Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RISE AIRLINES WE RISE TOGETHER! With the recent crisis in the country's airline industry failing to meet customer needs and demand, Rise Airlines is

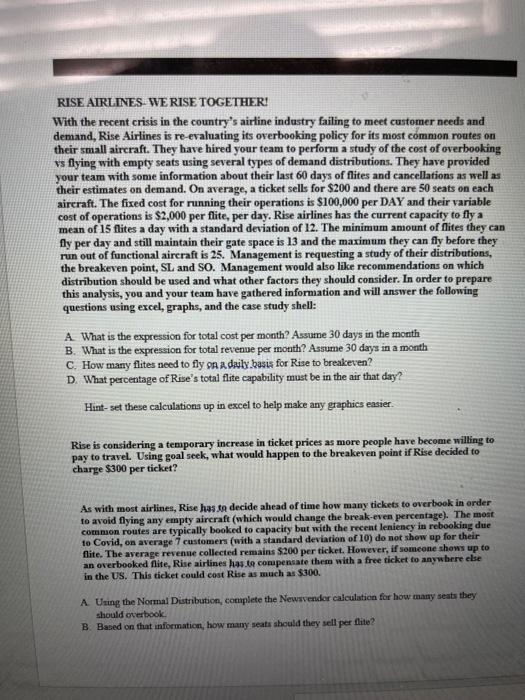

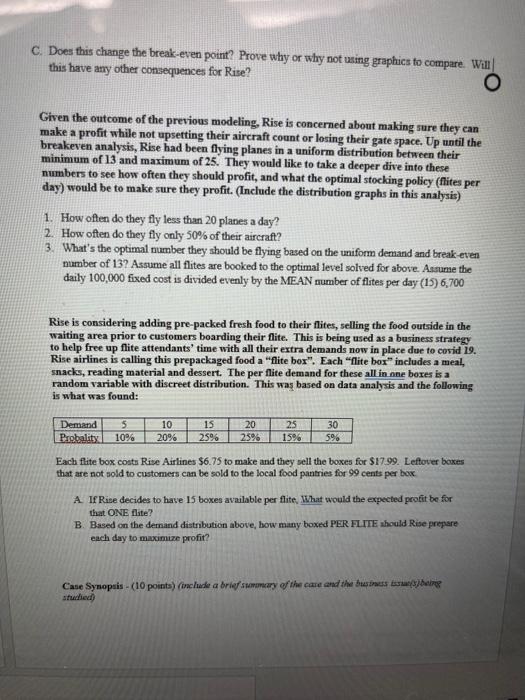

RISE AIRLINES WE RISE TOGETHER! With the recent crisis in the country's airline industry failing to meet customer needs and demand, Rise Airlines is re-evaluating its overbooking policy for its most common routes on their small aircraft. They have hired your team to perform a study of the cost of overbooking vs flying with empty seats using several types of demand distributions. They have provided your team with some information about their last 60 days of flites and cancellations as well as their estimates on demand. On average, a ticket sells for $200 and there are 50 seats on each aircraft. The fixed cost for running their operations is $100,000 per DAY and their variable cost of operations is $2,000 per flite, per day. Rise airlines has the current capacity to fly a mean of 15 flites a day with a standard deviation of 12. The minimum amount of flites they can fly per day and still maintain their gate space is 13 and the maximum they can fly before they run out of functional aircraft is 25. Management is requesting a study of their distributions, the breakeven point, SL and SO. Management would also like recommendations on which distribution should be used and what other factors they should consider. In order to prepare this analysis, you and your team have gathered information and will answer the following questions using excel, graphs, and the case study shell: A What is the expression for total cost per month? Assume 30 days in the month B. What is the expression for total revenue per month? Assume 30 days in a month C. How many flites need to fly on a daily basis for Rise to breakeven? D. What percentage of Rise's total flite capability must be in the air that day? Hint-set these calculations up in excel to help make any graphics easier. Rise is considering a temporary increase in ticket prices as more people have become willing to pay to travel. Using goal seek, what would happen to the breakeven point if Rise decided to charge $300 per ticket? As with most airlines, Rise has to decide ahead of time how many tickets to overbook in order to avoid flying any empty aircraft (which would change the break-even percentage). The most common routes are typically booked to capacity but with the recent leniency in rebooking due to Covid, on average 7 customers (with a standard deviation of 10) do not show up for their flite. The average revenue collected remains $200 per ticket. However, if someone shows up to an overbooked flite, Rise airlines has to compensate them with a free ticket to anywhere else in the US. This ticket could cost Rise as much as $300. A. Using the Normal Distribution, complete the Newsvendor calculation for how many seats they should overbook. B. Based on that information, how many seats should they sell per flite? C. Does this change the break-even point? Prove why or why not using graphics to compare. Will this have any other consequences for Rise? O Given the outcome of the previous modeling, Rise is concerned about making sure they can make a profit while not upsetting their aircraft count or losing their gate space. Up until the breakeven analysis, Rise had been flying planes in a uniform distribution between their minimum of 13 and maximum of 25. They would like to take a deeper dive into these numbers to see how often they should profit, and what the optimal stocking policy (flites per day) would be to make sure they profit. (Include the distribution graphs in this analysis) 1. How often do they fly less than 20 planes a day? 2. How often do they fly only 50% of their aircraft? 3. What's the optimal number they should be flying based on the uniform demand and break-even number of 13? Assume all flites are booked to the optimal level solved for above. Assume the daily 100,000 fixed cost is divided evenly by the MEAN number of flites per day (15) 6,700 Rise is considering adding pre-packed fresh food to their flites, selling the food outside in the waiting area prior to customers boarding their flite. This is being used as a business strategy to help free up flite attendants' time with all their extra demands now in place due to covid 19. Rise airlines is calling this prepackaged food a "flite box". Each "flite box" includes a meal, snacks, reading material and dessert. The per flite demand for these all in one boxes is a random variable with discreet distribution. This was based on data analysis and the following is what was found: Demand 5 10 Probality 10% 20% 15 25% 20 25% 25 15% 30 5% Each flite box costs Rise Airlines $6.75 to make and they sell the boxes for $17.99. Leftover boxes that are not sold to customers can be sold to the local food pantries for 99 cents per box A. If Rise decides to have 15 boxes available per flite, What would the expected profit be for that ONE flite? B. Based on the demand distribution above, how many boxed PER FLITE should Rise prepare each day to maximize profit? Case Synopsis - (10 points) (include a brief summary of the case and the business is being studed) Methodology (20 points) (including a discussion of what information was provided and how you used this information to analyze the problem) organize the available data and make sure it's clear in excel. Findings and Conclusions (50 points) (include summary of analysis results) Based on your analysis, what are the answers to what Rise is asking? The summary of analysis results should be not only written but shown in graphics and visuals Recommendations (20 points). What other factors need to be considered in making the recommendations? Do you agree with the decisions from your quantitative analysis? Why or why not? Using the recommendations you made in the findings and conclusions section and your own management perspective (other issues to consider), what is your recommendation to Rise Airlines? You should also do some outside research and/or base your opinion on your knowledge and/or experience. -Make sure to cite all sources in the appendix

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started