Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Riley Company estimates the company will incur $65,000 in overhead costs and 5,000 direct labor hours during the year. Actual direct labor hours were

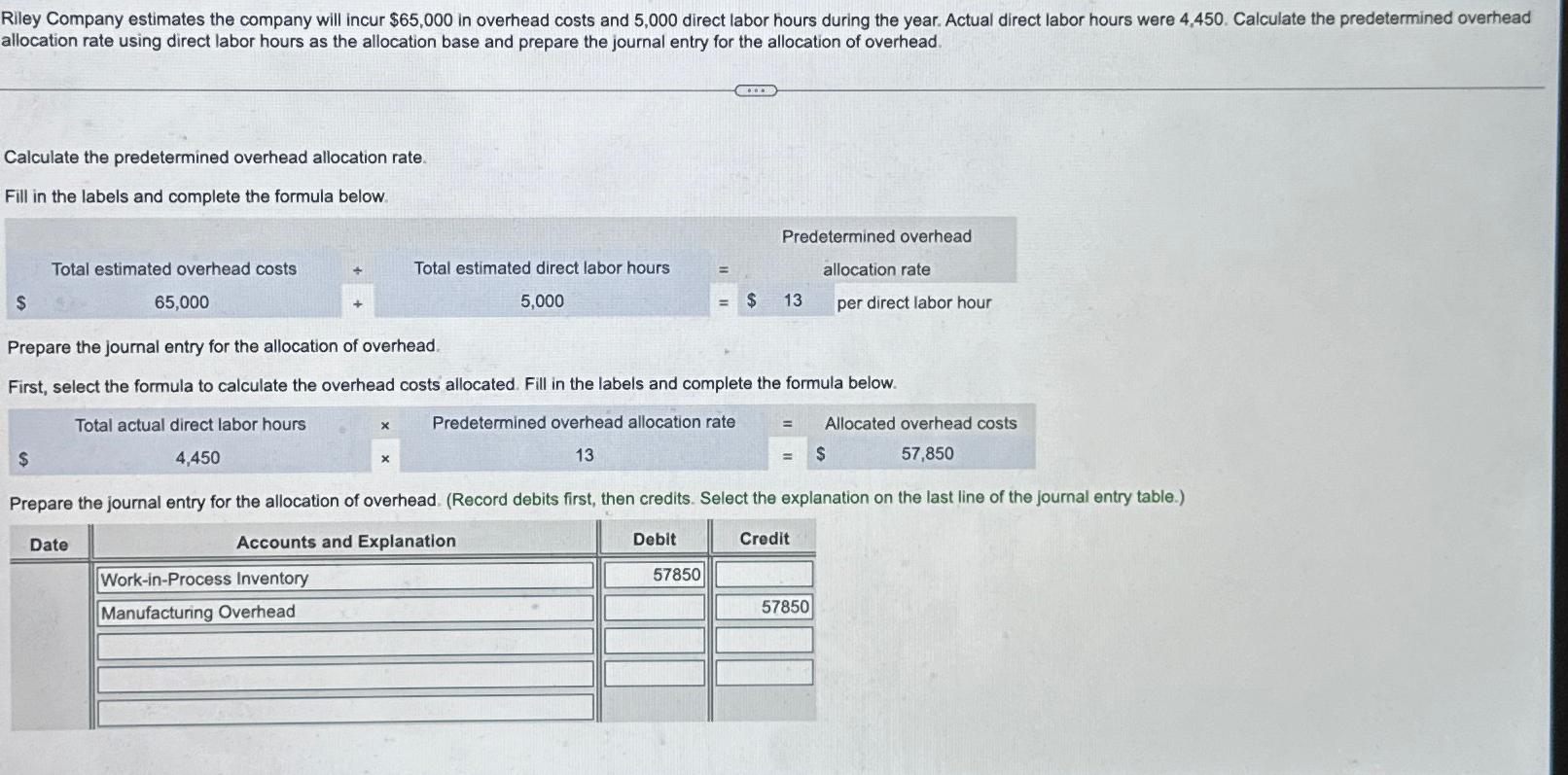

Riley Company estimates the company will incur $65,000 in overhead costs and 5,000 direct labor hours during the year. Actual direct labor hours were 4,450. Calculate the predetermined overhead allocation rate using direct labor hours as the allocation base and prepare the journal entry for the allocation of overhead. Calculate the predetermined overhead allocation rate. Fill in the labels and complete the formula below. Predetermined overhead Total estimated direct labor hours 5,000 = allocation rate $ 13 per direct labor hour $ Total estimated overhead costs 65,000 Prepare the journal entry for the allocation of overhead. First, select the formula to calculate the overhead costs allocated. Fill in the labels and complete the formula below. $ Total actual direct labor hours 4,450 x Predetermined overhead allocation rate = 13 $ Allocated overhead costs 57,850 Prepare the journal entry for the allocation of overhead. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Work-in-Process Inventory Manufacturing Overhead Debit Credit 57850 57850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started