Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Riley Ryan Research began business on July 1st. Record the transactions in the journal, post them to the ledger, prepare a trial balance, prepare

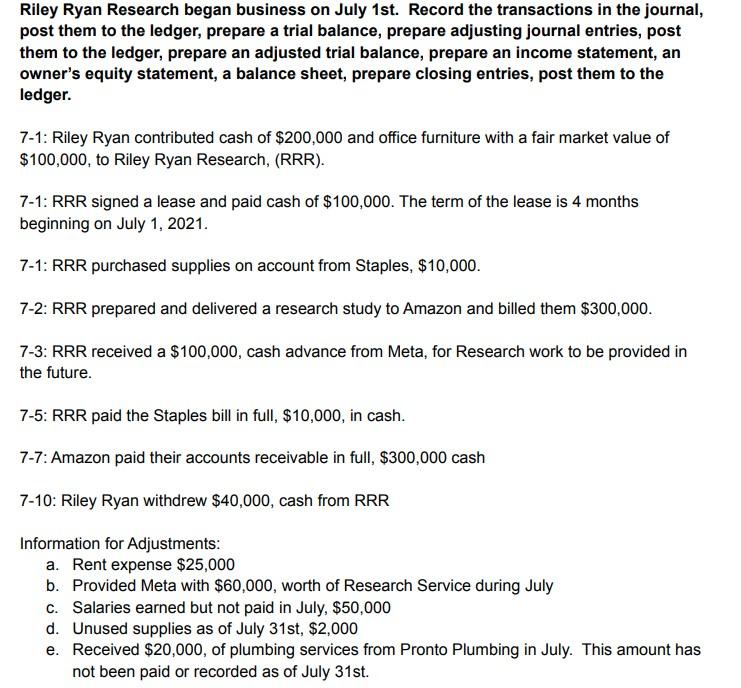

Riley Ryan Research began business on July 1st. Record the transactions in the journal, post them to the ledger, prepare a trial balance, prepare adjusting journal entries, post them to the ledger, prepare an adjusted trial balance, prepare an income statement, an owner's equity statement, a balance sheet, prepare closing entries, post them to the ledger. 7-1: Riley Ryan contributed cash of $200,000 and office furniture with a fair market value of $100,000, to Riley Ryan Research, (RRR). 7-1: RRR signed a lease and paid cash of $100,000. The term of the lease is 4 months beginning on July 1, 2021. 7-1: RRR purchased supplies on account from Staples, $10,000. 7-2: RRR prepared and delivered a research study to Amazon and billed them $300,000. 7-3: RRR received a $100,000, cash advance from Meta, for Research work to be provided in the future. 7-5: RRR paid the Staples bill in full, $10,000, in cash. 7-7: Amazon paid their accounts receivable in full, $300,000 cash 7-10: Riley Ryan withdrew $40,000, cash from RRR Information for Adjustments: a. Rent expense $25,000 b. Provided Meta with $60,000, worth of Research Service during July c. Salaries earned but not paid in July, $50,000 d. Unused supplies as of July 31st, $2,000 e. Received $20,000, of plumbing services from Pronto Plumbing in July. This amount has not been paid or recorded as of July 31st.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started