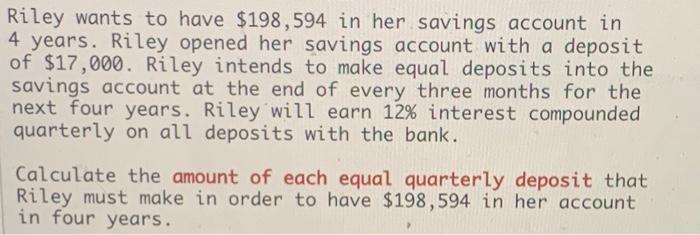

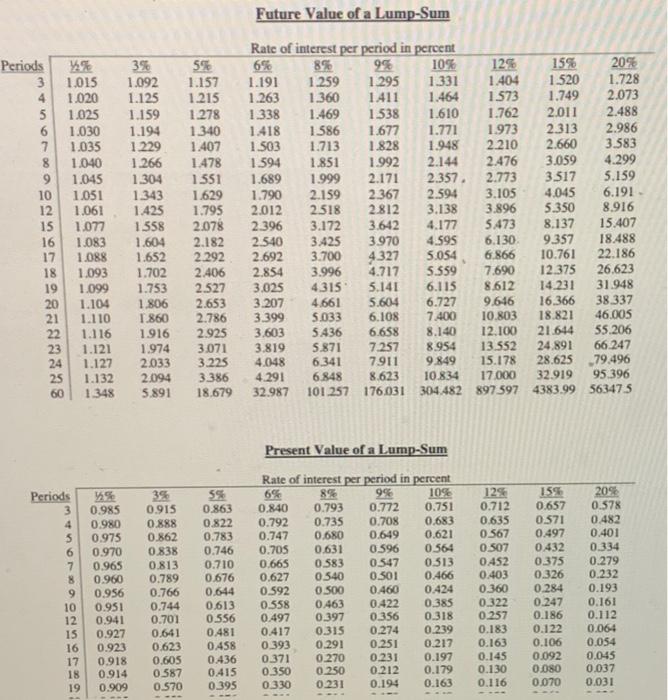

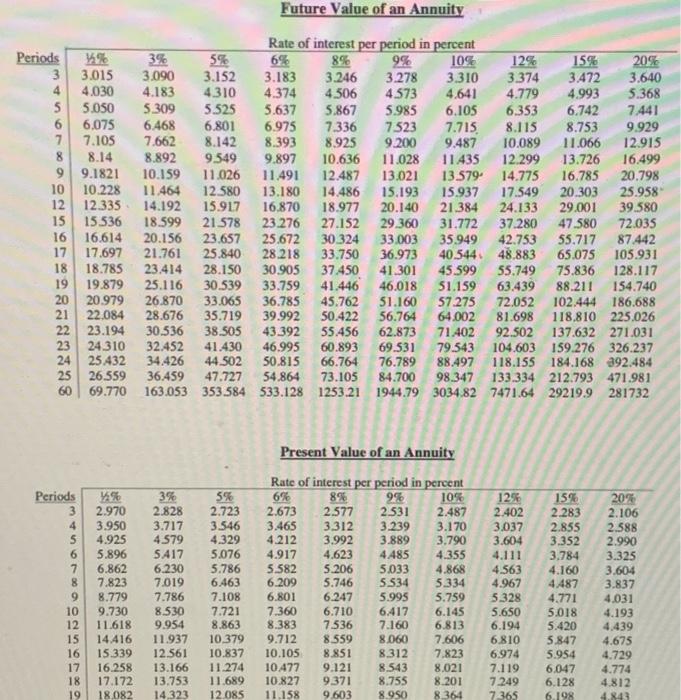

Riley wants to have $198,594 in her savings account in 4 years. Riley opened her savings account with a deposit of $17,000. Riley intends to make equal deposits into the savings account at the end of every three months for the next four years. Riley will earn 12% interest compounded quarterly on all deposits with the bank. Calculate the amount of each equal quarterly deposit that Riley must make in order to have $198,594 in her account in four years. Future Value of a Lump-Sum Periods 3 4 5 6 5.159 8 9 10 12 15 16 17 18 19 20 21 22 23 24 25 60 1.015 1.020 1.025 1.030 1.035 1.040 1.045 1.051 1.061 1.077 1.083 1.088 1.093 1.099 1.104 1.110 1.116 1.121 1.127 1.132 1.348 3% 1.092 1.125 1.159 1.194 1229 1.266 1.304 1.343 1.425 1358 1.604 1.652 1.702 1.753 1.806 1.860 1916 1.974 2.033 2.094 5.891 Rate of interest per period in percent 5% 6% 8% 9% 10% 125 15% 209 1.157 1.191 1.259 1.295 1.331 1.404 1.520 1.728 1.215 1.263 1.360 1.411 1.464 1.573 1.749 2.073 1.278 1.338 1.469 1.538 1.610 1.762 2011 2.488 1.340 1.418 1.586 1.677 1.771 1.973 2.313 2.986 1.407 1.503 1.713 1.828 1.948 2.210 2.660 3.583 1.478 1594 1.851 1.992 2.144 2.476 3.059 4.299 1551 1.689 1.999 2.171 2.357 2.773 3517 1.629 1.790 2.159 2.367 2.594 3.105 4.045 6.191 1.795 2.012 2.518 2812 3.138 3.896 5.350 8.916 2.078 2.396 3.172 3.642 4.177 5473 8.137 15.407 2.182 2.540 3425 3970 4.595 6.130 9.357 18.488 2.292 2.692 3.700 4.327 5.054 6,866 10.761 22.186 2.406 2.854 3.996 4.717 5.559 7.690 12.375 26.623 2.527 3.025 4.315 5.141 6.115 8.612 14.231 31.948 2.653 3.207 4.661 5.604 6.727 9.616 16.366 38337 2.786 3.399 5.033 6.108 7400 10.803 18.821 46.005 2.925 3.603 5436 6.658 8.140 12.100 21.614 55.206 3.071 3.819 5.871 7.257 8.954 13.552 24.891 66.247 3.225 4.048 