Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RIO's company's ordinary shares are expected to pay $2.1 per share in dividends for 5 years and after which the dividends are expected to grow

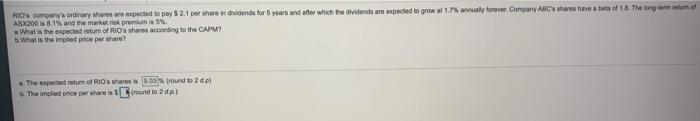

RIO's company's ordinary shares are expected to pay $2.1 per share in dividends for 5 years and after which the dividends are expected to grow at 1.7% annually forever. Company ABC's shares have a beta of 1.8. The long-term return of ASX200 is 8.1% and the market risk premium is 5%.

RIO comanya ordinary share are expected to pay $2.1 per share individende for 5 years and after which the dividends are expected to grow of 1.5 any forever. Conany ABC's aberta oft. There ASX200 Is 8.1% and the market risk premium 5% What is the expected rum of RIO's she according to the CAPM? b. What is the med proper whare? The expected return of Rosaria 2.00 mundo 2 dp Tha implied price per share is found to 2p) a. What is the expected return of RIO's shares according to the CAPM?

b. What is the implied price per share?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started