation has filled or Department of the Treasury le attaching Form 2553 to elect to be an corporation. 2020 Internal Revenue Service Go to www.lrs.gov/Form11205 for Instructions and the latest Information For calendar year 2020 or tax year beginning 2020, ending 20 A Selection effective date Name (Enter corporation name exactly as shown above.) D Employer identification number TYPE B Business activity code number OR Number, street, and room or suite no. If a P.O. bax, see instructions. E Date incorporated (see instructions) PRINT City ar town, state or province, country, and ZIP or foreign postal code F Total assets (see instructions C Check if Sch. M-3 attached G is the corporation electing to be an Scorporation beginning with this tax year? Yes No If "Yes," attach Form 2553 if not already filed H Check if: (1) Final return (2) Name change (3) Address Change (4) Amended retum (5) Selection termination or revacation I Enter the number of shareholders who were shareholders during any part of the tax year J Check if corporation: (1) Aggregated activities for section 465 at-risk purposes (2) Grouped activities for section 469 passive activity purposes Caution: Include only trade or business income and expenses on lines 1a through 21. See the instructions for more information 1a Gross receipts or sales 1a b Returns and allowances 1b c Balance. Subtract line 1b from line 1a 10 Income | 2 Cost of goods sold (attach Form 1125-A) 2 3 Gross profit. Subtract line 2 from line 10 3 4 Net gain (loss) from Form 4797, line 17 (attach Form 4797) 4 5 Other income (loss) (see instructions-attach statement) 5 6 Total Income (1088). Add lines 3 through 5 6 7 Compensation of officers (see instructions-attach Form 1125-E) 7 8 Salaries and wages (less employment credits) 8 9 Repairs and maintenance 9 10 Bad debts 101 11 Rents 11 12 Taxes and licenses 12 Deductions (see 13 Interest (see instructions) 13 instructions for 14 Depreciation not claimed on Form 1125 A or elsewhere on return (attach Form 4562) 14 limitations) 15 Depletion (Do not deduct oll and gas depletion.) 15 16 Advertising 16 17 Pension, profit sharing, etc., plans 17 18 Employee benefit programs 18 19 Other deductions (attach statement) 19 20 Total deductions. Add lines 7 through 19 20 | 21 Ordinary business Income (1088). Subtract line 20 from line 6 21 22a Excess net passive income or LIFO recapture tax (see instructions) 22a b Tax from Schedule D (Form 1120-S) 22b c Add lines 22a and 22b (see instructions for additional taxes) 22c 23a 2020 estimated tax payments and 2019 overpayment credited to 2020 23a Tax and b Tax deposited with Form 7004 23b Payments c Credit for federal tax paid on fuels (attach Form 4136) 23c d Refundable credit from Form Ba27, line 5c 23d e Add lines 23a through 23d 23e 24 Estimated tax penalty (see instructions). Check if Form 2220 is attached 24 25 Amount owed. If line 23e is smaller than the total af lines 220 and 24, enter amount owed 25 | 26 Overpayment. If line 23e is larger than the total of lines 220 and 24, enter amount overpaid 26 27 Enter amount from line 26. Credited to 2021 estimated tax Refunded 27 Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge Sian 0 0 0 innStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started