6.341 7911 9.849 15.178 28.625 79.496 3.386 4.291 6.848 8.623 10.834 17.000 32.919 95 396 18.679 32.987 101 257 176031304482 897 597 4383.99563475 Present Value of a Lump-Sum Periods 3 4 5 6 7 8 9 10 12 15 16 17 18 19 yg 0.985 0.980 0.975 0.970 0.965 0.960 0.956 0.951 0.941 0.927 0.923 0.918 0.914 0.909 3% 0.915 0.888 0.862 0.838 0.813 0.789 0.766 0.744 0.701 0.641 0.623 0.605 0.587 0.570 5% 0.863 0.822 0.783 0.746 0.710 0.676 0.644 0.613 0556 0.481 0.458 0.436 0.415 0.395 Rate of interest per period in percent 8% 99 10% 0.840 0.793 0.772 0.751 0.792 0.735 0.708 0.683 0.747 0.680 0.649 0.621 0.705 0.631 0.596 0.564 0.665 0.583 0.547 0.513 0.627 0.540 0.501 0.466 0.592 0.500 0.460 0.424 0.558 0.463 0.422 0.385 0.497 0.397 0.356 0.318 0.417 0.315 0.274 0.239 0.393 0.291 0.251 0.217 0.371 0.270 0.231 0.197 0.350 0.250 0.212 0.179 0330 0.231 0.194 0.163 129 0.712 0.635 0 567 0507 0452 0.403 0.360 0.322 0.257 0.183 0.163 0.145 0.130 0.116 159 0.657 0.571 0.497 0.432 0.375 0.326 0.284 0.247 0.186 0.122 0.106 0.092 0.080 0.070 209 0.578 0.482 0.401 0.334 0.279 0.232 0.193 0.161 0.112 0.064 0.054 0.045 0.037 0.031 au Future Value of an Annuity Periods 3 4 5 6 7 8 9 10 12 15 16 17 18 19 20 21 22 23 24 25 60 1% 3.015 4.030 5.050 6.075 7.105 8.14 9.1821 10.228 12.335 15.536 16.614 17.697 18.785 19.879 20.979 22.084 23.194 24310 25 432 26.559 69.770 Rate of interest per period in percent 3% 5% 6% 8% 9% 10% 12% 15% 205 3.090 3.152 3.183 3.246 3.278 3.310 3.374 3.472 3.640 4.183 4.310 4.374 4.506 4.573 4.641 4.779 4.993 5.368 5.309 5.525 5.637 5.867 5.985 6.105 6.353 6.742 7.441 6.468 6.801 6.975 7.336 7.523 7.715 8.115 8.753 9.929 7.662 8.142 8.393 8.925 9.2009.487 10.089 11.066 12.915 8.892 9.549 9.897 10.636 11.028 11435 12.299 13.726 16.499 10.159 11.026 11.491 12.487 13.021 13.579. 14.775 16.785 20.798 11464 12.580 13.180 14.486 15.193 15.937 17.549 20.303 25.958 14.192 15.917 16.870 18.977 20.140 21.384 24.133 29.001 39.580 18.599 21.578 23.276 27.152 29,360 31.772 37.280 47.580 72.035 20.156 23.657 25.672 30.324 33.003 35.949 42.753 55.717 87 442 21.761 25.840 28.218 33.750 36.973 40.544 48.883 65.075 105.931 23.414 28.150 30.905 37.450 41.301 45.599 55.749 75.836 128.117 25.116 30.539 33.759 41.446 46.018 51.159 63.439 88.211 154.740 26.870 33.065 36.785 45.762 51.160 57.275 72.052 102.444 186.688 28.676 35.719 39.992 50.422 56.764 64.002 81.698 118.810 225.026 30.536 38.505 43.392 55 456 62.873 71.402 92.502 137.632 271.031 32.452 41.430 46.995 60.893 69.531 79.543 104.603 159.276 326.237 34,426 44.502 50.815 66.764 76.789 88.497 118.155 184.168 392.484 36.459 47.727 54.864 73.105 84.700 98.347 133.334 212.793 471.981 163.053 353.584 533.128 1253.21 1944.79 3034.82 7471.64 29219.9 281732 Present Value of an Annuity Periods 3 4 5 6 7 8 9 10 12 15 16 17 18 19 1% 2.970 3.950 4.925 5.896 6.862 7.823 8.779 9.730 11.618 14.416 15.339 16.258 17.172 18.082 3% 2.828 3.717 4579 SA17 6.230 7,019 7.786 8.530 9.954 11.937 12.561 13.166 13,753 14,323 5% 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.721 8.863 10.379 10.837 11.274 11.689 12.085 Rate of interest per period in percent 6% 8% 9% 10% 2.673 2.577 2531 2.487 3.465 3.312 3.239 3.170 4.212 3.992 3.889 3.790 4.917 4.623 4485 4.355 5.582 5.206 5.033 4.868 6.209 5.746 5.534 5.334 6.801 6.247 5.995 5.759 7.360 6.710 6.417 6.145 8.383 7.536 7.160 6.813 9.712 8.559 8.060 7.606 10.105 8.851 8.312 7.823 10477 9.121 8.543 8.021 10.827 9.371 8.755 8.201 11.158 9.603 8.950 8.364 12% 2.402 3.037 3.604 4.111 4.563 4.967 5.328 5.650 6.194 6.810 6.974 7.119 7.249 7365 15% 2.283 2.855 3.352 3.784 4.160 4487 4.771 5.018 5.420 5.847 5.954 6.047 6.128 6.198 20% 2.106 2.588 2.990 3.325 3.604 3.837 4.031 4.193 4.439 4.675 4.729 4.774 4.812 4.843